How Do You Calculate Your Debt

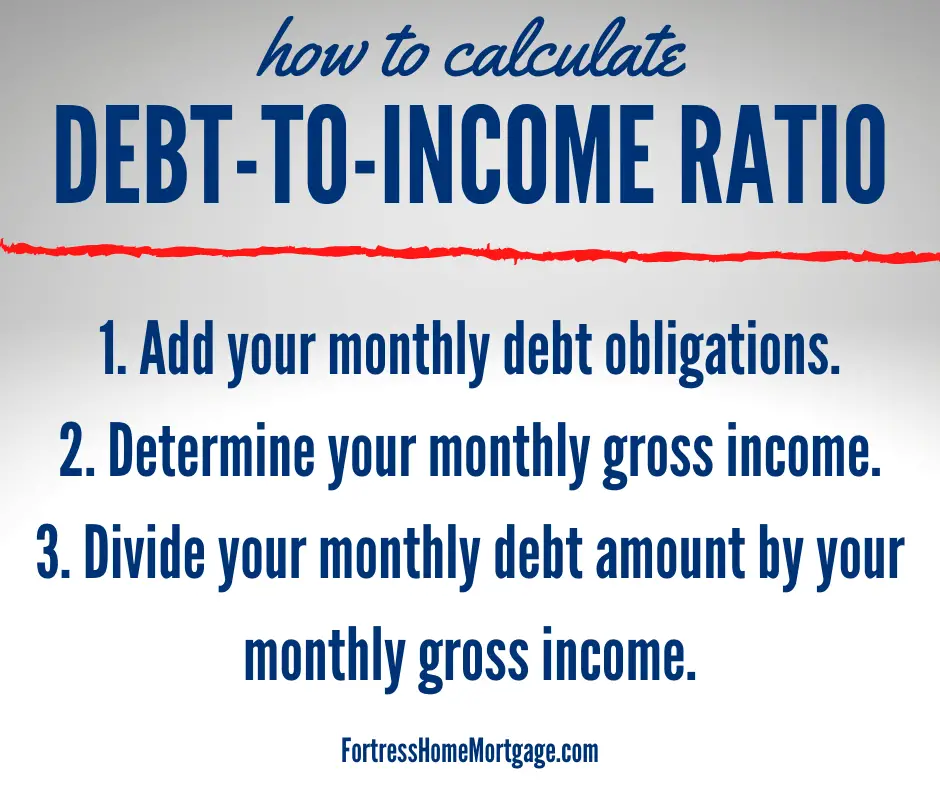

If you want to calculate your debt-to-income ratio ratio yourself, heres a quick look at how to figure it out. .

Add up your recurring monthly debt, including your mortgage payments or rent, personal loans, car finance, , student loans or child support, if these apply to you.

Next, add up your monthly income, including your gross wages before tax and national insurance deductions, and any freelance income or investment profits you regularly receive.

Finally, divide your monthly debt by your monthly income and then multiply this figure by 100.

Whether or not the bank or credit provider includes the new loan in this calculation is up to them, so to be on the safe side, include this expense in your debt-to-income ratio calculation tool.

What Is Your Debt

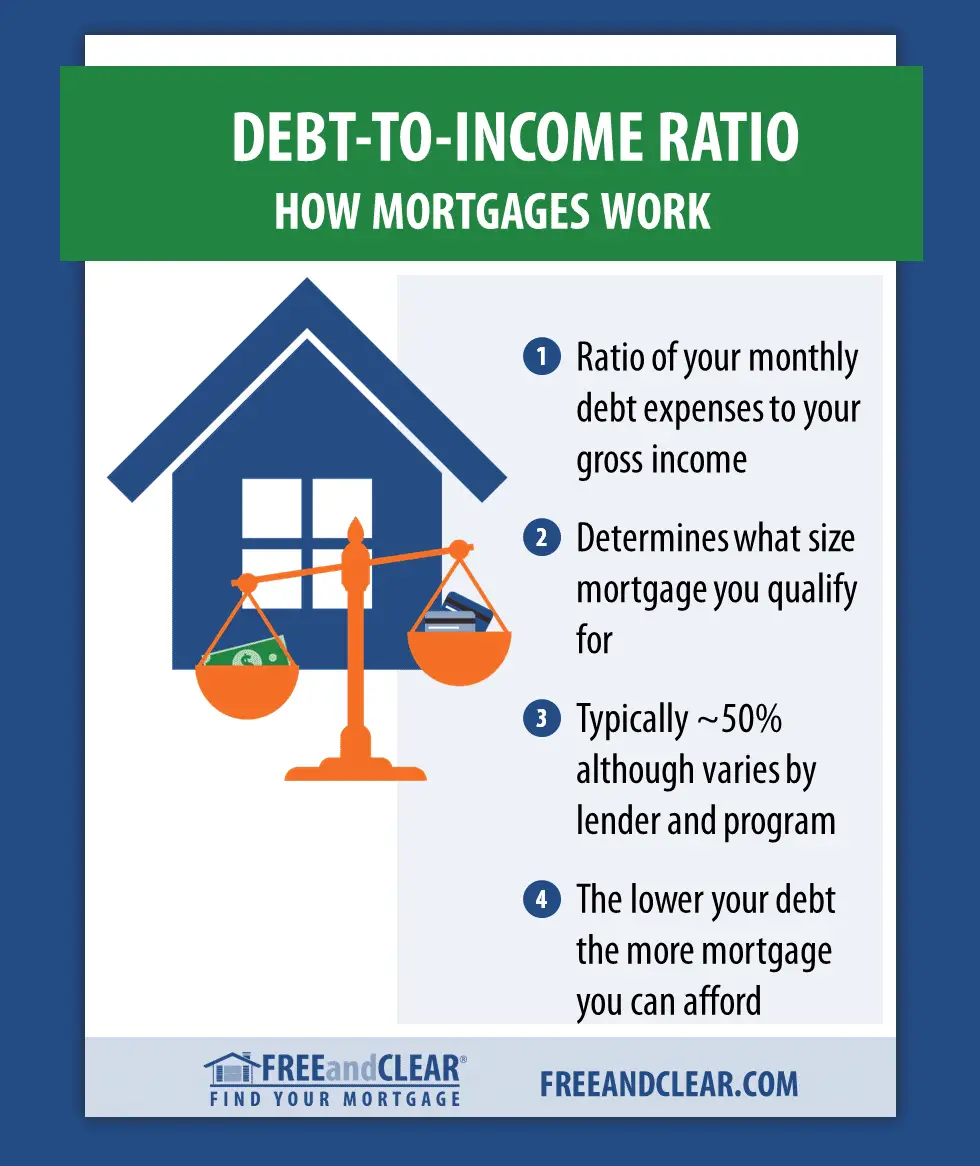

One of the many things a lender considers about your home equity loan application is your debt-to-income ratio. Since this calculation compares what you earn to the total amount of debt youll have if youre approved, its a key indicator of your overall financial health. More specifically, your DTI ratio helps the lender estimate how much you can pay on a loan, after you make your existing payments.

Applicants whove kept their debt to a minimum relative to their earnings are more likely to get the loan theyre applying for, along with more favorable terms. Consider this example:

Pete and Melissa are a young couple looking to renovate their 19th century home. Together they make $15,000 per month before taxes. After approval, they will have $5,000 in monthly debt which puts their DTI at 33 percent, which is ten percentage points lower than a typical conventional maximum allowable debt for a home equity loan.

As a result of their low DTI and other positive indicators, Pete and Melissa received a home equity loan for the amount they requested and with favorable terms. However, a household with a borderline 43 percent DTI may have to accept a lower loan amount, a different loan length, or not be approved at all.

What You Need To Know About Debt To Income Ratio

Debt-to-income ratio has become a common yet important tool that measures your financial health. If your DTI is low, it could mean you are in good financial shape, with little monthly debt when compared against your income. However, if your DTI ratio is high, it could be a red flag to lenders that you are carrying too much debt in comparison to your income which could prevent you from being approved for new offers or obtaining additional credit.

March 3, 2021 in Learn

Also Check: How Does Bankruptcy Affect Your Job And Future Credit

Debt: Income = Gross Monthly Debt: Gross Monthly Income

Where

Gross Monthly Debt = All the debt payments to be made monthly at the time of calculating the ratio

Gross Monthly Income = The monthly income earned by you.

Fullerton India offers a personal loan eligibility calculator as well as a personal loan EMI calculator online. This will automatically calculate the amount of personal loan you are eligible for depending on your income and existing obligations, as well as the EMI you will have to pay every month for a certain interest rate and tenure. Thus, the personal loan eligibility calculator primarily factors in the Debt-income ratio.

Demonstrate And Put Into Practice A High Level Of Productive Patience

Next, be patient. If you figured out your own DTI and noticed it is above the lenders acceptable levels, now may not be the time to apply for the loan you are seeking. Although applying for a loan that is rejected will not have any effect on your debt-to-income ratio, it might have a small negative effect on your credit rating. In addition to your DTI, your credit rating is a major deciding factor your potential lender will consider.

Your patience can include a laser focus on addressing issues within your personal and household finances that might be contributing to your high DTI. Plan your spending, put large purchases such as a new car or new appliance on hold or at least on a plan to save up and purchase without additional debt, and look for ways to improve your DTI.

Recommended Reading: How Does Bankruptcy Affect Student Loans

Monitor Your Dti And Your Credit For Better Access To Credit

Even if you don’t anticipate needing to apply for credit anytime soon, it’s a good idea to keep an eye on your DTI and your credit score to make sure you’re ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian’s free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You’ll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

Don’t Miss: Pallets Of Merchandise For Sale

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

How To Lower Your Debt

Don’t Miss: What’s The Minimum Debt For Bankruptcy

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Ways To Lower Your Debt

Whether youre trying to bring your debt-to-income ratio down so that you can be accepted for a mortgage, or if youre simply trying to reduce your debt burden, youll need to find ways to improve your debt-to-income ratio somehow. This often involves some strategic long-term planning, but its certainly possible.

Below are some common ways to do this but remember, if you are struggling with debt youre not alone. You might find it interesting to read some of our research on the UKs attitudes to talking about debt.

Read Also: How Does Bankruptcy Work In Tn

What Your Debt To Income Ratio Means

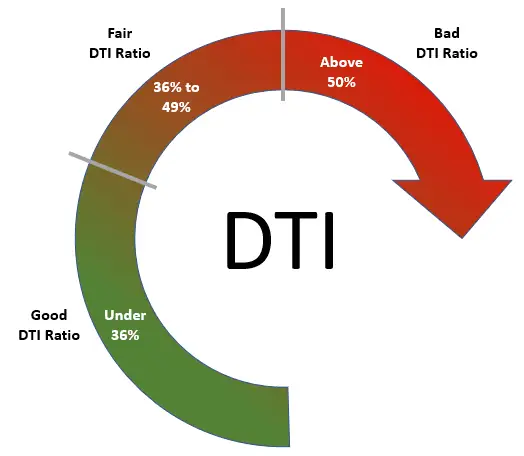

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isn’t a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Don’t hesitate to seek professional help.

A High Dti May Make It Difficult To Juggle Bills

Spending a high percentage of your monthly income on debt payments can make it difficult to make ends meet. A debt-to-income ratio of 35% or less usually means you have manageable monthly debt payments. Debt can be harder to manage if your DTI ratio falls between 36% and 49%.

Juggling bills can become a major challenge if debt repayments eat up more than 50% of your gross monthly income. For example, if 65% of your paycheck is going toward student debt, credit card bills and a personal loan, there might not be much left in your budget to put into savings or weather an emergency, like an unexpected medical bill or major car repair.

One financial hiccup could put you behind on your minimum payments, causing you to rack up late fees and potentially put you deeper in debt. Those issues may ultimately impact your credit score and worsen your financial situation.

Recommended Reading: How Many Times Can You File Bankruptcy In Tn

Why Does Your Debt To Income Ratio Matter

Your debt to income ratio shows how much debt you have for every dollar you earn. If your ratio is high, it means you owe a lot compared to your income. It could be very difficult for you to get out of debt, save money or even make your minimum monthly payments. A high debt to income ratio could also prevent you from getting approved for other loans or a mortgage.

If your ratio is low, it suggests that you are in good financial shape. Lenders like to see a low debt-to-income ratio as it could mean that you are at lower risk of defaulting on a loan or credit card payments.

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Also Check: Can You Keep Your House In Bankruptcy Canada

How To Lower The Back

There are two ways to lower an individuals back-end ratio:

For example, Betty earns $5,000 and owes $1,500 per month. It is equivalent to a 30% back-end ratio. However, if she owes $1,200 per month while continuing to earn $5,000, she would yield a 24% back-end ratio. From a different aspect, if Betty earns $6,000 and owes $1,500 per month, she will show a ratio of 25%.

As the denominator stays constant while the numerator decreases, the overall ratio will decrease. The same result will occur if the denominator increases while the numerator stays constant. If the numerator decreases while the denominator increases, the back-end ratio will fall significantly relative to the previous two scenarios.

Dont Miss: How Many Times Has Donald Trump Declared Bankruptcy

Improving Your Dti Ratio

If a high debt-to-income ratio prevents you from getting approved, you can take the following steps to improve your numbers:

- Pay off debt: This logical step can reduce your debt-to-income ratio because youll have smaller or fewer monthly payments included in your ratio.

- Increase your income: Getting a raise or taking on additional work improves the income side of the equation and reduces your DTI ratio.

- Add a co-signer: Adding a co-signer can help you get approved, but be aware that your co-signer takes a risk by adding their name to your loan.

- Delay borrowing: If you know youre going to apply for an important loan, such as a home loan, avoid taking on other debts. You can apply for additional loans after the most important purchases are funded.

- Make a bigger down payment: A large down payment helps keep your monthly payments low.

In addition to improving your chances of getting a loan, a low debt-to-income ratio makes it easier to save for financial goals and absorb lifes surprises.

Read Also: Can You File Bankruptcy On Hospital Bills

Dti Is A Major Factor In How You Borrow Money

DTI is not the only factor that lenders use to evaluate your loan application. They will also look at your credit score, your credit report, your employment situation, and your income, among other factors.

Your DTI still has a significant impact on your ability to borrow. Lenders will be reluctant to lend to borrowers with a high DTI. They may charge higher interest rates and they may not lend at all.

You can also look at your DTI as a way of determining whether or not you want to apply for a new loan. A high DTI is a sign that you may not be able to take on new credit without the risk of default.

Knowing your DTI and keeping track of how it changes over time will help you determine whether youre ready for a new loan and what loans youd qualify for. Its an important tool for monitoring and evaluating your finances.

Read Also: Paying Off Credit Card Debt

How Dti Impacts Your Credit Score

Not only does your DTI impact your ability to secure a loan, it also indirectly affects your credit. That means even if you arent trying to borrow money right now, a DTI thats too high could knock points off your credit score and make it tougher to secure an apartment or open a utility account.

The main reason DTI and credit are related is because the total amount of debt you owe affects approximately 30% of your FICO score. The lower the amount of debt you owe in relation to your available credit, the better for your score. Conversely, the more debt you have to your name, the worse its impact on your score. So if you have a high DTI, it follows that you are probably using a significant portion of your available credit.

DTI also can impact your credit if you owe so much that you arent able to keep up with payments. As the most heavily weighted factor in calculating your credit score, payment history makes up 35%. Just one missed payment can knock quite a few points off your score, so its important to keep your debt levels manageable.

Recommended Reading: Debt Relief Credit Card

What Is Actually A Debt

A minimal financial obligation-to-money proportion is best, whenever looking to yet another loan, as it mode you can afford to repay way more obligations than some body with a high personal debt-to-income proportion.

To possess figuratively speaking, its always best to have an educatonal loan debt-to-income proportion which is not as much as 10%, with a stretch restriction of 15% if you do not have many other types of loans. Their full student loan debt is less than the annual money.

When refinancing figuratively speaking, most lenders will not accept an exclusive student loan when your debt-to-money ratio for all debt money is more than fifty%.

Just remember that , refinancing government loans function a loss in benefits income-driven payment plans, people government mortgage forgiveness potential, good-sized deferment choice, and.

Whenever borrowing a home loan, very lenders think one or two obligations-to-money ratios, you to to possess financial personal debt costs and one for all repeated obligations payments, conveyed as the a percentage off gross month-to-month income. The continual personal debt money become mastercard repayments, automotive loans and you may college loans, in addition to mortgage repayments.

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Read Also: How To Claim Bankruptcy In Nh