Should I Consider Filing For Bankruptcy

Bankruptcy is a good financial option for those who are struggling to keep up with their debt payments each month. Whether you have a large amount of debt, have recently become unemployed, or are just struggling to keep up each month, filing for bankruptcy can be a welcome relief for many.

There are two types of bankruptcy:

- Chapter 7: Chapter 7 bankruptcy requests that your debts be entirely erased. This includes credit cards, medical bills, and any other unsecured debts.

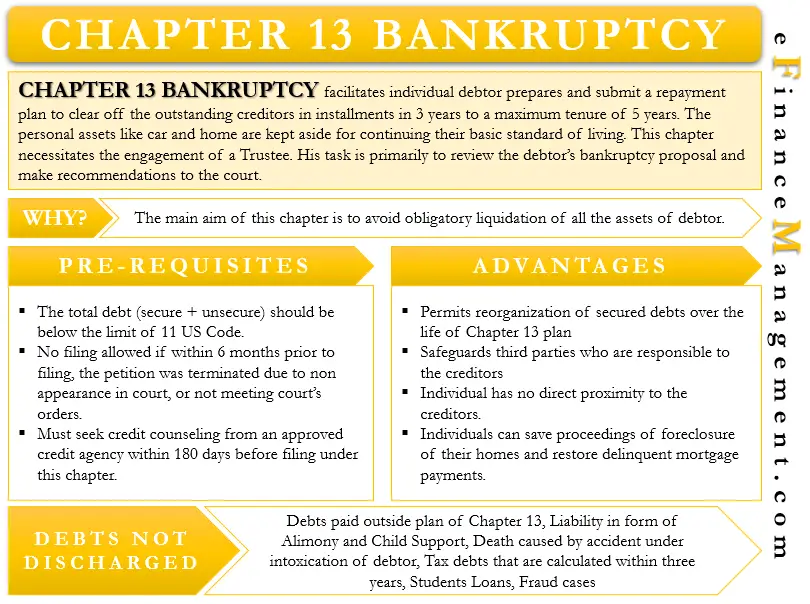

- Chapter 13: Chapter 13 bankruptcy consolidates your debt into one, affordable monthly payment. You will make payments for three to five years and if you keep up with regular payments, the rest is erased.

It is important to evaluate the eligibility requirements of each one. You can also discuss your financial situation with a bankruptcy attorney today to explore your options.

How Soon Will Everyone Know

To find bankruptcy information, one must go through the steps to find it. In a notice to creditors, the court will contact anyone you owe money to. You, your bankruptcy attorney, and creditors will attend a Meeting of the Creditors, which is open to the public. Nevertheless, no invitations are posted prior to the meeting.

Other ways to obtain bankruptcy information include:

- The PACER system: Court documents are uploaded and stored in the PACER system, which is accessible to the public. To access the system, you need to create an account and a password then you can access documents at a small fee per page. While you can register online and search the Pacer Case Locator, few people other than bankruptcy attorneys take the effort to obtain personal details.

Even with information publicly available, its unlikely someone would stumble upon your case by accident. A person would have to be so curious as to go through the effort of getting a password and learning the systems search features. Theyd probably already know you filed at this point.

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy In Florida

Aside from the names, below are some of the differences between Chapter 7 and Chapter 13 in Florida:

- Chapter 7 allows debtors to liquidate their properties and assets to settle the debts, while Chapter 13 allows debtors to retain control of their properties and assets and develop a repayment plan.

- Chapter 7 can be filed by both individuals and businesses, while Chapter 13 can only be filed by individuals with regular income.

- Debtors who file Chapter 7 bankruptcy will have their unsecured debts discharged, while debtors who file Chapter 13 may have to make full or partial repayment of their unsecured debts.

Also Check: How Many Times Has Trump Filed Bankrupsy

How To File A Chapter 11 Bankruptcy In Utah

In Utah, debtors can commence a chapter 11 bankruptcy by filing a bankruptcy petition at the bankruptcy court in their jurisdiction. However, in the case of an involuntary petition, two or more creditors can force a debtor to file for bankruptcy. Persons or entities filing a voluntary petition must take a credit counseling course in-person or via phone call at an accredited agency. Debtors must present the certificate alongside other necessary documents to the clerk of the bankruptcy court in Utah. The following documents are required when filing a chapter 11 bankruptcy:

Debtors filing without the aid of an attorney can check the minimum checklist for necessary documents via an online list. In addition, debtors may also for filing a chapter 11 bankruptcy on the Utah bankruptcy courts online platform.

Can I Look Up Online If Someone Filed For Bankruptcy

All of the documents filed in a bankruptcy proceeding are available as public record. You can use the Public Access to Court Electronic Records service to look up bankruptcy records online. All that is needed is an account to search and locate bankruptcy court cases. PACER charges a fee for each page that is viewed using the system.

If you know the case number you can do a bankruptcy case number search to find the information you need. Using the case number, complete name, or social security number, you can call a toll free number to reach an automated system and access the following information:

- Case number

- Case disposition.

Also Check: What Does Dave Ramsey Say About Bankruptcy

What Is Chapter 13 Bankruptcy In Utah

A chapter 13 bankruptcy is a legal proceeding that enables debtors to repay debts from future earnings. In a chapter 13 bankruptcy, the debtor assumes control of all assets and creates a repayment plan to pay off creditors. To repay debts, debtors must make a repayment plan by considering their disposable income, expected future earnings, and the value of non-exempt properties and assets. Thus, debtors must pay the proposed amount out of their monthly income once the courts approve the repayment plan.

Bankruptcy In South Carolina

Bankruptcy in South Carolina refers to a legal proceeding that enables debts to be restructured or eliminated to get relief from all debts. For instance, debtors filing a bankruptcy in South Carolina can discharge most of their debts via the liquidation of assets or the creation of a repayment plan from future earnings. Under the Bankruptcy Code, all individuals or entities can file for bankruptcy. Also, all bankruptcy cases are under the jurisdiction of the federal court. Therefore, debtors must file for bankruptcy at the bankruptcy court where their business or residence is situated. As of 2021, South Carolina has only one district bankruptcy court.

The Bankruptcy Code enables debtors to file for different types of bankruptcy, depending on the debt requirement, income level, and type of the desired result. For instance, filing a chapter 7 bankruptcy leads to the liquidation of assets. In contrast, filing a chapter 11 or 13 bankruptcy allows debtors to restructure debts and take the best repayment plan.

You May Like: What Is Epiq Bankruptcy Solutions Llc

What Are Rhode Island Bankruptcy Records

Bankruptcy records consist of documents generated in the course of bankruptcy cases. State courts cannot hear bankruptcy cases because bankruptcy is a federal process. Federal courts have exclusive jurisdiction over bankruptcy cases. Each district in the United States has a bankruptcy court. Rhode Island has only one federal bankruptcy court, called the United States Bankruptcy Court for the District of Rhode Island. The court has just one location in Providence.

The US Bankruptcy Court Clerk maintains bankruptcy court records. Interested parties may submit records requests to the Clerk in person, through email, or over the phone. The US Bankruptcy Court in Rhode Island also makes bankruptcy records available online and through automated voice systems. Some third-party websites host public bankruptcy information. Interested parties may obtain available information from the websites.

Who Will Know If Ive Filed For Bankruptcy

As previously mentioned, bankruptcy professionals will usually be the only ones actively looking for bankruptcy information. However, there are a few instances where others may discover that you have filed. Obviously, creditors and co-debtors will receive direct notice when you have filed.

In addition to creditors, anyone running a credit check will also be able to see if you have filed for bankruptcy. This means if you are applying for a job, trying to rent an apartment, or applying for credit, the people looking at your credit report will be able to see that you have filed for bankruptcy.

An ex-spouse that receives child support will also be notified about your bankruptcy. During the time of notification, they may also be given instructions for how to proceed should you fail to continue to pay child support, as that is not a dischargeable debt.

Also Check: Fizzics Net Worth 2021

Why Should I Find Out If Someone Filed Bankruptcy

Discharging debts in bankruptcy means that a debtor is no longer required to pay those debts. Debs are either discharged and assets sold to pay the creditors, or the court creates a repayment plan for the debtor to repay debts in a way that is more manageable based on their current income and finances.

The court enters an order that prohibits creditors to attempt to collect the discharged debts via legal action, telephone calls, letters, or other forms of contact.

There are a variety of reasons why someone might file for bankruptcy. Some of the more common reasons include:

- Unemployment

- Overextended personal lines of consumer credit

Filing for bankruptcy is generally not a decision people take lightly, but the fact that someone has taken that route to get out of debt might be of interest to other individuals who have an interest in their financial history and current financial health.

Bankruptcy cases are exclusively the jurisdiction of federal bankruptcy courts. Bankruptcy records are public information and can be helpful for making financial decisions. There are several reasons why you might want to find out if someone filed for bankruptcy. Some of the more common reasons are:

- Researching the financial history of a potential business partner

- You need to determine whether it is a smart decision to loan money to someone or

- You are interested in the financial history of a business.

Public Records Arent Necessarily Gone Forever

Although the credit reporting agencies have agreed to remove certain public records from credit reports for now, that doesnt mean tax liens and judgments wont be added back to credit reports in the future. There are two reasons: Its not illegal to put them on a credit report, and the credit bureaus only agreed to remove them for a time.

Don’t Miss: How To Declare Bankruptcy In Tx

What Are Alabama Bankruptcy Records

Bankruptcy records contain information regarding bankruptcy cases filed in the state of Alabama. Bankruptcy courts in Alabama are special courts that have jurisdiction over all bankruptcy filings in the state. Alabama bankruptcy courts operate through federal legal guidelines to provide financial relief to overburdened debtors, either by discharging accumulated debt or by providing a means of managing a poor financial situation. There are three bankruptcy courts in Alabama

Debtors may file the bankruptcy petition in the court with jurisdiction on the area where the debtor lives, where the business is located, or where the debtor has the principal asset. By filing the petition, debtors declare themselves as unable to settle outstanding debts and have to follow the procedure to get a mostly clean slate. Bankruptcy courts generate bankruptcy records as a means of conserving information during the execution of their duties. The file’s content includes details of the bankruptcy case and the entities involved .

In the state of Alabama, bankruptcy is a debt relief option provided by federal laws and rules and available to insolvent individuals, businesses, and municipalities. There are many bankruptcy options available to interested parties under the U.S. Bankruptcy Code. However, persons must meet the eligibility criteria and satisfy all conditions before initiating the process.

How Do I Find Out If My Bankruptcy Case Is Closed In Utah

To find out if a case is closed in Utah, an individual can use the simple case look up to search the court’s database. This search feature enables parties to follow a bankruptcy case as the bankruptcy court updates this database daily. Other information provided through the search site includes the schedule of the 341 meetings, information on the trustee and lawyer connected to the case, the date when the case will be discharged or dismissed, and other details about the bankruptcy case. Individuals can access this information using any of the following:

- The case number

- The debtor’s social security number

- The debtor’s name, or for a corporation, a business name

Read Also: Letter Of Explanation For Bankruptcy

What Is Chapter 7 Bankruptcy

Bankruptcy under Chapter 7 settles debt by liquidating the applicant’s assets and properties. After the sale, the court keeps a percentage of the proceeds for the assigned trustee and pays creditors with the rest. Chapter 7 bankruptcy is unavailable where the applicant has made a previous filing in the last eight years.

Also known as liquidation bankruptcy, Chapter 7 bankruptcy may be completed in a few months. Since there is no repayment plan, the court may approve the application, sell all non-exempt assets, and resolve the case within six months. However, like other types of bankruptcy, debtors must continue to pay alimony, child support, student loans, and criminal fines. A Chapter 7 bankruptcy filing stays on the applicant’s report for ten years after the filing date.

In most cases, Chapter 7 bankruptcy applicants can discharge the following debts:

- Mortgage loans

- Student loans – proof of undue hardship is required

Approval for Chapter 7 bankruptcy requires a means test to determine that the application is not an abuse of the bankruptcy system. The court must appraise the applicant’s financials, including income, expenditure, secured debt, and unsecured debt.

Regardless of the preferred type, bankruptcy law prevents debtors from applying within 180 days of a previous discharge if any of the following applies:

Whats Included In My Bankruptcy Record And Who Can See It

Many people are concerned with the negative stigma that surrounds bankruptcy. They want to know who will find out if they decide to file. While bankruptcy is publicly recorded, typically only creditors or bankruptcy attorneys will actually view this information. You probably shouldnt worry too much about your friends, neighbors, or others in your social circles finding out.

Recommended Reading: How Many Times Has Donald Filed For Bankruptcy

How To Reestablish Your Credit

After declaring bankruptcy, you’ll want to look at ways you can earn a score in a range that will qualify you for better financing options and that begins with rebuilding your credit.

You may not be able to immediately qualify for the best credit cards, but there are others that apply to people with less-than-stellar credit.

Secured credit cards require a deposit that acts as your credit limit. If you make your credit card payments on time and in full on this new secured card, you then have a greater chance at qualifying for an unsecured credit card in the near future.

The Capital One® Secured has no annual fee and minimum security deposits of $49, $99 or $200, based on your creditworthiness. Those who qualify for the low $49 or $99 deposits will receive a $200 credit limit. Cardholders can obtain a higher credit limit if they make their first five monthly payments on time.

The Citi® Secured Mastercard® is another option with no annual fee. There is a $200 security deposit required, which would mirror your credit limit. Cardholders can also take advantage of Citi’s special entertainment access, which provides early access to presales and premium seating for concerts and games.

Once you add this new credit car, make sure you pay your monthly bills on time and in full to quickly work your way toward better credit.

Editorial Note:

How To Get Florida Bankruptcy Records

Individuals can access Florida bankruptcy records online, electronically, or through the clerks office. However, once a couple of years have passed, the records are sent to the Federal Records Center in Ellenwood, Georgia. When this happens, the archived records can only be retrieved from the National Archives and Records Administration and not directly from the court.

Online access to bankruptcy files is given through PACER for a small fee. Available 24/7, the PACER system allows members of the public to obtain case and docket information from the Florida bankruptcy courts. An individual must have an account to retrieve electronic records from PACER. For further information on using the service, the PACER Service Center receives inquiries on 676-6856 Note that records provided through PACER are within particular years. Records preceding December 1, 2003, that have been closed for over a year are usually not accessible to everyone except the case parties. Although these cases have restricted access, members of the public can still obtain docket information and sheets via PACER or from the public access terminals at the clerks office.

Additionally, the U.S. Bankruptcy Court for the Middle District of Florida also provides information on complex bankruptcy cases on the Complex Case Registry.

You May Like: How Many Bankruptcies Has Donald Trump Filed

Where Is Bankruptcy Information Published

In addition to the PACER system, bankruptcy information will also show up on your credit report. Credit reports are accessible by current and potential employers. In most cases, current employers will not run an updated credit report of their current employees. Unfortunately, you cannot prevent the credit reporting organizations to report this information.

Some people interested in filing for bankruptcy may worry that the local newspaper will publish their information. While this is legal and always a possibility, it is a practice that is not often used anymore. Most courts process thousands of bankruptcies each month, meaning it would be unrealistic to publish all of them.

If you have concerns, you could always request information from your local city on how they handle this information. If you choose to file your bankruptcy with a bankruptcy lawyer, and there are many reasons to consider doing so, then they can guide you on the common practices in your area.

Who Will Find Out If I File Bankruptcy In Georgia

Who is going to know if I file bankruptcy? I get this question a lot. This past Friday, I was asked this question by a client in my Dalton, Georgia office.

When you meet with me, I promise to give you the cold hard truth. Unfortunately, the cold hard truth is that filing bankruptcy is a matter of public record. In order to access the PACER bankruptcy records, you must have a login and a password. Usually, only attorneys have access to PACER.

I was shocked when I first moved to Rome, Georgia and found out that the Rome News Tribune publishes weekly filings of Northwest Georgia bankruptcies in the section of the newspaper entitled the Roman Record. They are the only newspaper that I know of who chooses to take this action. There is no law that requires the Rome News Tribune to publish names and case numbers of bankruptcy debtors. Im not sure why they choose to inflict more suffering on people who are already suffering but they do. I wish there was a way for me to make them stop but I cant.

The Rome News Tribune also publishes the names of the parties in creditor lawsuits. As a result, if you ignore your creditors and they end up filing a lawsuit against you, your name will still be published in the Roman Record. Why not consider bankruptcy and address the debt issues? The problem wont go away by itself.

Don’t Miss: Ezbankruptcyforms.com Reviews