Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

How Is Your Dti Ratio Calculated

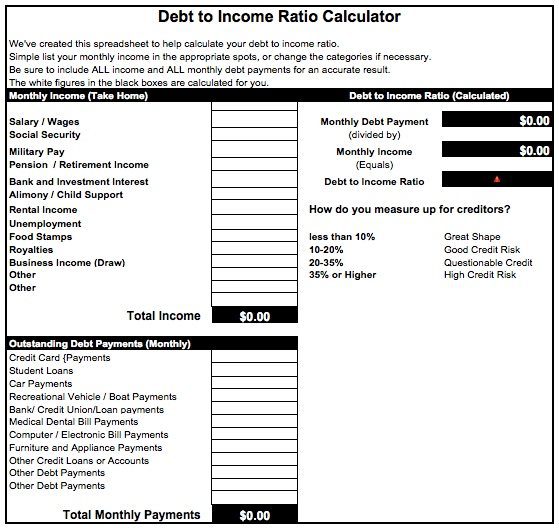

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

Recommended Reading: How To File Bankruptcy Without Money

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

How To Improve Your Debt

When you’re applying for a mortgage, improving your debt-to-income ratio can make a difference in how lenders view you. Several steps can help you achieve a lower DTI, including:

- Reduce your total debt by paying off credit cards and paying down any other loans that you can.

- Avoid taking on new debt.

- Consider a debt consolidation loan to make it easier to reduce debt faster.

- Improve your income by asking for a raise, getting a second job or finding a new primary job that pays more.

- Review your budget to see where you could save money to put toward paying down debt. If you don’t have a budget, start one.

Also Check: How To Get Around Debt To Income Ratio

Why Does Your Dti Ratio Matter

Lenders may consider your DTI ratio as one factor when determining whether to lend you additional money and at what interest rate. Generally speaking, the lower a DTI ratio you have, the less risky you appear to lenders. The preferred maximum DTI ratio varies. However, for most lenders, 43 percent is the maximum DTI ratio a borrower can have and still be approved for a mortgage.

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

You May Like: Bulk Merchandise For Sale

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

How To Improve Your Debt To Income Ratio

There are two ways to improve your debt to income ratio: increase your income or decrease your debt. Ideally you are able to do both over time, but thats far easier said than done. If your DTI is being inflated due to student loans and credit card debt, you might be paying 20% or more in interest, refinancing that amount would make a significant difference in your total debt obligation. Consolidating your debt enables you to pay down debts with a higher interest rate by rolling them into a lower-interest rate loan, which lowers your monthly debt payments and enables you to pay off your debt more aggressively.

As you make choices that affect your income stream and debt load, keep this number in mind and update it accordingly. If you only keep track of two personal finance metrics, they should be your credit score and debt to income ratio.

Recommended Reading: Student Loan Bankruptcy Lawyer

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

How Is The Debt

Read Also: Can You File Bankruptcy On Just Credit Cards

Reducing Your Dti By Using A Combination Of Both

Usually, the best way to go is using a mix of these two strategies. Why work with one hand when you have two at your disposal? Lets say that you can lower your monthly debt obligation by $600 by cutting costs while, at the same time, you can negotiate a pay increase of $800 with your boss.

Your monthly debt obligations are now down to $1,900, while your gross monthly income is up to $7,100, meaning your debt-it-income ratio is now around 27%.

Debt To Income Ratio Formula For Mortgage:

Step 1: Add up all your monthly debts including your new mortgage payment, car payment, credit card payments, student loans, etc.

Step 2: Take your annual gross income and divide it by 12 to get your monthly gross income

Step 3: Divide your total monthly debts by your monthly gross income

For example, if your monthly debts are $1,500 and your monthly gross income is $5,000, your debt to income ratio would be 30%.

Read Also: How To File Bankruptcy For Free

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Also Check: How Long To Keep Bankruptcy Discharge Papers

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

It Provides A Snapshot Of Your Overall Financial Health

If your DTI ratio is below 36%, its a pretty good indicator that youre able to take on and manage new debt responsibly. If your DTI is over 43%and particularly if its over 50%youll likely need to pay down some debt or find other sources of income before lenders will approve you for a mortgage or personal loan.

You May Like: Can You Claim Bankruptcy On Court Fines

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

How Do Lenders Interpret Your Dti

All other circumstances being equal, the lower your debt-to-income ratio, the higher the chance of seeing your loan application approved.

Thats because loan providers want to make sure that you have enough available income to make monthly debt repayments without putting excessive stress on your personal finances. If your current debt obligations eat away too much of your monthly earnings, lenders will see extending a loan to you as a risky business.

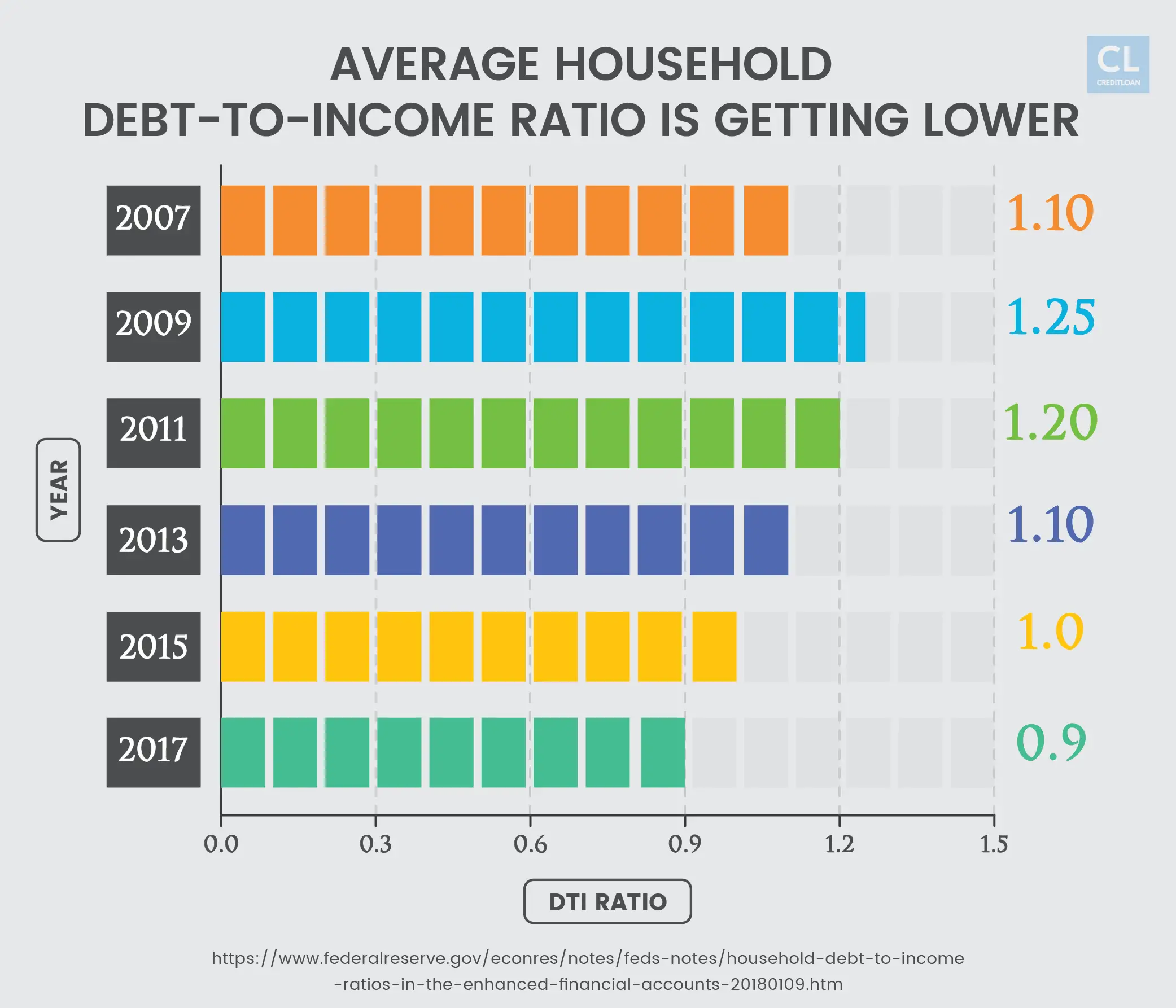

A lenders evaluation may vary based on whether you are a homeowner or a renter. Here is some interesting data provided by the Consumer Financial Protection Bureau.

- Lenders want to see a DTI of 36% or less when homeowners apply for a loan .

- If you are a renter, you should keep your DTI below 20% . Please note that your rent payments are not a debt obligation and are not included in the calculation of your debt-to-income ratio.

Moreover, your current debt-to-income ratio may affect the amount you are allowed to borrow and not just the success of your loan application.

Read more:How Much Can I Borrow?

Recommended Reading: Can You File Bankruptcy On Traffic Tickets

How Dti Impacts Your Credit Score

Not only does your DTI impact your ability to secure a loan, it also indirectly affects your credit. That means even if you arent trying to borrow money right now, a DTI thats too high could knock points off your credit score and make it tougher to secure an apartment or open a utility account.

The main reason DTI and credit are related is because the total amount of debt you owe affects approximately 30% of your FICO score. The lower the amount of debt you owe in relation to your available credit, the better for your score. Conversely, the more debt you have to your name, the worse its impact on your score. So if you have a high DTI, it follows that you are probably using a significant portion of your available credit.

DTI also can impact your credit if you owe so much that you arent able to keep up with payments. As the most heavily weighted factor in calculating your credit score, payment history makes up 35%. Just one missed payment can knock quite a few points off your score, so its important to keep your debt levels manageable.

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

Recommended Reading: Which Statement Regarding Bankruptcy Is Not True

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

You May Like: Can You File Bankruptcy On Medical Bills Only

Reducing Your Dti By Lowering Your Total Debt

Lets assume your current debt-to-income ratio is around 39%.

You earn $6,300 a month working full-time. Your total debt monthly obligations amount to $2,500 and are distributed as follows:

- mortgage payment: $1,400

- car loan payment: $400

There is currently no room to increase your monthly salary. Because you have a good FICO score, you find an online lender willing to offer a personal loan at very favorable conditions. You can use it to consolidate both your credit card debt and car loan over a longer period of time and at a more advantageous interest rate. This may significantly reduce your monthly debt obligations. For example, your new situation could be:

- mortgage payment: $1,400

- personal loan payment: $300

Your monthly debt obligations would now amount to $1,700, and your debt-to-income would only be 27%.

Alternative ways to reduce your monthly debt obligations include:

- paying back a significant share of the principal by selling valuable assets or accumulating enough savings

- enrolling in a debt management plan

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Read Also: How Does Bankruptcy Affect My Partner Australia