Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

What Is The National Debt Costing Us

As the debt grows, so does the interest we pay.

Similar to a home or car loan, interest payments represent the price we pay to borrow money. As we borrow more and more, federal interest costs rise and compound. Rapidly growing interest payments are a burden that hinders our future economy.

Interest will become the fastest growing part of the federal budget.

In ten years, our interest will nearly triple from where it is today.

What Will Happen To Our National Debt

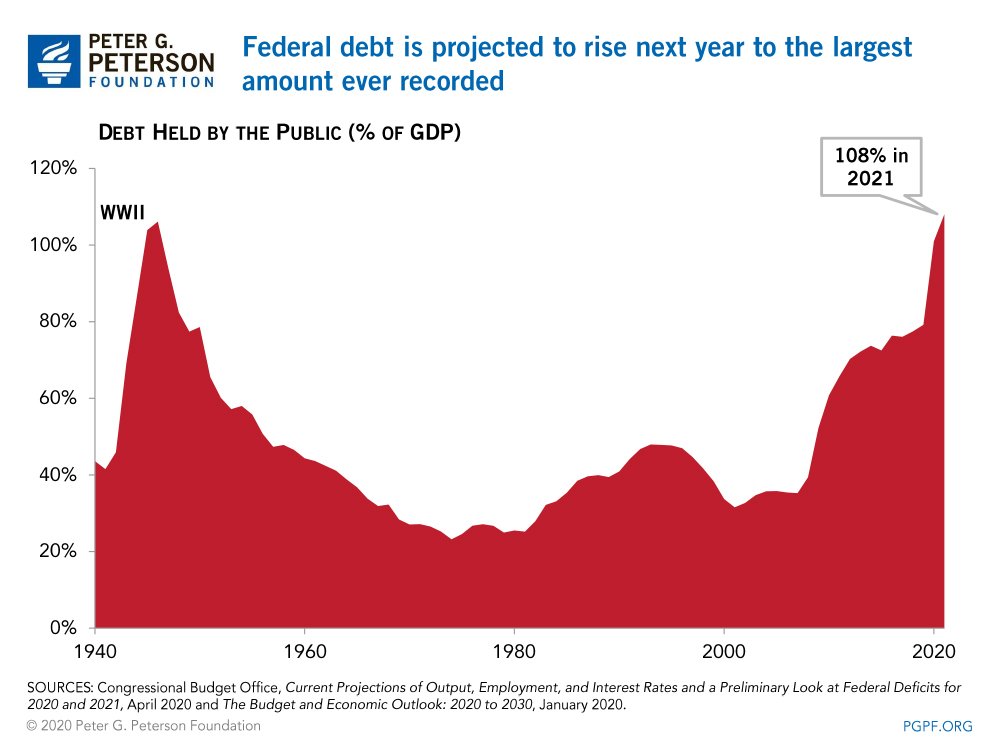

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

Recommended Reading: How Do You File For Bankruptcy In Ca

Consequences Of Growing National Debt

Japan’s experience shows sovereigns can incur a surprising amount of debt if the country’s central bank is willing to monetize the borrowing, and so long as it doesn’t stoke inflation.

But even if we discount the remote risk of a default, rising debt imposes higher interest costs, especially when interest rates rise. The CBO expects the U.S. government’s net interest costs to triple over the next decade, reaching $1.2 trillion annually by 2032.

That will force lawmakers to decide between running even larger deficits just to keep spending and revenue constant, or some combination of spending cuts and revenue increases.

If the choice is even larger deficits, bond buyers might require higher yields to compensate them for the resulting increase in risk. Or they may not, if slowing economic growth prompts investment flows into fixed income amid expectations of lower interest rates.

What Is The Debt Of The United States

The United States government’s debt is very high. The interest on the debt has become a significant component of the US budget. The chart below illustrates the growth in the public debt over the years. The figures represent the official historical figures of the Congressional Budget Office .

Please note that the dollar amounts are in billions of US Dollars and are not adjusted for inflation. The term “deficit” refers to the annual increase to the overall debt figures illustrated below. The figures in the table represent the end-of-year figures.

By way of example, the total deficit on in 2010 was just over $9,000 billion US Dollars , or $9 trillion USD. When you divide this figure by 309 million, which is approximately the entire population of the United States that year, you are left with over $29,000 USD for every man, woman and child.

| Year |

he means for a fiscal year I think.

The national debt is currently at over 12.5 trillion. When you adjust it for CPI, the chart shows debt has increased dramatically in last few years. Debt to GDP stands to be 100% in 2012, higher than the debt to GDP when Truman was president.

What a load of crap. When inflation is considered and when the debt is compared to GDP, the graph will look very different.

Why is associated press writer, Martin Crutsinger, stating today that deficit has topped trillion dollars for FIRST time?

Post your comments

You May Like: How Long Does Your Bankruptcy Stay On Credit Report

How Can We Reduce The National Debt

To reduce the debt, the country could raise taxes and/or cut spending. These are two of the tools of contractionary fiscal policy, and either tactic could slow economic growth.

Spending cuts come with pitfalls though. In 2021, government spending was 30% of GDP, which is the value of all goods and services produced in a country in a given year. If the government cuts spending too much, GDP will drop and economic growth will slow. That leads to less revenue and a larger deficit.

Tax increases can also slow economic growth. One study found that a tax increase of 1% lowers real GDP by about 3%. The real GDP is an inflation-adjusted measure that simplifies tracking the GDP from year to year.

Most governments can safely finance their deficits with the help of government bonds instead of balancing the budget.

As long as the debt is below the tipping point, creditors have confidence that the government will repay them. The tipping point is when the amount of public debt hinders a country’s ability to grow economically. When debt is moderate, government interest rates can remain low and that allows governments to keep running deficits for years.

Tracking The Federal Deficit: April 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $308 billion in April 2022, the seventh month of fiscal year 2022. This surplus was the difference between $864 billion in receipts and $556 billion in spending. Aprils surplus compares to a $226 billion deficit in April 2021, with the dramatic change primarily due to the winding down of most pandemic relief spending and income tax receipts arriving in April 2022 that were delayed during the last fiscal year. In both 2021 and 2022, May 1 fell on a weekend, shifting some outlays into April that would normally have occurred in May. If not for those shifts, the April 2022 surplus would have been $373 billion and the April 2021 deficit would have been $166 billion. The following discussion excludes the effects of those timing shifts.

Analysis of notable trends: The federal government typically runs a surplus in April, the month when most taxpayers pay individual income taxes. However, due to high levels of pandemic relief spending and the IRSs decision to delay Tax Day in 2020 and 2021, April 2022 marked the first April surplus since 2019.

Read Also: How Long Does Bankruptcy Stay On Your Credit File

Tracking The Federal Deficit: May 2019

The Congressional Budget Office reported that the federal government generated a$207 billiondeficit inMay, the eighth monthof Fiscal Year 2019, for a total deficit of $738 billionso far this fiscal year.Maysdeficit is41 percent more than the deficit recorded a year earlier inMay 2018. If not for timing shifts of certain payments, the deficit would have been7 percent larger than the deficit inMay 2018. Total revenues so far inFiscal Year 2019increased by2 percent , while spending increased by9 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Corporate income tax receipts were down by 9 percent compared to last year, reflecting the lower marginal corporate tax rate enacted in the Tax Cuts and Jobs Act of 2017. Further, customs duties increased by 78 percent versus last year, due to the imposition of new tariffs. On the spending side, Department of Defense spending increased by 10 percent compared to last year, particularly on military operations, maintenance, procurement, and R& D. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

How Much Would Each American Owe To Pay Off Its National Debt

The US Census Bureau estimates the American population is 324,356,000 at the end of 2019. The US national debt as of 2019 was approximately $22.7 trillion. Thus, every American, regardless of age, would have to pay nearly $70,000 to resolve the US national debt. If only adults are taken into account, then the per capita debt would be about $90,500.

Read Also: Will Capital One Approve Me After Bankruptcy

How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

Why Is The Debt So High

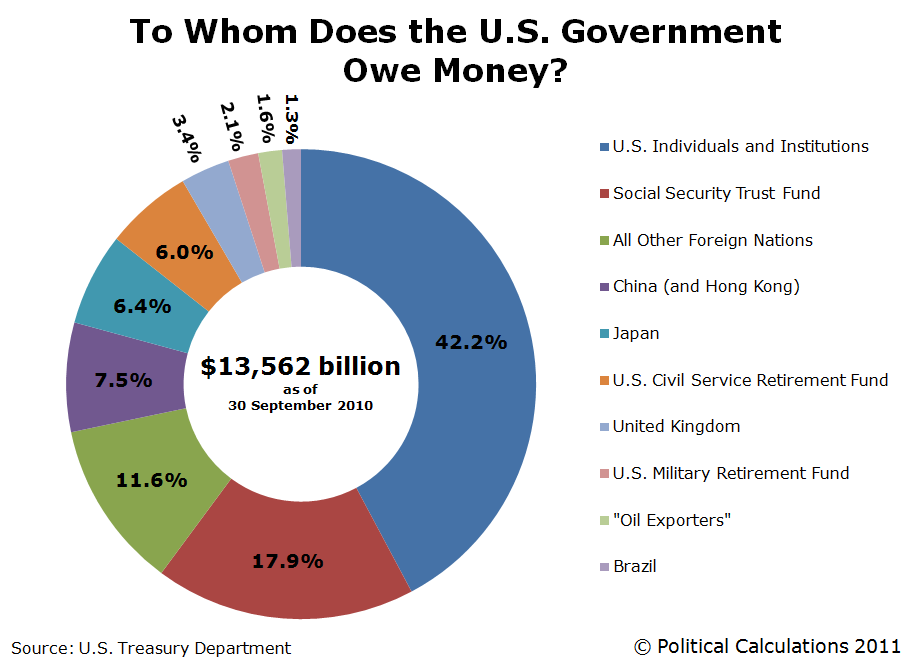

As of March 2022, the U.S.s national debt stands at $30.2 trillion.Factors that contribute to the U.S.s high national debt include continued federal budget deficits, the government borrowing from the Social Security Trust Fund, the steady Treasury lending from other countries, low interest rates that promote increased investment, and raised debt ceilings.

Other factors that contribute to the high national debt include the inefficient healthcare system and the changing demographics of the country. Though the U.S. spends more than other countries on healthcare, health outcomes are not much better. In addition, the Baby Boomer generation are now becoming elders and seeking benefits and increased healthcare services. The government will spend, sometimes inefficiently, more on programs and services for the longer living older generations.

Don’t Miss: How Much Debt Does The Us Have

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

Why The Federal Reserve Owns Treasurys

As the nation’s central bank, the Federal Reserve is in charge of the country’s credit. It doesn’t have a financial reason to own Treasury notes. So why does it?

The Federal Reserve actually tripled its holdings between 2007 and 2014. The Fed had to fight the 2008 financial crisis, so it ramped up open market operations by purchasing bank-owned mortgage-backed securities. The Fed began adding U.S. Treasurys in 2009. It owned $1.6 trillion, by 2011, maxing out at $2.5 trillion in 2014.

This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets. It gave businesses continued access to low-cost borrowing for operations and expansion.

The Fed purchased Treasurys from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high-interest-rate penalty it would incur for excessive debt.

The Fed ended quantitative easing in October 2014. Interest rates on the benchmark 10-year Treasury note rose from a 200-year low of 1.43% in July 2012 to around 2.17% by the end of 2014 as a result.

The Federal Open Market Committee said the Fed would begin reducing its Treasury holdings in 2017. But it purchased Treasurys again just a few years later.

Read Also: Credit Counseling Of America

Social Security Trust Fund

Every president borrows from the Social Security Trust Fund. Over the years, the Fund has taken in more revenue than it needed through payroll taxes leveraged on the baby boomer generation.

Ideally, this money should have been invested to be available when members of that generation retire. Instead, the Fund was “loaned” to the government to finance increased spending. This interest-free loan helps keep Treasury bond interest rates low, allowing more debt financing. But, it must be repaid by increased taxes as more individuals retire.

Recovery From The Civil War

The Civil War alone is estimated to have cost $5.2 billion when it ended and government debt skyrocketed from $65 million to $2.6 billion. Post-Civil War inflation along with economic disturbance from Europes financial struggles contributed to the vulnerable economic climate of the late 19th century.

The collapse of Jay Cooke & Co., a major bank invested in railroading, caused the Panic of 1873. Nearly a quarter of the countrys railroads went bankrupt, more than 18,000 businesses closed, unemployment hit 14 percent and the New York Stock Exchange began sinking.

This period of deflation and low growth continued for 65 months making it the longest depression, according to the National Bureau of Economic Research. During this time the government collected less money in taxes and the national debt grew.

Recommended Reading: Can Only 1 Spouse File For Bankruptcy

Tracking The Federal Deficit: September 2019

The Congressional Budget Office reported that the federal government generated a surplus of $83 billion in September, the final month of Fiscal Year 2019. This brings the total FY2019 deficit to $984 billion,26 percent higher than last years deficit. If not for timing shifts of certain payments, this years deficit would have been21 percent larger than the deficit inFY2018. On an apples-to-apples basis, total revenues inFY2019increased by4 percent , while spending increased by7 percent , compared to the prior fiscal year.

Analysis of Notable Trends for Fiscal Year 2019: Corporate income tax revenue increased by 14 percent relative to 2018, although that year notably was tied for the lowest corporate revenue level as a share of the economy since 1965, a result of the Tax Cuts and Jobs Act of 2017 . Customs duties increased by 71 percent versus last year due to the imposition of tariffs, specifically on certain imports from China. On the spending side, outlays from the refundable earned income and child tax credits increased by 14 percent versus last year, reflecting expansions enacted in TCJA. Finally, payments for net interest on the public debt rose by an alarming 14 percent , largely due to higher short-term interest rates and a growing federal debt burden on which those interest payments are owed.

How Is The National Debt Measured

Measuring the national debt can bebroken into three parts: debt held by the public, gross federal debt, and debt subject to limit.

Debt held by the public is the amount of money that the U.S. treasury borrows from external lenders through financial markets. The money gathered funds the governments activities and programs. Many financial analysts and economists think of this portion of the debt as the most meaningful because it focuses on the money that is raised through financial markets. This portion of the debt is made up of two-thirds domestic creditors and one-third foreign creditors. By the end of fiscal year 2021, the debt held by the public was $22.3 trillion.

Gross federal debt includes the public debt and federal trust funds and other government accounts. This is the amount that the government owes other governments and itself. By the end of fiscal year 2021, the gross federal debt was $28.4 trillion .

Debt subject to limit is similar to gross federal debt but does not include debt issued by agencies other than the Treasury and Federal Financing Bank. At the end of fiscal year 2021, this number was $28.4 trillion.

Read Also: Bankruptcy Chapter 7 Discharged