How To File Chapter 13 Bankruptcy

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Chapter 13 bankruptcy lets you restructure overwhelming debts under the protection of a federal court, setting up a repayment period of three to five years.

This is also called wage earners bankruptcy, because you must have a regular income to qualify. The goal is to resolve some debts and get current on secured loans those with collateral, such as a home or car. Here’s how to figure out if Chapter 13 bankruptcy is right for you and how to file.

How Do I Repay Creditors In Chapter 13

You must begin making payments according to the proposed three- or five-year repayment plan within 30 days after filing for Chapter 13. The bankruptcy trustee will hold the payments until the court either confirms or denies your plan.

If the court denies the plan, the trustee will return the money to you. If the court confirms your plan, the trustee will distribute the funds to creditors following the program you created.

Estimated Proofs Of Claim

The IRS files estimated proofs of claim if you have unfiled, past due federal tax returns. Its important to have an up-to-date proof of claim for any federal taxes you owe before confirmation of your Chapter 13 plan. This ensures you dont pay any more than you need to and minimizes discharge of the tax debt issues upon completion of the Chapter 13 plan.

To help the IRS quickly amend an estimated proof of claim, promptly provide the IRS bankruptcy specialist with a copy of each late filed return for each year on the proof of claim. This helps to avoid unnecessary litigation on the proof of claim or discharge of the liability.

The specialists name and contact information are in part 3 of page 3 of the proof of claim. Otherwise, call 800-973-0424 to get the name and phone number of the specialist handling your case.

The specialist will ordinarily amend the proof of claim within 21 days. If you havent heard from the specialist within 21 days of submitting your late filed returns, please call 800-973-0424.

Also Check: How Many Times Did Trump File Bankruptcy

How Does Chapter 13 Work

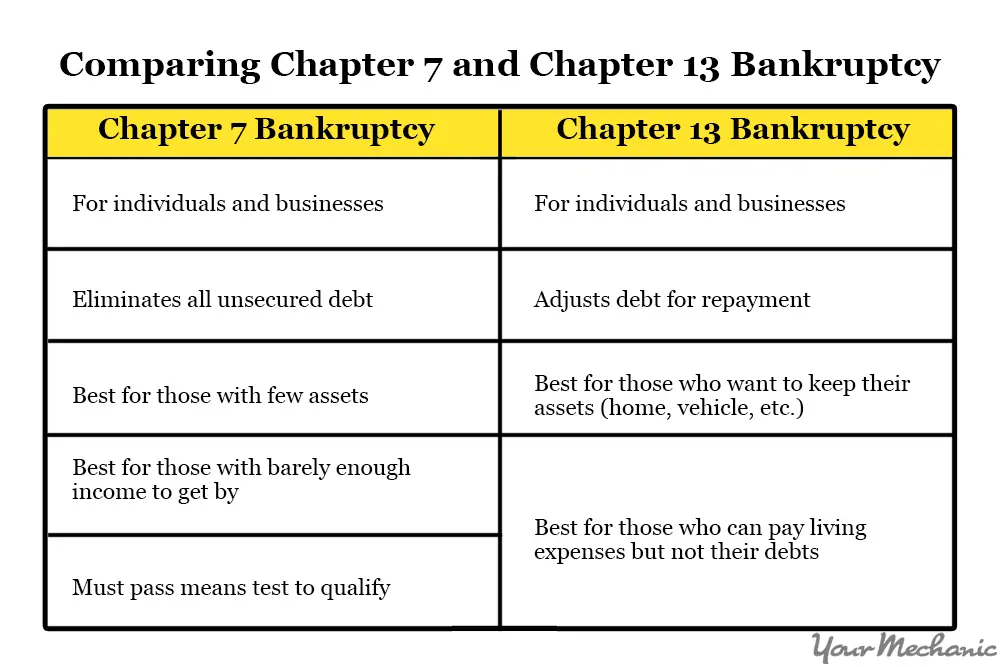

Chapter 13 is similar to Chapter 11, which is usually applicable to companies. In both instances, the petitioner presents a reorganization plan that protects assets against seizure or foreclosure and usually includes a request for debt forgiveness.

Both are distinct from the more severe Chapter 7 filing, which effectively liquidates all assets save those expressly safeguarded.

No bankruptcy discharges all obligations. Payments of child support and alimony and the majority of school loans and some kinds of taxes are not dischargeable.

However, bankruptcy may eliminate various other obligations, though it will almost certainly make future borrowing more difficult.

Let Our North Carolina Chapter 13 Bankruptcy Lawyers Help You

Schedule a free consultation with our North Carolina bankruptcy law firm today to discuss whether Chapter 13 might be an option for you. Our bankruptcy lawyers work with individuals and businesses throughout North Carolina, including in Wake, Harnett, Johnston, Durham, Orange, Granville, Vance, Franklin, Warren, Nash, Lee, Chatham, and Moore counties.

More resources:

You May Like: How To Write A Letter Of Explanation For Bankruptcy

Conversion To Chapter 7

You can also convert â or change â your case from a Chapter 13 to a Chapter 7. A new trustee is appointed, and youâll have to go to another meeting of creditors. The converted case will proceed like a regular Chapter 7, with the trustee looking for and selling non-exempt assets for the benefit of your creditors.

Is Chapter 13 Right For You

If all of your debt is unsecured and youâre eligible for a Chapter 7 discharge, Chapter 13 probably isnât right for you. But, if you have car loans or missed mortgage payments that you need to deal with, Chapter 13 might be exactly what you need.

Chapter 13 bankruptcy is right for you only if you can pay for all of your reasonable living expenses and make the plan payment without having to compromise on something.

While the plan payment is determined by your actual disposable income, the minimum amount it has to be also depends on your specific goals. Want to pay off that car loan? Your monthly plan payment has to cover at least that. Want to keep certain non-exempt personal property? Your plan payment has to cover that as well.

Chapter 13 is powerful, but you have to have the means to pay for it. If youâre $40,000 in arrears on your mortgage and making the monthly mortgage payments is still a stretch, filing a Chapter 13 to save your home is likely not a good idea.

One way to look at whether Chapter 13 is right for you is to compare your proposed plan payment to your current car payment. If your plan payment is equal to or less than what youâre currently paying for your car loans every month, you will have more money for necessities in a Chapter 13 than you have now.

Don’t Miss: How Long Does Bankruptcy Stay On Credit Report

Some Of The Benefits Of Filing For Chapter 13 Bankruptcy Include:

- Stops foreclosure and provides the property owner an opportunity to bring current the arrears over time

- Stops vehicle and mobile home repossessions and may provide an opportunity to restructure these obligations

- Provides relief from student loan collection actions for the duration of the repayment plan

- Provides protection from creditors seeking to collect past-due domestic support obligations

- Provides protection from taxing authorities attempting to collection past-due taxes

- May allow for the stripping off of fully unsecured junior mortgages on residential real property

- May allow for the impairment and discharge of non-support marital obligations

- May allow for the impairment and discharge of unsecured debts

- Allows for the debtor to retain all of their assets

If you are considering filing for Chapter 13 in North Carolina, contact our board-certified North Carolina bankruptcy attorneys today to discuss your options. You may also want to review the basics of North Carolina chapter 13 bankruptcy as established by the government. We will review your case for free, and you do not need to pay us any fees upfront to file a case. Instead, all fees and costs related to the bankruptcy filing can be rolled into your eventual payment plan.

Indiana Bankruptcy Lawyer Cost

While the thought of having to pay a lawyer to file for Chapter 7 bankruptcy in Indiana may seem like it adds insult to injury, it may be worth it depending on your specific situation. In Indiana, the cost of a bankruptcy lawyer ranges between $795 and $1,450, though more complicated cases may end up costing you more, at least in the short term.

-

Attorney cost estimate: $795à ââ¬â $1,450

You May Like: How To File Bankruptcy In Texas Without An Attorney

More About Online Bankruptcy

If bankruptcy is in your future, there are tools online to help you find your way through the maze.

However, it is important to note that while the forms can be downloaded online and there is plenty of help online, the actual filing of the forms, in almost all cases, must be done in person at bankruptcy court.

There is one exception: If an individual is what is called ECF Certified.

ECF stands for Electronic Case Files, and is a way documents are filed online with courts. However, the average person must take classes and be ECF certified and approved by the court to file that way.

Attorneys are ECF certified the average consumer is not. For most of us, that means finding the location of your bankruptcy court and taking the documents there to file.

In the event that you the consumer need to turn to bankruptcy to solve debt issues and it should always be an option of last resort you can file for Chapter 7 or Chapter 13 bankruptcy. Yes, you can go through the paperwork and court process yourself, without an attorney.

But a strong word of warning: Its tricky. Another word of warning: Because its tricky, it behooves you to be careful and precise. A final word of warning: If youre nervous about being careful and precise, its wise to consult with an attorney.

But a great deal of the paperwork and educational requirements can be done online with help from a bankruptcy attorney or a non-attorney bankruptcy petition preparer.

How Do I Know If Chapter 13 Is Right For Me

This is a pretty complicated question, but you can start by looking at some of the basics. The first question you should ask yourself is whether you have a regular income. Chapter 13 is called the wage earner bankruptcy because its success relies on the filerâs regular income. If youâre commission-based, a gig worker, or unemployed, Chapter 13 may not be right for you.

If you do have regular income, take a look at your monthly expenses. Ignore credit card payments, car loans, and other loan repayments. Do you have money left over at the end of the month if you donât have to make all the minimum payments to your creditors? If so, Chapter 13 may be right for you.

Don’t Miss: Renting Apartment After Bankruptcy

What If I Lose My Job While Im In A Chapter 13

If you lose your job or otherwise experience a significant decrease in income while youâre in a Chapter 13, youâre not stuck! Remember, the goal isnât to put you into a situation you canât afford to be in. Depending on the circumstances you may either modify your plan or convert your case to deal with the loss of income.

Types Of Bankruptcy Filings

Chapter 7: Liquidation

Chapter 7 is designed for individuals and businesses experiencing financial difficulty that do not have the ability to pay their existing debts. Under Chapter 7 a trustee takes possession of all of your property. You may claim certain property as exempt under governing law. A bankruptcy trustee then liquidates all non-exempt property and uses the proceeds to pay your creditors according to a distribution scheme required by the Bankruptcy Code.

The main purpose of filing a Chapter 7 case is to obtain a discharge of your existing debts. A bankruptcy discharge is a court order releasing you from liability for many types of debts. If, however, you are found to have committed certain kinds of improper conduct described in the Bankruptcy Code, your discharge may be denied by the court and the purpose for which you filed the bankruptcy petition will be defeated.

Even if you receive a discharge, there are some debts which are not discharged under the law. These include certain types of taxes, student loans, alimony and child support payments, debts fraudulently incurred, debts for willful and malicious injury to a person or property, and debts arising from a drunk driving charge. Generally speaking, a bankruptcy discharge does not remove liens from your property.

Chapter 11: Reorganization

Chapter 11 is designed for the reorganization of a business. It is also available to individual debtors who exceed the thresholds for Chapter 13 bankruptcies.

Read Also: How Many Times Has Trumps Businesses Filed Bankruptcy

Attend A 341 Creditors Meeting

The creditors meeting, called a 341 meeting, is where the bankruptcy trustee appointed to your case will ask you questions under oath about your financial situation. Specifically, the trustee will verify your identity, ask about the accuracy of your bankruptcy petition and schedules and give you the chance to reveal any changes that have taken place since you filed your documents.

Immediate Relief From Financial Stress

In most Chapter 13 bankruptcy cases , an automatic stay is entered as soon as the case is filed. The automatic stay is a court order that puts an immediate stop to creditor calls, debt collection letters, law suits and even wage garnishments. When you take action to turn your finances around, the pressure could be off in just a few days.

Read Also: Has Trump Ever Filed For Bankruptcy

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Take The Second Debtor Education Course And Receive Your Discharge

Youâve made it to the end! Taking the second debtor education course is the very last step before receiving your discharge.

As long as youâve followed the terms in your Chapter 13 plan, youâll receive a discharge at the conclusion of your case. Any unpaid balances on most unsecured debts will be eliminated. For example, if you were required to pay your unsecured debts back at 10%, youâll be relieved of the obligation to pay back the 90% balance.

Read Also: How Long Before My Bankruptcy Is Off My Credit Report

What Are The Advantages Of Filing A Chapter 13 Bankruptcy

Since the Chapter 13 process allows the filer to reorganize their debts and pay certain types of debt in full while discharging others, there are significant advantages to filing Chapter 13 over Chapter 7. Wage earners with a regular monthly income thatâs high enough to pay their monthly living expenses and make a monthly plan payment can take advantage of the following features of a Chapter 13 bankruptcy.

Reaching Your Goal To Be Debt Free

Bankruptcy may sound like a curse, but it can also be a blessing and help you get back on your feet. If youre overwhelmed with debt but have income and simply cant pay it off in the time creditors are demanding, its time to reassess your approach. Chapter 13 is a better option with major upsides, such as preventing foreclosure on a home by granting you more time to pay what you cant afford to in a short time. Debt can snowball and be overwhelming, but with the right legal guidance, you can find a plan that works for you.

Van Horn Law Group has many years of experience and success with bankruptcy cases theyve handled. They also offer a free consultation where an attorney will assess your unique financial situation and offer options to you. Working with a firm that specifically handles bankruptcy cases is the way to go to get the best outcome out of filing for bankruptcy possible. As long as you have the proper legal guidance, you will be able to negotiate a reasonable plan with creditors through a Chapter 13 hearing to eliminate your debt.

Read Also: How Many Times Has Donald Trump Declared Bankruptcy

Advantages Of Chapter 13

Chapter 13 offers individuals a number of advantages over liquidation under chapter 7. Perhaps most significantly, chapter 13 offers individuals an opportunity to save their homes from foreclosure. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time. Nevertheless, they must still make all mortgage payments that come due during the chapter 13 plan on time. Another advantage of chapter 13 is that it allows individuals to reschedule secured debts and extend them over the life of the chapter 13 plan. Doing this may lower the payments. Chapter 13 also has a special provision that protects third parties who are liable with the debtor on “consumer debts.” This provision may protect co-signers. Finally, chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. Individuals will have no direct contact with creditors while under chapter 13 protection.

The Chapter 13 Process

First, you should find a bankruptcy lawyer who can provide you with a free evaluation and estimate to file.

The cost to file Chapter 13 bankruptcy consists of filing fees and fees charged by a bankruptcy attorney. Petitioners need to pay a $313 filing fee to the bankruptcy court. They also need to provide:

- A list of creditors and the amount of their claims

- Disclosure of the amount and sources of the debtors income

- A list of the debtors property, as well as an accounting of all contracts and leases in the debtors name

- A breakdown of the debtors monthly living expenses

- Tax information, including a copy of the debtors most recent federal tax return and a statement of any unpaid taxes.

Chapter 13 petitioners must stipulate that they havent had a bankruptcy petition dismissed in the 180 days before filing due to their unwillingness to appear in court. Also, anyone seeking bankruptcy protection, must undergo from an approved agency within 180 days of filing a petition.

Shortly after filing bankruptcy, the debtor also must propose a repayment plan. A bankruptcy judge or administrator will hold a hearing to determine whether the plan meets the requirements of the bankruptcy code and is fair. Creditors may raise objections to the plan, but the court has the final say.

Debtors can arrange to make up delinquent payments over time, but under Chapter 13 rules, all new mortgage payments from the time of filing must be made on time.

Don’t Miss: How To File For Bankruptcy In Massachusetts