Fha Debt To Income Ratio Requirements Versus Conventional Loans

FHA Debt To Income Ratio Requirements applies for both home purchase, refinance loans, and Cash-Out Refinance Mortgage Loans.

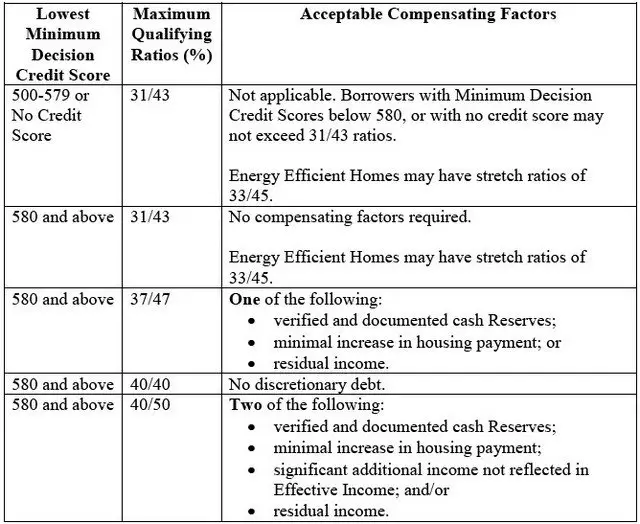

Just because borrowers meet all the HUD Agency Mortgage Guidelineson FHA loans does not mean that all lenders will approve borrowers meeting just the minimum agency mortgage guidelines. Lenders will require all borrowers to meet the minimum HUD agency mortgage guidelines on FHA loans. Most Lenders will have Lender Overlays on debt to income ratios, which we will discuss on this blog. Lender overlays are additional lending requirements that are above and beyond the minimum HUD Agency Guidelines. Lenders are allowed to have tougher lending requirements that are above and beyond the minimum HUD Agency Guidelines. There are lenders like Gustan Cho Associateswith no lender overlays on government and conventional loans. Gustan Cho Associates has no lender overlays on FHA loans. We just go off the automated underwriting system and have zero lender overlays.

In this article

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wonât likely have money to handle an unforeseen event and will have limited borrowing options.

Recommended Reading: When Should You File For Chapter 7 Bankruptcy

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: Does Bankruptcy Stop You From Buying A House

Explore Conventional Loans Today

Now that you know the answer to the question, What is a conventional loan, and who qualifies? youre in a better position to decide which type of home loan is best for you.

If you decide to take out a conventional loan, remember that loan requirements, interest rates and other terms can vary from lender to lender. This makes it important to shop around and make sure youre getting the best deal before taking out your loan.

If you would like some assistance with comparing lenders, the experts at Paddio are here to help.

Score The Dti You Need For A Mortgage

Your debt-to-income ratio is one number that holds a lot of weight when it comes to buying or refinancing a home. But even though it gives a snapshot of your financial health, it doesnt tell the whole story. As you prepare to become a homeowner, work on lowering your DTI, while also keeping in mind the big picture of your finances. As you raise your credit score and increase your savings, you may just see your DTI improve as well.

Wondering how much house you can really afford?

Also Check: Will Bankruptcy Get Rid Of Tax Debt

How To Lower Your Debt

To get your DTI ratio under better control, focus on paying down debt with these four tips.

Choosing The Type Of Mortgage Loan For You

There are many types of mortgage loans, but choosing a mortgage thats right for you could give you favorable loan terms. Here are some options to consider.

Choncé MaddoxAugust 18, 2022

In This Article

Cant afford to pay for a new home with a pile of cash? Youre in good company. Most of us dont have six figures or more lying around for the taking. Finding your dream home in a competitive housing market may seem like the ultimate prize, but its only half the battle.

Once you enter the home-buying process, you need to decide which type of mortgage will work best for your financial situation. Given the different types of mortgage loans to choose from, youll want to make this decision with careful consideration.

Don’t Miss: Listing Of Foreclosures For Free

Sourcing Your Down Payment

A conventional loan borrower has the option to put anywhere from 3% to 20% down or more.

Plus, a down payment gift can cover the entire amount in some cases. Check with your loan officer for gift and donor documentation requirements.

Unless its a gift, the applicant will need to verify a valid source of the down payment such as a savings or checking account.

Applicants can liquidate investment accounts and even use a 401k loan for the down payment.

Typically, home buyers will need to supply a 60-day history for any account from which down payment funds are taken.

What Is An Fha Loan

The Federal Housing Administration backs FHA loans. These loans are intended for borrowers with a limited credit history or low savings. You can qualify with a credit score as low as 580 and put as little as 3% down on your home. You may still be able to get an FHA mortgage with a credit score lower than 580, but you may have to make a larger down payment.

You can only use an FHA loan for your primary residence, so this would not be an option for vacation homes or investment properties. When putting less than 20% down on a home, youd be responsible for private mortgage insurance , which protects the lender if the house ever has to be foreclosed.

PMI is broken up and added to your monthly mortgage payment. PMI costs range between 0.22% to 2.25% of your mortgage. Youd have to pay PMI throughout your loan term with an FHA loan. Other types of mortgages, like conventional loans, allow you to get rid of PMI once you reach a certain amount of home equity.

Recommended Reading: Can You Keep Your Car After Bankruptcy

Conventional Dti Calculator For Fannie Mae Dti Guidelines

Fannie Mae DTI Guidelines on Conventional Loans: Borrowers can calculate their debt-to-income ratio using the Conventional Loan DTI Mortgage Calculator powered by Gustan Cho Associates. Conventional loans are the most popular loan program for first-time homebuyers due to the low 3% down payment program. Fannie Mae DTI Guidelines cap the DTI at 50%. However, to get an approve/eligible with lower credit scores, the debt-to-income ratio may be capped at 45%. Fannie Mae DTI Guidelines have a maximum debt to income ratio cap of 50% DTI on conventional loans. Conventional loan debt-to-income ratio guidelines are different than any other mortgage loan program. There is no maximum front-end debt to income ratio on conventional loans. There is only one debt to income ratio on conforming loans which is the back end.

Qualifying With High Debt To Income Ratio For Conventional Loan

Home Buyers who need to qualify for conventional loans with high debt to income ratios can contact us at Gustan Cho Associates at 262-716-8151 or text us for a faster response. Or email us at Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans. Not too many conventional lenders will go to the 50% debt to income ratio limit. Gustan Cho Associates has zero overlays on debt to income ratio for conventional loans and we just go off AUS FINDINGS. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Also Check: Can You File Bankruptcy For Free

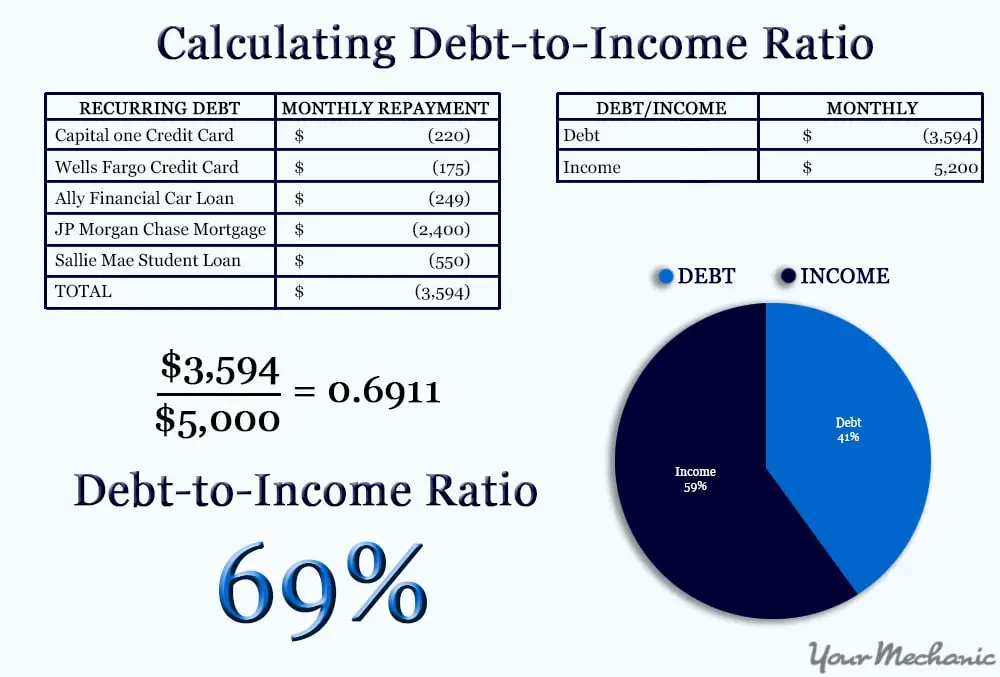

How To Calculate Your Dti Ratio

- Take your gross monthly income

- And divide it by your proposed housing payment

- And then your proposed housing payment and monthly liabilities

- To get both debt ratios

If youd like to figure out your debt-to-income ratio, simply take your average gross annual income based on your last two tax returns and divide it by 12 .

So if you made on average $100,000 gross each year for the past two years, that would equate to $8,333 per month in income.

Next, add up all your monthly liabilities and your proposed housing payment and divide that total by your monthly income and voila.

For that proposed housing payment, you can use my mortgage payment calculator to get the P& I payment. Then gather the insurance, taxes, and other costs from each source for an accurate estimate.

When I say liabilities, I mean all the minimum payments that appear on your credit report. Bills that dont show up on your credit report generally arent counted toward your debt-to-income ratio because they arent credit-related and/or documented.

For example, health insurance premiums, a cell phone bill, cable bill, gardening bill, gym membership, or a pool service may not figure into your DTI. This is a good thing if youre cutting it close.

Keep in mind that youll need a free credit report to accurately see what all your monthly payments are. Fortunately, these are very easy to come by these days.

Conventional Loan Credit Scores

In general, conventional loans are best suited for those with a credit score of 680 or higher. If you have a higher credit score, its possible that a conventional loan will offer the lowest mortgage rate. Applicants with lower scores may still qualify, but they can expect to pay higher interest rates.

Buyers with lower credit scores might benefit from a different type of mortgage, perhaps one backed by a government agency. Some other loan programs may cost less overall. For example, Fannie Mae and Freddie Mac impose Loan Level Price Adjustments to lenders who then pass those costs to the consumer. This fee costs more the lower your credit score.

For instance, someone with a 740 score putting 20% down on a home has 0.25% added to their loan fee. But, someone with a 660 score putting the same amount down would have a 2.75% fee added. These fees are not paid upfront but rather, translate to higher interest rates for homeowners.

See the complete matrix of LLPAs.

Recommended Reading: Can You Keep Your House If You File Bankruptcy

Todays Conventional Loan Rates

| Loan type | |

| % | % |

*Average rates reported daily by TheMortgageReports.com lender network. Your own interest rate will be different. See our full loan assumptions here.

Conventional loan rates are heavily based on the applicants credit score more so than rates for FHA loans.

For instance, a home buyer with a 740 score and 20% down will be offered about a 0.50% lower rate than a buyer with a 640 score.

Rates are also based on mortgage-backed securities which are traded just like stocks. And like stocks, conventional loan rates change daily, and throughout the day.

What Are Conventional Loans

In order for lenders to be able to sell conventional loans they fund on the secondary market, the loans they originate and fund need to meet Fannie Mae and/or Freddie Mac Guidelines. A conventional loan is also known as a conforming loan. Conventional Loans are also called conforming loans because they need to conform to Fannie Mae and/or Freddie Mac Mortgage Guidelines.

Read Also: How Often Can You File Bankruptcy In Ga

Why Is Knowing Your Dti Ratio Important

Your DTI ratio is utilized by lenders as a measuring tool. Your DTI ratio helps lenders determine your ability to manage your finances, specifically, your monthly payments to repay the money you borrowed. Keep in mind that lenders do not know what you will do with your money in the future, so they refer to historical data to verify your income and debt totals. Moreover, your DTI ratio illustrates that you have a sufficient balance between your income and debt, thus, are more likely to be able to manage your mortgage payments.

Also Check: How Many Times Has Pg& e Filed Bankruptcy

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: When Will My Chapter 7 Bankruptcy Be Discharged

Don’t Miss: Can You File Bankruptcy Separate From Your Spouse

What Is My Debt

You may hear two terms related to the debt-to-income calculation for mortgages: front-end DTI and back-end DTI.

Heres what they mean:

- Front-end DTI: Your mortgage payment divided by your gross income.

- Back-end DTI: Your total monthly debt payments, including your new mortgage payment, divided by your gross income .

Get Preapproved For A Mortgage With Realtorcom

The key to getting approved for a mortgage is not only preparing your finances to take on a home loan, but having the right team by your side. On Realtor.com®, you can get connected with a trusted mortgage lender in no time to begin the mortgage process. Visit Realtor.com® to start the homebuying process today.

Discover more first-time homebuyer content with expert insights on how to find a Realtor, get preapproved for a mortgage, and more on our first-time homebuyers resource page.

Read Also: How To File Bankruptcy In Oklahoma

This Number Gives Lenders A Snapshot Of Your Financial Situation

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.

Mortgage Rates On Fha Versus Conventional Loans

With FHA loans, as long as borrowers have a 640 or higher credit score, borrowers will most likely get the best FHA mortgage rate. For a conventional loan applicant to get the best available conventional mortgage rate, they would need a credit score higher than 740. Due to the government guarantee, lenders have less riskwith FHA and VA loans. Lenders are able to offer lower mortgage rates on government loans.

Don’t Miss: How Long Does A Bankruptcy Stay On My Credit Report

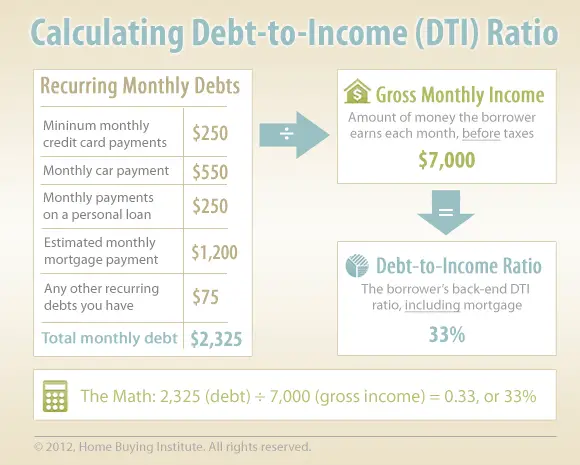

Lets Look At A Basic Example Of The Debt

- Annual gross income : $120,000

- Monthly gross income: $10,000

- 35% debt-to-income ratio

In this example, your debt-to-income ratio would be 35% . Pretty simple, right?

Well, before you think youre done calculating your DTI, you should know that the debt-to-income ratio goes into greater detail and comes up with two separate percentages.

One for all of your monthly liabilities divided by your gross monthly income , and one for just your proposed monthly housing expense divided by income .

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Recommended Reading: Homes For Sale Near Em