Chapter 7 Bankruptcy Protection Eligibility And Means Test

At this point, the trustee has gathered and reviewed all of your information and the court makes a decision on whether or not you are eligible for Chapter 7 protection. You might not be eligible if you can’t pass the means test . If the court denies eligibility, you still may have the option to file for Chapter 13 bankruptcy.

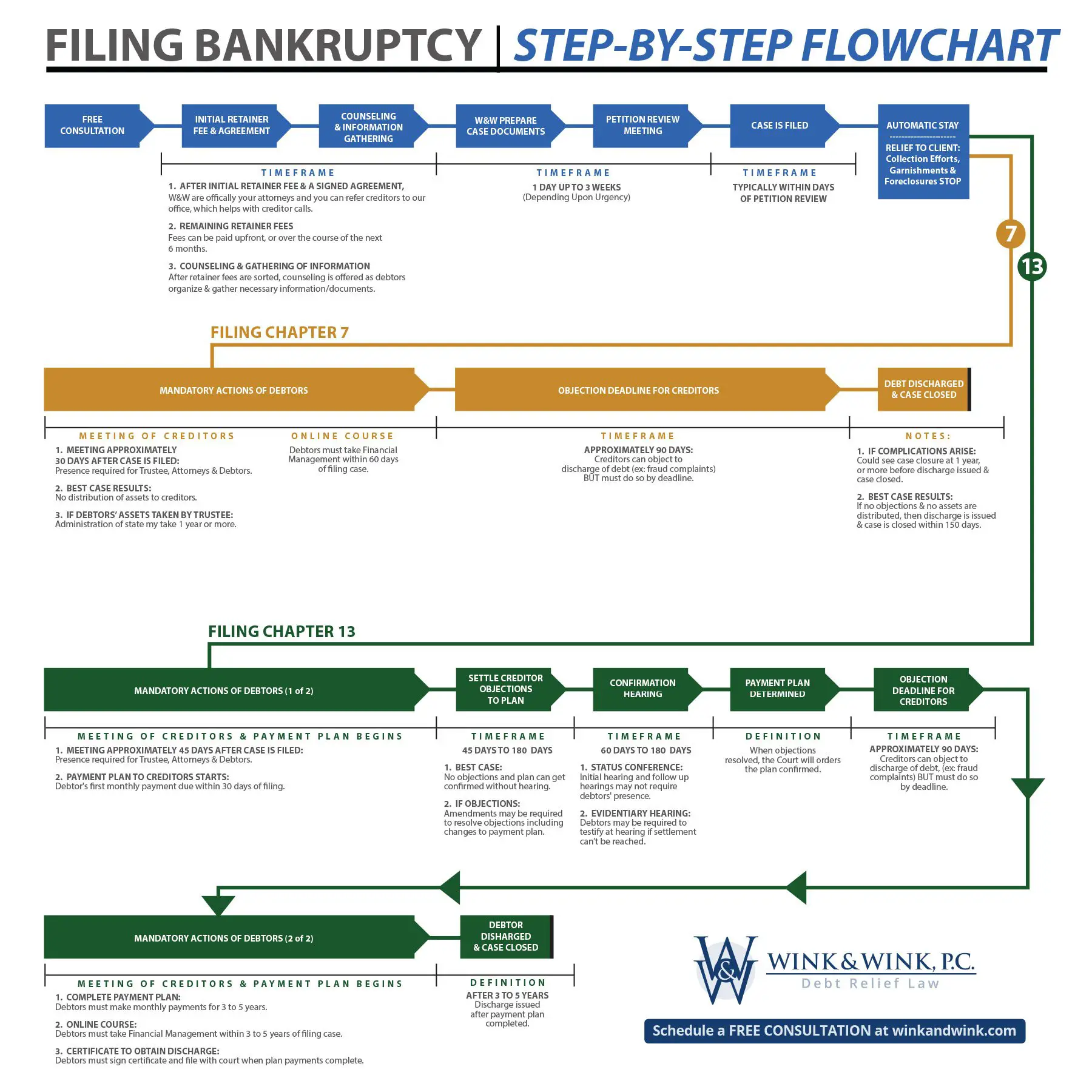

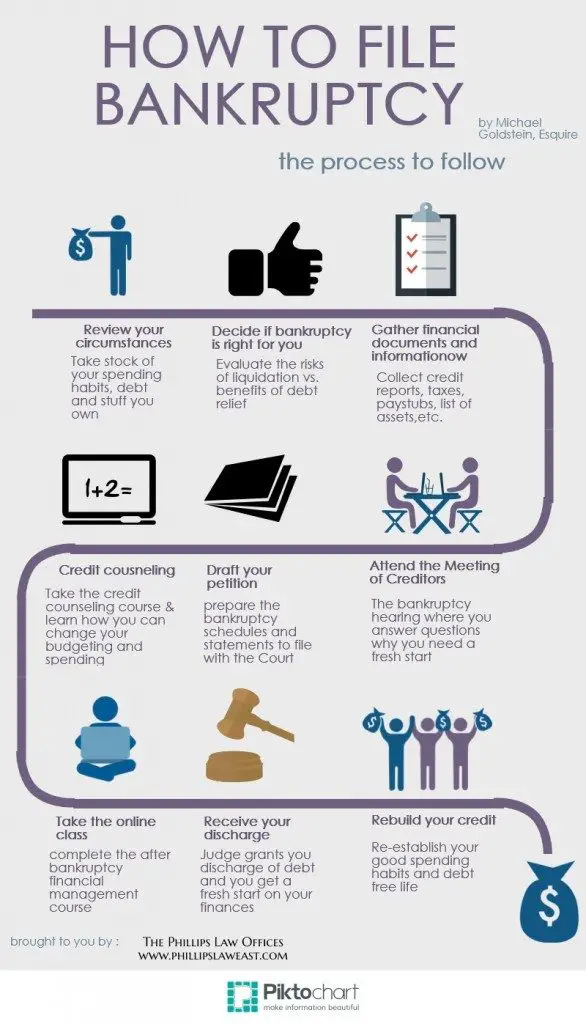

What Is The Process Of Filing Bankruptcy

Home » Frequently Asked Questions » What Is the Process of Filing Bankruptcy?

The process of filing bankruptcy begins with deciding which type of bankruptcy is right for you. You will then need to compile important financial documents, submit a petition to your local bankruptcy court, and attend meetings. Below, we will explain how bankruptcy works and how an attorney can guide you through the process.

Our bankruptcy attorneys will help you navigate and complete the bankruptcy process, which can be overwhelming to people unfamiliar with how it works. We can manage your entire case and explain what to expect.

Wind Up Your Secured Debts

When you filed your bankruptcy forms, you’ll complete a form in which you stated how you intend to handle your secured debts. Before your case is closed, you’ll need to act on these matters. For instance, if you indicated that you’d return a car, you’ll want to be sure to make it available to the lender.

You May Like: Filing For Bankruptcy In Il

Contact Our Chicago Bankruptcy Lawyer

Are you considering bankruptcy? The entire process ordinarily takes about four to five months to complete, and during that period, your creditors cannot take any legal action against you. At the end of the process, you are free from a large portion of what you had owed and your initial debts are gone forever.

Connect with our firm to speak with our bankruptcy lawyer so we can review your situation and advise you about your eligibility.

Print Your Bankruptcy Forms

Once you have prepared your bankruptcy forms, you will need to print them out for the court. You must print them single-sided. The court wonât accept double-sided pages. You will also need to sign the forms once they are printed.

You will need:

-

Your paycheck stubs

-

If needed, your application for a fee waiver or installment plan

Most bankruptcy courts require just one signed original of the petition, but some courts require additional copies. So, before you head out to submit your forms, to find out how many copies you will need to bring and confirm you have all the required local forms.

Also Check: Leasing A Car After Chapter 13

Insolvency & Bankruptcy Statistics In Alberta

| 14,348 |

Bankruptcy rates are back on the rise after falling in 2018. During 2019, the number of filings for personal bankruptcy totalled a little over 400 per month on average. That is a 13.5% increase from the previous year. These numbers dropped at the start of 2020 indicating that Albertans are finding more success with other debt solutions such as debt settlement programs that are available to the public.

Surplus Income Adds To The Cost Of Bankruptcy

As mentioned above, you may be required to pay a portion of your monthly income towards your debts via the Trustee, depending on how much you earn and the size of your household. The principle is that if you earn more than your household needs to survive, you must pay a portion of the surplus income to your Trustee for the creditors. The formula used to calculate this is prescribed by law. In simple terms, you will pay about half the amount deemed to be surplus income to your Trustee. Your Trustee can tell you how the surplus income rule will likely apply in your situation.

In general, the greater your income, the greater the cost of bankruptcy and the more attractive the alternatives to bankruptcy become.

Don’t Miss: Cost To File Bankruptcy In Wisconsin

Begin Your Repayment Plan For Chapter 13

Once the court approves your repayment plan on a chapter 13 case, you will begin repayment of your creditors for a period of either three or five years. You will make payments to the case trustee who will then distribute the funds to your creditors.

Once you complete all the payments required on the repayment plan, some of your debts may be discharged but you could still be required to repay other creditors.

Nonexempt Property Liquidation Or Repayment Plan

If you file for Chapter 7 bankruptcy, any nonexempt property will be liquidated to pay off your debts at this point.

Your trustee will determine whether your nonexempt assets are worth selling. In some cases, you may be able to keep some nonexempt assets if the trustee determines that selling them isnt cost-effective. For example, say you own a car worth $3,000. You owe $2,800 on the car loan, and it would cost $200 to sell the car. In this case, the trustee may determine that selling the vehicle is not in your creditors best interests.

If you file for Chapter 13 bankruptcy and the court confirms your proposed repayment plan, its up to you to stick to the repayment schedule outlined in that plan. Most repayment plans last three to five years. If you cant make the agreed-upon payments during this time, the court may dismiss your case or convert it to a Chapter 7 liquidation case. If circumstances beyond your control make it impossible for you to continue making payments, the court may be willing to modify the plan or grant a hardship discharge.

Also Check: Nortel Epiq

Obtaining Discharge And Getting Back On Track

Its important to keep in contact with your Trustee throughout the whole process so that you obtain your discharge. While the burden of collection calls and steep minimum payments on your credit cards is over, you have new responsibilities with your slate wiped clean.

You now have to cover the fees to your Trustee and other administrative charges, which can add up quite substantially. You have to stay accountable too, by providing your monthly income statement to your Trustee and attending credit counselling sessions to carve out better financial habits. If youre required to attend a discharge meeting, your Trustee will explain that to you so that you can be prepared and attend as needed.

A Creditor Making You Bankrupt

Your creditors can present a creditor’s petition if you owe them an unsecured debt of over £5,000. This may be the sum of two or more debts which total over £5,000. There might be different petitioning creditors on the same petition for different debts you owe.

Once bankruptcy proceedings have started, you must co-operate fully even if it’s a creditor’s petition and you dispute their claim. If possible you should try to reach a settlement before the petition’s due to be heard – doing it later can be difficult and expensive.

You May Like: Cinlegal Com

How Does Bankruptcy Work

In plain language, this is what happens in personal bankruptcy in Canada: you assign your non-exempt assets to a Licensed Insolvency Trustee in exchange for the elimination of your debts. Certain exemptions that vary by province may allow you to keep some assets such as your home , car, RRSPs, pension plans, furnishings and effects, etc.

As soon as your bankruptcy papers are filed, your creditors are barred from attempting to contact you, and most legal proceedings and garnishments related to your debts will cease. Once you are released from bankruptcy , the debts included in the bankruptcy will be extinguished. Those creditors are legally blocked from approaching you for any further payments.

Filing For Bankruptcy With The Court

After counseling, you file with the court. At this point, the bankruptcy appears on your and creditors must stop calling you or making attempts to collect on your debt. The reason why creditors are prohibited from contacting you is because bankruptcy invokes an automatic stay, which stops all legal activities from taking place the moment the bankruptcy is filed.

Read Also: How Many Times Has Trump Declared Bankruptcy

Attend A Credit Counseling Course

After determining which chapter is for you, you must attend a credit counseling course within 180 days before you file for bankruptcy, per 11 U.S. Code § 109 of the federal Bankruptcy Code. You will have to take debtor education after you file, as well. Both courses are required before the discharge of your debts takes place, the U.S. Courts advise.

Liquidation Of Nonexempt Property

If you have assets that can be liquidated to pay debt, or nonexempt property, the trustee managing your case may make the decision whether or not to seize the property. This is a very important point in the process to have an attorney to work with the trustee to allow you to keep some or all of your nonexempt property.

You May Like: Filing Bankruptcy California

Filing For Bankruptcy In Alberta

Filing for bankruptcy in Alberta is something many Canadians think they have to undergo. Although the recent economic downturn exacerbated the problem of debtors being unable to pay their debts, the truth of the matter is that there are always people in Canada who find themselves in over their heads when it comes to what they owe their creditors. From mortgages to student loans to credit cards, some residents find themselves in a situation they never anticipatedthey cannot keep up with their bills.

Average consumer debt levels in Alberta are the highest in the country with Calgary and Edmonton leading the way. Non-mortgage consumer debt in Alberta hit $29,117 in Q1 of 2019, an increase of 3.4% from 2018. Because of these high-debt loads, bankruptcies in the province are up 13.5% over 2018 with Alberta the only other province to see a significant increase in the rate of bankruptcies.

How Chapter 7 Works

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. In addition to the petition, the debtor must also file with the court: schedules of assets and liabilities a schedule of current income and expenditures a statement of financial affairs and a schedule of executory contracts and unexpired leases. Fed. R. Bankr. P. 1007. Debtors must also provide the assigned case trustee with a copy of the tax return or transcripts for the most recent tax year as well as tax returns filed during the case . 11 U.S.C. § 521. Individual debtors with primarily consumer debts have additional document filing requirements. They must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. Id. A husband and wife may file a joint petition or individual petitions. 11 U.S.C. § 302. Even if filing jointly, a husband and wife are subject to all the document filing requirements of individual debtors.

You May Like: How To File For Bankruptcy In Texas Without A Lawyer

Consequences Of Filing For Bankruptcy

As mentioned above, your will be impacted for at least six years after you are discharged from your bankruptcy. Take heart, though you can begin to improve your credit rating as soon as your bankruptcy is discharged, and your credit options will improve in step with your credit rating. Read more on our page: When Does a Bankruptcy Clear from My Credit Report?

While your bankruptcy is in progress, you may not be a director in a corporation. Certain professional designations and board memberships are also affected while you are bankrupt your Trustee can help you source the relevant information, or you may check with the specific professional association or board.

Some financial and professional applications will require you to declare whether you have been bankrupt you will need to answer truthfully. This does not necessarily mean your application will be denied. Note that if you have filed a consumer proposal but have never been bankrupt, you will answer no to this question.

What Is The Process

The bankruptcy process almost always begins with a voluntarily assignment into bankruptcy although it is possible for someone to be petitioned into bankruptcy by their creditors.

You will work with a Licensed Insolvency Trustee who will administer your bankruptcy, file all necessary paperwork and deal with your creditors on your behalf.

As an officer of the court, the trustee does not work for you or your creditors, although the trustee will ensure that both you and your creditors are treated fairly.

This outline shows the steps involved in a typical straightforward case.

Your trustee will notify your creditors of your bankruptcy, hold the meeting of creditors and will give you your two required bankruptcy counselling meetings that are part of your bankruptcy duties.

If you have any assets you have to surrender because they are not protected by the exemptions the trustee will hold these assets until they can be sold and then will hold the funds from the sale in trust for distribution to your creditors who have submitted a valid Proof of Claim on debts that you owe to them.

You must finish any of the bankruptcy duties required and make all required payments to your bankruptcy estate in order to receive your bankruptcy discharge.

Need Help Reviewing Your Financial Situation?Contact a Licensed Trustee for a Free Debt Relief Evaluation

* You do not complete all of your required bankruptcy duties.

Don’t Miss: If You File Bankruptcy Can You Rent An Apartment

Attend A Meeting Of Creditors

After you file your bankruptcy petition, the trustee will hold a meeting of your creditors. During this meeting, the trustee and your creditors will ask you questions you must answer under oath.

If that sounds scary, dont worry your lawyer will prepare you for the meeting and attend it with you. In most cases, the questions will be similar to the ones youve already answered in your petition. The purpose of the meeting of creditors is to have you confirm, under oath, that the information in your paperwork is accurate and complete.

What Happens Once I Make The Person Bankrupt

- The trustee will notify the person of their bankruptcy.

- The trustee will send the person a Bankruptcy Form including instructions how to complete the form online. The completed form will need to be submitted within 14 days.

- The earliest day that the bankruptcy can end is 3 years and 1 day after acceptance of the Bankruptcy Form.

Don’t Miss: Bankruptcy Score Range

Your Debts Are Discharged

In a Chapter 7 bankruptcy, your remaining debts will be discharged once the trustee sells your nonexempt assets and pays out creditor claims.

In a Chapter 13 bankruptcy, before the court concludes your case and discharges your remaining eligible debts, you must complete a personal financial management course. This course is designed to educate you on personal financial management. You can search for an approved debtor education provider in your area via the U.S. Department of Justice.

Once your debts have been discharged, those creditors are no longer allowed to take any collection actions against those debts.

Pro Tip: If you file for bankruptcy, itll take a lot of hard work to build your credit score back up. To get a head start, sign up for Experian Boost. This free service factors in payments from utility bills to help give your credit score an immediate boost.

Go To Court To File Your Bankruptcy Forms

Once you enter the doors of your local courthouse, you will be greeted by security guards, who will ask you to pass through a metal detector. Once you pass security, you will go to the clerkâs office and tell the clerk that youâre there to file for bankruptcy. They will take your bankruptcy forms and your filing fee .

Do not submit your bank statements or tax returns to the court. These documents go to the trustee after the case is filed. Check out Step 7 below for more info on that.

While you wait, the clerk will process your case by scanning your forms and uploading them to the courtâs online filing system. This usually takes no more than 15 minutes.

Once done, the clerk will call you back to the front desk and give you:

-

Your bankruptcy case number

-

The name of your bankruptcy trustee

-

The date, time, and location of your meeting with your trustee

At this point, your case has been filed! Congrats! The automatic stay now protects you from all debt collectors. But youâre not home yet – there are other steps you need to complete to get a fresh start under Chapter 7 of the Bankruptcy Code!

Also Check: Bankruptcy Laws In Indiana

Set Up A Meeting With A Local Licensed Insolvency Trustee

The trustee will help you review your financial situation and give you the pros and cons of each debt relief option available to you.

Depending on your amount of debt and/or income, certain bankruptcy alternatives might not be viable for you.

Your trustee will help you make an informed decision on whether bankruptcy is the best choice for you or if there is a better option based on your personal finances.

Rebuilding Credit Post Bankruptcy

Hoorfar recommends taking the following steps to repair your credit after bankruptcy.

-Continue paying on your non-bankruptcy accounts.

-Take the help of a cosigner or become an authorized user of an account if you cant get new credit alone.

-After getting discharged from debts, swipe your credit cards only for an amount you can comfortably pay every billing cycle.

-Make sure your payments get reported to all major credit bureaus.

However, it may take about two years to improve your credit score after getting discharged from debts in bankruptcy, he says.

Recommended Reading: Taco Bell Bankruptsy