What Should You Do If You Have A High Debt To Income Ratio

For your own knowledge, you should at all times monitor your debt to income ratio. It is a part of good financial planning to have a tab on your finances. When your income rises or when you are considering the idea of availing a new loan, it is a good idea to re-check your debt-income ratio and assess your financial position.

If you notice that your Debt to Income Ratio is high then there are things you can do to lower it. You can:

- Postpone a purchase if it is not essential.

- Increase your EMI and pay off the loan quicker this will temporarily raise your debt-income ratio but make it lesser in the long run.

- Not take more debt until your ratio has stabilized to below 35%.

- Look for ways in which you can increase your income

- If possible, foreclosing any existing loans would also be a good idea.

How Do You Calculate Your Dti

Like we said, figuring out your DTI is a fairly simple process. You dont need anything fancier than the calculator on your phone. All you need to do is add up all your monthly minimum debt payments and divide that by your monthly pre-tax income.

But, before we get any further, we need to talk about the different types of DTI.

Front-end ratio

To calculate your front-end DTI, also known as your housing ratio, youll need to add up all of your housing-related expenses. That includes your future monthly mortgage payments, plus property taxes, homeowners insurance, and any applicable homeowners or condo association dues.

Back-end DTI

Back-end DTI, sometimes called the total debt-to-income, is the number lenders pay attention to. It paints an entire portrait of a borrowers monthly spending.

Your back-end DTI includes additional debts and payments on top of the housing-related pieces outlined under front-end DTI. Back-end DTI is based on the minimum monthly payments for your credit cards, student loans, auto loans and any other personal loans you may have or may be co-signed to.

Its worth noting that when applying for the Knock Home Swap, the monthly mortgage payments on your old house will not be factored into your DTI calculation. Thats because Knock covers up to six months worth of mortgage payments on that house while waiting for it to sell. Those payments are part of the Home Swaps interest-free Equity Advance loan.

How Is The Debt

You May Like: How Long Does A Bankruptcy Stay On Your U4

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Don’t Miss: How Many Chapters Of Bankruptcies Are There

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Also Check: Does Chapter 7 Bankruptcy Get Rid Of Student Loans

How To Calculate Your Dti Ratio

For the most part, calculating your DTI ratio is actually rather simple. First, gather information using the following steps:

Add up your monthly debt payments to determine your total monthly debt.

Determine your total monthly income before taxes.

Divide your total monthly debt payment by your gross monthly income.

If your income is higher than your debt, you will yield a decimal

Multiply the decimal by 100 to discover your DTI percentage.

The equation is as follows:

Total Monthly Debt Payments ÷ Gross Monthly Income = Total DTI

If you find that your debt-to-income ratio is above 50%, you might need to pay off some of your previous loans before you can consider a new purchase. While on the other hand, if your DTI ratio is below 30%, you may find that you can be approved for a larger loan than you expected.

Either way, always be aware of your most up-to-date DTI status, as the information will allow you to make more thoughtful financial decisions.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Read Also: Can You Get A Mortgage With A Bankruptcy

What Is A Good Dti

According to debt.org, The maximum DTI you can have to qualify for a mortgage is usually 43%. Realtor.com reports a qualifying DTI ratio should not exceed 36%.

So whats a good DTI? While the maximum DTI will vary by lender and the loan product you choose, most lenders consider anything under 36% as acceptable for a DTI ratio but there are other factors that lenders consider also, such as credit score, employment history, etc.

Lenders look at your DTI to get a snapshot of your financial stability and your ability to make the new mortgage payments along with your other debt payments. If you have a lot of accrued debt, even if you have a large income, they may consider you to be more of a risk than someone who has less debt.

If your debt-to-income ratio is higher than 36% some lenders may still work with you, but it might cost youtheir loan offer may be smaller or come with higher interest rates.

Homebuying, meet simplicity.

How To Calculate It And Why Its Important To Know Before You Apply For A Mortgage

Your income is an important part of your mortgage application, but its not the only number mortgage lenders review.

Even with an impressive monthly paycheck you could find yourself unable to qualify for the loan requested or, worse, denied a loan entirely if you have a high debt-to-income ratio . Your DTI is an essential indicator lenders use to determine your creditworthiness and the ability to make your mortgage payments.

So what is a DTI? How do you calculate it? And how does it impact your homebuying options?

Its actually pretty simplelets dig in!

You May Like: Does Chapter 13 Bankruptcy Affect Tax Returns

Housing Ratio: Front End Ratio

The housing ratio only includes housing-related expenses, such as the subject propertys monthly mortgage payment, property taxes and insurance, and any applicable PMI or homeowners association dues. The total monthly housing payment divided by your monthly pre-tax income equates to your housing ratio.

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

You May Like: Has Michael Bloomberg Ever Declared Bankruptcy

How To Calculate Your Debt

To calculate your DTI, add up the total of all of your monthly debt payments and divide this amount by your gross monthly income, which is typically the amount of money you make before taxes and other deductions each month.

Lets consider an example. Say your gross monthly income is $6,500 and your debt payments total $3,000. Heres how they break down.

| Monthly bill |

|---|

Heres how youd calculate your debt-to-income ratio.

$3,000/$6,500 x 100 = 46.2%

How To Lower Your Debt

You May Like: Buy By The Pallet Merchandise

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

D/e Ratio Formula And Calculation

Debt/Equity

\begin & \text = \text + \text \\ \end Assets=Liabilities+Shareholder Equity

These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt.

To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations.

Also Check: Can You File Bankruptcy Without Your Spouse

How To Improve Your Debt

When you’re applying for a mortgage, improving your debt-to-income ratio can make a difference in how lenders view you. Several steps can help you achieve a lower DTI, including:

- Reduce your total debt by paying off credit cards and paying down any other loans that you can.

- Avoid taking on new debt.

- Consider a debt consolidation loan to make it easier to reduce debt faster.

- Improve your income by asking for a raise, getting a second job or finding a new primary job that pays more.

- Review your budget to see where you could save money to put toward paying down debt. If you don’t have a budget, start one.

How To Improve A High Debt

Calculating your debt-to-income ratio is a good way to see if your current gross income is sufficient to pay all existing monthly debt payments. You already know that a lower DTI is better. But what happens if your DTI is at 50% or higher? Luckily, there are ways to lower your DTI, including the following:

Read Also: How Much Money Can You Have When Filing Bankruptcy

You Need To Know This Number If You’re Going For A Mortgage

Your debt-to-income ratio is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

Why do you need to know this number? Because lenders use it as a measure of your ability to repay the money you have borrowed or to take on additional debtsuch as a mortgage or a car loan. It’s also a helpful number for you to know as you consider whether you want to make a big purchase in the first place. This article will walk you through the steps to take to determine your debt-to-income ratio.

How To Lower Your Dti Ratio

You can reduce your DTI ratio and increase your chances of getting approved for a loan with favorable rates and terms in a number of ways. Here are several suggestions:

Its a good idea to recalculate your DTI ratio every month to find out whether youre making progress. By watching the percentage go down slowly but surely, youll be motivated to keep your debt at manageable levels.

Also Check: How To Buy Force Close House

Debt: Income = Gross Monthly Debt: Gross Monthly Income

Where

Gross Monthly Debt = All the debt payments to be made monthly at the time of calculating the ratio

Gross Monthly Income = The monthly income earned by you.

Fullerton India offers a personal loan eligibility calculator as well as a personal loan EMI calculator online. This will automatically calculate the amount of personal loan you are eligible for depending on your income and existing obligations, as well as the EMI you will have to pay every month for a certain interest rate and tenure. Thus, the personal loan eligibility calculator primarily factors in the Debt-income ratio.

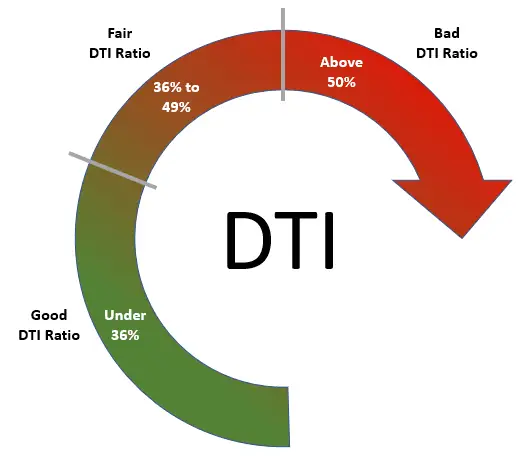

What Is A High Debt

High Debt-to-Income Ratio If your debt-to-income ratio is more than 50%, you definitely have too much debt. That means you’re spending at least half your monthly income on debt. Between 36% and 49% isn’t terrible, but those are still some risky numbers. Ideally, your debt-to-income ratio should be less than 36%.

Recommended Reading: Loans To Stop Foreclosure

What Your Dti Will Not Tell You

Calculating your debt-to-income ratio is valuable, but it doesnt provide the entire picture regarding the financial health of your business. For example, while the DTI can let you know how much debt youre carrying in regards to income, it does not:

- Distinguish between different types of debt

- Provide you with the interest rate that your loans carry

- Provide extensive financial information about your business

- Address credit limits or your credit history

- Provide a detailed credit report

- Provide a credit utilization ratio