Stay In Control Of Business

Chapter 11 bankruptcy allows business owners control of their company even after filing for business bankruptcy. So its a good way to keep a business afloat when the debts threaten to run your company to the ground. The Chapter 11 bankruptcy also facilitates business owners to reduce debt gradually over time. Chapter 11 can also aid in getting rid of high-stakes litigation by discharging the pending litigation claims that were previously being waged against your company.

Why Choose Bradford Law Offices For Your Chapter 7 Bankruptcy

Danny Bradford has been helping people facing overwhelming debt since 1996, and in that time has represented over 3,000 debtors. Over 70% of his clients have been married or individual debtors like you, so you can relax knowing you are in good, experienced hands. Attorney Bradford is a member of the Wake County Bar, bankruptcy section of the North Carolina Bar Association, and National Association of Consumer Bankruptcy Attorneys.

Over twenty five years spent working with both individuals and businesses has taught us at Bradford Law Offices that every case is unique. We will never try to apply a one-size-fits-all approach to your case. We will take the time to truly listen to you, understand your situation, and determine the best possible solution for you. When you work with Bradford Law Offices, you receive legal services that are informed, compassionate and focused on helping you reach the best possible result in your Chapter 7 proceeding.

What Debts Are Discharged In Bankruptcy

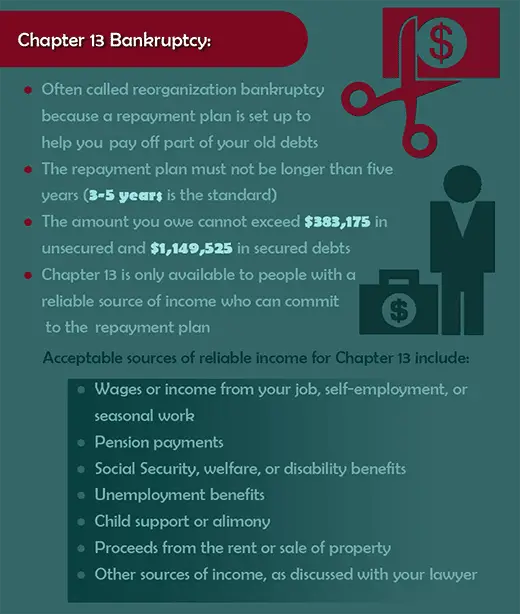

Under Chapter 7 bankruptcy, much of your unsecured debt can be erased. You may very well be able to discharge credit card debt, medical payments, personal loans, utility bills, business debts, some taxes, and more. Chapter 13 enables you to discharge more debt, as it can eliminate debt that stems from willful or malicious property damage. Some separation debts can be erased as well, though child support and alimony can never be discharged. Bankruptcy might enable you up to pay your debt and/or have it wiped clean. It can be a way to free you from the burdens of debt and allow you to start building stronger credit, stay debt-free, and move into financial security.

If you own a small business that owes a small enough amount , then you can file for Chapter 11 bankruptcy. There are some benefits to this bankruptcy too, even though it is an incredibly complicated process. This is called business reorganization bankruptcy, and it allows you stay in business while your payment plan is restructured. In this way, you may be able to pay off all your debts. While this usually costs more than Chapter 13 bankruptcy, Chapter 11 is faster and requires fewer hearings. You can keep in business and take care of your debt. For whatever bankruptcy you want to file, you should consult a trustworthy bankruptcy attorney in Florida who can guide you through all the complexities.

Don’t Miss: Bankruptcy Friendly Auto Loans

The Final Steps Of Your Journey Towards Lasting Debt Relief

Getting all of your bankruptcy forms prepared and filed with the bankruptcy court is usually the most time-intensive process of a Chapter 7 bankruptcy. But that doesnât mean that your job is done. There are a few things everyone filing Chapter 7 bankruptcy has to do to successfully complete their bankruptcy case and receive a discharge. Letâs take a look at what you can expect will happen in your Chapter 7 bankruptcy.

Pay Filing Fee in Installment Payments

If you can’t pay the entire Chapter 7 bankruptcy filing fee and you don’t qualify for a fee waiver, then you can apply to pay the filing fee in installments. You can ask to make four installment payments. The entire fee is due within 120 days after filing.

If the bankruptcy court approves your application, it will grant an Order Approving Payment of Filing Fee in Installments. Your installment payment due dates will be in that order. You must pay all installments on time or your case is at risk of being dismissed.

Take Bankruptcy Course 2

You will complete a credit counseling course before filing bankruptcy. There’s a second course you must take after filing bankruptcy. It covers personal financial management and can help you take advantage of your fresh start after erasing your debts through bankruptcy.

You have to take this course after your case is filed but make sure itâs be completed within 60 days from the date of the meeting of creditors. A certificate of completion must be filed with the court.

What Happens When Declaring Bankruptcy

If you find yourself struggling to pay your bills and facing the prospect of losing everything, you may have no choice but to file for bankruptcy. One of the most important things that happen immediately upon filing for bankruptcy is that an automatic stay is placed on any debt collection attempts that you are dealing with.

This means that the harassing phone calls and letters youve been receiving from mortgage companies, credit card companies, debt collectors, and others should stop immediately. They are to refrain from contacting you while the bankruptcy process is sorted out. In addition, wages cannot be garnished, and no money can be deducted from your bank account.

Also Check: When Will Bankruptcy Come Off My Credit Report

Also Check: Has Tom Steyer Ever Filed Bankruptcy

Benefit: Discharge Of Debts

Another one of the most helpful benefits of filing bankruptcy is the discharge of debts. For many people, their main goal in filing for bankruptcy is to obtain a discharge order. This is a federal court order that acts as a permanent injunction against creditor collection of certain pre-bankruptcy debts. These debts generally include credit cards, business loans, medical bills, utility bills, and most other kinds of personal or business debt. A discharge permanently wipes away these kinds of dischargeable debts, leaving the person free to use their income and assets without the threat of loss to creditor collection actions, and free from burdensome interest, fees, and charges which were holding that person back from continued financial growth. Note, however, that certain debts are not dischargeable, such as certain taxes, child support and alimony, and other specific kinds of debts that are protected from discharge by the Bankruptcy Code, and that some kinds of debts are only dischargeable in certain types of bankruptcy cases.

Bankruptcy Is A Powerful Tool For Debtors But It Doesn’t Solve All Problems Learn What Happens When You File For Bankruptcy And What Bankruptcy Can Do To Help You Improve Your Financial Situation

When facing financial difficulties, it’s essential to know what happens in bankruptcy before deciding to file a bankruptcy case. There’s no doubt that if you’re experiencing severe debt problems, filing for bankruptcy can be a powerful remedy. It stops most lawsuits, wage garnishments, and other collection activities. It also eliminates many types of debt, including credit card balances, medical bills, personal loans, and more.

But it doesn’t stop all creditors, and it doesn’t wipe out all obligations. For instance, you’ll still have to pay your student loans unless you can prove hardship. You’ll also need to pay arrearages for child support, alimony, and most tax debts.

Find out what happens in bankruptcy and how bankruptcy works, including:

- what Chapter 7 and Chapter 13 bankruptcy can do

- what happens only in Chapter 13 bankruptcy, and

- what you can’t do in bankruptcy whatsoever.

Once you understand the basics, you’ll likely want information targeted to your situation. Look for the links to additional resources at the end of the article.

- Get answers to questions about bankruptcies.

Read Also: Is There Such A Thing As Medical Bankruptcy

Determining The Median Income For Your Household Size

The income limit for your state and household size is based on data from the Census Bureau, and it changes multiple times per year.

To find the most up-to-date information, go to the means testing page from the United States Trustee and choose the current option in the drop-down menu titled âData Required for Completing the 122A Forms and the 122C Forms.â This will bring you to a new page on the Justice Departmentâs website that provides a link titled âMedian Family Income Based on State/Territory and Family Sizeâ provided by the Census Bureau. From there, you can pull up a table showing median incomes by household size, for each state.

Bankruptcy Benefits For Struggling Small Businesses And Owners

Small businesses have the potential to reinvigorate poor economic conditions by creating jobs and provide exciting investment opportunities. However, because of the current state of the U.S. economy, access to loans and credit has proven more difficult for small businesses, some of which end up turning to bankruptcy protection. While many small business owners presumably view bankruptcy as a failure and the end of their ventures, this is not typically the case. In fact, filing bankruptcy may tactically benefit some small businesses.

Read Also: How Long Does It Take To Recover From A Bankruptcy

Saving Your Credit Score Is Only One Reason

An end to collection hell: Nosals study found that once people fell seriously behind on their debt with at least one account 120 days overdue, for example their financial troubles tended to get worse. Balances in collections and the percentage of people with court judgments grew.

By contrast, people who file for bankruptcy benefit from its automatic stay, which halts almost all collection efforts, including lawsuits and wage garnishment. If the underlying debt is erased, the lawsuits and garnishment end.

Freedom from certain debts: Chapter 7 bankruptcy wipes out many kinds of debt, including:

-

Civil judgments .

-

Business debts.

-

Some older tax debts.

Some debts, including child support and recent tax debt, cant be erased in bankruptcy. Student loan debt can be, but its very rare. But if your most troublesome debt cant be discharged, erasing other debts could give you the room you need to repay what remains.

Better access to credit: It can be difficult to get credit right after a bankruptcy. But Nosals study shows people who have completed bankruptcy are more likely to be granted new credit lines within 18 months than are people who fell 120 days or more overdue at the same time but didnt file.

Your credit limits after bankruptcy are likely to be low, however, and your access to credit like your credit scores wont recover completely until a Chapter 7 bankruptcy drops off your credit reports after 10 years.

Chapter 7 Remains On Your Credit For 10 Years

Its true that bankruptcy can hurt your credit score. But whats worsecontinuing to not make payments and continuing to ruin your credit for years or starting to rebuild after one big credit event? Instead of digging the hole deeper over time, Chapter 7 bankruptcy allows you to start rebuilding credit.

Read Also: How To File Bankruptcy In Va

What Is The Process For Filing For Bankruptcy Twice

The only rules when filing for bankruptcy a second time involve the time between the filings. The filing process the first time will be the same for the second bankruptcy filing, but you may need to wait several years to file again if you received a discharge. If your case was dismissed during the first bankruptcy case, you can often file again immediately.

The Chapter 7 Income Limits And The Bankruptcy Means Test

The bankruptcy means test is a calculation laid out in the Bankruptcy Code. The starting point for this calculation is your stateâs median household income. Median income can be part of the Chapter 7 income limits. If your household income is less than the median household income for the same household size of the state youâre filing in, you make less than the income limit. This means you pass the Chapter 7 means test and qualify for Chapter 7 bankruptcy.

If your household income is greater than the median, you may still qualify for Chapter 7 bankruptcy if your household expenses under the means test calculation donât leave you with any disposable income. More on that in Part 2, below.

Recommended Reading: Does Filing For Bankruptcy Eliminate Debt

Benefits Of Filing For Bankruptcy

Bankruptcy has some notable advantages for those deep in debt.

- Debt elimination: Most importantly, bankruptcy offers a way to eliminate your debt or develop a firm plan to repay all or some of it.

- Protection from legal action: Throughout the bankruptcy process, federal courts protect debtors from any legal action that creditors may try to impose.

- Property protection: In some types of bankruptcy, your property is protected from being seized and liquidated.

- Discrimination protection: The government provides several protections from discrimination for those who have declared bankruptcy. For instance, businesses cant fire an employee solely because of a bankruptcy filing.

Chapter 7 Means Test Calculator

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

The Chapter 7 means test is the analysis that determines whether a person can file Chapter 7 bankruptcy. Itâs called the bankruptcy means test because, at its most basic level, it looks at whether someone has the means to pay their debts.

Written byAttorney Andrea Wimmer.

One of the most confusing things about filing for Chapter 7 bankruptcy is the means test analysis. There are various âfree means test calculatorsâ online that often lead to more confusion. This article will explore what the means test is, what it does, and how it works. This will help you understand why there really is no such thing as a means test âcalculatorâ â only a means test calculation.

Don’t Miss: Will I Lose My House If I File Bankruptcy

Keep The Majority Of Real And Personal Property

Filing bankruptcy does not mean that creditors can take everything a debtor owns to satisfy the debt. The home that the debtor lives in and the car they drive are generally safe from being taken in most Chapter 13 bankruptcy proceedings. The same is true of personal effects inside the home. If there are a lot of extra items, such as additional cars, motorcycles, boats, or other big-ticket assets, a creditor may try to take these to satisfy a debt. In Chapter 7 bankruptcy cases, the court may agree to that and some of the debtors property will be lost.

It is important for a debtor to think about which type of bankruptcy they want to file for, and talk to their attorney about their options. You may be able to restructure and pay off their debt over time, while keep your property. Or you may choose to liquidate assets to wipe away debt completely.

What To Do After Filing For Bankruptcy

Bankruptcy doesnt have to be an everlasting burden. There are a few ways to move forward from a bankruptcy filing and start improving your financial state. While these tips can be helpful, you should consult an attorney for professional legal advice.

Shayna Waltower contributed to the writing and research in this article.

You May Like: How Does Bankruptcy Affect Your Future In Canada

The Chapter 13 Hardship Discharge

After confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. In such situations, the debtor may ask the court to grant a “hardship discharge.” 11 U.S.C. § 1328. Generally, such a discharge is available only if: the debtor’s failure to complete plan payments is due to circumstances beyond the debtor’s control and through no fault of the debtor creditors have received at least as much as they would have received in a chapter 7 liquidation case and modification of the plan is not possible. Injury or illness that precludes employment sufficient to fund even a modified plan may serve as the basis for a hardship discharge. The hardship discharge is more limited than the discharge described above and does not apply to any debts that are nondischargeable in a chapter 7 case. 11 U.S.C. § 523.

Compare Your Income To The Median Income

In the first step, the filer compares their gross household income to the median household income for a family of the same size in their state.

The median household income is determined by the U.S. Census Bureau and updated multiple times per year. The most up-to-date information about the current median income for your state is available from the Office of the United States Trustee . This is the division of the Department of Justice thatâs tasked with preventing abuse of the bankruptcy system.

ââ If youâre looking for the current median household income, donât rely on a simple Google search. Since the information changes regularly, the only reliable place to check the numbers currently in effect is on the USTâs website. ââ

Now that you know how to look up the median income for your state, letâs take a look at how to calculate your average income to compare.

You May Like: How To File For Bankruptcy In Indiana Without A Lawyer