Monitor Your Dti And Your Credit For Better Access To Credit

Even if you don’t anticipate needing to apply for credit anytime soon, it’s a good idea to keep an eye on your DTI and your credit score to make sure you’re ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian’s free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You’ll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Consider The Snowball Method Of Paying Off Debt

This involves starting with your smallest balance first, paying that off and then rolling that same payment towards the next smallest balance as you work your way up to the largest balance. This method can help you build momentum as each balance is paid off. Understand the pros and cons of this debt pay down strategy by reviewing the Snowball versus Avalanche methods of paying down debt.

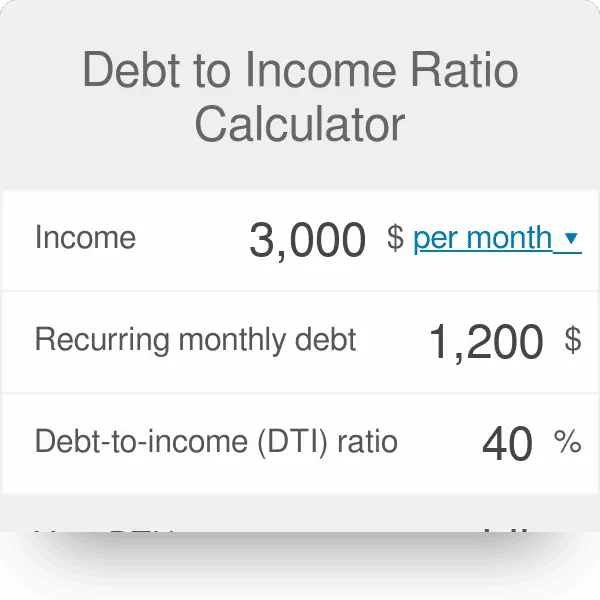

Tuesday Tip: How To Calculate Your Debt

Do you know what your debt-to-income ratio is? Do you know why its an important figure? Well, lenders and credit reporting agencies will use this figure as part of the criteria for determining your creditworthiness. Our advice is for you to work towards making it as low as possible. It could mean the difference between obtaining credit or not.

American Consumer Credit Counseling is here to de-mystify the debt-to-income ratio.

Read Also: How To File For Bankruptcy In Virginia Without A Lawyer

Why Do Lenders Care About My Debt

When a lender considers whether or not to let you borrow money, it wants information about how you handle your finances both past and present. So lenders will look at different factors like your , and debt-to-income ratio to get an idea of your financial picture.

When lenders see a healthy debt-to-income ratio, it can help them feel more confident that youll be able to make your loan payments. This might help you qualify for financing.

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Recommended Reading: How To Find Out If A Company Filed Bankruptcy

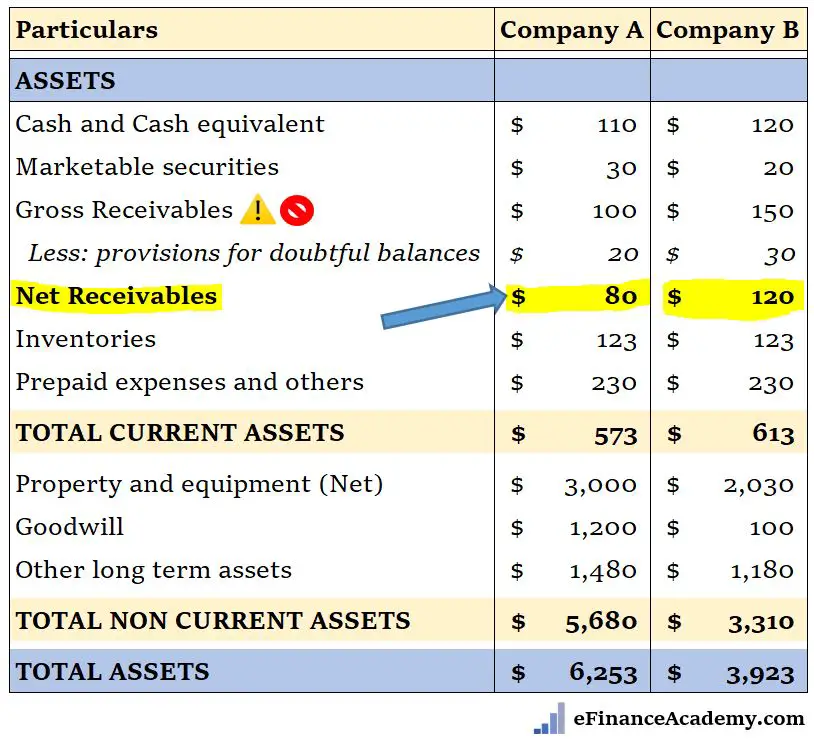

Add Up Your Monthly Debts

The first step toward calculating your debt-to-income ratio is adding up all your monthly debt payments. For fixed-payment loans like rent, an auto loan or a personal loan, you will use your regular monthly payment. Use your minimum monthly payment for variable payments such as credit card payments or a home equity line of credit. Your monthly debts will include any debts listed on your credit report.

For your mortgage payment, you will calculate with the full PITI . This will be your regular monthly payment if you escrow your taxes and insurance. If you dont escrow, your lender will likely take your annual tax and insurance payments, divide them by 12 and include them as part of your mortgage payment for purposes of DTI calculation.

Here is an example of what it could look like after considering these monthly debts:

- Mortgage: $1,600

- Minimum credit card payments: $300

- Student loan: $200

Find Your Monthly Gross Income

Your monthly gross income refers to the amount of money you make before taxes or other deductions. Use your paycheck as a source of information. If you are paid hourly rather than monthly, multiply the hourly rate by the number of hours you worked in a given week and multiply it by 52 to calculate your annual gross income. Now, take this value and divide it by 12 . This will result in your monthly gross income.

Example: Your hourly rate is $20 and you worked 40 hours per week. Multiplying 20 by 40 equals $800. Next, multiply $800 by 52 to get $41,600. This is your annual gross income. To get your monthly gross income, divide $41,600 by 12. This results in a monthly gross income of approximately $3,467.

$20 x 40 = $800

$800 x 52 = $41,600 (annual gross income

$41,600 / 12 = $3,467 (monthly gross income

Don’t Miss: Liquidation Pallets Charlotte Nc

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

If Your Dti Is Less Than 36%

Youre in great shape. Approval for most loans, including car loans and consolidation loans should be easy. Even mortgage approval should go smoother with a DTI in the optimal range. However, a great DTI ratio does not guarantee the best loan terms . As such, in addition to ensuring that your debt-to-income percentage stays low, make sure your credit score is healthy by maintaining a low credit utilization rate, making on-time payments, and keeping credit inquiries to a minimum.

Don’t Miss: Buy Through Auction.com

How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

The Factors That Make Up A Debt

The debt-to-income ratio is made up of two factors: the front-end ratio and the back-end ratio.

-

Front-End Ratio – This is also called the housing ratio. This shows what percentage of your monthly income goes to your housing expenses. This ratio includes your monthly mortgage payment, property taxes, homeowners insurance, and homeowners association dues.

-

Back-End Ratio – This ratio is all about your other debt typesyour other monthly debt obligations. This includes credit card or car loans, ongoing student loans, child support or alimony, or any other monthly debt that shows up in your credit report.

Also Check: Why Did Pg& e Filed Bankruptcy

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

Also Check: Do It Yourself Bankruptcy Chapter 7 Forms

What Is A Debt To Income Ratio

This figure is used by creditors, lenders, and credit reporting agencies as part of the formula to determine your creditworthiness. This is not the only criteria they use, but it is taken into account. Someone with a high debt-to- income ratio may be seen as a high risk, and may have trouble obtaining credit or a loan. If they do get approved, the terms may not be as favorable as someone with a lower debt to income ratio.

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Don’t Miss: Can You Keep A Credit Card If You File Bankruptcy

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

You Need To Know This Number If You’re Going For A Mortgage

Your debt-to-income ratio is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debtsuch as a mortgage or a car loan. It’s also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

Read Also: Bankruptcy Lawyer Las Vegas

Increase Your Down Payment

When lenders calculate your DTI, they consider the impact of a mortgage loan on your finances and aim to keep your DTI with your mortgage under a certain level. According to Heck, you can reduce your DTI when you own a home by putting down a larger down payment, which will result in lower mortgage payments each month.

If Im getting into affordability, one of the best things to do is begin saving and either pay off existing balances as you save or save more to be able to put more down on your home, which would lower your DTI, Heck says. Those are both longer-term solutions, but thats the true best approach to affordability.

Doing The Simple Math

Once you’ve calculated what you spend each month on debt payments and what you receive each month in income, you have the numbers you need to calculate your debt-to-income ratio. To calculate the ratio, divide your monthly debt payments by your monthly income. Then, multiply the result by 100 to come up with a percent.

Read Also: Pallets Of Items For Sale

If Your Dti Is Between 3650%

It will be challenging to get approved for loans or financing if your DTI is within this rangeespecially for a mortgage or auto loan. Youll likely need a larger down payment or have greater cash reserves than someone with a lower DTI.

You may be able to quickly improve your DTI ratio by making extra payments towards a particular debt or increasing your monthly income, perhaps by taking on a part-time job. If you cant eliminate at least some of your debt effectively on your own, its time to explore debt relief. Less debt improves your debt ratio, as well as your credit score. Its a win-win.

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Don’t Miss: Can You File For Bankruptcy If You Owe The Irs

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Also Check: What Makes You Eligible For Bankruptcy

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

What Types Of Payments Are Included In Dti

A front-end DTI ratio only includes housing-related costs such as rent, mortgage payments , home insurance payments, property taxes, or HOA fees. This ratio is typically only used by mortgage lenders when you buy a home. A back-end ratio includes all financial obligations like car payments or student loans and is used by most lenders. The DTI calculation does not include expenses such as food, utilities, insurance, or cellphone bills even if they are recurring.

An easy way to determine which types of debt payments are included in DTI is to consider the types of payments that affect your credit score. A missed credit card payment would definitely be noted on your credit score. Forgetting to pay your cell phone service provider, however, wouldnt carry the same credit penalties. That phone payment wouldnt be immediately reported to a credit bureau and therefore doesnt need to be included in your debt-to-income calculation.

Other types of payments to include in a DTI calculation are:

- Any other monthly installment loans

You May Like: How Soon After Bankruptcy Can You Get A Car Loan