How To Lower Your Debt

How To Improve Your Ratio

It seems as though many Americans are having to deal with high debt-to-income ratios. In the first quarter of 2022, the total household debt in the U.S. increased by $266 billion .

If youre one of the individuals in this position, there are steps you can take to lower your ratio. The most obvious way to do so is to pay down debt. This can be done by increasing monthly payments and avoiding solely paying minimum payment amounts.

Creating a detailed budget can help you cut back in various ways, whether its on your internet bill or at the grocery store, and allow you to pay off debts with the extra money saved. Check your DTI regularly to keep track of any fluctuations that occur.

What Industries Have High D/e Ratios

In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials.

Read Also: How To File Bankruptcy While Married

Play The Competition Or Contact A Mortgage Broker

To negotiate the best offer, we advise you to consult several banks and then to assert the competition, with supporting evidence.

This work is tedious but allows you to support your negotiation in a very concrete way. You can also consider using a broker.

His role will be to negotiate for you with the banks. Often, you will have access to attractive conditions, particularly in terms of interest rates and other costs.

Turn It Into A Percentage

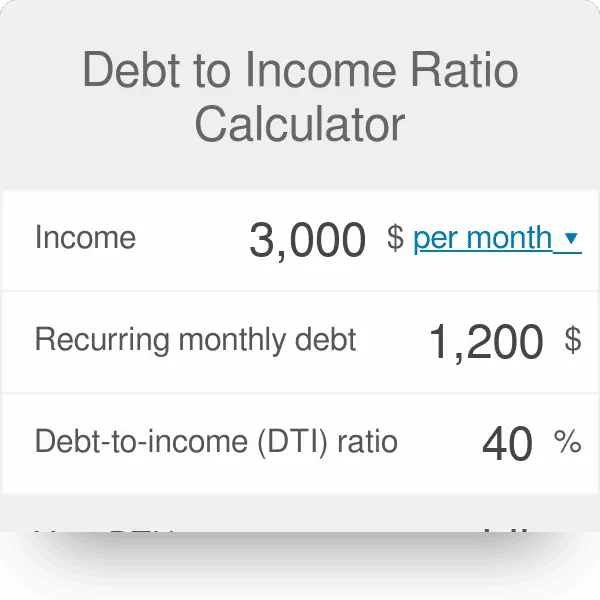

Once youve calculated your debt-to-income ratio, youll need to turn the value into a percentage:

DTI ratio x 100 = debt-to-income ratio percentage

Example:Multiply the debt-to-income ratio of 0.40 by 100. This results in a debt-to-income ratio percentage of 40%. This would be considered a high debt-to-income ratio because lenders tend to prefer borrowers who have a debt-to-income ratio smaller than 36. The lower the DTI, the less risky you are to lenders.

0.40 x 100 = 40

You May Like: What Are The Best Debt Consolidation Companies

Read Also: How Does Bankruptcy Affect Car Insurance

Relevance And Uses Of Debt Service Coverage Ratio Formula

- This ratio is really important, as stated multiple times above, to sense what is the level of financial flexibility the business has, particularly in a growth situation. If the ratio is high, it means that there is a higher ability with the business to invest and grow in the future. Similarly, if DSCR is low , then businesses need to improve this ratio otherwise, they will face difficulty to procure a loan from the lenders.

- All lenders have different risk appetites and different strategies in mind, and some give more importance to DSCR than others. So they use DSCR differently while entering into loan agreements with a borrower. Lenders, who only get paid back through the companys Cash flow , give more focus on DSCR, and they generally put a covenant in the agreement with an escalating ratio to make sure that money is coming. In a nutshell, lenders have greater control over this ratio because they are the ones who will dictate the repayment of principal.

You May Like: How To Pay Off Old Debt In Collections

Debt Service Coverage Ratio & Financial Analysis

The Debt Service Coverage Ratio is one metric within the coverage bucket when analyzing a company. Other coverage ratios include EBIT over Interest , as well as the Fixed Charge Coverage Ratio .

Coverage measures are never taken in isolation when analyzing a company theyre always used in conjunction with other categories of credit metrics like leverage and liquidity

DSC is calculated on an annualized basis meaning cash flow in a period over obligations in the same period. This is in contrast to leverage and liquidity, which represent a snapshot of the borrowers financial health at a single point in time .

In all adjustment scenarios, a higher DSCR is considered better than a lower one. Anything less than 1x is considered very weak and suggests that a company owes more money to creditors than it generates in cash per year.

Most commercial banks and equipment finance firms want to see a minimum of 1.25x but strongly prefer something closer to 2x or more. Many small and middle market commercial lenders will set minimum DSC covenants at not less than 1.25x.

Read Also: Why Is Us In Debt

What Is The Gross Debt Service Ratio

Your gross debt service ratio is how much of your gross income goes towards housing costs. This calculation includes:

- Mortgage payments

- Utility costs, like heat and hydro

- If you live in a condo, this ratio will include 50% of your condo fees

The general rule is to have your GDS ratio at most 39%.

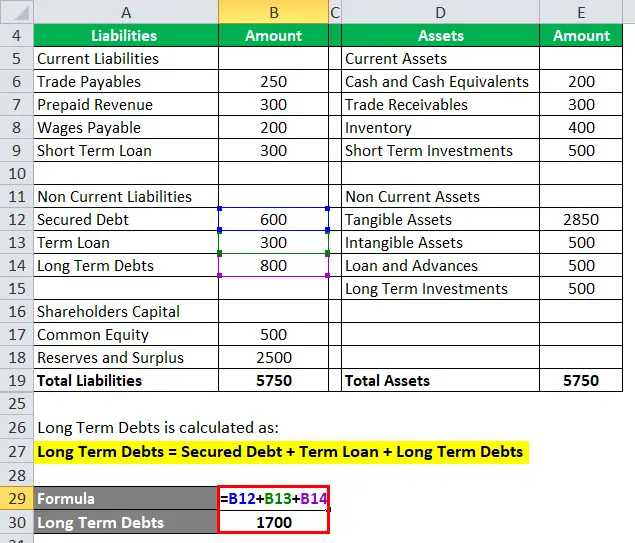

How To Calculate D/e Ratio In Excel

Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as D/E ratio and debt ratio. Or you could enter the values for total liabilities and shareholders equity in adjacent spreadsheet cells, say B2 and B3, then add the formula =B2/B3 in cell B4 to obtain the D/E ratio.

Recommended Reading: How Long To Refinance After Bankruptcy

What Is Debt Ratio

Debt ratio, or debt to asset ratio, is a leverage ratio that measures a companys or individuals debt against its assets. It is expressed as total debt divided by total assets. Its a useful ratio for investors to use because it helps them determine the default risk of a company.

In other words, how much is a company leveraging, or how much of its financing is coming from debt capital? Once we know this ratio, we can use it to determine how likely a company is to become unable to pay off its debts.

What Are The Risks Of High Operating Leverage And High Financial Leverage

If leverage can multiply earnings, it can also multiply risk. Having both high operating and financial leverage ratios can be very risky for a business. A high operating leverage ratio illustrates that a company is generating few sales, yet has high costs or margins that need to be covered. This may either result in a lower income target or insufficient operating income to cover other expenses and will result in negative earnings for the company.

On the other hand, high financial leverage ratios occur when the return on investment does not exceed the interest paid on loans. This will significantly decrease the companys profitability and earnings per share.

You May Like: Which Type Of Debt Cannot Be Discharged Through Bankruptcy

Why Is Debt To Equity Ratio Important

The debt to equity ratio is a simple formula to show how capital has been raised to run a business. It’s considered an important financial metric because it indicates the stability of a company and its ability to raise additional capital to grow.

As an entrepreneur or small business owner, this ratio is used when applying for a loan or business line of credit.

For investors, the debt to equity ratio is used to indicate how risky it is to invest in a company. The higher the debt to equity ratio, the riskier the investment.

To further clarify the ratio, let’s define debt and equity next.

What Is The Total Debt Service Ratio

Your total debt service ratio is similar to your gross debt service ratio. But your TDS takes into account any other debt that you may have and adds that into the equation. This includes:

- Loans co-signed for family/friend

Lenders will typically set a limit of 44% for your TDS ratio, but being closer to 42% is much more ideal. Itâs also important to note, if youâre purchasing a home with someone else, itâs possible to exceed both the TDS and GDS ratios since lenders look at combined income and debts when determining mortgage affordability.

Also Check: What Happens To Your Home If You File Bankruptcy

How To Calculate Debt Ratio

To calculate the debt ratio of a company, youll need information about its debt and assets. This can be found on the companys balance sheet. You can access the balance sheets of publicly traded companies on websites like Yahoo Finance or Nasdaq. Some companies post them on their own websites as well.

Lets walk through a couple of examples of how to calculate a debt ratio using data from Heineken’s and Campari Groups 2018 filings. Since both are European companies, the data on their balance sheets is measured in Euros. No need to convert into U.S. Dollarsthe debt ratios will be the same.

Campari Group

Total liabilities: 2419.7 million

Debt ratio = 2419.7/4582.5 = 0.53

At 0.53, Campari Group is doing ok. About half of the companys capital is coming from debt, and for the wine, beer, and spirit industry, thats not bad.

Heineken

Total liabilities: 27,598 million

Debt ratio = 27,598/41,956 = 0.66

At 0.66, Heineken’s debt ratio is higher than Camparis, higher than the industry average, and higher than what would be acceptable in any industry. A high ratio like this makes it harder for the company to find additional debt financing. It also makes them less appealing to investors.

| Related: Debt isn’t always a bad thing, especially if you prepare for it. Learn how creating a sinking fund helps corporations get ahead of their debts. |

Its all fun and games…

How To Calculate Your Debt Ratio

Theres a fairly simple formula that can be used to ascertain your companys debt ratio. Simply divide your total liabilities or debts by your total assets. Be sure to account for everything so that you get a clear picture of your companys overall debt burden and not its current debts.

So, for instance, if a company has a total of £5 million in assets, and £1,250,000 in total debt liabilities, its debt ratio is 25% or .25.

Don’t Miss: How To Get A Credit Card After Bankruptcy Discharge

Total Debt Service Ratio Formula

Your TDS ratio is the percentage of your income needed to cover all of your debts.

It is similar to the GDS, except that it considers all your monthly debts . This includes car payments, , alimony, and any loans.

To calculate your TDS ratio, add all of your monthly debts and divide that figure by your gross monthly income. Then multiply that sum by 100, and youll have your TDS ratio.

TDS = x 100

What Is A Good TDS?

You need to fall under 40% on the total debt service ratio to properly qualify for a loan.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Read Also: Do You Need An Attorney To File Bankruptcy

Understanding The Results Of Debt To Asset Ratio

After calculating your debt to asset ratio, its used to better understand your company and where it stands financially. Understanding the result of the equation is done by examining it for being high or low.

A business whose debt to asset ratio is above one indicates that its funds are entirely covered by debt or alternative financing. This is worrisome for the company in question because it puts them at high risk for defaulting on their loan, or worse, going bankrupt.

Even with a debt to asset ratio below one, the figure still needs to be put into perspective. A debt to asset ratio below one doesnt necessarily tell the tale of a thriving business. If an organization has a debt to asset ratio of 0.973, 97.3% of it is covered on borrowed dollars.

Lower debt to asset ratios suggests a business is in good financial standing and likely wont be in danger of default. The general rule of thumb is to keep the debt percentage below 40%.

How Is The Debt

Don’t Miss: I Am In Debt

What’s The Difference Between Your Debt

Debt-to-credit and DTI ratios are similar concepts however, it’s important not to confuse the two.

Your debt-to-credit ratio refers to the amount you owe across all revolving credit accounts compared to the amount of revolving credit available to you. Your debt-to-credit ratio may be one factor in calculating your credit scores, depending on the scoring model used. Other factors may include your payment history, the length of your credit history, how many credit accounts you’ve opened recently and the types of credit accounts you have.

Your DTI ratio refers to the total amount of debt you carry each month compared to your total monthly income. Your DTI ratio doesn’t directly impact your credit score, but it’s one factor lenders may consider when deciding whether to approve you for an additional credit account.

Familiarizing yourself with both ratios may give you a better understanding of your credit situation and help you anticipate how lenders may view you as you apply for credit.

Definition Of Debt Ratio

The debt ratio is also known as the debt to asset ratio or the total debt to total assets ratio. Hence, the formula for the debt ratio is: total liabilities divided by total assets.

The debt ratio indicates the percentage of the total asset amounts that is owed to .

The larger the debt ratio the greater is the company’s financial leverage. The appropriate debt ratio depends on the industry and factors that are unique to the company.

Recommended Reading: How Long Does It Take To Finalize Bankruptcy

How Can You Tell Whether A Particular Debt Ratio Is Good Or Bad

Instinctively, you might think that having as low of a debt ratio as possible would be good, and a high one would be bad. But there’s a bit more nuance to it than that, says Anessa Custovic, the chief investment officer at Cardinal Retirement Planning, Inc.

“I would only look at it in context, Custovic says. If you are looking at a company as a potential investment, make sure you check and see what industry averages of the debt ratio areis this firm more leveraged than the average? Is it less leveraged?”

Some industries simply require more debt in order to operate, and that’s just normal. A food service company needs equipment, real estate, supplies and a lot of employees, for example, while a tech company might only need a limited number of servers and a smaller workforce to operate.

You can find industry averages to compare a particular company to in many places, including Ready Ratios.

What Is Total Debt

A companys total debt is the sum of short-term debt, long-term debt, and other fixed payment obligations of a business that are incurred while under normal operating cycles. Creating a debt schedule helps split out liabilities by specific pieces.

Not all current and non-current liabilities are considered debt. Below are some examples of things that are and are not considered debt.

Considered debt:

- Dividends payable

Don’t Miss: Us Bankruptcy Court Maryland