American Medical Debt In 2020

Medical debt can be difficult to track. However, it’s clear that it’s a growing problem.

According to Urban Institute, 16% of Americans — over 52 million people — had medical debt in collections in 2017. That number is higher, 19%, in communities of color.

Some states have significantly higher numbers, too. For example, 31% of West Virginians have medical debt in collections.

The median debt also varies quite a bit. In the United States overall, the median medical debt in collections is $694. In Alaska, Wyoming, and West Virginia, though, that number is over $1,000 .

While statistics are scarce, it seems likely that rising healthcare costs — especially during a global pandemic — will have pushed these numbers higher.

| State |

|---|

| 2.08 |

As you can see, residential and commercial real estate loans have had more charge-offs and delinquencies in Q2 2020 than they did in Q1, though the rates are notably lower than they were in previous years.

The delinquency and charge-off rate for consumer loans was 1.98% in Q2, while the overall rate, which includes real estate and commercial loans, was 1.54%. The consumer delinquency and charge-off rate is notably lower than the 2.47% from Q1, which may be a reflection of relief measures put in place by companies in response to coronavirus-related income loss.

Again, these figures can take time to adjust to new economic conditions, so we may see changes in the coming months.

The State Of Canadian Household Debt

Dealing with household debt can be a major challenge for many Canadians. When saddled with excessive debt, it becomes extraordinarily difficult to save up for anything, like a getaway, car, new appliance, new gadget, or any other goal that requires a significant amount of money.

Thankfully, there are debt help options available that can help you get out of debt for good. Its also important to understand the current state of Canadian household debt and what drives it so we can be better prepared to avoid debt in the future.

How Much Is The Average Household Debt In Canada

The average consumer debt in Canada is hovering at about $20,739 therefore, a two-person household could have close to $41,500 in debt. Of course, the debt of any given household varies depending on different factors.

For example, if you rent rather than own your home, you can avoid mortgage debt. Or, if you’ve recently fallen on tough times due to a job loss or other issue, you may find yourself adding to your credit card debt just to cover basic expenses.

So, if your household debt is starting to worry you or cause you stress, its important to remember that there are solutions. You can look into free credit counselling services, debt consolidation services, or other debt-relief options to help you get out of debt!

Recommended Reading: On Line Auction Houses

What Is The Most Debt Someone Has Been In

Former financial arbitrage trader Jerome Kerviel is the most indebted man on the planet, owing his former employer $6.3 billion. The amount Kerviel owes to French bank Societe Generale for fraudulent trades made in 2007 and 2008 would make Kerviel one of the 50 richest people in America if those debts were assets.

Negotiate With Your Credit Card Company

If youve already missed a payment or are about to, reach out to your credit card issuer. The company may be willing to work out a more manageable repayment plan for you. Some offer forbearance or hardship programs that could reduce your monthly payment or postpone a certain number of payments. You may even be able to settle your debt for a lower amount if the company determines that you arent able to pay back the full amount.

If you are able to work out an alternate repayment plan with your creditor, be sure to ask for the plan in writing.

You May Like: What Is Chapter 13 Bankruptcies

Average Credit Card Debtby Age Group

The figures also show that credit card debt tends to peak somewhere around middle age and then declines steadily throughout the later part of consumers’ lifetimes.

With an average credit card debt of $3,660, cardholders under age 35 carry the lowest amount of credit card debt compared to other generations. For members of that age bracket, the largest source of debt is student loans.

Average American Household Debt In : Facts And Figures

By: Dann Albright | Published Nov. 18, 2020

Image source: Getty Images

How much debt does the average American household have? How is that debt split between mortgages, auto loans, credit cards, and other types of loans? What about the coronavirus pandemic and its effects on Americans’ jobs and income?

The answers to questions like these can give us insight into the financial state of the average American household. We pulled together as much data as we could find on Americans’ average household debt in 2020 to give you a snapshot of how we handled our debt this year.

Keep reading for more detailed statistics on each type of debt, including comparisons of debt over time and breakdowns by race, age, and more.

You May Like: How To Remove A Dismissed Bankruptcy From Credit Report

Average Credit Card Debt In 2020

| Figure | |

|---|---|

| Delinquency rate of all credit card loans from commercial banks, Q2 2020 | 2.42% |

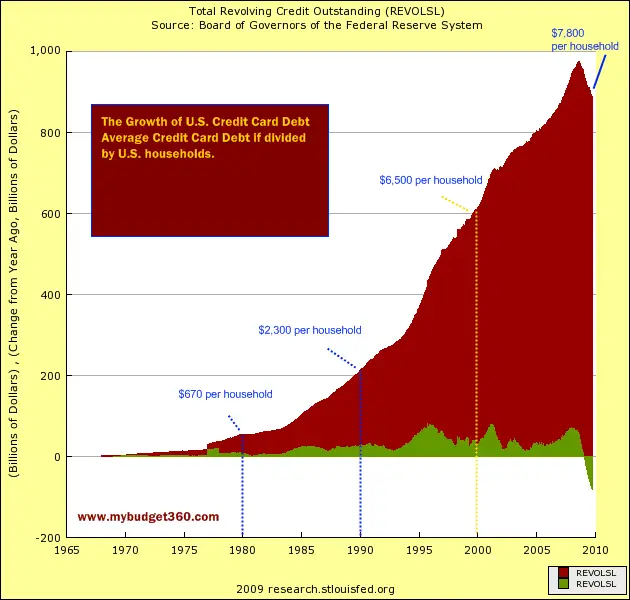

According to the latest Household Debt and Credit survey results from the New York Fed, Americans owe $807 billion in credit card debt as of Q3 2020. That’s down from $881 billion in Q3 2019 and $817 billion in the second quarter of 2020.

This could be because Americans are spending a bit more conservatively with their than they were before the pandemic.

“Consumers tightened their belts in 2020, leading them to carry less revolving debt and focus on paying their credit card bills on time every month,” says Melinda Opperman, President of , a nonprofit HUD-approved housing and nationwide consumer credit counseling organization headquartered in Riverside, California.

“But those encouraging numbers are ironically a sign of financial instability struggling families are cutting back wherever they can as we all brace for the fallout when foreclosure and eviction moratoriums end.”

So what does that mean for individual credit card holders?

According to Experian’s Oct. 20 report, Americans have an average of $5,897 in credit card debt spread over three cards. Americans also have 2.4 store credit cards, on average, with a total balance of $2,044.

Income Has Outpaced The Cost Of Living But By How Much

Over the past decade, the 10 years immediately following the Great Recession, the cost of living has increased 19% while median household income has soared 41%, according to government data. This suggests that some consumers came into 2020 with breathing room in their budgets, but the pandemics pervasive impact provides important context to understand these numbers.

The chart above shows a huge jump in household income by the end of 2019, but that increase is very likely overstated because of the challenges of collecting data during the pandemic. Data on average annual household income comes from the U.S. Census Bureau, which collected the 2019 numbers from surveys conducted in 2020. But surveys are being affected by a nonresponse bias more strongly associated with income than in the past, according to the Census Bureau. Simply put, changes to survey practices necessitated by the pandemic including the suspension of in-person interviews means that people who were struggling financially were more likely to be missed. As a result, 2019 income was overstated and poverty rates are understated.

The Census Bureau estimates that median household income in 2019 is actually 2.8% lower than reported, although the reported figure remains the official government number. Were using the reported number for year-over-year consistency.

You May Like: Debt Per Person In Us

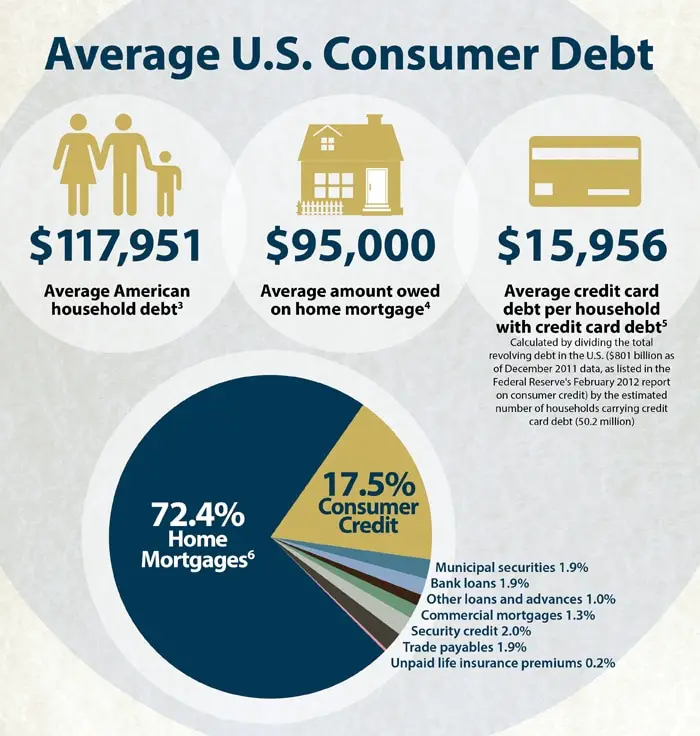

General Consumer Debt Statistics

- Total bankruptcy filings reached 1.4 million in 2009

- Total consumer debt per household now averages $16,046

- Total debt per household with credit cards still averages $54,000

Given the tough state of the economy Americans are now struggling to get their finances back on track. Particularly for families with credit card debt this can be a difficult journey. In many cases, you could take the next 20-30 years to pay back what you owe right now alone and thats if you dont buy anything else on credit!

Instead of struggling for the next few decades to overcome your debt, there are solutions that can help you get out of debt in as little as 36 months. Take a Free Debt Analysis now to find out where you stand or call to speak with a professional credit counselor who can help you find the right solution to your debt problem today.

Whats The Average Interest Rate On Peoples Credit Cards What About Those Who Carry A Balance What About New Credit Card Offers

For all credit cards, the average APR in the second quarter of 2022 was 15.13%.

For cards accruing interest, the average in the second quarter of 2022 was 16.65%.

For new credit card offers, the average today is 21.59% the highest rate weve seen since we began tracking rates monthly in 2019.

| Average APRs for current credit card accounts and new card offers | |

| Average APR for new credit card offers | 21.59% |

| Average APR for all accounts that accrue interest | 16.65% |

The Federal Reserves G.19 consumer credit report showed that the average APR for all current credit card accounts jumped in the second quarter of 2022, up from 14.56% in the first quarter. Meanwhile, APRs for cards accruing interest rose to 16.65%, up from 16.17% in the first quarter.

If youre planning to get a new credit card, your interest rate will likely be higher than those listed above. The latest LendingTree data on credit card APRs shows that the average APR with a new credit card offer is 21.59%, with the average card offering an APR range of 18.04% to 25.14%, with your rate varying based on your creditworthiness. Those rates have risen significantly in recent months, thanks to the Federal Reserves announcement of interest rate hikes in March, May, June and July. The Fed will likely do the same in September and perhaps more in 2022. When this happens, cardholders should expect to see their cards APRs rise in the next billing cycle or two as a result.

Recommended Reading: The United States Debt

Average Consumer Household Debt In 2020

| Debt type | |

|---|---|

| Total credit card debt | $807 billion |

The New York Fed’s quarterly Household Debt and Credit Survey shows that total consumer debt stands at $14.35 trillion as of the third quarter of 2020. That’s a record high as far as the HHDC goes.

According to the 2019 Survey of Consumer Finances, the average household debt among those who had any debt was $140,416, while the median was $65,000. That includes a wide range of debt, from mortgages to personal loans, credit cards, and more.

Total debt has increased since 2019 — we estimate the average household debt in 2020 to be around $145,000 and the median to be approximately $67,000 in 2020.

Average Mortgage Rate In : 278%

2020 was a record year for mortgage rates, with the average 30-year fixed rate at 2.78% on Nov. 5. That’s the lowest it’s been since the St. Louis Fed started compiling this data in 1971.

These low rates have also led to a rush on refinances, especially before the new 0.5% refinance fee kicks in on Dec. 1.

Also Check: Can File Bankruptcy On Student Loans

Get Out Of Debt With A Balance Transfer Credit Card

A balance transfer is a smart way to ease the burden of paying off your credit card debt. Balance transfers can add up to substantial savings if you’re carrying a balance on a high interest credit card, where a portion of your payment goes toward interest charges.

Balance transfer cards often have set limits on the amount of debt you can transfer, and you can’t complete a transfer between cards issued from the same bank. Also make sure you read the fine print before requesting a transfer and consider any balance transfer fees.

Average Credit Card Debtby Income

There is a strong correlation between average income and average credit card debt. The greater a persons income, the higher the credit card debt. Americans who earn less than $16,000 have an average debt of $3,830, while those with the highest credit card debt on average typically earn over $290,160 per year.

Also Check: How Long Before You Can Claim Bankruptcy Again

States With The Most And Least Average Credit Card Debt

The average amount of credit card debt that people have can vary based on location.

People living in Alaska had the most credit card debt in 2019, with an average of $8,026 per person. Residents of New Jersey had the second-highest amount of average credit card debt, at $7,084, followed by Connecticut at $7,082.

The state with the least amount of average credit card debt per person in 2019 was Iowa, at $4,744. Wisconsin had the next to last, with an average of $4,908, followed by Mississippi at $5,134.

What Should I Do If Im In Debt

The average American debt is at $92,727 and if you have a balance, the worst thing you can do is ignore it. Interest may accrue on your account, and missed payments could lead to late fees and damage to your credit.

If youre looking to get out of debt, heres where to start:

- Make a list of what you owe. List all of your debts with balances, due dates, interest rates, minimum monthly payments and contact information.

- Go over your budget. Write down how much you earn each month and how much you spend on bills, such as rent, utilities, groceries and minimum debt payments.

- Find room for debt payments. Subtract your bills from your income to see whats left over. Put this amount toward your debt each month. You can also put windfalls, such as tax refunds, toward your principal balances.

- Prioritize the debts. Financial experts usually recommend using one of two methods: the snowball method or the avalanche method. With the snowball method, you pay off your smallest balance first, then move one by one to the largest. With the avalanche method, you can focus on paying off the balance with the highest interest rate first to save more money and work down from there.

- Make a goal. Based on your debt balance and your extra payments, how long will it take until youre debt-free? For example, if you want to pay off $5,500 in credit card debt and you can pay $500 each month, then the balance should be gone in 12 months, assuming a 16 percent APR.

Also Check: When Will My Bankruptcy Be Discharged

Average Monthly Credit Card Payment

The average next credit card payment for Credit Karma members is $173. But the average payment is naturally higher for those with higher total credit card debt. For example, Gen X members average $7,923 in credit card debt and have an average next payment of $222. On the flip side, Gen Z members have an average of $2,589 in total card debt and an average next payment of only $78.

How Long Should It Take To Pay Off Credit Card Debt

The answer depends largely on your own personal circumstances. How much can you afford to pay off monthly?

Whats important for anyone to know, says Arbour, is their monthly capacity to make payments.

Being proactive and disciplined about meeting at least your minimum paymentsand more, whenever possibleis essential to settling your debt. Overestimating what you can afford to pay, however, can create an untenable financial situation that might require you to take on even more debt. Arbour recommends using a calculator like this interactive budgeting tool to help yourself find the sweet spot.

What dream or goal do you have for your future self or loved ones that you could be saving for now, rather than using your hard-earned dollars to repay that debt for months or years to come?

Read Also: If You File Bankruptcy Can You Keep Your Car

What Age Should You Be Debt Free

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Which States Residents Have The Most Credit Card Debt

LendingTree analysts reviewed anonymized January and February 2021 credit report data from more than 1 million LendingTree users to calculate these averages and create a list of states with the most debt.

Overall, the national average card debt among cardholders with unpaid balances was $6,569. That includes debt from both bank cards and retail credit cards.

The four states with the most debt were all on the East Coast, while the three lowest were found in the South. There was a major difference in balances between the states at the top and bottom of our rankings, with New Jersey cardholders owing $7,872 and Kentuckys owing $5,441. That means the average New Jersey balance is 45% higher than the average balance in Kentucky.

Also Check: How To Build Credit While In Chapter 13 Bankruptcy