Tips For Rebuilding Your Credit After A Bankruptcy

- Getting your credit profile back on track following a bankruptcy can be tough. Consider working with a financial advisor to figure out ways to get started. Luckily, finding the right financial advisor doesnt have to be hard. In fact, SmartAssets free tool matches you with up to three financial advisors in your area in just five minutes. Get started now.

- A credit card can be a valuable tool in helping you rebuild your credit after a bankruptcy. You may need to consider a secured card to get started, but SmartAsset has for all types of uses as well.

Learn How Long Chapter 7 Bankruptcy Will Stay On Your Credit Report

By Carron Nicks

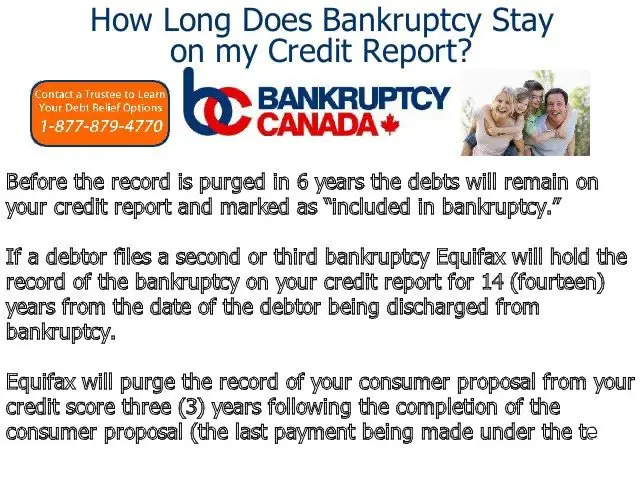

Most people file a bankruptcy case when they need to put financial problems behind them and get a fresh start. Part of that fresh start often involves improving a credit score, and filers can take positive steps by paying bills on time and keeping credit balances low. Even so, it can take up to ten years for the bankruptcy to fall off your credit report, depending on the bankruptcy chapter that you file.

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

Read Also: Bankruptcy Software For Consumers

If You Discharged Debts In Bankruptcy Here’s How They Should Be Listed On Your Credit Report

Updated By Cara O’Neill, Attorney

In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too. In this article, you’ll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge, and what to do if your credit report contains incorrect information.

Bottom Line: Bankruptcy And Credit

I have personally seen the impact of the bankruptcy petition on some debtors five to seven years later and most are doing fine, says Arnold Hernandez, an attorney in Tustin, Calif., who handles bankruptcy cases. Bankruptcy is not forever.

Read Also: Filing Bankruptcy In Texas Yourself

Where Does Bankruptcy Appear On Your Credit Report

Regardless of the type of bankruptcy you file for, youll want to know where exactly it shows up on your credit report. Your bankruptcy status will appear in conjunction with any debts or accounts that will get addressed throughout your bankruptcy proceeding. For instance, if Loan A was discharged as a result of your bankruptcy, then youll still see the debt appear in your credit report. It will say something like Loan A: Discharged in bankruptcy.

Prior to your bankruptcy, these debts will either show current, meaning youre keeping up with the payments, or delinquent if youve fallen behind on them. Each time a potential lender looks into your report, theyll see those accounts, which means theyll know you filed for bankruptcy in the past. We know what youre thinking How long does bankruptcy last on my report?. This answer depends on the type of bankruptcy you file for.

How Does A Bankruptcy Affect Your Credit Score

Having a bankruptcy on your credit report can be devastating to your credit scores. According to FICO, for a person with a credit score of 680, a bankruptcy on your credit report will lower your credit score by 130-150 points.

For a person with a credit score of 780, a bankruptcy will cost you 220-240 points. That one event immediately drops you several categories lower and impacts your ability to access credit, and yes, the higher your initial credit score is, the more it falls.

You might not be eligible for future loans or credit cards, and if you are, youll most likely end up paying much higher interest rates. Not only that, the amount you can borrow will probably become limited.

While filing for bankruptcy may be the best financial decision at this point in your life, its still important to understand how and why it affects your credit score.

You May Like: How Many Times Have Donald Trump Filed For Bankruptcy

How Does Bankruptcy Affect Your Credit Score

Unfortunately, bankruptcy is considered a seriously negative event by scoring models like FICO and VantageScore. As such, if a bankruptcy is added to your credit report, it can have a severe negative impact on your .

According to myFICO, someone with a score in the mid-600s or 700s could expect their score to fall by 100 points or more even 200+. Also, the more accounts that are included in your bankruptcy, the heavier an impact it’s likely to have on your score.

Thankfully, the negative impact of a bankruptcy on your credit report will diminish over time. So even though a bankruptcy will still be on your credit report five years down the road, its impact on your score will be much less than it was in the year that you filed.

How Does Bankruptcy Impact My Credit Report

A bankruptcy will affect your credit report in two ways.

The bankruptcy stays on seven or ten years after filing.

So the agency will typically remove the accounts the bankruptcy includes from your credit report first.

Their delinquency dates will pretty much always precede the bankruptcy filing date.

Bankruptcies will always negatively impact your credit report. However, the severity of the impact will vary case by case.

If you have several accounts included in your bankruptcy, its going to have a more significant impact than if you only have a single car loan or credit card.

Public court records are always accessible via the Public Access to Court Electronic Records system.

If you have a fraudulent bankruptcy on your record, due to identity theft or perhaps a clerical error, it shouldnt be hard to track down.

You May Like: Leasing A Car After Bankruptcy Discharge

How Bankruptcy Is Removed From A Credit Report

Oct 7, 2021Bankruptcy

When people file Chapter 7 and 13 bankruptcies, theyre usually focused on filling out all of the necessary paperwork and after all is said and done, on rebuilding their credit. They rarely think much about when and how the bankruptcy falls off their credit report. Its been almost 10 years since I filed Chapter 7. What do I need to do to get it removed from my credit on the 10-year anniversary?

In the above situation, usually the debtor doesnt need to do anything to have their Chapter 7 bankruptcy removed from their credit report. Why? Because, Chapter 7 and 13 bankruptcies and all of the included or discharged debts are deleted automatically after a specified period of time passes.

Budgeting After Chapter 7 Bankruptcy

Many people file for bankruptcy due to no fault of their own after experiencing an unexpected event, such as an illness, job loss, or divorce. Even so, everyone can benefit from cutting unnecessary costs and building a nest egg to fall back onnot just those who filed for bankruptcy to wipe out credit card balances.

Reviewing your spending habits and making a comfortable budget is a commonsense place to start. Avoid buying items on credit that you can’t afford to pay for in cash. If you take out new credit cards, pay off most, if not all, of your account balance each month so that you don’t accrue interest.

Read Also: How To Obtain Bankruptcy Discharge Papers

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

Building Credit After Chapter 7 Bankruptcy

Most can rebuild their credit rating and have a better score than ever within 1 â 2 years after they file Chapter 7 bankruptcy. But, you canât take this for granted. To get the full benefit of your bankruptcy filing, youâll have to make an effort to improve your credit score.

Getting new credit after filing bankruptcy â itâs easier than you might think!Ã

One of the biggest surprises for many bankruptcy filers is the amount of car loan and credit card offers they receive â often within a couple of weeks of filing their case. Itâs a lot! Why?à Ã

Filing Chapter 7 bankruptcy makes you a low credit risk

The Bankruptcy Code limits how often someone can file a bankruptcy. Once you get a Chapter 7 bankruptcy discharge, youâre not able to get another one for 8 years. Banks, credit card issuers and other lenders know this.Ã

They also know that, with the possible exception of your student loans, you have no unsecured debts and no monthly debt payment obligations. This tells them that you can use all of your disposable income to make monthly payments.Ã

Beware of high interest rates

Pay close attention to the interest rates in the new credit offers you receive. Credit card companies and car loan lenders have the upper hand here. They know you want to build your credit rating back to an excellent FICO score. And they know that youâll be willing to pay a higher interest rate than someone with perfect credit and no bankruptcy on their record.Ã

Shop around

Also Check: Bankruptcy Petition Preparer Software

How To Build Credit After Bankruptcy

You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Bankruptcy will show on your record for 7-10 years, but every year you work to improve your credit, the less it will affect you and the financing you seek.

You need to wait 30 days after you receive the final discharge. This means most of your accounts will be at a zero balance, and creditors must stop calling you about debts.

To rebuild your credit score, you should:

Check Your Credit Report For Bankruptcy Errors

In this step, youll need a copy of all 3 of your credit reports. This is where having a comes in handy. TransUnion is the best credit monitoring service in my opinion, plus you get a free credit score.

Review the credit report carefully for any inaccurate or incomplete information. Here is a list of the most common bankruptcy errors. Names, addresses, and phone numbers Incorrect dates Discharged debts that still show a balance

If you have found no inaccuracies within the information on your credit report, then unfortunately theres nothing that can be done to remove it prematurely, youll have to wait 7-10 years for it to fall off your credit report.

Don’t Miss: Chapter 13 And Renting An Apartment

Difficulties You May Face Before A Bankruptcy Falls Off Your Credit Report

Before a bakruptcy is removed from your credit report, you may face the following problems:

- Unsecured credit card applications will not be approved

- Loan applications will not be approved

- Payment of higher interest rates

- Payment of higher insurance premiums

- More difficult time finding a job

- More difficult time getting approved to rent an apartment

- Difficulty taking out a loan to buy a home

Much Like Other Derogatory Marks Bankruptcy Records Will Remain On Your Credit Report For Up To Seven Years This Duration Will Begin Based On The Date They Were Filed Fortunately The Discharge Date Has No Effect On When The Information Will Fall That Is To Say It Is Possible That The Information Will Have Already Been Removed Before The Discharge

However, the type of bankruptcy does affect how long a bankruptcy record will remain part of your credit file. The two most common types of bankruptcy are Chapter 7 and Chapter 13.

Nevertheless, the Fair Credit Reporting Act sets a time frame for items to stay on consumer credit reports. As a result, bankruptcy records and other negative marks will naturally fall off of your credit report. In short, you donât need to do anything to have a bankruptcy removed.

Read Also: How To File Bankruptcy In Wisconsin

Bankruptcy And Your Consumer Credit Report

Chapter 13 does not remain on your credit report as long as Chapter 7. Generally, Chapter 13 is considered a less harsh remedy as it remains on your credit report for only seven years from the filing date. Chapter 7 has a more harsh effect as it remains on your credit report for 10 years. In some instances, a Chapter 13 that is later dismissed or not completed can also remain on your credit report for 10 years.

What Happens After Bankruptcy

Its almost certainly going to be hard to get any kind of loan or credit once you have a bankruptcy on your record.

However, here are some things you can do in order to start the process of rebuilding your credit.

It wont happen overnight. Therefore, its important to understand that its going to take time.

There is an old riddle you may have heard: How do you eat an elephant? One bite at a time.

You May Like:

You May Like: File For Bankruptcy In Texas

Will Your Credit Score Stay Poor Until Your Bankruptcy Is Removed From Your Credit Report

One common misconception is that your score will remain poor during the duration the bankruptcy is on your credit report. This is not true at all. In fact, you can start rebuilding your credit after your debt is discharged. According to bankruptcy experts, there is even a chance that your score will go above 700 after four to five years.

Why Would Someone Request A Dismissal Of Their Own Case

Perhaps you want your case dismissed due to a change in circumstances, such as discovery or inheritance of a valuable asset that will allow you to avoid bankruptcy or youâve successfully negotiated a real estate loan modification. Alternatively, you may need to refile because youâve incurred significant debt since the time you submitted your bankruptcy petition, perhaps due to an accident or significant medical diagnosis. If you hope to get your case dismissed, you can file a Motion for Voluntary Dismissal. However, itâs important to understand that this process isnât straightforward. This bankruptcy process is subject to various conditions and you may run up against barriers that prevent the success of your motion.

Your motion is more likely to succeed if youâve filed for Chapter 13 bankruptcy, partially because the court recognizes that a lot can change during a 3-5 year repayment period. Chapter 7 voluntary dismissals are much less likely to succeed because filers must demonstrate that they are making the motion in good faith. Courts rarely grant Chapter 7 voluntary dismissal motions.

Note that if you do submit a motion for voluntary dismissal, you may be barred from refiling for bankruptcy for a minimum of 180 days and a maximum of several years, depending on your circumstances.

Also Check: Can You Lease A Car While In Chapter 7

When Can You Get A Line Of Credit Again

Once youve established good financial habits, the best way to start rebuilding your credit profile and score is to obtain a secured loan of some type. This includes secured credit cards from a bank or a line of credit.

Most banks will approve you for an approved secured credit card a few years after filing bankruptcy. That should be the next step someone takes, Exantus said.

In addition, dont be surprised if you start receiving credit card offers during the seven to 10 years that a bankruptcy remains on your report. Credit card companies make more from customers who have low credit scores or bankruptcies.

You are a prime candidate for credit because most credit card companies know that a person has filed for bankruptcy and that they are going to want to get credit again. And they know they can charge you a higher interest rate because you have a lower credit score, Exantus added.