Tracking The Federal Deficit: July 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $301 billion in July, the tenth month of fiscal year 2021. Because August 1 fell on a weekend in both 2020 and 2021, certain federal programs that typically pay out large sums on the first of the month did so twice in July. If not for these timing shifts, the deficit would have been $60 billion less last month. Julys deficit was the difference between $261 billion in revenue and $562 billion in spending. Monthly receipts dropped 54% compared to last July due to 2021s return to the regular April and June tax filing deadlines for individual and corporate tax payments.

So far this fiscal year, the federal government has run a cumulative deficit of $2.5 trillion, the difference between $3.3 trillion in revenue and $5.9 trillion in spending. This deficit is 10% lower than over the same period in FY2020, but nearly triple the FY2019 deficit .

Analysis of Notable Trends: Fiscal patterns over the past month continue to reflect the federal governments response to the COVID-19 pandemic, as well as the developing economic recovery.

Growth in federal revenues remains robust, increasing 17% compared to the same 10-month period in FY2020. This increase is indicative of a strengthening economy, with a steady inflow of individual income and payroll taxes from higher total wages and salaries, and corporate taxes from larger corporate profits, the latter of which increased 76% year-over-year.

Can The Us Pay Off Its Debt

As budget deficits are one of the factors that contribute to the national debt, the U.S. can take measures to pay off its debt through budget surpluses. The last time that the U.S. held a budget surplus was in 2001. Much of the world depends on U.S. bonds to fund their own countries, and it has become a way of life for governments around the world. While it is unlikely that the U.S. will stop doing this, measures can be taken in other areas to decrease the national debt.

Return To Record Deficits

When he took office in 2001, President George W. Bush cited the Clinton surplus as evidence that taxes were too high. He pushed through significant tax cuts and oversaw an increase in spending, and the combination again drove the U.S. budget into the red.

The deficit reached a record $458 billion in 2008, Bush’s last year in office, and would triple the following year as the Bush and Obama administrations faced the Global Financial Crisis.

Read Also: Chapter 13 Bankruptcy Arizona

Why The Budget Deficit Matters

The federal deficit and debt are concerns for the country because the majority of the national debt is held by those who have purchased Treasury notes and other securities. A continuous deficit adds to the national debt, increasing the amount owed to security holders.

The concern is that the country won’t be able to pay its debt off. Debt holders demand higher interest to compensate for the higher risk when that happens. This increases the cost of all interest rates and can cause a recession.

Tracking The Federal Deficit: January 2020

The Congressional Budget Office reported that the federal government generated a $32 billion deficit in January, the fourth month of fiscal year 2020. Januarys deficit is a $40 billion change from the $9 billion surplus recorded a year earlier in January 2019. Januarys deficit brings the total deficit so far this fiscal year to $388 billion, which is 25% higher than the same period last year . Total revenues so far in FY2020 increased by 6% , while spending increased by 10% , compared to the same period last year. (After accounting for timing shifts, spending rose by 6% or $90 billion.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first four months of FY2020, revenue from corporate income taxes rose by 27% . Additionally, Federal Reserve remittances increased by 14% partly due to lower short-term interest rates that reduced its interest expenses. On the spending side, after accounting for timing shifts, total Social Security, Medicare, and Medicaid outlays rose by 6% . Outlays for the Department of Defense rose by 7% , largely for procurement and research and development.

Also Check: Will Filing Bankruptcy Help My Credit

The Late 20th Century: 1950

Three things happened to the national debt during the 20th century’s second half — and one thing didn’t.

The Korean War simply doesn’t appear in the national balance sheet. Unlike almost every other war in its history, America did not meaningfully borrow to pay for this conflict. Instead, borrowing only ticked up at a slightly above-average rate from 1951 to 1954.

But between 1965 and 1978, two issues profoundly and permanently changed America’s finances. First, in 1966 Lyndon Johnson signed the Medicare program into law, creating one of the most expensive and enduring social programs in the country’s history. And then from roughly 1965 to 1975, America fought the Vietnam War.

Vietnam and Korea were the first two major undeclared wars in U.S. history, and Vietnam was by far the more expensive one. Without a declaration of war to put the country on a wartime economy, Congress paid for Vietnam by increasing the national debt. Over the course of the conflict, America’s debt nearly doubled, growing from approximately $317 billion in 1965 to $620 billion in 1976.

The rate of indebtedness then grew even faster under President Ronald Reagan’s 1980s administration. The Reagan era introduced America’s modern debate over the role of taxes in economic policy.

Series: A Closer Look

Examining the News

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as theyre published.

This story was co-published with The Washington Post.

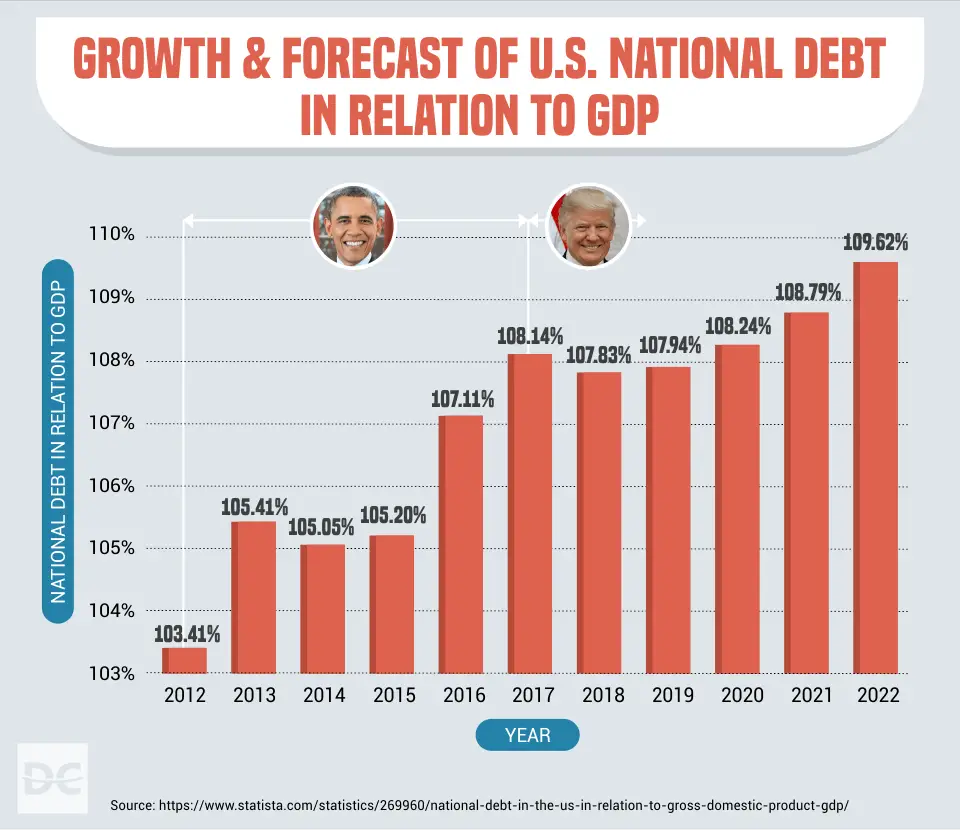

One of President Donald Trumps lesser known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch. The financial burden that hes inflicted on our government will wreak havoc for decades, saddling our kids and grandkids with debt.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

Don’t Miss: Can The United States Declare Bankruptcy

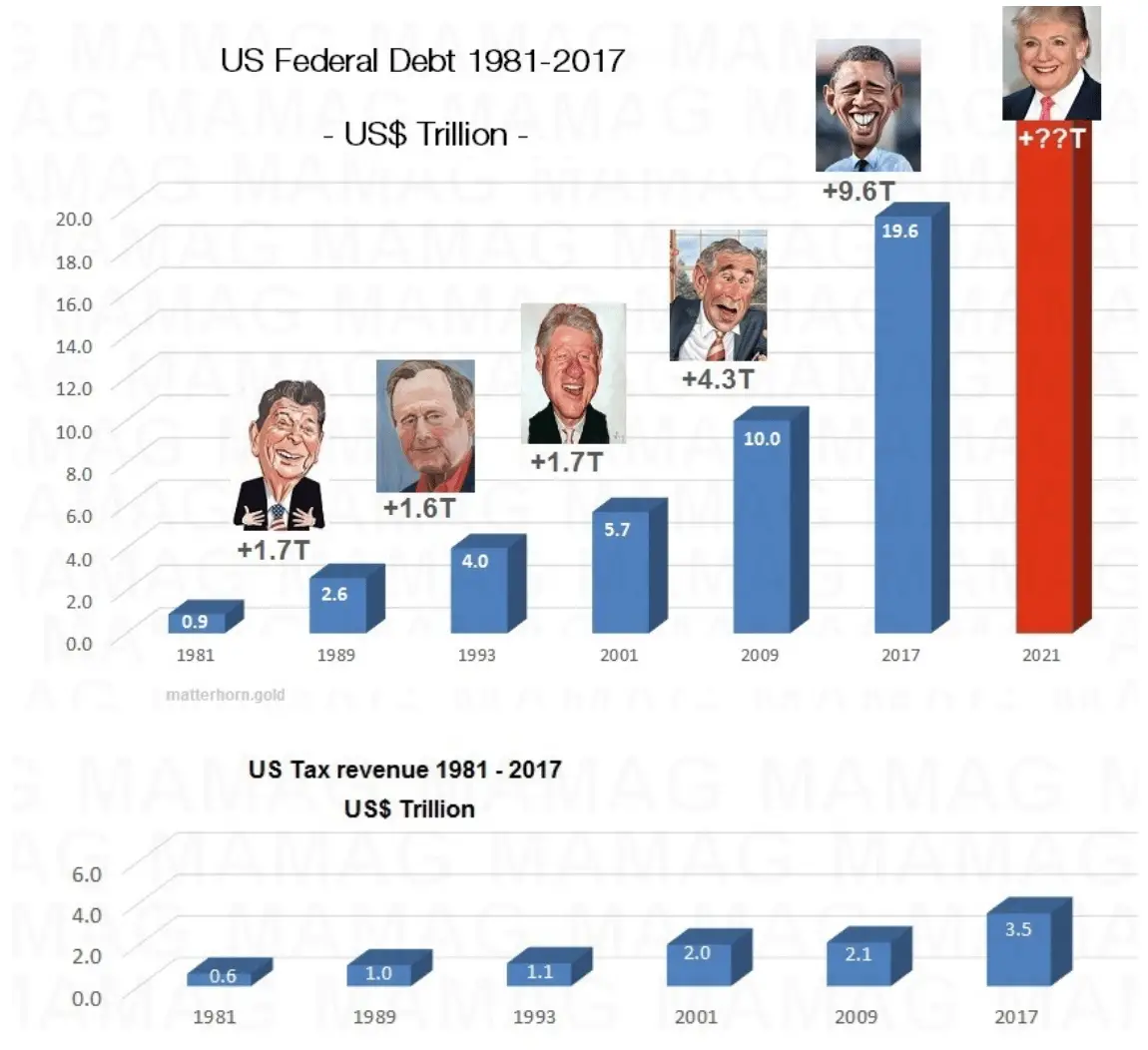

Visualizing National Debt By President: Which Presidents You Should Blame The Most

Ernest Hemingway once supposedly wrote, How did you go bankrupt? Two ways. Gradually, then suddenly.

Hemingways observation looks increasingly spot on when it comes to the U.S. national debt, which now stands at well over $21 trillion. A trillion dollars written out is $1,000,000,000,000. Thats 12 zeroes. How did we get here? Our visualization offers a unique perspective, breaking down the debt into the deficits each U.S. President has added throughout American history.

The U.S. Treasury tracks the historical data for U.S. government debt. Overall figures from before 1950 can be found here, and more specific numbers after 1950 can be found here. We should also give proper credit for pulling these disparate sources together to The Balance. We created a 3-D visualization showing the cumulative deficits each U.S. President has added to the national debt in history, where each block represents $3 billion in todays dollars. All the Presidents from 1789 1913 are lumped together at the bottom, but as you move from the bottom up, you can see the color-coded contribution from each administration. The numbers for future increases to the debt under President Trump came come directly from the White House.

About the article

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

Don’t Miss: What Happens If You File Chapter 7 Bankruptcy

Biden Administration Forecasts $103 Trillion Deficit Down By Nearly $400 Billion

WASHINGTON The Biden administration is forecasting that this years budget deficit will be nearly $400 billion lower than it estimated back in March, due in part to stronger than expected revenues, reduced spending, and an economy that has recovered all of the jobs lost during the multi-year pandemic.

In full, this years deficit will decline by $1.7 trillion, representing the single largest decline in the federal deficit in American history, the Office of Management and Budget says.

Despite the gains, the administration said Tuesday that it is forecasting a deficit of $1.03 trillion for the budget year that ends Sept. 30. That number signifies a movement away from the record deficit in 2020, which reached $3.13 trillion.

The administrations Mid-Session Review said much of the improvement in the deficit forecast for this year stemmed from the economy transitioning from a historic and rapid recovery to stable and steady growth.

The administration sees inflation pressures remaining into 2023, however.

The Presidents top economic priority continues to be tackling the challenge of inflation, without giving up the historic economic gains weve made over the past 18 months, said Shalanda Young, director of the Office of Management and Budget in a statement.

While costs are still too high for too many families, the Presidents economic plan is working and were on the right track, she said.

Fiscal Year 2021 In Review

The federal government ran a deficit of $2.8 trillion in fiscal year 2021, the difference between $4.0 trillion in revenues and $6.8 trillion in spending. This deficit was 12% lower than in fiscal year 2020, due to revenue increases outpacing expenditure growth. The FY2021 deficit, however, was almost three times that of FY2019 , as federal COVID-19 relief spending has continued to drive outlays to record highs. This years deficit amounted to approximately 13% of GDP, the second largest deficit as a share of the economy since 1945. Revenues tallied 18% of GDP, while spending rose to 30% of GDP.

Receipts totaled $4.0 trillion in FY2021an 18% year-over-year increasereflecting the general strength of the economy during the initial stages of the pandemic recovery. Individual income and payroll tax revenues together rose 15%, due to a combination of higher wages, increased employment, and payroll taxes that had been deferred by most employers from 2020 to 2021 per the CARES Act of March 2020. Corporate tax revenues increased by 75% in part due to higher corporate profits, and unemployment insurance receipts increased by 31% as states replenished their unemployment insurance trust funds.

Recommended Reading: Macomb County Sheriff Sale

Tracking The Federal Deficit: February 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $312 billion in February 2021, the fifth month of fiscal year 2021. This months deficitthe difference between $246 billion in revenue and $558 billion in spendingwas $77 billion more than last Februarys. The deficit so far in fiscal year 2021 has climbed to just over $1 trillion, an 83% year-over-year increase . Year-over-year, total spending has risen by 25% and revenues have increased by 5%.

Analysis of Notable Trends: Increased spending in February, and fiscal year 2021 as a whole, mostly resulted from pandemic relief legislation. For instance, the Small Business Administrations Paycheck Protection Program accounted for most of the $133 billion spending increase from last February to this one. SBA outlays soared to $91 billion this February compared to only $100 million in the same month last year. The other largest spending changes were greater outlays on unemployment compensation and $17 billion less in refundable tax credit payments because of a delayed start to the tax filing season this year.

Despite a historic recession, revenues were 5% higher in the first five months of fiscal year 2021 than during the same period last year . This healthy growth is surprising, especially when compared to the onset of the last major recession: In the first five months of fiscal year 2009, revenues plunged 11% year-over-year.

List Of Presidents’ Budget Deficits By Fiscal Year

Although most other presidents have run deficits, none has yet came close to the four detailed above. One partial explanation is that the U.S. economy, as measured by gross domestic product , was so much smaller for other presidents.

For example, by the end of 1981, GDP was only $3.2 trillion, one-fifth of the roughly $16.3 trillion GDP by the end of 2012. Below are each president’s annual budget deficits since Woodrow Wilson.

You May Like: Can You Keep Your Car After Bankruptcy

Why Is El Salvador Ranked Higher

Despite having lower values in the two metrics discussed above, El Salvador ranks higher than Ukraine because of its larger interest expense and total government debt.

According to the data above, El Salvador has annual interest payments equal to 4.9% of its GDP, which is relatively high. Comparing to the U.S. once more, Americas federal interest costs amounted to 1.6% of GDP in 2020.

When totaled, El Salvadors outstanding debts are equal to 82.6% of GDP. This is considered high by historical standards, but today its actually quite normal.

The next date to watch will be January 2023, as this is when the countrys $800 million sovereign bond reaches maturity. Recent research suggests that if El Salvador were to default, it would experience significant, yet temporary, negative effects.

Tracking The Federal Deficit: July 2019

The Congressional Budget Office reported that the federal government generated a $120 billion deficit in July, the tenth month of Fiscal Year 2019. This makes for a total deficit of $867 billion so far this fiscal year, 27 percent higher than over the same period last year . Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 8 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Increased revenues were driven mostly by a 7 percent increase in payroll taxes due to the strong labor market that has resulted in continued job growth and rising wages. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 6 percent . Department of Education outlays rose by 79 percent , mostly due to an upward revision to the net subsidy costs of previously issued student loans. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Also Check: Different Types Of Bankruptcies For Businesses

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

The Birth Of Public Debt

George Washington,portrait by Gilbert Stuart

“No pecuniary consideration is more urgent than the regular redemption and discharge of the public debt: on none can delay be more injurious, or an economy of the time more valuable.”

George Washington, 1793, Message to the House of Representatives

The public debt of the United States can be traced back as far as the American Revolution. In 1776, a committee of ten founders took charge of what would become the Treasury, and they helped secure funding for the war through “loan certificates” with which they borrowed money for the fledgling government from France and the Netherlands. This committee morphed over the next decade into the Department of Finance. Robert Morris, a wealthy merchant and Congressman , was chosen to lead a new Department of Finance in 1782.

As the new Superintendent of Finance, Morris was the first committee member to order a reporting of the total government debt owed. This marked the beginning of annual Treasury reports to the President. On January 1, 1783, the public debt of the new United States totaled $43 million.

You May Like: Cheap Bankruptcy Chapter 7