Deficit And Debt: What Are They

A deficit occurs when the federal government spends more money in a year than it brings in. The federal debt – also referred to as the national debt is the total amount the government still owes from current and past deficits.

The government also must pay interest on the debt. In 2020, interest on the national debt amounted to about four percent of total federal spending.

At the end of 2020, the total federal debt was about $21 trillion, following a year when government spending grew to meet the COVID-19 crisis. This sounds like a lot, but many economists believe this level of debt is perfectly sustainable for an economy the size of the U.S.

How Obama’s Policies Increased The Debt

The third method is to measure the debt incurred by Obama’s specific policies. The Congressional Budget Office has done that for many of them.

The American Recovery and Reinvestment Act contributed $830 billion between 2009 and 2019. More than 90% of its budget impact occurred by the end of 2012. It cut taxes, extended unemployment benefits, and funded job-creating public works projects. Like the tax cuts, the ARRA stimulated the economy after the 2008 financial crisis.

Obama’s largest contribution to the debt was the Obama tax cuts, an extension of the Bush tax cuts. They added $858 billion to the debt in 2011 and 2012.

Obama also increased military spending, with the highest level of spending occurring in 2011. Here’s a breakdown:

- Department of Defense base budget: $528.3 billion

- Spending by defense-related agencies: $166.7 billion

- Homeland Security: $41.9 billion

- FBI and Cybersecurity: $7.8 billion

- National Nuclear Security Administration: $10.5 billion

- Overseas Contingency Operations for DoD and defense-related agencies: $159.5 billion

Using this same methodology, Obamas total defense spending was $6.3 trillion:

- 2010: $857.7 billion

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Don’t Miss: How Many Times Has Sears Filed Bankruptcy

United Kingdom National Debt

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on |

|

|

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies.

At the end of December 2021, UK General government gross debt was £2,382.8 billion, or 102.8% of Gross domestic product, the second lowest in the G7 while 14.6% above the average of the EU member states at that time.

Approximately a third of the UK National Debt is owned by the British government due to the Bank of England‘s quantitative easing programme, so approximately a third of the cost of servicing the debt is paid by the government to itself. In 2018, this reduced the annual servicing cost to approximately £30 billion .

‘a Major Problem’: The Us Is Now A Record $31 Trillion In Debt Made Worse By Rising Interest Rates And This Is Who Holds The Ious

The gross national debt in America has hit new heights, surpassing $31 trillion, according to a recent U.S. treasury report.

If you find that hard to wrap your head around, it basically boils down to more than $93,000 of debt for every person in the country, according to the Peter G. Peterson Foundation.

And with the dramatic rise in interest rates over the past few months the Fed funds rate is currently between 3.7% and 4% the national debt will be growing at a rate that makes it even harder to ignore.

Interest rates are a major problem, says Phillip Braun, clinical professor of finance at North Western Universitys Kellogg School of Management.

The Treasury finances the debt with a lot of short-term borrowing It’ll push other budgetary items out.

You May Like: How Long Does Bankruptcy Take From Start To Finish

Taking National Debt Personally

While voters are not fans of national debt on principle, the debt-to-GDP ratio makes for a lackluster rallying point in practice, since even economists cant agree on what percentage is too high.

Hence, efforts follow to frame the national debt burden in easily understood terms. One popular tactic is to divide national debt by the population to determine debt per capita. Dividing the U.S. national debt of $31.1 trillion as of Q3 2022 by an estimated U.S. population of 333.2 million in 2022 yields national debt per capita of more than $93,337, which sounds like a lot.

Fortunately, the per capita apportionment of government debt ignores the fact that no individual, not even a child, can hope to repay debt in a currency that they create, like the U.S. government and many other sovereign borrowers do.

The improbability of default by a sovereign borrowing in its own currency is what marks out such debt as a safe asset relative to credit issued to private borrowers. In this sense, the national debt can be thought of as an interest-bearing currency supplementing interest-free banknotes. Like currency, the national debt is a government obligation serving as an asset and store of value for its owners.

Tracking The Federal Deficit: May 2019

The Congressional Budget Office reported that the federal government generated a$207 billiondeficit inMay, the eighth monthof Fiscal Year 2019, for a total deficit of $738 billionso far this fiscal year.Maysdeficit is41 percent more than the deficit recorded a year earlier inMay 2018. If not for timing shifts of certain payments, the deficit would have been7 percent larger than the deficit inMay 2018. Total revenues so far inFiscal Year 2019increased by2 percent , while spending increased by9 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Corporate income tax receipts were down by 9 percent compared to last year, reflecting the lower marginal corporate tax rate enacted in the Tax Cuts and Jobs Act of 2017. Further, customs duties increased by 78 percent versus last year, due to the imposition of new tariffs. On the spending side, Department of Defense spending increased by 10 percent compared to last year, particularly on military operations, maintenance, procurement, and R& D. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

Don’t Miss: Chapter 13 Bankruptcy Illinois

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

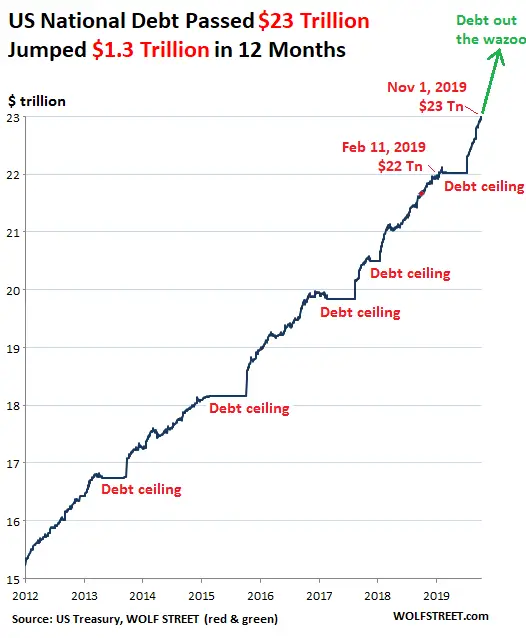

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

Tracking The Federal Deficit: July 2019

The Congressional Budget Office reported that the federal government generated a $120 billion deficit in July, the tenth month of Fiscal Year 2019. This makes for a total deficit of $867 billion so far this fiscal year, 27 percent higher than over the same period last year . Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 8 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Increased revenues were driven mostly by a 7 percent increase in payroll taxes due to the strong labor market that has resulted in continued job growth and rising wages. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 6 percent . Department of Education outlays rose by 79 percent , mostly due to an upward revision to the net subsidy costs of previously issued student loans. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Don’t Miss: Damaged Freight For Sale

Debt Added Since Obama Took Office

The largest number comes from calculating how much the debt increased during Obama’s two terms. When Obama was sworn in on Jan. 20, 2009, the debt was $10.626 trillion. When he left office on Jan. 20, 2017, it was $19.937 trillion. It explains why some would say Obama added $9 trillion to the debt.

How Does The Government Borrow Money

The government typically borrows money from the markets. In its simplest form, some have likened this to the government operating its own savings account service.

The government issues its own bonds . Those who buy these bonds are in effect lending the government money. At a later date, people can always sell on these government bonds to others, through a secondary bond market.

Pension funds and insurance companies traditionally like the idea of investing in the governments bonds because they consider them to be low risk. The UK government has yet to default on its debt obligations, and it is considered unlikely to do so, given that it has the ability to command money from the public through taxation. Government bonds also typically offer an in interest rate in excess of other low risk investments, such as cash.

Historically the government required purchasers of its new bonds to settle the transaction by transferring central bank reserves into a government owned account, thereby ensuring that government borrowing did not create additional money or induce a monetary stimulus to the economy.

One notable exception to the governmental borrowing money through gilt issues has been the Private Finance Initiative. Here the government has also borrowed directly from banks to pay for specific projects.

Read Also: Northern District Of Texas Bankruptcy Court

The Cost Of Servicing The National Debt

The first part of the Twenty First Century has seen a period of historically low interest rates. This has had a significant impact on the cost of servicing the national debt. The governments Asset Purchase Facility scheme, relating to the practice of quantitative easing, has also reduced the net cost to the government of servicing the national debt.

According to statistics from the Office of Budget Responsibility, the total cost of government interest payments had previously amounted to £41.2 billion in 2011/12, the equivalent of 2.5% of GDP.

Even though the national debt had doubled in the ensuing decade, the effect of lower interest rates meant that the cost of servicing the national debt was expected to drop to £23.5 Billion in 2021/22.

However in the early 2020s the impact of rising interest rates has lead to a considerable increase in the cost of servicing the national debt. In November 2022, the Office of Budget Responsibility projected the UKs expenditure on debt interest to reach £83.0 billion in 2023/24.

Based on these figures, the interest on the national debt therefore was set to equate to 5.2% of total public spending. According to the OBR, this equated to 2.5% of the UKs GDP and was the equivalent to £1,900 per household.

Tracking The Federal Deficit: December 2018

The Congressional Budget Office reported that the federal government generated an $11 billion deficit in December, the third month of Fiscal Year 2019, for a total deficit of $317 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in December would have been roughly $32 billion, according to CBO. Decembers deficit is 52 percent lower than the deficit recorded a year earlier in December 2017. Total revenues so far in Fiscal Year 2019 increased by 0.1 percent , while spending increased by 9.4 percent , compared to the same period last year.

Analysis of Notable Trends in December 2018: Revenue from customs duties spiked by 83 percent from October-December 2018, relative to the same period in 2017, due to the administrations imposition of new tariffs. Conversely, corporate income tax revenue declined by 15 percent from October-December 2018 relative to the same period in 2017. This dip mainly reflects the reduction of corporate tax rates enacted in the Tax Cuts and Jobs Act of 2017. On the spending side, interest payments on the federal debt in December 2018 rose by 47 percent relative to December 2017.

Don’t Miss: How To Make Bankruptcy Payments Online

Why Is The Us In Debt

Countries around the world currently hold a national debt in order to grow the economy and the country, debt is oftentimes needed to fund expansions and programming. The United States debt levels are extremely high, and can be attributed, in part, to income inequalities and trade deficit. These two factors indicate that some level of debt must be taken on in order to keep the economy moving. The U.S.s national debt increased 840% during the period from 1989 to 2020.

Tracking The Federal Deficit: February 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $216 billion in February 2022, the fifth month of fiscal year 2022. Februarys deficit followed a surplus in January and was the difference between $290 billion in revenues and $506 billion in spending. This deficit level is $95 billion less than the deficit recorded in February 2021.

Analysis of notable trends: In the first five months of FY2022, the federal government ran a deficit of $475 billion, 55% less than at this point in FY2021 . The cumulative deficit for FY2022 thus far is $149 billion lower than even the deficit over the comparable period in FY2020, pre-dating the onset of the COVID-19 pandemic.

Receipts continue to grow robustly at $1.8 trillion for FY2022 to date, $371 billion more than the government collected during the first five months of the prior fiscal year. Individual income and payroll tax receipts increased by 25% , reflecting rising wages and salaries primarily among higher-income workers subject to higher tax rates, as well as the influx of some payroll taxes that companies were allowed to defer under pandemic relief legislation. Corporate income tax revenues increased by 31% over the past five months compared to the same period last fiscal year.

Read Also: Liquidation Pallets South Carolina

Why The National Debt Matters To Americans

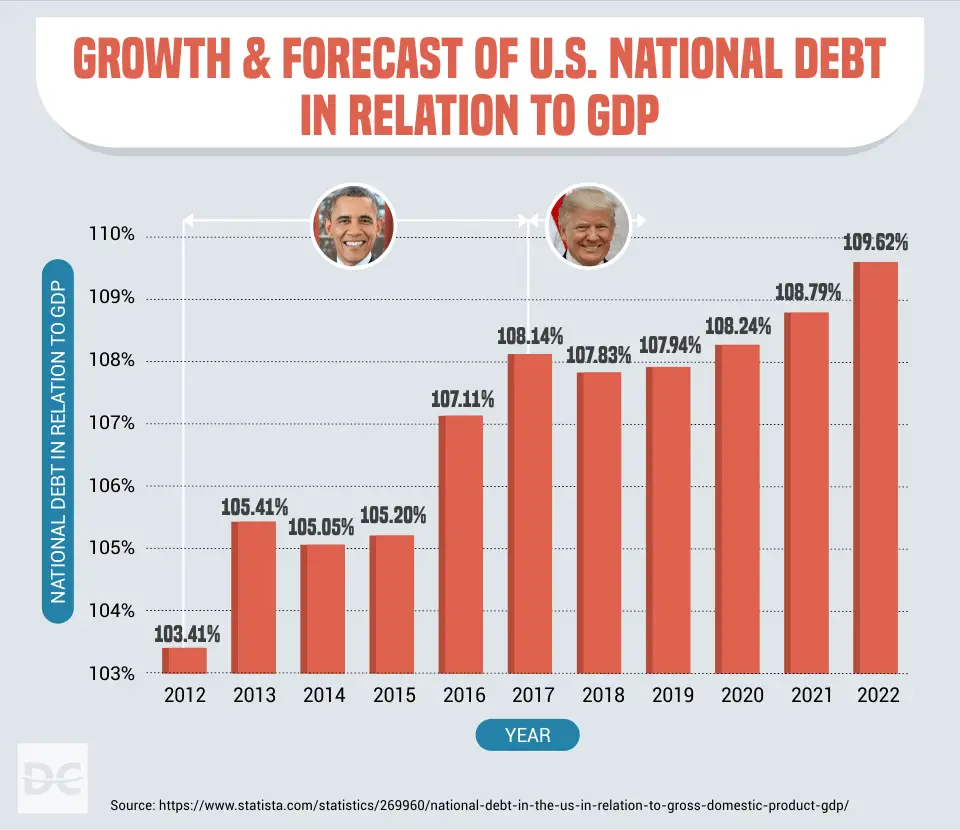

Over the past 12 years, U.S. debt has grown over 400%, while the U.S. income has only grown 30%, according to the Federal Reserve Bank of St. Louis.

As the national debt continues to skyrocket, some policymakers worry about the sustainability of rising debt, and how it will impact the future of the nation. Thats because the higher the US debt, the more of the countrys overall budget must go toward debt payments, rather than on other expenses, such as infrastructure or social services.

Those worried about the increase in debt also believe that it could lead to lower private investments, since private borrowers may compete with the federal government to borrow funds, leading to potentially higher interest rates and lower confidence.

In addition, research shows that countries confronted with crises while in great debt have fewer options available to them to respond. Thus, the country takes more time to recover. The increased debt could put the United States in a difficult position to handle unexpected problems, such as a recession, and could change the amount of time it moves through business cycles.

How To Safeguard Your Investments From Debt

Staying ahead of the national debt isnt easy. Savvy investors will need to keep an eye on the national debt when it comes to structuring their portfolios, planning for retirement income and considering estate-planning needs.

To mitigate risks from interest rate hikes and inflation, investors could diversify their portfolios with investments that keep pace with inflation. One smart inflation investment includes Treasury inflation-protected securities , which increase investment principal with inflation and decrease with deflation.

Another inflation-savvy investment includes real estate, which traditionally keeps up with inflation over time. And investment vehicles that invest in property such as real estate investment trusts can also outperform the market when inflation is highest.

Finally, another common investment associated with inflation hedging includes commodities. The price of these assets typically rises when inflation accelerates. The price of commodities used to produce goods and services goes up when the cost of those goods and services increases during inflation.

Don’t Miss: How To Declare Bankruptcy In Ontario