What Does Your Debt

| DTI | What it means |

|---|---|

| Less than 36% | You have a good amount of debt relative to your income, which should make it easier to maintain financial stability. If you apply for new financing, you should have little trouble getting approved, as long as your credit score is high enough to qualify. |

| 37-41% | This is within a normal range of how much debt you should have relative to your income. However, you may need to eliminate some debt before you apply for your next loan or line of credit. This will make it easier to ensure you can get approved. |

| 41-45% | Having this much debt will make it difficult to find a lender that will extend you a new line of credit. You should take action to reduce debt and stop making new charges on your credit cards until youve paid off some of your balances. Consider options, like debt consolidation, that can make it easier to pay off your balances. |

| More than 50% | This much debt is bad for your financial health and you need to get help immediately. This much debt may make it difficult to pay off on your own, since you have too much debt to qualify for do-it-yourself options, like debt consolidation loans. Call to review your options for relief with a trained credit counsellor. |

How lenders use debt-to-income ratio during loan underwriting

Talk to a trained credit counsellor to find the best way to eliminate debt for your needs and budget.

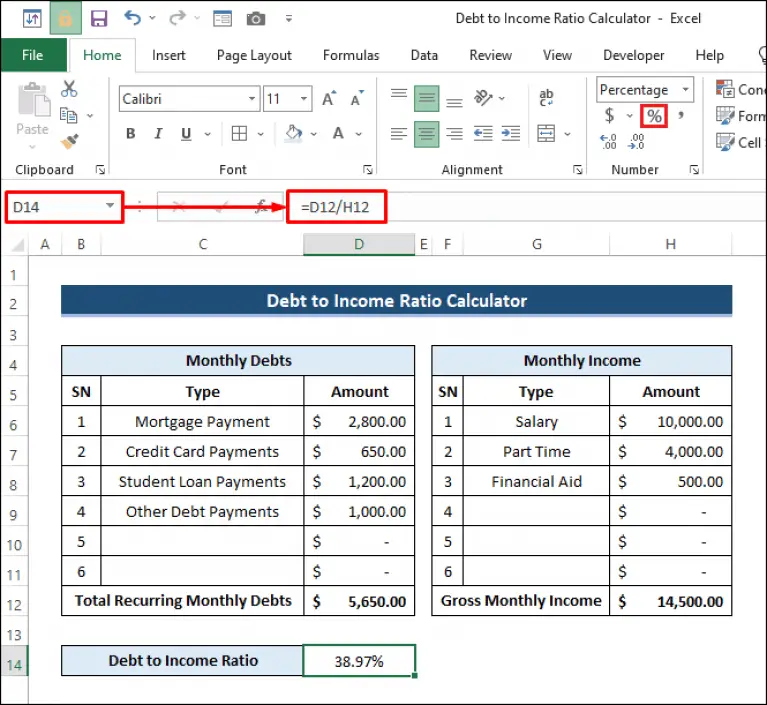

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Read Also: Difference Between 7 And 13 Bankruptcy

Tuesday Tip: How To Calculate Your Debt

Do you know what your debt-to-income ratio is? Do you know why its an important figure? Well, lenders and credit reporting agencies will use this figure as part of the criteria for determining your creditworthiness. Our advice is for you to work towards making it as low as possible. It could mean the difference between obtaining credit or not.

American Consumer Credit Counseling is here to de-mystify the debt-to-income ratio.

Calculating Your Dti Ratio As A Couple

When buying a home, a mortgage is often shared by a couple, which means that the DTI gets calculated for the couple, rather than for the individual. Some lenders also offer personal loans to couples and may even loan larger amounts in these cases.

If youre thinking of getting a personal loan as a couple, you should determine your DTI ratio as an individual and as a couple and compare the results. If one partner has more debt than the other, its an especially good idea to calculate whether a shared loan will put you ahead or behind.

Read Also: Dismissed Bankruptcy Chapter 13

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Exactly Is A Debt

Your debt-to-income ratio is the percentage that represents your monthly income that goes toward paying down your debts. This includes your mortgage, credit card payments, student loans, and other outstanding loans you might have.

A high debt-to-income ratio can indeed make it difficult to get approved for new loans and lines of credit and can even lead to higher interest rates. It can also make it difficult to save money for a down payment on a new home or an emergency fund.

Do you know how much home you can afford?

Most people dont… Find out in 10 minutes.

There are a few different ways to lower your debt-to-income ratio. You can work on paying down your existing debts, reducing the monthly income that goes toward them. You can also increase your income, giving you more money to work with each month.

You May Like: Free Listings For Foreclosed Homes

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

How Is The Debt

Read Also: How To Find Out If Company Filed Bankruptcy

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

How To Get Your Credit Report And Credit Score

You can request your credit report at no cost once a year from the top 3 credit reporting agencies Equifax®, Experian®, and TransUnion® through annualcreditreport.com. When you get your report, review it carefully to make sure your credit history is accurate and free from errors.

It is important to understand that your free annual credit report may not include your credit score, and a reporting agency may charge a fee for your credit score.

Did you know? Eligible Wells Fargo customers can easily access their FICO® Credit Score through Wells Fargo Online® – plus tools tips, and much more. Learn how to access your FICO Score. Don’t worry, requesting your score or reports in these ways won’t affect your score.

Don’t Miss: Can I File Bankruptcy And Keep My Car Loan

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

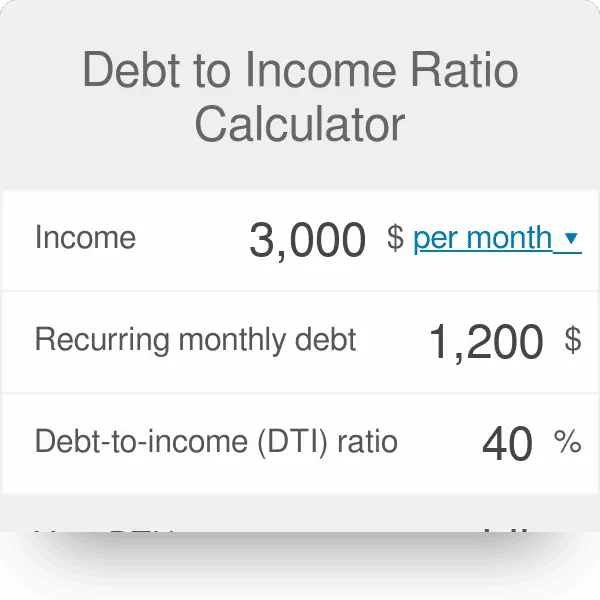

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Read Also: Can You Declare Bankruptcy On Credit Cards

Does My Dti Ratio Affect My Credit Score

Your DTI ratio has little bearing on your actual credit score. But its important to remember that your credit utilization ratio accounts for 30% of your credit scoreand if you have a high DTI ratio, its most likely that you have a high credit utilization ratio.

To give you a better example:

Say, your credit limit is $3,000 and you have a balance of $1,700. This would give you a 57% credit utilization ratio. You want to keep this number below 30% when youre applying for a loan.

Its important to lower this number because not only will you be paying down more debt, but this will also boost your credit score and lower your DTI ratio. Getting a secured credit card is an alternative way of building your credit score.

Now that you understand what the debt-to-income ratio is and how it affects your financial standing, its important to be mindful of your spending habits and your debts, especially if youre considering applying for a credit card or loan sometime in the future.

121 Financial Credit Union has been in the business for over 85 years, serving the people of Jacksonville, Florida. We are extremely dedicated to delivering highly personalized financial services that benefit our members and our community.

Well be more than happy to go over your numbers and give you the best advice on what your next best steps are regarding your current situation.

Reasons You Might Want To Wait

Remember that the means test looks back six months. Even if your income in January, for example, was much higher than your income in June, the test will use an average.

Say you recently lost your job. That drastic change in income won’t be reflected in your calculated annual income. If you wait a few months, the results of your means test may be very different.

You should also wait if you think you’ll have more debt soon.

This is because you can only file every eight years. You can’t file Chapter 7 bankruptcy every time you get in a tight spot.

Don’t Miss: How Many Times Has Trump Declared Bankruptcy

How To Use Debt

Your debt-to-income ratio or DTI represents the amount of your income that goes to debt repayment each month. So why does that matter? For one thing, debt to income can be an important factor in determining whether you qualify for certain loans. If youre trying to buy a home, for instance, lenders will calculate your DTI when determining mortgage approval. For another, a lower debt-to-income ratio means you may have more money to save and invest for the future. If youre not sure how much of your income goes to debt each month, heres how to calculate it.

Working with a financial advisor could help you create and execute a financial plan for your needs and goals.

Also Check: Auto Loans For People With Bankruptcy

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

Also Check: How To Claim Bankruptcy Without A Lawyer

What Is A Good Debt

The lower your DTI ratio, the more likely you will be able to afford a mortgage opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

| 36% or less | DTI ratio is good | A debt-to-income ratio of36/43 is favorable to lenders, because it shows you’re not overstretched. After paying your monthly bills, you most likely have money left over for saving or spending. |

|---|---|---|

| 37% – 50% | DTI ratio is OK | The maximum allowed DTIcan vary depending on the type of home loan you’re applying for and the requirements set by your lender. In most cases, the highest DTI that a homebuyer can have is 50%. |

| 51% or higher | DTI ratio is high | Just because you have a high DTI ratio doesn’t mean you can’t still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility. Paying down debt or increasing your income can helpimprove your DTI ratio. |

Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Also Check: Surplus Liquidators Warehouse Sale

How To Calculate Dti

What Is Included In Your Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, , and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like rent, health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

What is your front-end ratio?

The front-end-DTI ratio, also called the housing ratio, only looks at how much of an applicants gross income is spent on housing costs, including principal, interest, taxes and insurance.

What is your back-end ratio?

The back-end-DTI ratio considers what portion of your income is needed to cover your monthly debt obligations, including future mortgage payments and housing expenses. This is the number most lenders focus on, as it gives a broad picture of an applicants monthly spending and the relationship between income and overall debt.

A general rule would be to work towards a back-end ratio of 36% or lower, with a front-end ratio that does not exceed 28%.

Read Also: Can You File Bankruptcy On Alimony

Why Is Dti Important

Your DTI can impact your financial opportunities. Most lenders adhere to the 28/36 rule when assessing loan requests and determining interest rates. Although DTI is not a factor in calculating your credit score, it does reflect your creditworthiness: The higher your DTI, the more likely you are to default. According to the Consumer Financial Protection Bureau, a DTI of 43 percent is the highest ratio you can have to receive a qualified mortgage.

A heavy debt load also takes a toll on your emotional and physical well-being. Research out of Northwestern University found that high debt relative to available assets is associated with greater rates of stress and depression, worse general health, and elevated blood pressure. Its hard to relax and enjoy life if youre worried about whether or not youll be able to pay your bills. Plus, having such a thin cushion makes it difficult to bounce back from financial curveballs, like an unexpected car expense or job loss.