Will The Us Inflate Away Its Public Debt

Faced with daunting levels of public debt, it may be tempting to inflate away the burden. Some recent research has endorsed such a policy, but this column argues that it is infeasible. The rule of thumb that suggests an inflation rate four percentage points higher would reduce debt by 20% ignores creditor composition and maturity details, even if a 6% inflation rate were achievable. The hard truth is that there is no easy way out of debt.

Should the US Federal Reserve raise the inflation target from its current level of 2%? And will it? One benefit would be to make hitting the zero lower bound less likely, which would lead to less severe recessions, as Olivier Blanchard, Giovanni DellAriccia, and Paolo Mauro , Daniel Leigh , and Laurence Ball have argued on this website. Other benefits of higher inflation that Kenneth Rogoff has been emphasising for a while might include accelerating the fall in real wages during the recession, and deflating away debt overhang .1

However, in our recent work we show that the probability that US inflation lowers the real value of the debt by even as little as 4.2% of GDP is less than 1% . Why is this estimate so small? We show that there are two reasons: first, the private sector holds shorter maturity debt second, high levels of inflation in the next few years are extremely unlikely.

All combined, the effect of 0.1% higher inflation forever is only 0.18%. But to get a better estimate, one needs to go beyond rules of thumb.

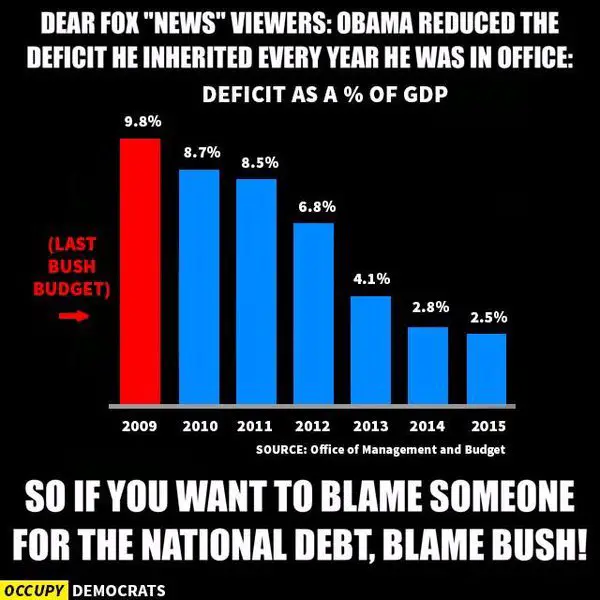

What Is The National Debt

The national debt is the debt that the federal government holds – this includes public debt, federal trust funds, and various government accounts. In simpler terms, the national debt includes both what the government owes others and owes itself. This is the total amount of deficit that the government has accumulated over the years.

The national debt today stands at more than $30.2 trillion. Here are some facts to give you an idea of how big this number really is:

- With $23.8 trillion held by the public, the government could give $71,000 per U.S. citizen.

- From 2000 to 2019, the federal debt increased 297%.

- $23.8 trillion is about the size of the economies of China, Japan, and Germany combined – the three largest economies in the world after the united States.

- $23.8 trillion is enough to cover a four year college degree for every American high school graduate for the next 57 years.

Great Depression And Stock Market Crash

People started investing heavily in the stock market in 1920 unaware that Black Tuesday would dawn with an $8 billion loss in market value when the stock market crashed on October 29, 1929. The United States relied on the gold standard and raised inflation, rather than lowering rates to ease the burden of inflation.

During the following era, income inequality between classes grew. More than 25 percent of the workforce was unemployed, people made purchases on credit and were forced into foreclosures and repossessions.

President Franklin D. Roosevelt developed programs for unemployment pay and social security pensions, along with providing assistance to labor unions. Although Roosevelt addressed many problems in the U.S. economy, the funding for his programs grew the national debt to $33 billion.

Read Also: How Often Can You Apply For Bankruptcy

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

What Can I Do If Im Way Behind On Paying My Credit Card Debt

Talk with your credit card company, even if youve been turned down before for a lower interest rate or other help with your debt. Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free. Find their phone number on your card or statement. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment plan that lowers your payments to a level you can manage.

If you don’t pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt. In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss.

Read Also: How Long After Bankruptcy To Buy A House

How Is The Covid

In response to the pandemic, the federal government has spent trillions of dollars to boost the economy, including on stimulus checks for citizens and aid for businesses and state and local governments. According to the Congressional Budget Office , these measures swelled the federal deficit to $3.1 trillion in 2020, about 15 percent of GDP and the highest level since World War II. Even before the pandemic, the CBO projected that annual deficits would breach the $1 trillion mark in 2020 and remain above that level indefinitely.

More on:

Debt held by the publicthe measure of how much the government owes to outside investorswas $16.9 trillion in 2019. That was more than double the amount in 2007, an increase to almost 80 percent of GDP from 35 percent. Before accounting for spending to combat COVID-19, publicly held U.S. debt was set to nearly double to more than $29 trillion over the next decade. Now, it is about $22 trillion, and its projected to be double the size of the economy by 2051.

Could The Us Mint A Trillion

Heres a wonky idea resurfacing in the debt ceiling debate: The US Treasury will only default if it doesnt have money to pay its debt, so why not mint a trillion-dollar coin made of platinum, pay the entire debt and call it a day?

The idea of the trillion-dollar coin emerged in debt ceiling battles during Barack Obamas presidency, and while talk of the idea went silent for a number of years, it returned during this years debt ceiling crisis. The idea stems from the Coinage Act, which prescribes limits on how many gold, silver and copper coins the US Treasury can circulate at one time. But according to subsection of the act, there isnt a limit on how many platinum coins it can circulate, nor does the act prescribe limits on the value those coins can be minted at.

If the US government minted such a coin, it could wipe out its debt swiftly, nullifying the debt ceiling issue in the process.

But this is a completely theoretical idea, and not something worked out by experts. Yellen said on CNBC that she opposes the idea of the trillion-dollar coin, calling it a gimmick and reasserting that its necessary for Congress to show that the world can count on America paying its debt.

You May Like: Missouri Statute Of Limitations Debt

Don’t Miss: How Long Can A Bankruptcy Remain On A Credit Report

How A Us Debt Default Could Impact The Economy

A U.S. debt default is much more than the federal government just needing to finally pay its debt. It would greatly impact the economy and people in the U.S.

A default would increase interest rates, which could then increase prices and contribute to inflation.

The stock market would also suffer, as U.S. investments would not be seen as safe as they once were, especially if the U.S. credit rating was downgraded.

Several government programs like Social Security and Medicare would all be impacted, too. Military wages and even small business owners with federal loans would be at risk in the event of a default. Federal employees wouldnt be paid and parents expecting a Child Tax Credit payment would get nothing.

These financial impacts would have a major effect on consumer spending and businesses could shut down. Eventually, the U.S. could enter another recession as a result.

Who Does The Us Owe Money To

The public holds over $22 trillion of the national debt. 3 Foreign governments hold a large portion of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and holders of savings bonds.

You May Like: Why Is My Bankruptcy Still On My Credit

How Can The Us Avoid Defaulting On Its Debt In The Future

Treasury Secretary Yellen said in an October 2021 statement that a U.S. debt default is unnecessary and must be avoided.

We are staring into a catastrophe in which we surrender this hard-earned reputation, and force the American people, and American industry, to accept all the pain, turmoil, and hardship that comes with default, she wrote.

The simplest way to avoid an immediate default on its debt is for Congress to raise or suspend the debt ceiling.

One way to potentially avoid the U.S. defaulting on its debt is to increase revenue through higher taxes and spending cuts. This could help the U.S. government make more money to pay down its debt. The U.S. did this in the 1990s, and between a series of tax increases, defense spending cuts, and an economic boom, the U.S. saw four years of a budget surplus that it hadn’t seen in 40 years. That helped reduce the national debt and prevent default.

Settle For Less Than You Owe

Debt settlement is when the institution or entity you owe money to agrees to consider the debt paid for less than you originally owed. Its a popular solution for credit card debt and debt thats in collection. Debt settlement will affect your credit differently than consolidation and is more damaging. Youll need to weigh if thats worth paying less out of pocket.

Settling your debt requires negotiating a settlement agreement with your creditor, which can be accomplished on your own or with a debt settlement company. If you have tax debt, youll need to use a specialized solution calledOffer in Compromise which allows you to clear your debts with the IRS for a percentage of what you owe.

Pro tip: Youll want to consolidate before opting for settlement. Since settlements can damage your credit score, you could end up becoming ineligible for many consolidation solutions. Consolidation is usually the first solution you should opt for since it simplifies your payment schedule and it wont damage your credit.

You May Like: What Is Debt Consolidation And Why Is It Helpful

Recommended Reading: How Much Debt Does It Take To File Bankruptcies

What Would Happen If The Us Paid Off Its Debt

According to a report published by Moody’s Analytics, the US GDP would decline, approximately 6 million jobs would be lost and the unemployment rate would increase dramatically. And, just as significantly, the country’s track record, at least as far as paying its debts is concerned, would be irrevocably stained.

The National Debt Is Now More Than $31 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $31,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $31 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

Also Check: Can I Declare Bankruptcy Without My Spouse

Fiscal Responsibility Is About: Preparedness

We cant always predict, so we must prepare.

None of us can say what the next major test of our nation will be whether its an economic downturn, a national security threat, a climate disaster, another pandemic, or some other crisis. But as a wealthy nation, and with peoples lives and livelihoods in the balance, we must do more to prepare for the unexpected.

Preparedness includes determining national priorities and finding ways to pay for them. It means making smart investments that benefit our economy over time. It means investing in our national security so that we can address new global threats, like cyber attacks. It means having stockpiles of essential supplies, so we are prepared for the unexpected. It means strengthening our safety net to help support and sustain the most vulnerable in society.

The truth is that we cant adequately prepare for the future without a solid fiscal foundation. A sustainable budget will ensure that we have sufficient resources, in good times and bad, to meet the needs of our citizens and cope with whatever future challenges we may face.

How Would China Suffer From The Us Government Defaulting On Its Debt

Like many other countries and individual investors around the world, China owns U.S. Treasury debt. In early 2022, China held more than $1 trillion in Treasury securities. If the U.S. were to default on its debt, China might not receive interest payments on those securities, and it could lose its investment altogether.

Don’t Miss: Does Filing For Bankruptcy Clear Medical Bills

What Are The Main Types Of Personal Bankruptcy

The two main types of personal bankruptcy are Chapter 13 and Chapter 7. You must file for them in federal bankruptcy court. Filing fees are several hundred dollars, and attorney fees are extra. For more information, visit the United States Courts.

Both types of bankruptcy may discharge and get rid of unsecured debts like credit card or medical debt, and stop foreclosures, repossessions, garnishments, and utility shut-offs, as well as debt collection activities. They also give exemptions that let you keep certain assets, though how much is exempt depends on your state.

What If Im Having Trouble Paying My Car Debt

Most car financing agreements say a lender can repossess your car any time youre in default and not making your car payments. They dont have to give you any notice. If your car is repossessed, you may have to pay the balance due on the loan, plus towing and storage costs, to get it back. If you cant, the lender might sell the car.

If you know youre going to default, you might be better off selling the car yourself and paying off the debt. Youll avoid the costs of repossession and a negative entry on your credit report.

You May Like: How To Get Rid Of Student Loans In Bankruptcy

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Budget Surpluses: Up to 20 states are using their excess funds to help taxpayers deal with rising costs. But some economists worry that the payments could fuel inflation.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

In recent weeks, administration officials have walked a thin line on deficits. They have championed deficit-cutting moves like the climate, health care and tax bill that Mr. Biden signed into law in August as necessary complements to the Feds efforts to bring down inflation by raising interest rates. They have said Mr. Biden would be happy to sign further deficit cuts into law, in the form of tax increases on high earners and large corporations.

Our budgets have been heavily fiscally responsible, and they build a very compelling architecture toward critical investments and fiscal responsibility, Jared Bernstein, a member of the White House Council of Economic Advisers, said in an interview. So it would be a mistake to overtorque in reaction to current events.

Revolutionary War Kicks Off Us Debt

Wars were always a major debt factor for our nation. Congress could not finance the Revolutionary war with large tax raises, as the memory of unjust taxation from the British stood fresh in the minds of the American public. Instead, the Continental Congress borrowed money from other nations.

The founders led negotiations with Benjamin Franklin securing loans of over $2 million from the French Government and President John Adams securing a loan from Dutch bankers. We also borrowed from domestic creditors. While the war was still going on, in 1781, Congress established the U.S. Department of Finance.

Two years later, as the war ended in 1783, the Department of Finance reported U.S. debt to the American Public for the first time. Congress took initiative to raise taxes then, as the total debt reached $43 million.

Don’t Miss: List Of Homes In Foreclosure

How Would Defaulting Affect The Us Economy

The impact would be acute and widespread. Millions of Americans wouldnât receive Social Security or Medicare benefits. The federal government would stop issuing paychecks for all US troops and federal employees, and only certain essential federal employees would be allowed to work. According to a report published by Moodyâs Analytics, the US GDP would decline, approximately 6 million jobs would be lost and the unemployment rate would increase dramatically. And, just as significantly, the countryâs track record, at least as far as paying its debts is concerned, would be irrevocably stained.

âInternationally, the United States will have for the first time undermined the full faith and credit of its own currency â a blow to our standing in the world and a boon for our adversaries such as China who are arguing to the world that the US is on the decline,â Adair said.