Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

What Is Debt To Income Ratio

3 min read

In this article we look at what debt to income ratio is. We also look at different factors the lenders look at when assessing your home loan application.

There are several factors credit assessors look at when deciding how much you can borrow and whether they will approve your loan application including your debt to income ratio. These factors include:

- Loan-Value-Ratio

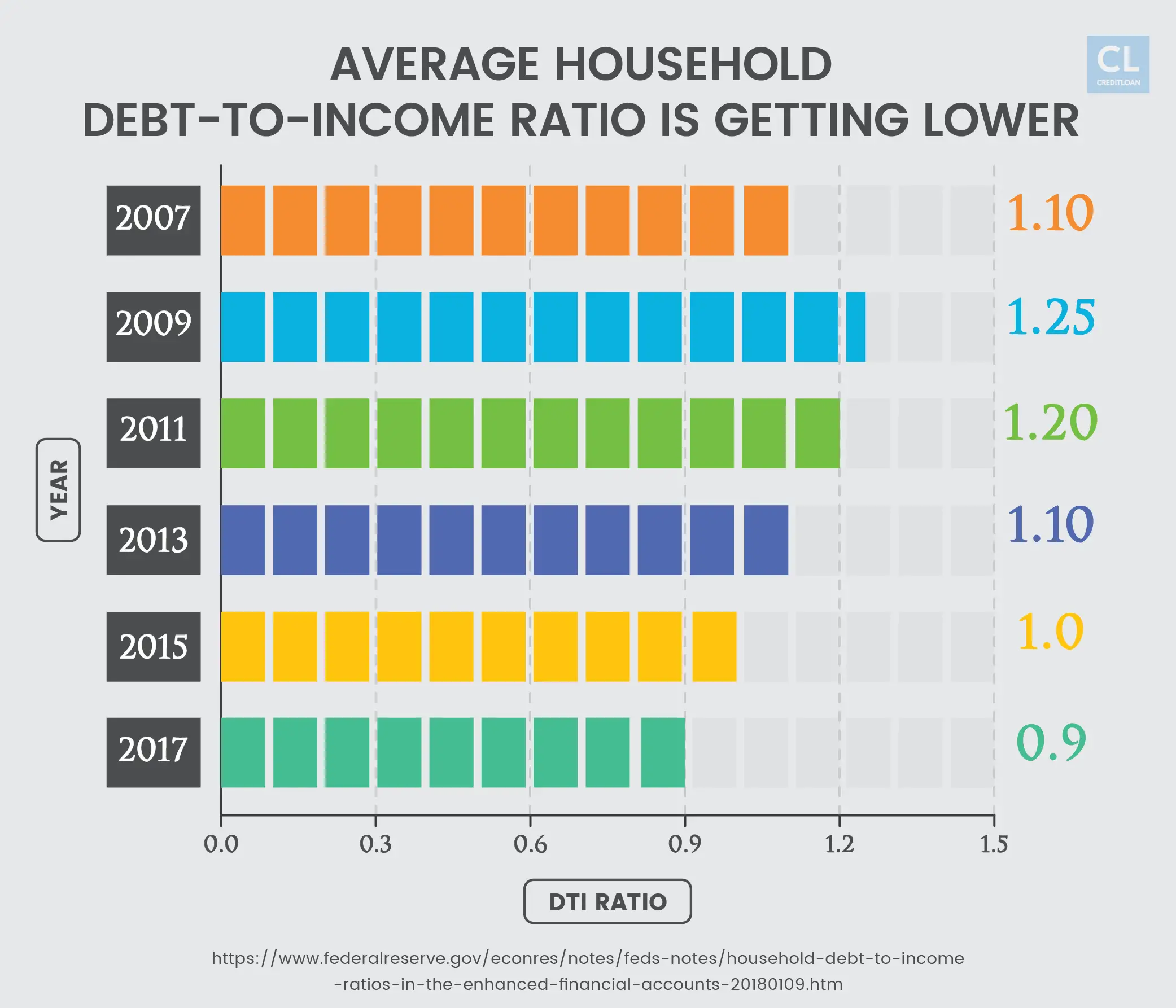

Recently, a couple of lenders announced they were decreasing their acceptable Debt-to-Income Ratio .

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt-to-income ratio means.

Read Also: Can You File Bankruptcy On Payday Loans

Get Help With The Mortgage Process

Our experienced mortgage loan officers will support you every step of the way.

If youre in the homebuying market, youve probably heard the phrase debt-to-income ratio thrown around. Whether youre a first-time homebuyer or just brushing up on your financial savvy, its important to understand what this phrase means.

Your debt-to-income ratio is a financial measure thats used by mortgage lenders and others to assess your financial health and determine how much mortgage you can afford.

It might seem confusing at first, but knowing your DTI is the first step toward ensuring youll be able to manage a mortgage and keep up with payments while still setting aside enough money for your other needs.

How Is DTI Calculated?DTI is expressed as a percentage, which is calculated by dividing your total recurring monthly debt by your monthly gross income.

Monthly debt should include ongoing loans such as your rent or mortgage, auto loans, personal loans, credit cards, alimony or child support and student loans. It does not include living expenses like groceries or utilities. Monthly income should include your entire households salaries or wages before tax.

Heres an example:

- Total monthly debts are $300 + $200 + $1,000 = $1,500

- Total monthly gross income = $4,500

- $1,500 / $4,500 = 33.33

- This households DTI is 33%.

To try it yourself, plug in your potential mortgage payment with your other monthly debts and see what your DTI would be.

DTI Ranges:

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

Also Check: How Many Times Can You File Bankruptcy In Ga

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when theyre considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This could put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Total Your Monthly Bills

Take some time and total up the general, recurring bills you pay each month, like:

- Monthly rent or housing payment

- Monthly child support or other marital debt

- minimum monthly payments

Remember, payments like groceries, gas, parking, utilities, day care, cable, taxes are generally not included in your debt-to-income calculation. However, when you sit down to create your budget, be sure to include those items in your expense list.

Read Also: Can You Declare Bankruptcy And Keep Your House

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

How Do The Big Four Banks Use Your Debt

When it comes to the big four banks, each financial institution offers and accepts different debt-to-income ratios depending on their unique processes. See below for a breakdown, as at the time of writing:

- ANZ wont accept applications where the debt-to-income ratio is greater than 9 for any home loans

- CommBanks credit department needs to manually approve applications with a debt-to-income ratio higher than 7

- National Australia Bank has a debt-to-income ratio cap of 9 for all home loan applications

- Westpac has a policy for debt-to-income ratios of 7 or greater, whereby your application will be referred to its credit department for further review.

Read Also: What Happens If You Declare Bankruptcy In Ontario

Divide Your Total Monthly Bills By Your Income

To get your ratio, divide the total of your monthly bills above by your pretax, gross monthly income. This calculation will result in a number that will reflect your DTI ratio as a percentage. For example, if the result of your calculation is 0.325, then your DTI is 32.5% when converted to a percentage. You can also use our DTI Calculator.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Also Check: What State Has The Highest Bankruptcy Rate

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Recommended Reading: What Is Debt To Income Ratio For Conventional Mortgage

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Putting It All Together: Dti Credit Score And More

Keep in mind there are several criteria lenders use to judge your creditworthiness and DTI is just one of them. If you have a high DTI but a good credit score and good credit history, your DTI might play less of a role in the lenders decision. Thus, if youre a physician with significant debt, you might still qualify for a loan despite having a high DTI if you have a good credit score and history. Many lenders offer Physician mortgages for this reason.

You May Like: How Does Filing Bankruptcy Affect Child Support

Add Up All Your Monthly Debt

When lenders add up your total debts, they typically do it one of two ways these two methods of determining your DTI are called front-end and back-end ratios.

Your front-end ratio only takes into consideration your housing related debts, such as rent payments, monthly mortgage payments, real estate taxes, homeowners association fees, etc.

Your back-end ratio, however, includes those monthly payments as well as other debts that might show up on your credit report, such as , personal loans, auto loans, student loans, child support, etc.

Your lender might calculate your front-end or back-end ratio when determining your DTI and sometimes they may look at both to get a better idea of your financial situation. When calculating your own DTI, its a good idea to add all these expenses up as part of your monthly debt to be prepared. Keep in mind that when tallying up your debts, lenders typically only look at things that appear on your credit report so things like utility payments may not actually count toward your total.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Read Also: Houses For Sale Auction

What Is The Debt

The debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. The DTI ratio compares an individuals monthly debt payments to his or her monthly gross income. It is a key indicator that lenders use to measure an individuals ability to repay monthly payments and accumulate additional debt.

How Is The Debt

Don’t Miss: Can You Buy A Home After Bankruptcy

S To Decrease The Debt

1. Decrease monthly debt payments

Consider an outstanding $50,000 student loan with a monthly interest rate of 1%. Scenario one involves an individual who is not repaying their principal debt, while scenario two involves an individual who has paid down $30,000 of their principal debt.

As illustrated above, as an individual pays down more of their principal debt, the monthly interest payments decrease.

2. Increase gross income

Consider two scenarios with a monthly debt payment of $1,500 each. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario two is $5,000. As such, the debt-to-income ratio would be as follows:

DTI Ratio = $1,500 / $3,000 x 100 = 50%

DTI Ratio = $1,500 / $5,000 x 100 = 30%

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

You May Like: What Does The Bankruptcy Trustee Investigate

Calculating Income For A Mortgage Approval

Mortgage lenders calculate income a little bit differently than you may expect. Theres more than just the take-home pay to consider, for example.

Lenders also perform special math for bonus income give credit for certain itemized tax deductions and apply specific guidelines to part-time work.

The simplest income calculations apply to W-2 employees who receive no bonus and make no itemized deductions.

For W-2 employees, the lender will typically look at your pay stubs and use the year-to-date average to determine your gross income and your monthly household income.

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

You May Like: Can Bankruptcy Stop Foreclosure In Florida

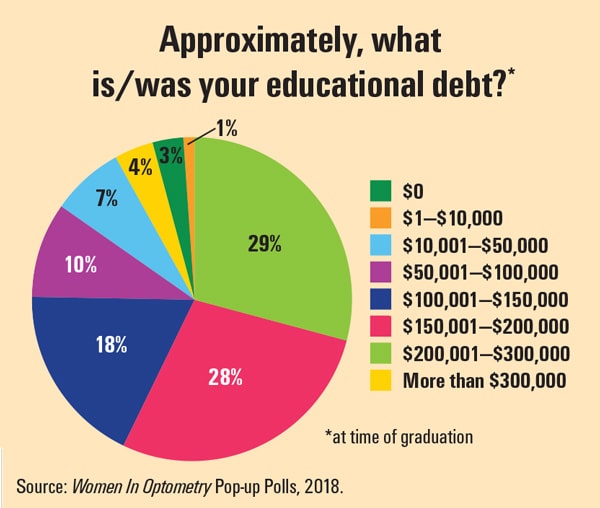

Whats The Impact Of Dti For Student Loan Refi

Your DTI also plays a role in whether you can refinance your student loans. There isnt a hard and fast rule of thumb for the maximum DTI to have when refinancing your student loans but typically, a DTI of 40% or lower is considered a reasonable threshold when youre applying to refinance the lower your DTI is, the higher the chance youll qualify for a new loan with a lower interest rate.

How To Reduce Your Dti Ratio

If you find that your debt-to-income ratio is higher than youd like it to be, there are obviously only two things you can do about it.

You can bring your DTI down to a more desirable level if you can pay off a debt or to lower your total monthly debt obligations by even a hundred dollars.

Read Also: How To Declare Bankruptcy In Nc

How To Achieve A Healthy Debt To Income Ratio

What is the Debt-to-Income Ratio?Understanding the Debt-to-Income Ratio. The debt-to-income ratio is of utmost importance to creditors that are considering providing financing to an individual.Front-End vs. Debt-to-Income Ratio in the Credit Analysis Process. Formula for the Debt-to-Income Ratio. Practical Example. Methods to Decrease the Debt-to-Income Ratio. Related Readings.

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

Recommended Reading: How To File Bankruptcy In Michigan

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.