How Much House Can I Afford With An Fha Loan

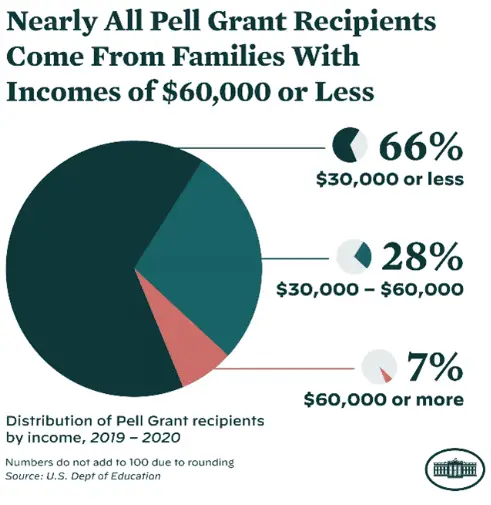

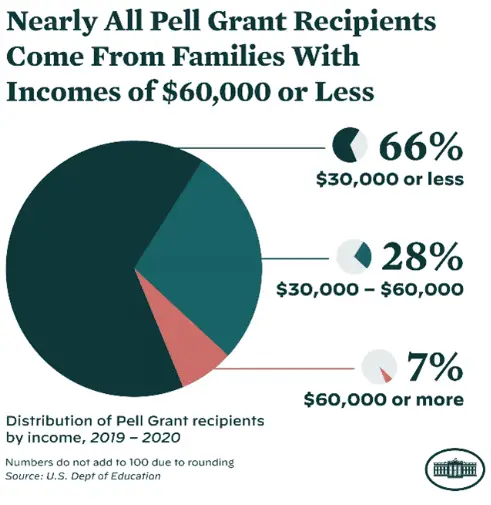

With a FHA loan, yourdebt-to-income limitsare typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirementsare met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Extend Your Mortgage Term

Choosing a longer mortgage term spreads your loan balance over more total payments, reducing the amount of each payment individually.

But remember, extending your term comes at a cost, as youll ultimately pay more in cumulative interest over the life of your loan.

Read more:15-Year Mortgages vs. 30-Year Mortgages

Borrow Up To 8 Times Your Salary With A Big Down Payment

Lets assume you can make a $160,000 down payment maybe by using equity youve built up over many years in previous homes, or maybe because youve had a windfall of cash.

With such a hefty down payment, how many times your salary can you borrow for a mortgage?

- Value of the home you can afford $790,800

- Monthly payment $2,700

Again, your total monthly housing costs havent changed. But the value of the home you can afford is nudging $800K because youre making a big down payment.

Don’t Miss: How Long Does Ch 13 Bankruptcy Stay On Credit Report

What Do Lenders Look At To Determine Your Home Affordability

Lenders look at several factors when determining whether a borrower will qualify for home financing, including the following:

- Income: Your gross income includes all wages and other earnings before taxes. Your income helps lenders determine whether you can afford to purchase a home.

- Your helps the lender analyze the risk associated with lending you the money to buy a house. Precise credit score requirements depend on the loan type and lender, but in general, youll need a score of at least 620 for a conventional loan.

- Debt: Your debt-to-income ratio shows how much you earn compared to how much a mortgage would cost. Lenders use this to see how easily you would be able to afford a monthly mortgage payment.

- Down payment: Though not everyone can afford to put 20% down, a larger down payment will mean a lower monthly mortgage payment.

Check and monitor your credit score.

Get a free Rocket Account

Where Should I Stash My Down Payment

You could stash your down payment in a simple money market savings account. Youre not going to make tons on interest, but you wont lose money either. Keep in mind: Saving a down payment is not the same as investing for retirement. Saving a down payment should only take you a year or twoso you want to keep your savings in a place thats easy for you to access.

Also Check: What Debts Are Not Discharged In Bankruptcy

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Why It’s Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month.

For example, lets say you earn $4,000 each month. That means your mortgage payment should be a maximum of $1,120 , and your other debts should add up to no more than $1,440 each month . What do you do with whats left? Youll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

You May Like: How Much Does Filing Bankruptcy Lower Your Credit Score

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

What Are Todays Mortgage Rates

Todays rates are still low, which is good news for home buyers. The lower your interest rate, the more real estate you get for your dollar.

Remember, theres no perfect amount to spend on your home loan. The decision is personal it depends on how much you make, how much you currently spend each month, and how large of a housing payment youre comfortable with.

So explore your options, check your rates, and pick the right mortgage amount for you.

Don’t Miss: How Much To File Bankruptcy In Wisconsin

What Salary Do You Need To Buy A $400000 House

Now lets take what weve learned and put it into an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 . To cover that payment, youd need to earn a monthly take-home pay of at least $10,000 .

So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 . But youd actually need more than that after adding in the cost of property taxes and home insurance.

If that doesnt sound like you, dont worry. You have a few options. You could save a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Also Check: Liquidation Stores Charlotte Nc

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

My Take: Somewhere In Between

Not everybody is as debt-averse as Ramsey. And his one-size-fits-all advice might shut out a huge segment of Americans from ever realizing their homeownership dreams.

Good luck finding a mortgage in California that you can pay off over a 15-year term, with monthly payments at less than 25% of your after-tax income. That approach will be unrealistic in a number of regional American housing markets with high home prices.

If I had to set a rule, it would be this:

- Aim to keep your mortgage payment at or below 28% of your pretax monthly income.

- Keep your total debt payments at or below 40% of your pretax monthly income.

Note that 40% should be a maximum. I recommend striving to keep total debt to a third of your pretax income, or 33%.

As some commenters have pointed out, while it may be possible to buy a decent home in a small midwestern town for $100,000 , buyers in New York or San Francisco will need to spend five times that amount just to get a hole in the wall. Yes, people tend to earn more in these high-cost-of-living areas, but not that much more. Does it mean they shouldnt buy a home? Not necessarily. Theyll simply have to make trade-offs to buy in those areas.

Also Check: Loans To Help Pay Off Debt

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Also Check: B& p Liquidation Pallets

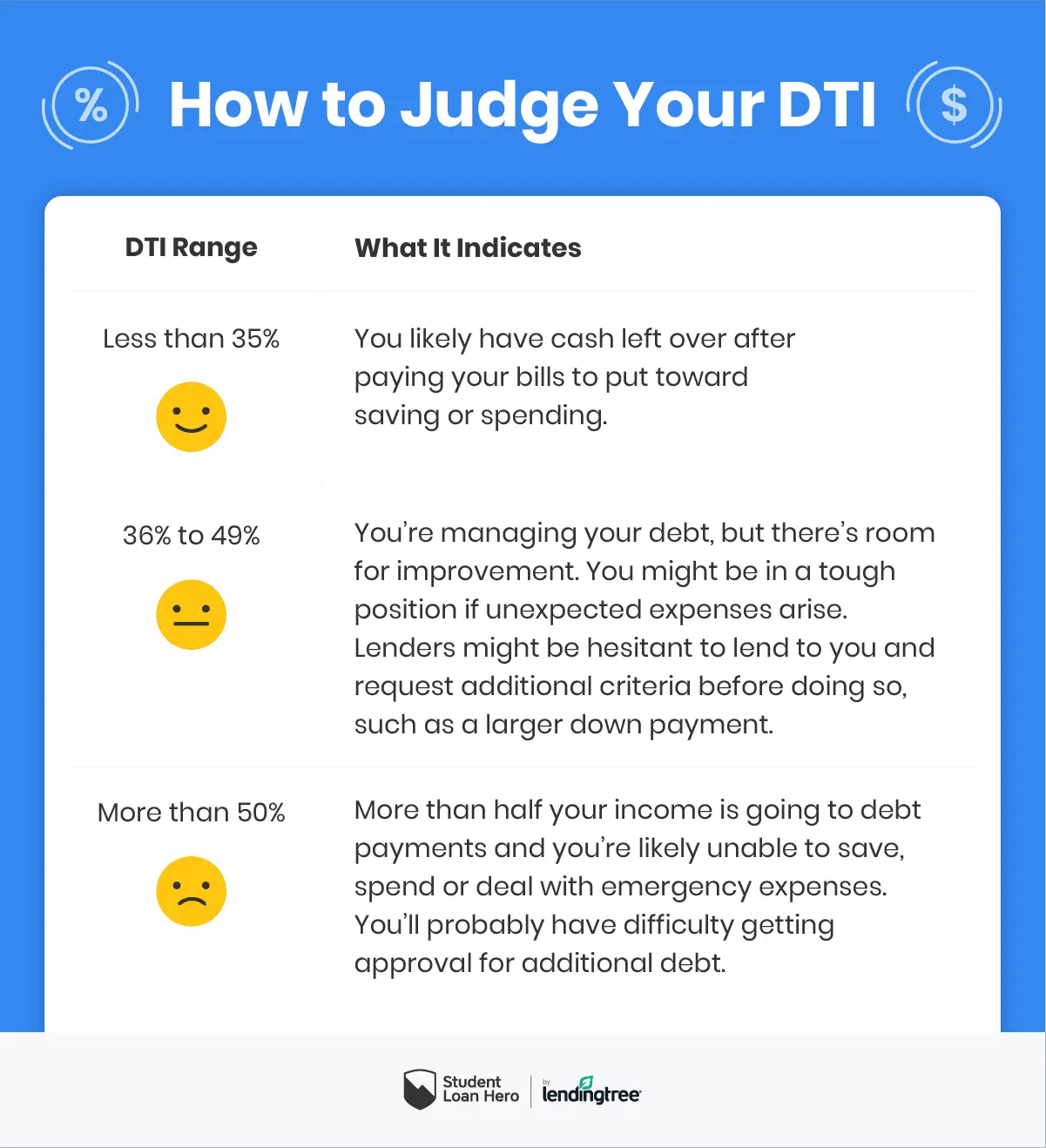

What Is A Debt

A debt-to-income ratio is the percentage ofgross monthly incomethat goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 36/43.

Front-end ratio is the percentage of income that goes toward your total monthly mortgage costs, such as:

- Mortgage principal and interest

- Alimony payments

- Vacation/rental property costs

Lenders often look at both ratios during themortgage underwriting process the step when your lender decides whether you qualify for a loan. Our debt-to-income calculator looks at the back-end ratio when estimating your DTI, because it takes into account your entire monthly debt. In addition to your DTI ratio, lenders may look at your credit history, current credit score, total assets andloan-to-value ratiobefore deciding to approve, deny or suspend the loan approval with contingencies.

How Much Should Your Mortgage Be

Your mortgage should be a loan amount you can comfortably afford in your monthly budget.

So when determining the right size, you have to work backwards find the right monthly payment first, and calculate the home purchase price based on that number.

When it comes to monthly mortgage payments, one number is key in determining what you can afford: your debt-to-income ratio .

This number compares your monthly income against your monthly debts to see how much mortgage you could afford alongside your existing payments.

Keep in mind that your loan officer is going to qualify you on gross income. Therefore, if your gross DTI is 43% , you personally may want to consider what it is for your net , says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

Of course, other factors matter too, like your credit score, mortgage rate, and down payment.

But DTI has a huge impact on affordability. So its important to understand how mortgage lenders look at this number.

Also Check: Can You File Bankruptcy And Keep Your Car

What To Include When Calculating Your Debt

When adding up your debt, take a look at your bills. Consider your new mortgage payments principle, plus interest, taxes, insurance and homeowners association dues. Also include any other mortgages you may have, alimony and child support payments, credit cards, student loans, car loans, personal loans and any other loans you make a payment on each month.

Whats not included? Household expenses, like utilities, internet or groceries.

To calculate your gross monthly income, youll want to consider your income before taxes and other deductions are taken.

If youre earning income from multiple sources and your income is more difficult to calculate, you can speak with a licensed loan originator who can explain how income stream flows together to create your gross monthly income.

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Recommended Reading: Total Credit Card Phone Number

How Can I Get Assistance Buying A Home

There are quite a few opportunities to get financial assistance with buying a home. If its your first time or if you havent owned a home in the last three years start by exploring the first-time homebuyer loans and programs that cater to your state or city. There are also grant programs, many of which are tailored to help low- and moderate-income borrowers with money that does not have to be paid back. Additionally, you might be able to get assistance based on your line of work. For example, teachers and emergency service workers, like police officers and firefighters, can qualify for the Good Neighbor Next Door program, which lets qualifying individuals buy HUD-approved properties for 50 percent off their purchase price.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Recommended Reading: Can Bankruptcy Take Your Income Tax Refund

Monitor Your Dti And Your Credit For Better Access To Credit

You should keep an eye on your DTI and your credit score even if you arent planning on applying for credit anytime soon. When you pay off a loan or credit card or take on new credit, calculate your DTI whenever you pay off a debt.

To check your credit score, you can take advantage of Experians free credit monitoring service, which gives you access to your Experian credit report and FICO® score. Youll also be notified when your credit report changes in real-time, so youll be able to spot any potential problems early on.

Oops A Problem With Having No Debt

Theres one problem here. People who never borrow tend to have poor credit scores because they have thin files.

If you never or rarely borrow, you havent demonstrated that youre a responsible borrower. This could make mortgage qualifying more difficult.

However, some lenders are willing to consider alternative forms of credit, like rent and utility payments, for those with thin files.

So if you find yourself in this situation, be sure to shop around carefully and look for a lender that can help you.

Read Also: Does Bankruptcy Clear Tax Debt In Canada

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

How Much House Does Dave Ramsey Say I Can Afford

For decades, Dave Ramsey has told radio listeners to follow the 25% rule when buying a houseremember, that means never buying a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional mortgage.

At Ramsey Solutions, we also teach people they cant afford to buy a house until they:

- Are completely debt-free

- Have an emergency fund of 36 months of expenses

- Have a down payment of 20% or more

Why is all this important? Because when life happens, an unexpected expense or a job loss could crush someone financially if theyre also trying to get out of debt and pay a mortgage. We dont want that to happen to you.

Don’t Miss: Why Is My Bankruptcy Still On My Credit