Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Whats A Dti Ratio And Why Does It Matter

Your DTI ratio is calculated by taking the sum of your monthly debt payments and dividing by your gross monthly income. If you have a low DTI ratio, it means you dont have excessive debt to pay in relation to your income. A high DTI ratio means a large chunk of your income goes toward paying off debts. This can cause some lenders to see you as a high riskpotentially leading to the rejection of your loan application. Plus, a high DTI ratio can simply be hard to manage without missing payments.

If youre hoping to get a mortgage soon, youll want to be mindful of your DTI ratio. Many lenders arent able to offer a Qualified Mortgage unless the borrowers DTI ratio is 43% or lower. Qualified Mortgages are meant to provide extra protections to consumers and are less likely to result in a borrower defaulting on their loan.

So, if you want to be eligible for a more accessible mortgage with potentially lower rates and fees, youll need a low DTI ratio.

Where Can You Get A Loan If You Have A High Debt

Different lenders offer different debt-to-income ratio limits, but consumers with high debt-to-income ratios have to prove their ability to pay by other means. For example, while Fannie Mae and Freddie Mac recently raised its debt-to-income ratio from 45% to 50%, borrowers must also have at least 12 monthâs worth of cash reserves and the loan must be less than or equal to 80% of the property value.

If you donât qualify for Fannie Mae or Freddie Mac, you might qualify for an FHA loan. For an FHA loan with a debt-to-income ratio of over 43% the lender is required to provide proof of why they believe the consumer has the ability to pay a monthly mortgage over the life of the loan.

VA loans have a general limit of 41% but if you can prove you have additional residual income, you may qualify for a VA loan with a debt-to-income ratio higher than 41%. VA residual income requirements vary depending on where you live and the size of your household.

You May Like: What Happens When Chapter 13 Bankruptcy Is Dismissed

Home Equity: At Least 15%

The amount youre able to borrow on a home equity loan is limited by the amount of equity you have but you also must have a minimum amount of equity to qualify. Many lenders will have a loan-to-value limit for a home equity loan. The loan-to-value ratio is the total amount of debt on the home compared to its worth, a measure of equity. For example, if you owe $200,000 on your mortgage but the home is worth $250,000, your loan-to-value is 80% and equity is 20%.

You often must have at least 15% equity in the home to qualify for a loan , though many lenders will go beyond this threshold. FDIC guidelines recommend that lenders require mortgage insurance or other special protections once the loan-to-value goes beyond 90%.

Donât Miss: How To Remove A Dismissed Bankruptcy From Credit Report

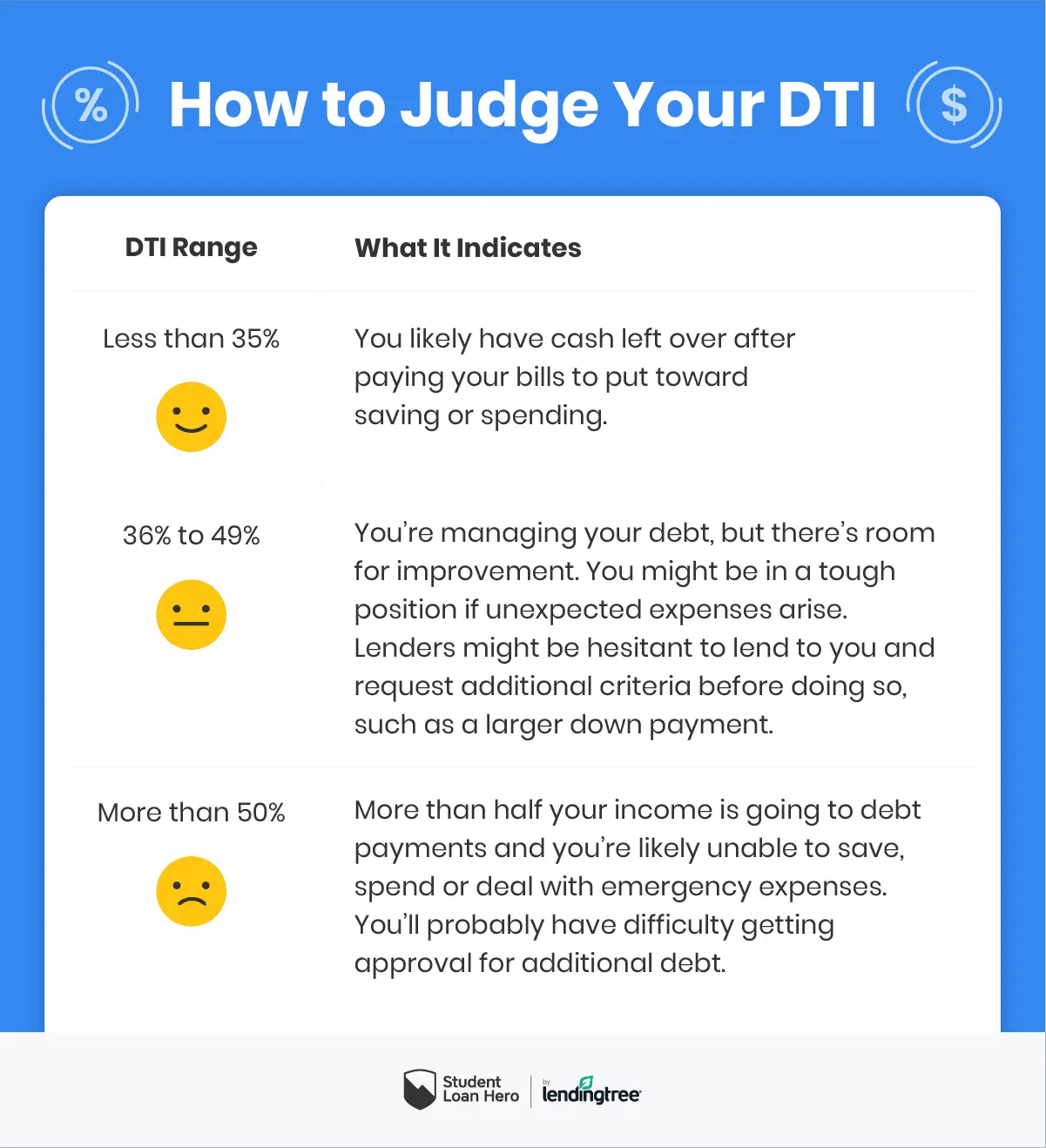

What Is The Ideal Dti

It is not just one number that is considered an ideal DTI. It may vary from person to person depending upon their income and liabilities. But, the lower the ratio the better it is considered and vis-a-versa. Still, while calculating your personal loan eligibility following break-up can help you out-

- Less than 35% is considered favourable.

- 36-49% is considered adequate, but the loan sum can be affected.

- More than 50% is not an ideal figure. It may earn you a rejection or get a loan at a higher rate of interest.

Read Also: Foreclosured Homes For Sale

Calculate Your Dti Ratio

Divide your total monthly debt payments by your monthly net income. To convert this into a percentage, multiply it by 100 this number is your DTI ratio.

For example:

The DTI ratio youll need to qualify for a loan will depend on the type of loan you get as well as the lender. For example, if you want to take out a personal loan, your DTI ratio should be no higher than 40% though some lenders might require lower ratios than this.

If your DTI ratio seems to be in good shape and you want to apply for a personal loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

It Works In Tandem With Your Credit Score

Though your DTI does not directly impact your credit score, it is closely associated with your credit utilization. If your DTI ratio and your ratio are both low, youll have a better chance of being approved for loans. Keep in mind: most lenders do not advertise maximum debt-to-income ratios, but instead provide guidelines that offer some flexibility. For example, a common guideline is the 28/36 rule used by some lenders to assess borrowing capacity. According to this rule, a household should only spend 27% of its gross monthly income on housing expenses, and no more than 36% on debt expenseslike car payments and credit cards.

Recommended Reading: When Will My Bankruptcy Be Removed From My Credit Report

What Can You Use A Personal Loan For

A personal loan is often used to consolidate debt, pay an unforeseen expense, or pay off higher-interest debt. A personal loan shouldnt be used to increase your debt. Instead, you want to use a personal loan for something that improves your financial situation.

You can use a personal loan to make a home improvement, for example, that boosts the value of your home or helps your home sell faster. You can also use it to buy a piece of equipment that you need to take your business to the next level. These types of purchases could actually boost your income and help you pay off the loan quickly.

For people in debt, a personal loan is a common solution. It may seem backward to get a loan to decrease your debt but a personal loan can actually help you pay off higher-interest debt so that you can pay off your debt sooner. Instead of paying all the interest fees, you actually make payments that pay down your principal balance.

Using a personal loan to help you pay off high-interest credit cards could help you get out of debt faster. Now that you have a lower interest rate, more of your payments are going toward reducing your debt. The key is to make sure you dont keep using your high-interest credit cards while you also have a personal loan. This will just add to more debt.

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

You May Like: How To Find Out When You Filed Bankruptcy

Plan For Getting Out Of Debt Even With A High Debt To Income Ratio

If you are struggling with debt, you might be considering consolidation loans. For high debt to income ratios, however, you may want to look at your other options before deciding. Freedom Debt Relief can help you understand these options, including our debt settlement program. Our Certified Debt Consultants can help you find a solution that will help you get a handle on your finances. Find out if you qualify right now.

What Is The Maximum Allowable Debt

FHA uses two different debt-to-income ratios. The âfront-endâ ratio looks at housing-related debts such as a monthly mortgage payment and property taxes. The âback endâ ratio involves all of your debts including the mortgage but also credit cards, car loans, personal loans, etc.

According to official FHA guidelines, debt-to-income ratios limits are 31% on the front end, and 43% on the back end. But the FHA can make exceptions if your back-end ratio is as high as 50%, if you can qualify in other ways such as having cash reserves or some other income. Itâs on a case-by-case basis.

Read Also: How To Rebuild Your Credit After Bankruptcy Discharge

How To Calculate Your Debt To Income Ratio

Its pretty simple to calculate your DTI percentage. Take the sum of your total monthly debts, and then divide that sum by your monthly household income. Then, multiply that number by 100 to see your percentage.

Your monthly debts include your monthly payments that are required, regular, and recurring. And your gross household income includes the pre-tax income you make each month.

To see this calculation written as an equation, well call the sum of your total monthly debts D and your total gross household income I.

x 100

Can You Have More Than One Home Equity Product At A Time

Yes. As long as you have enough equity to borrow against and you meet the qualifications for each product, you can have multiple home equity loans, or a home equity loan and a HELOC. To account for all your loans, prospective lenders will look at your combined loan-to-value ratio to determine how much more you can borrow.

Also Check: Can You File Bankruptcy For Student Loan Debt

Whats The Maximum Dti For A Home Loan

Be mindful that each mortgage lender may have its own eligibility requirements and maximum DTI. Generally, though, a good debt-to-income ratio is around 36% or less and not higher than 43%.

Here are the common maximum DTI ratios for major loan programs:

- Conventional loans : 45% to 50%

- VA loans: No max DTI specified, but borrowers with higher DTI could be subject to additional scrutiny

- USDA loans: 41% to 46%

- Jumbo loans: 43%

Selling A Home Or Selling A Car: Additional Ways To Reduce Your Debt

In addition to paying off your high-interest credit cards, there are other ways to reduce your debt. If you own a home with a mortgage, this is also contributing to your debt totals. In todays real estate market, homes are in short supply. This could mean a big payout for your home.

If your home needs a lot of work, you may be hesitant to believe you can get an offer on your home. This is where an all-cash, as-is offer from an investor can help you sell your home and reduce your debt. With our home buying program, you dont have to wait months for a buyer to buy your home. Youre given a free home evaluation, a cash offer from one of our partners, and a quick closing.

Once your home is sold, your debt-to-income ratio will go way down. Youll have a lot more financial freedom to buy or rent your next home. In addition to selling your home, you can also sell your car. Maybe you and your spouse or partner, no longer need two cars, for example.

Once you sell your home, you can move to a more walkable location, where one or no car is necessary. Removing your car loan could greatly reduce your debt-to-income ratio. You can buy or rent a less expensive home and also buy a less expensive car without the need for a car loan. Between this and reducing your debt with a personal loan, you may be able to lower your debt ratio in just a few short months.

You May Like: When Does A Bankruptcy Come Off Credit Report

Make A Plan To Reduce Your Debt

In addition to personal loans, there are other things you can do to improve your debt-to-income ratio. To start, create a budget of all the income you have coming in as well as your expenses. You want to be as detailed as possible here to make sure youre getting an accurate picture of your finances.

Next, look at all your fixed expenses. These are things such as your mortgage, rent, car payment, and student loan payments. These are expenses you have to pay. Your other expenses, such as gym memberships, or groceries, for example, are costs you can cut or adjust if needed.

Once you see what youre left with you can make a plan to start paying off your debt. You can start by using your personal loan to pay down your high-interest cards first. After your cards are paid off, you can call your credit card company to freeze them. This means you cant use your card until you unfreeze your account.

You can also trim some of your other expenses to start building up an emergency fund as well as pay off your personal loan. The less you spend, the more you can save and the more payments you can make on your personal loan. This will help you get out of debt, reduce your debt-to-income ratio, and stay out of debt in the future.

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

Recommended Reading: Is Debt Consolidation The Same As Bankruptcy

Recommended Reading: How Many Years Does Bankruptcy Last

How The Dti Ratio Is Calculated

Lenders value a low DTI and not high income. The DTI ratio compares the total monthly debt payments to your pre-tax income. To calculate the DTI, all you have to do is add all monthly debt obligations and divide the resulting figure by your gross monthly income.

The DTI ratio doesnt include monthly bills for basic household expenses such as food, health insurance premiums, utilities, or entertainment. Instead, it includes the type of debt from lines of credit or housing expenses such as HOA fees, homeowners insurance premiums, monthly mortgage payments, credit card debt, student loans, personal loans, and car loans.

The total monthly debt includes housing-related expenses such as:

- Property taxes and homeowners insurance

- Proposed monthly mortgage payment

The lender will also add the minimum required payments toward other debts such as:

When adding up debt, dont include the entire amount of the loan, just the minimum monthly payments. The monthly gross income is the total amount of income earned each month before taxes.

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Recommended Reading: Is My 401k Protected From Bankruptcy

How To Lower Your Dti

This is the avenue you want to go down if youre trying to improve your financial situation. Here are some steps you can take to lower your DTI and make yourself a more attractive candidate for a loan.

- Pay off loans early. Lowering the amount of debt you have is the fastest way to improve your DTI.

- Increase income. Finding a second job or getting a promotion with an increase in pay is the second fastest step toward improving your DTI. More income means more opportunity to pay down debt, which means an improved DTI. Side hustles are plentiful on the internet these days.

- Reduce spending. Things like eating out, shopping for clothing, and entertainment spending add to your debt. Put all of them on hold and dedicate more of your paycheck to reducing, then eliminating debt.

- Balance transfer card. This is a total longshot because you need a credit score of 680 or higher to get a 0% balance transfer card. But if you qualify, take it and apply as much of your income as you can to wiping out credit card debt altogether.

- Refinance loans. If you refinance loans by extending the payment times, it will lower your monthly debt payment and this increase your DTI. However, this is the least desirable method available. It keeps you in debt longer and you pay more interest.