Questions And Answers Regarding The Fha

Are FHA loans just for first-time home buyers?

No, FHA loans are not just for first-time home buyers. They are available to anyone who meets the eligibility requirements, which include a minimum credit score and down payment amount. However, first-time home buyers may be able to take advantage of some special programs that are offered exclusively to them.

Is it possible to gift the down payment?

Yes, the down payment can be gifted. The gift must be from a family member or friend and must be documented in order to prove the source of the funds.

How can I obtain the best mortgage interest rate?

There are a few things you can do to get the best mortgage interest rate:

1. Shop around. Compare rates from different lenders before you decide on one. 2. Get pre-approved. This will show lenders that you’re serious about getting a loan and that you’re a good risk. 3. Keep your credit score high. Your interest rate will be lower if your credit score is better. 4. Make a large down payment.

Is my credit score high enough for an FHA home loan?

There’s no definitive answer, as your credit score is just one factor that lenders consider when approving a mortgage. That said, a credit score of 580 or higher is generally considered to be acceptable for an FHA home loan. So if your credit score is in that range, you should be good to go.

What is the maximum amount I can borrow for an FHA home loan?

What is the difference between conventional and FHA loans?

High Debt To Income Ratio Due To Credit Card Balance

This Article On High Debt To Income Ratio Due To Credit Card Balance

Home Buyers planning on applying for a home purchase loan or a refinance mortgage loan, make sure to have credit card balances paid prior to the start of the mortgage process . High Debt To Income Ratio Due To Credit Card Balance is often the main issue with borrowers.

- There are strict debt to income ratio requirements mortgage borrowers need to adhere to

- Maximum debt to income ratio caps on conventional loans is 50%

- Maximum debt to income ratio caps for FHA loan programs are capped at a maximum 46.9% front end and 56.9% back end to get an approve/eligible per Automated Underwriting System Approval

In this article, we will discuss and cover issues with qualifying for a mortgage with High Debt To Income Ratio.

How Do You Calculate Dti For A Va Loan

Now that you understand the importance of your DTI for a VA loan approval, youll want to understand how to calculate it. Heres how.

- Add up your minimum monthly payments

- First, find the total of your debt payments for the month. Youll use the minimum payment for each monthly debt. In other words, if your account balance is higher than it usually is, use the amount you typically pay each month. Some examples of debt payments can include:

DTI ratio

0.3899, or 38.99%

According to VA loan guidelines, the borrower in the example above would qualify for a VA loan since their DTI is less than 41%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: What Property Can You Keep In Chapter 7 Bankruptcy

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Recommended Reading: What Does It Mean To Declare Bankruptcy

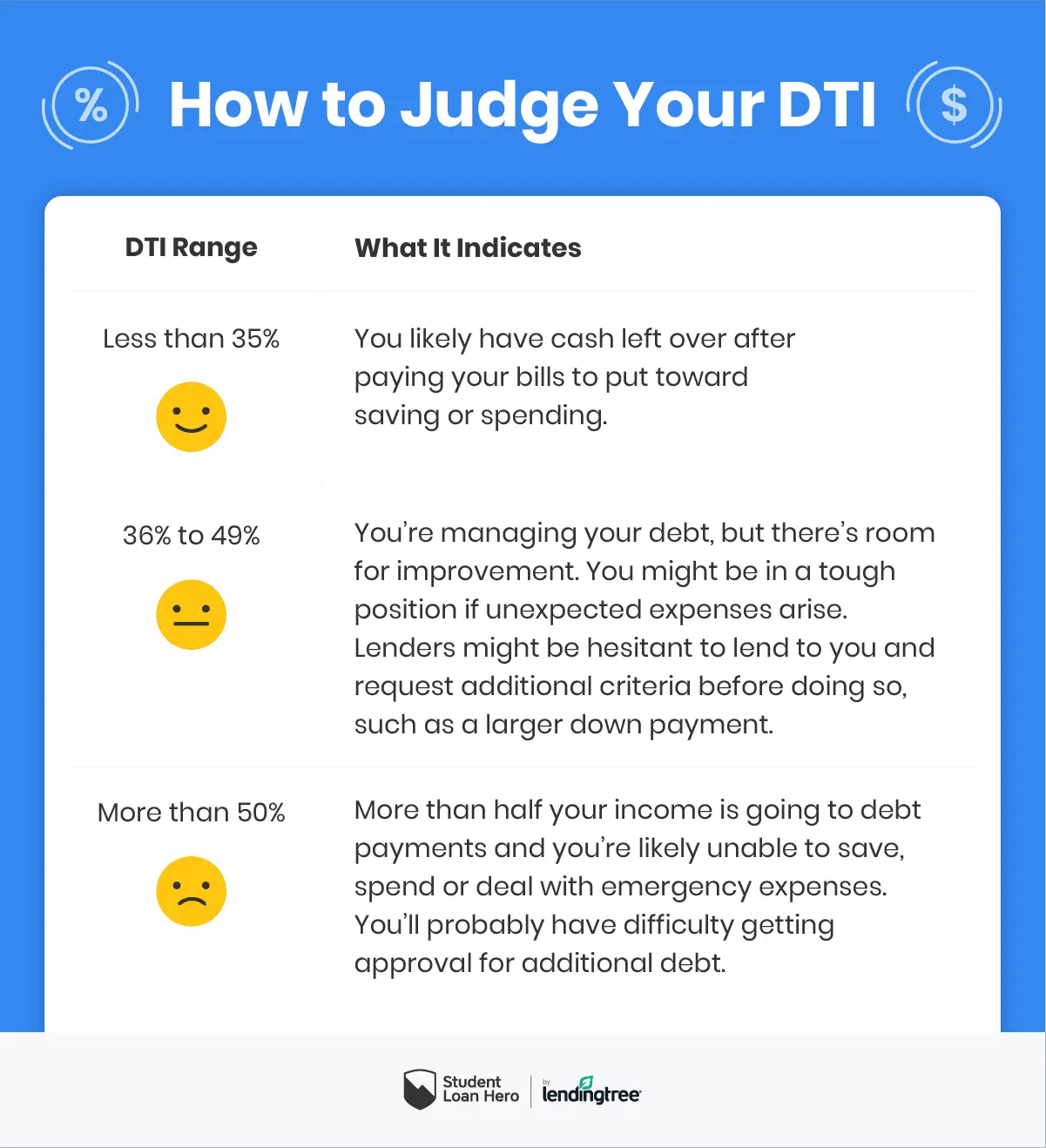

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

Dealing With High Dti Ratio

Having too high of a DTI ratio can force borrowers to make tough decisions.

One is to hold off on buying a home until they have a better balance of debts and income. Another option is to seek a lower loan amount.

For example, if your DTI ratio is too high with a $300,000 loan, you might be able to move forward with a $250,000 mortgage. Readjusting your homebuying budget is often disappointing, and it might not be realistic depending on your real estate market, needs, and other factors. But it’s an option for dealing with a high DTI ratio.

Talk with a Veterans United loan specialist if you have questions about your debts, income, and purchasing power.

You May Like: Can You Keep Some Credit Cards When Filing Bankruptcy

Fha Front End Debt To Income Ratio Calculation

The front end debt-to-income ratio is a calculation that takes the monthly gross income divided by the mortgage payment, including taxes, insurance, mortgage insurance fee, and any other expense paid monthly. According to the guidelines of the Federal Housing Administration , the maximum front end ratio can be up to 40% depending on the borrower’s credit history.

Here’s an example. The borrower earns $2,000 and the anticipated mortgage payment is $800 a month. The front end calculation includes the real estate taxes, homeowner’s insurance, mortgage insurance premium, and any other required fees.

$650 /$2,000 = 33%

Add Up All Your Monthly Debt

When lenders add up your total debts, they typically do it one of two ways these two methods of determining your DTI are called front-end and back-end ratios.

Your front-end ratio only takes into consideration your housing related debts, such as rent payments, monthly mortgage payments, real estate taxes, homeowners association fees, etc.

Your back-end ratio, however, includes those monthly payments as well as other debts that might show up on your credit report, such as , personal loans, auto loans, student loans, child support, etc.

Your lender might calculate your front-end or back-end ratio when determining your DTI and sometimes they may look at both to get a better idea of your financial situation. When calculating your own DTI, its a good idea to add all these expenses up as part of your monthly debt to be prepared. Keep in mind that when tallying up your debts, lenders typically only look at things that appear on your credit report so things like utility payments may not actually count toward your total.

Recommended Reading: Can You File Bankruptcy On A Lawsuit

The Bottom Line: Know How To Figure Out Your Debt

To recap, your debt-to-income ratio is the percentage of your gross monthly income that is spent on monthly debt payments. Its a very important number, because lenders use it to determine if youre a credit risk, and to ascertain what interest rate to offer you for your loan.

Understanding your DTI is a critical step in assessing whether youre ready to begin the process of buying a home.

How Do You Calculate Debt

Calculating your DTI is a fairly simple process, as long as you know the right numbers. In the simplest terms, you can calculate your DTI by dividing your total debt each month by your total income. But what expenses actually count toward your total debts? Lets break down what you should include when estimating your DTI.

While you can calculate this manually, you can also use the debt-to-income calculator in this article to calculate your DTI ratio quickly.

Also Check: How Many Times Has Mike Bloomberg Filed For Bankruptcy

High Debt To Income Ratio Due To Credit Card Balance: Lower Debt To Income Ratio Prior To Applying For A Mortgage

Borrowers do not want to be maxed out on credit cards prior to applying for a mortgage. Borrowers need to meet debt to income ratios when they are applying for a mortgage loan. Make sure to have sufficient room in debt to income ratios where if some line items do turn out to be more than anticipated borrowers do not go over the debt to income ratio caps. Going over the debt to income ratio caps during the mortgage approval process can cause delays in mortgage closings. Borrowers who need to pay down or pay off your credit card balances might be forced to close out the hard-earned payment history of credit card accounts.

This BLOG On High Debt To Income Ratio Due To Credit Card Balance Was UPDATED On July 18th, 2020

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

Also Check: What Can You Include In Bankruptcy

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

What Dti Do You Need For A Home Equity Loan

More than anything, lenders want borrowers who can pay back their loans regularly and on time. To that end, they look for people with low DTIs because it indicates that they has sufficient income to pay for a new loan after paying their current debt obligations.

The maximum DTI that most home equity loan lenders will accept is 43%. Of course, lower DTIs are more attractive to lender because it indicates you have more room in your budget to afford a new loan. A lower DTI can make you eligible for a larger loan or a lower interest rate, or both.

To decrease your DTI, you can pay off some debts before applying for a home equity loan. Paying down your credit cards is one way to do that. Reducing your credit card balance will also lower your , which can boost your credit score, further helping you qualify for a loan.

The Consumer Financial Protection Bureau suggests that homeowners aim for a total DTI no higher than 36%. In terms of mortgage debt alone it suggests a DTI of no more than 28% to 35%.

You May Like: What Is Needed To File Chapter 7 Bankruptcy

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Recommended Reading: How To File For Bankruptcy In Maryland

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Find Ways To Make Debt Less Expensive

When paying off debt, the name of the game is making your debt as cheap as possible. If youre carrying high-interest credit card debt, try to find less costly alternatives, such as:

- The balance transfer offer mentioned above.

- Asking your current card companies/debtors for a lower interest rate.

- If you already own a home, you might consider a cash-out refinance to consolidate debt.

- Applying for a personal loan with a fixed repayment schedule to consolidate debt to a lower interest rate.

Don’t Miss: Does Bankruptcy Affect Your Tax Refund

High Debt To Income Ratio Due To Credit Card Balance: Paying Down Credit Card Balances To Lower Dti

When mortgage underwriters suggest borrowers pay off certain credit card balances off in order for the debt to income ratio in line with the maximum allowed per mortgage guidelines they may also request to close them out.

- The underwriter may request that once they are paid to close out the credit card accounts to close out the credit card accounts

- This is very common for a mortgage underwriter to request

- It may also state per DU FINDINGS that borrowers pay off and close out existing credit card accounts after they pay off the balances

- This is often the case with Fannie Mae DU Automated Underwriting System

However, Freddie Mac LP Automated Underwriting System will allow borrowers to pay outstanding credit card balances and not close out the credit card accounts.

Getting A Loan With High Dti Ratio Faq

What is the highest debt-to-income ratio to qualify for a mortgage?

According to the Consumer Finance Protection Bureau , 43% is often the highest DTI a borrower can have and still get a qualified mortgage. However, depending on the loan program, borrowers can qualify for a mortgage loan with a DTI of up to 50% in some cases.

What is a good debt-to-income ratio?

While lenders and loan programs all have their own DTI requirements typically, a good DTI is 36% or lower.

What happens if my debt-to-income ratio is too high?

Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan. If youre in this situation, try to pay down or restructure some of your bigger debts before applying for a home loan.

How to lower your debt-to-income ratio

A commonsense approach can help reduce your DTI before beginning the home buying process. Increasing the monthly amount you pay toward existing debt, avoiding new debt, and using less of your available credit can all help lower DTI. Recalculating your DTI ratio each month will help you measure your progress and stay motivated.

Debt-to-income vs credit utilization

Recommended Reading: How Many Times Can Bankruptcy Be Filed