Pay Off Your Debt But Dont Forget About Your Emergency Fund And Your Retirement

Even though paying off your debt is beneficial for regaining control over your finances, dont downplay the importance of building an emergency fund and investing for your retirement. In an ideal world, you would do all three: pay off your debt, build an emergency fund which amounts to three to six months of expenses and invest for your retirement. But since that isnt always possible, prioritize paying off your debt. Then, youll have more money that you can set aside for your emergency fund, and after that youll be able to start investing.

Regardless of your situation, the important thing is to speak with an advisor. Sometimes, people are embarrassed about their debt and theyre afraid of being judged by their advisor. Theres no reason to be embarrassed, and advisors arent there to judge you. Theyre there to help you improve your financial situation.

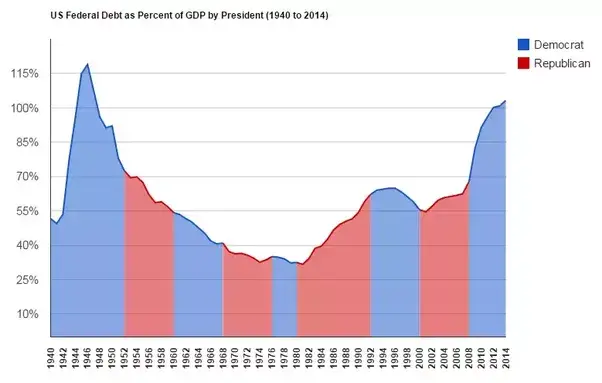

Us Debt By Presidential Term

The national debt between the Ronald Reagan era and Bill Clintons administration slowly increased, but it nearly doubled during the presidential term of George W. Bush to more than $9 trillion.

Here, then, is a brief timeline of how American debt has grown since John Hancock signed the Declaration of Independence on July 4, 1776.

How The National Debt Affects You

When the national debt is below the tipping point, government spending continues and contributes to a growing economy, which means more funding for programs that you can take advantage of.

But when the debt exceeds the tipping point, your standard of living could be impacted. Interest rates may increase and that could slow the economy. The stock market could react to a lack of investor confidence, which could mean lower returns on your investments. And a recession may even be possible.

This also puts downward pressure on a countrys currency because its value is tied to the value of the countrys bonds. As the currencys value declines, foreign bond holders’ repayments are worth less. That further decreases demand and drives up interest rates. As the currencys value declines, goods and services may become more expensive and that contributes to inflation.

You May Like: Is Filing For Bankruptcy Worth It

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

What Causes The National Debt To Increase

Sometimes the government needs to increase spending to stabilize the economy, and protect Americans and businesses from unexpected economic conditions.

During The Great Recession , for example, Congress passed legislation injecting $1.8 trillion into the economy. But that pales in comparison to the $4.5 trillion the Trump and Biden administrations have pumped into the economy since the Covid pandemic began in March 2020.

However, there are other reasons the national debt increases, even during years where spending is moderate and the economy is in good shape.

Also Check: How To Remove A Bankruptcy From Your Credit

Is National Debt Different From Personal Debt

If a government defaults on its debt, its credit will be affected and its economic abilities stifled, just like if you declare bankruptcyBoth have to pay interest, although the US governments rate is much lower due to its stability. Debt adds to the possibility of growth in both cases. More items

IN THIS ISSUE:Overview US Debt at Record High $21.7 TrillionDebt Held by the Public vs. Intragovernmental DebtThe Flimsy Argument For Why IntragovernmentalNational Debt as a Percent of Gross Domestic ProductConclusions: The Real National Debt & Debt-to-GDP Ratio

Content

How Much Debt Do You Have

No more hiding your head in the sandits time to face the truth so you can start doing something about it! Listen, adding up the grand total of your debt isnt going to be pretty. Lets rip the Band-Aid off. Ready? Take a deep breath and open up those envelopes and account pages. Look at the number, and no matter how small or large it is, tell yourself, I can do this.

Now that youve got a total, you can figure out how soon you can pay it off. Use this super easy debt snowball calculator tool to add up all your debt and find out how fast you can get it out of your life for good. Well show you the proven plan that will not only help you pay off debt but kick debt to the curb for good.

Don’t Miss: How To File Bankruptcy In Florida

Run It Like A Business

Some candidates like Michael Bloomberg run on the notion that he is a businessman, not a politician, and the government should be run like a business, i.e., be profitable without borrowing money. This is not the correct way to run a government though and not even how a business is run.

Businesses have debt, even successful ones. Imagine that you cracked the code of teleportation. Youve worked it out on paper, but you need money to build the machine. You dont want to get a loan to do it though because you dont want to take on debt.

Okay, so you come up with various money-spinning ideas to fund your project. You print t-shirts, you start and monetize a blog and a podcast. In thirty years you have the money to build your machine. But youre too late. Ten years ago some other person also cracked the code, but they borrowed money to build their machine. Now theyre a bazillionaire, and you have nothing.

The government is the same. We cant wait for enough tax revenue comes in to do things like providing health care to citizens and build roads. We have to borrow money to do those necessary things.

Home Equity Line Of Credit

Its never a good idea to borrow money against your home. You risk losing your house if you cant pay back the loan on time. No thanks! Its not worth a risk like that. Forget it, and just dont do it.

At the end of the day, these types of debt reduction options are dicey at best, only treating the symptoms of your money problems. Theyll never help you address the root issue of why you landed here in the first place. You dont need to consolidate, settle or borrow to deal with your debt. Plain and simple: You need to change how you handle your money. It will never change until you do!

Read Also: How Long Is Chapter 7 Bankruptcy

B Medicare And Medicaid

Although the aging of the population that raises the cost of Social Security also contributes to the higher cost of Medicare and Medicaid, the cost of the Medicare program rises much more rapidly than that of the Social Security pension. It does so for two reasons. First, the average cost of Medicare benefits per beneficiary rises in every year with the age of the beneficiary. The average age of those over 65 is rising because of increased survival rates in that demographic group, driving up the costs per Medicare participant. Second, the cost of the Medicare benefits for participants at every age also rises faster than GDP, reflecting a combination of new medical technologies and increases in the cost of the existing methods of care.

Much of the policy discussion about Medicare financing focuses on what can be done to reduce the rate of increase of Medicare costs, particularly to reduce the excess cost growth. The 2010 health care legislation created a high-level federal committee with the mandate to reduce future Medicare costs. The legislation also commits the administration to reduce Medicare spending relative to current projections by about $450 billion by 2019, an amount that is reflected in the CBOs cost scoring of the legislation.

The Medicare Accumulation Fund therefore evolves according to

dcc

National Debt And Budget Deficit

The federal government creates an annual budget that allocates funding towards services and programs for the country. This is made up of mandatory spending on government-funded programs, discretionary spending on areas such as defense and education, and interest on the debt. The budget deficit can be thought of as the annual difference between government spending and revenue. When the government spends more money on programs than it makes, the budget is in deficit.

You May Like: National Bureau Of Collections

Less To Spend On Other Government Initiatives

The more money the U.S. has to spend on meeting its debt obligations as interest rates increase, the less financial capacity it could have to fund programs focused on education, veterans benefits and transportation.

This breakdown of the 2019 Federal Budget from the Council on Foreign Relations shows how the budget pie is only so big, so when one area increases , another must decrease.

A Blessing Or A Curse

The United States has had an up-and-down relationship with debt. One of Congresss first actions was to assume states Revolutionary War debt in exchange for moving the countrys permanent capital to Washington, D.C. Alexander Hamilton saw collective debt as a way to build the nation and its international credit and bind the several states together in common cause.

A national debt, if it is not excessive, will be to us a national blessing, he wrote in 1781. It will be a powerful cement of our Union.

President Andrew Jackson differed considerably in his opinion. He campaigned on the promise of eliminating the national debt, which he regarded as a tool empowering the federal government and thus centralizing power.

I believe it a national curse, Jackson said in 1824. My vow shall be to pay the national debt, to prevent a monied aristocracy from growing up around our administration that must bend it to its views, and ultimately destroy the liberty of our country.

Jackson followed through on his promise, vetoing virtually every spending bill and using federal funds to pay down the debt until it was fully paid off in 1837 right before a six-year economic depression that pumped it back up again.

World War II ballooned the debt as the nation ratcheted up defense spending to finance the war, causing the countrys debt to rise to more than 100% of gross domestic product.

The financial crisis was the appropriate time to borrow, just like it is now, she added.

Don’t Miss: How Does Filing Chapter 13 Bankruptcy Work

How Has The Us Public Debt Changed Over The Years

The United States federal government has continuously had a fluctuating public debt since its formation in 1789, except for about a year during 18351836, a period in which the nation, during the presidency of Andrew Jackson, completely paid the national debt. To allow comparisons over the years, public debt is often expressed as a ratio to GDP.

Maintain A Good Credit Score

If you have a good , try to maintain that. If its not so good, paying off your debt will help to improve it. Credit scores range from 300 to 900. The higher the number, the less youre perceived as a risk to lenders. Late payments are one of the factors that reduce your score. The amount of debt you have also determines your score. If your credit limit is $10,000 and you use $9,000, your dependence on credit is considered to be high.

Contrary to what some may believe, never taking out any loans isnt necessarily a good thing. If youre buying a home or a car, lenders are less keen on granting you a loan if you dont have a credit history. Thats why you have to build a good credit report.

You May Like: Does Filing Bankruptcy Affect Spouses Credit

Wendy’s Fans Worry About A Possible Change To Beloved Treat

Why, too, would we need to pay it? Is there an urgency to which no one but Grant is privy? There would be if interest rates were unaffordable, inflation were overly high or there was the risk of crowd out . Thats not happening though.

4. America is not insolvent.

Is a graduate insolvent because of student loans? Is your neighbor insolvent because he cant liquidate his mortgage tomorrow morning? Do you feel insolvent if a new car costs more than you have in the checking account? Of course not. In actuarial terms, insolvency may mean when debt outstrips assets, but in practical terms its when debt outstrips current ability to pay. This isnt to say that unlimited debt is a good thing, but rather that its complicated. The real measure of debt is interest rates: how much are we paying, can we afford those payments and are they going up?

With its $18.7 trillion economy and $3.2 trillion in tax revenue, America can afford its interest and debt payments. And those payments arent high, in fact the interest rate is at historic lows. So while theres much to be debated about whether further debt spending to stimulate the economy is wise, theres no reasonable argument about whether America can afford its debt right now.

5. We owe a lot of that money to ourselves.

To keep unpacking the stupidity, a good portion of that $42,998 would get paid to you.

China, by the way, holds roughly 8% of the national debt, a far cry from owning the Great Lakes.

Can America Keep Piling Up Debt

Economists debate whether the spending is sustainable. The U.S. finances the debt by selling bonds at auction. Demand has traditionally been high due to the size of our economy and a historically stable government, but the Treasurys auction of bonds in March 2021 was met with a tepid response.

Historically low interest rates meant the U.S. borrowed money cheaply, and it would theoretically invest it in an economy that would produce higher rates of return.

But interest rates are not expected to stay low forever. The 10-year rate on Treasury notes was expected to rise from 1.7% in March 2021 to at least 2.0% by the end of 2021, according to Kiplingers forecast.

The cost to just finance our debt is expected to be $378 billion in 2021 and increase to $665 billion by the end of the decade, according to CBO estimates. That money will be spent only on interest, not on the principal.

The U.S. is by far the most indebted organization in world history. While debt has been an issue since the inception of the U.S., its rapid growth will continue to challenge lawmakers into creating better programs to reign in expenditures, as well as American consumers who must develop improved way of managing their personal debt.

6 Minute Read

You May Like: How Long Does Bankruptcy Stay On Your Record

How Bad Is National Debt

Americans living with high levels of government and private debt tend to see saving in a positive light, while treating borrowing as a problem. In fact, they go hand in hand since borrowings come from savings and provide savers with the interest they earn from deferring consumption.

U.S. national debt provides corresponding low-risk assets for pension funds and families, and enables consumption in excess of production for the country as a whole.

At the same time, nothing more than simple arithmetic is required to see the pace of the recent growth of government debt as unsustainable. That’s the term the U.S. Treasury used in the Financial Report of the U.S. Government for Fiscal Year 2021, after calculating that under prevailing trends the federal debt-to-GDP ratio would increase from 100% in 2021 to 701% by 2096.Economists and policy analysts on the left often differ from those on the right in evaluating the tradeoffs between the everyday utility of government debt and its growing risks amid rapid accumulation.

Critics of public debt often contend it can crowd out private investment, a theory not supported by U.S. credit markets developments in recent decades. In contrast, economists using Modern Monetary Theory argue government borrowing can improve economic outcomes if it fosters public investment that expands the economy’s productive potential.

Iii Mixed Financing Of Social Security And Medicare

The stop digging strategy can significantly reduce the dramatic rise in debt that is projected to occur between now and 2020. But even if that were fully implemented, the fiscal deficits will continue to rise sharply in the years after 2020. The primary driver of those out-year deficits is the spending for Social Security, Medicare, and Medicaid. Taken together the cost of these programs is expected to rise from 8.4% of GDP in the most recent decade to 12.4% of GDP in 2020, 17.1% of GDP in 2035, and 26.4% of GDP in 2084, the last year of the CBOs 75-year analysis .

The 7% of GDP rise in this spending as a share of GDP between now and 2035 is equal to 70% of current total personal and corporate taxes as a share of GDP. Even if the payroll tax revenue is included, the total personal and corporate revenue would be about 18% of GDP, implying that the extra cost of these programs would require raising all tax rates by more than 50%. The amounts in 2084 would have to be much larger.

This large financing gap can be closed without raising taxes only by slowing the growth of the government outlays for Social Security and for Medicare. But doing so need not mean reducing retiree incomes or the health care of older Americans if the current tax-financed system is broadened to a mixture of the tax-financed and investment-based benefits. I consider first the possibility of doing so for Social Security and then turn to the more complex issue of Medicare.

You May Like: Can You File Bankruptcy More Than Once