How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

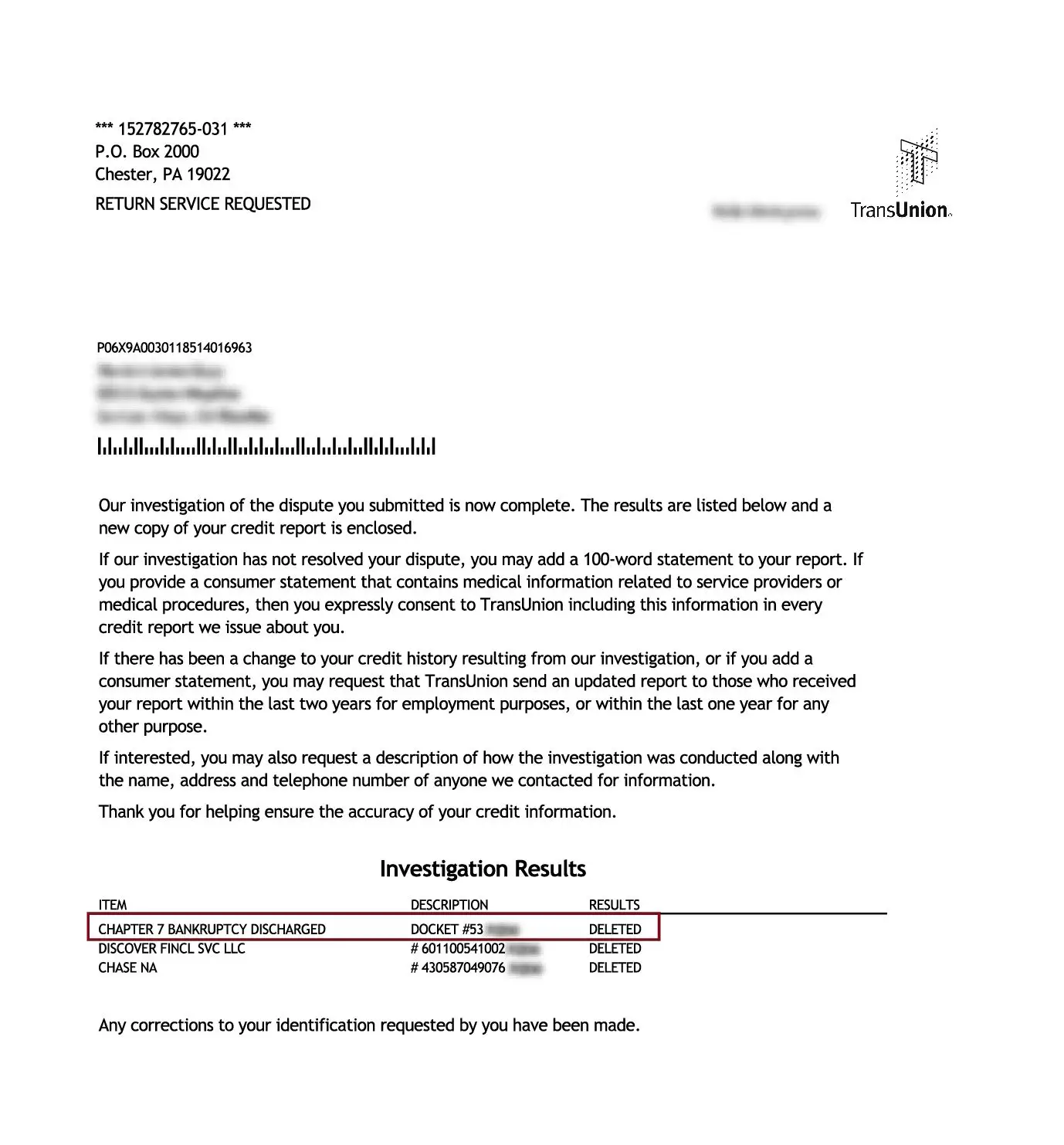

Check Your Credit Report For Bankruptcy Errors

In this step, youll need a copy of all 3 of your credit reports. This is where having a comes in handy. TransUnion is the best credit monitoring service in my opinion, plus you get a free credit score.

Review the credit report carefully for any inaccurate or incomplete information. Here is a list of the most common bankruptcy errors. Names, addresses, and phone numbers Incorrect dates Discharged debts that still show a balance

If you have found no inaccuracies within the information on your credit report, then unfortunately theres nothing that can be done to remove it prematurely, youll have to wait 7-10 years for it to fall off your credit report.

Recommended Reading: Did Donald Trump Filed For Bankruptcy

What Is A Bankruptcy Dismissal

A dismissal occurs when the debtor or the creditor does not want to continue with the case after it has been filed. A court order dismissing a bankruptcy may still affect your , despite not making any changes to your debt.

Once you file for bankruptcy, your is frozen. When you have a bankruptcy dismissed, it will still show up on your file for 10 years from the filing date of the original case.

It’s important to note that even though a bankruptcy may be dismissed, there are still major limitations on what you can do with your finances. For example, if you are able to owe a creditor money, then you will have to pay that back. In addition, the Internal Revenue Service may still be able to take action against you if they feel you under-reported your income during this time period or didn’t report it at all.

How Long Do Bankruptcies Stay On Your Credit Report

The length of time that a bankruptcy filing stays on your credit report depends on what type of bankruptcy you filed. We took a look at Chapter 7 and Chapter 13, which are the two main types of consumer bankruptcies, and to see how their impacts on your credit score differ.

- Chapter 7 bankruptcy: Also known as liquidation bankruptcy, Chapter 7 is what Harrison refers to as “straight bankruptcy.” It’s the most common form of consumer bankruptcy and is usually completed within three to six months. Those who file for Chapter 7 will no longer be required to pay back any unsecured debt , like personal loans, credit cards and medical expenses, but they may have to sell some of their assets to settle secured loans. Chapter 7 bankruptcies stay on consumers’ credit reports for 10 years from their filing date.

- Chapter 13 bankruptcy: Harrison refers to Chapter 13 as the “wage earner’s bankruptcy.” This form of filing offers a payment plan for those who have the income to repay their debts, just not necessarily on time. About a third of bankruptcies filed are Chapter 13 . Those who file are still required to pay back their debts, but instead over a three-to-five year time frame. Chapter 13 bankruptcies stay on consumers’ credit reports for seven years from their filing date.

Read Also: Cost To File Bankruptcy In Wisconsin

Does Bankruptcy Wipe Your Credit Report Clean

Myth: All bankruptcy debts will be wiped clean from your credit report.

The truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your credit report. All bankruptcy-related accounts will remain on your credit report and affect your credit score for up to seven years or as long as they normally would, though their impact will diminish over time.

How Many Years Until Bankruptcy Comes Off Credit Report

Asked by: Haven Jacobson

The bankruptcy public record is deleted from the credit report either seven years or 10 years from the filing date of the bankruptcy, depending on the chapter you filed. Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe.

Read Also: Fizzics Group Llc

Speak With Our Bankruptcy Lawyers In Phoenix & Scottsdale

Canterbury Law Group should be your first choice for any bankruptcy evaluation. Our experienced professionals will work with you to obtain the best possible outcome. You can on the firm to represent you well so you can move on with your life. Call today for an initial consultation. We can assist with all types of bankruptcies including Business Bankruptcy, Chapter 7 Bankruptcy, , Chapter 5 Claims, Chapter 13 Bankruptcy, Business Restructuring, Chapter 11 Bankruptcy, and more.

*This information is not intended to be legal advice. Please contact Canterbury Law Group today to learn more about your personal legal needs.

Recommended Reading: How Long After Filing Bankruptcy Can You Buy A Home

Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Also Check: When Did Donald Trump Declare Bankruptcy

You May Like: How Many Times Has Donald Trump Filed For Bankruptsy

What Is Credit Reporting And How Does It Affect Me

In Canada there are two major credit reporting agencies Equifax and TransUnion. Most people commonly refer to these agencies as the credit bureaus. Credit reporting agencies do exactly that: they report credit history. They can also be referred to as an information service as they provide copies of your credit report to potential lenders. This allows the banks and other lenders to determine how much risk they are taking when they loan you money. Whenever anyone lends money they are taking a risk that it will not be repaid.

To get any significant credit, you need a good borrowing history.

Approximately once each month every major lender in Canada sends a report about their borrowers to the credit bureaus. Also, the federal Superintendent of Bankruptcy reports a list of everyone who filed a consumer proposal or bankruptcy to the credit bureaus, as well as a list of everyone who has been discharged. The credit bureaus collect this information, summarize it, and sell it to their members, the lenders.

When you apply for credit you normally sign an application that provides the lender consent to access your credit history. Generally this consent allows then access not only the first time you apply, but anytime afterwards as well, as long as your account is open. It is also this consent that allows the lender to provide the bureau information on your payments etc. once you have been approved.

How Does Bankruptcy Affect Credit Score

Obviously, bankruptcies always negatively impact your credit report. How big an effect varies. Having more accounts that are included in your bankruptcy will have a bigger impact than if its just one car loan or credit card.

Your credit is rated on whats called a FICO score, which ranges from a perfect score of 850 to a low of 300 based largely on things lenders see on your credit report: your payment history, debt burden, how long youve had credit and the types of credit used. How badly bankruptcy damages your score depends on how high it was in the first place.

According to FICOs published guidelines, someone with a 680 credit score considered a good score would drop between 130 and 150 points into the poor range. Likewise, a 780 credit score would drop between 220 and 240 points, also into the poor range .

In each case, qualifying for a mortgage after bankruptcy or buying a car with credit after bankruptcy will prove to be difficult until you can rebuild your credit. That takes time and effort.

You May Like: How Many Bankruptcies For Donald Trump

Where Does Bankruptcy Appear On Your Credit Report

Regardless of the type of bankruptcy you file for, youll want to know where exactly it shows up on your credit report. Your bankruptcy status will appear in conjunction with any debts or accounts that will get addressed throughout your bankruptcy proceeding. For instance, if Loan A was discharged as a result of your bankruptcy, then youll still see the debt appear in your credit report. It will say something like Loan A: Discharged in bankruptcy.

Prior to your bankruptcy, these debts will either show current, meaning youre keeping up with the payments, or delinquent if youve fallen behind on them. Each time a potential lender looks into your report, theyll see those accounts, which means theyll know you filed for bankruptcy in the past. We know what youre thinking How long does bankruptcy last on my report?. This answer depends on the type of bankruptcy you file for.

Dont Miss: What Is Syncb Ntwk On Credit Report

Diy Vs Professional Credit Repair

It can often feel like credit repair is a catch-22. You may not have a lot of expendable income to hire a professional credit repair company, but you likely dont have the know-how or emotional bandwidth to tackle it yourself either. We get it.

Bankruptcy is the negative item we most encourage our readers to get professional help with though. The steps weve outlined are advanced tactics that in most cases are best left to credit repair specialists. They are more familiar with the ins and outs of the credit bureaus and court systems, as well as the steps well be outlining.

Below are the credit repair companies we recommend.

Also Check: Fizzics Company Worth

To Remove A Bankruptcy From Your Credit Report Youll Need To Find Evidence That The Bankruptcy Was Reported Incorrectly Otherwise It Will Only Come Off After Seven Or 10 Years Depending On The Type Of Bankruptcy

Beyond the stress and inconvenience that comes with filing for bankruptcy, it can have a long-standing impact on your credit report and score.

Fortunately, that negative impact can be mitigated with the right help.

How Long Does A Bankruptcy Stay On Your Credit Report

Did you know that more than 500,000 Americans declare bankruptcy each year? While unfortunate, its helpful to know that you are not alone when dealing with bankruptcy.

Even after your bankruptcy is discharged, there is the aftermath to contend with as well, namely, repairing your credit.

With so many people experiencing bankruptcy and so much financial data going through the credit bureaus, the chance for error is great. Thats why you must review all of your credit report information for accuracy, particularly the data surrounding the specifics of your bankruptcy.

Well walk you through why it works and what to do so you can start repairing your credit today, even with a bankruptcy in your past.

Don’t Miss: How Soon After Bankruptcy Can I Buy A New Car

How Long Does Chapter 13 Stay On A Credit Report

A Chapter 13 bankruptcy helps you get most of your debts discharged, but you are still expected to pay off a portion of your debts. How so? Youll get ordered to participate in a repayment plan that will last about three to five years. So long as you adhere to the plan, the rest of your debt will get discharged once your plan ends.

In a nutshell, your partial repayment means the bankruptcy will fall off your report faster than if you filed for a Chapter 7 bankruptcy. With a Chapter 13 bankruptcy, you can expect it to remain on your credit report for seven years from the date on which you filed for bankruptcy.

Accounts Included In Bankruptcy

When you include an account in your bankruptcy filing, the lender will update the account to show the status as “included in bankruptcy.” Once the bankruptcy is discharged, the status will be updated again to show that it has now been “discharged” in bankruptcy.

Whether you file Chapter 7 or Chapter 13, an account that was never late and then included in bankruptcy will be removed seven years from the bankruptcy filing date. If the account was delinquent at the time it was included in the bankruptcy, it will be removed seven years from the original delinquency date on the account. In both cases, accounts included in bankruptcy will continue to show the payment history on the account prior to the bankruptcy status.

Read Also: How To Obtain Bankruptcy Discharge Papers

Is My Credit Report Accurate

You should always check your credit score from time to time, even when you arent thinking about filing for bankruptcy. It is easy and free to check your score when you use these three large credit bureaus- Equifax, Experian, and TransUnion. You are allowed to look at your credit report for free once a year. You can order your own personal report at www.annualcreditreport.com to see for yourself your credit standing.

Youll want to carefully review all three of these reports, as not every creditor reports back to all of them. Check a few months after you file for bankruptcy to make sure it was noted from each creditor. If it isnt, you will want to make sure it gets corrected right away. If a potential lender looks at your report and sees a bill that is open but not paid, they may think that you are still the responsible party for it when you are not.

You will also want to check whether your Chapter 7 bankruptcy case has been discharged or dismissed. If it was discharged, this means that all of your qualifying debts were completely erased. A bankruptcy that is successful due to a discharge will mean that future lenders will look at your report differently than if it has been dismissed. Talk to your lawyer if you are unsure of the difference between a discharge and a dismissal. They can provide you with the information that you need.

Is It Even Possible To Get A Bankruptcy Removed From Your Credit Report

We want to be upfront and transparent: its very hard to get a bankruptcy removed from your credit report. If all information is accurate and complete, it is not possible to remove a bankruptcy from your credit report. But if the bankruptcy entry contains any inaccurate or incomplete information, it may be possible to have it removed.

Also Check: Best Bankruptcy Software

Does Your Credit Score Go Up After Chapter 7 Discharge

Your credit scores may improve when your bankruptcy is removed from your credit report, but you’ll need to request a new credit score after its removal in order to see any impact. Credit scores are not included in credit reports. Rather, scores reflect what is in your credit report at the time the score is calculated.

Send A Letter To The Court Administrator

If the credit bureaus claim they verified their information with the bankruptcy court, you can also write the court yourself, asking the court administrator about its procedure for verifying records with the credit bureaus.

When you do this, be sure to include a self-addressed stamped envelope to increase your chance of getting a response.

When you contact the bankruptcy court, you might have to dig a little bit to find the right department and address for your letter.

Start by visiting the courts website, and then look for any tab or menu item that says clerks office or clerk of courts.

The courts website should list phone numbers for various departmentsdont hesitate to call around to make sure youre sending your letter to the correct department.

Depending on which court youre dealing with, you might receive any number of responses.

But the bankruptcy courts say they dont verify bankruptcy information with the credit bureaus. Instead, the courts post bankruptcies on their dockets, which are public records.

In short, if a credit bureau claims it verified your bankruptcy with the court, this almost certainly isnt true.

If you can get a letter from the court saying as much, you might have a chance of getting the credit bureau to remove your bankruptcy.

Don’t Miss: Fizzics Net Worth

Why Repair Your Credit W/credit Glory Vs Diy

Removing inaccurate negative items helps improve your credit . DIY credit repair is a headache. Partnering w/Credit Glory is often a simpler alternative. Why?

- Easier – Making a mistake disputing DIY costs you. Credit Glory helps you build a strong case for disputing inaccurate collections .

- Saves you money – An unsuccessful dispute leaves you stuck with debt . Credit Glory helps you boost your score â which means saving money on loans .

- Top-class customer support – Credit Glory has best-in-class customer service to answer questions and keep you updated. Credit Glory even offers an industry-leading 100% money-back guarantee (if no errors are removed in the first