Contact A Chapter 7 Business Bankruptcy Attorney In Las Vegas

If your business is struggling with substantial debt and you are considering bankruptcy, its important to understand your options and the limitations of Chapter 7 business bankruptcy when it comes to debts you are personally responsible to pay. A Las Vegas bankruptcy attorney can help you explore your options and decide if bankruptcy is the best option. Contact the bankruptcy lawyers at Vegas BK today to learn more about the benefits and drawbacks of Chapter 7 business bankruptcy.

How Does Chapter 7 Affect My Credit Score

One major concern when it comes to filing any type of bankruptcy is the effect it has on your credit score. Ultimately, filing for bankruptcy means that you wont be paying debts as agreed. For this reason, filing for Chapter 7 bankruptcy may have a significant impact on your credit score. Its important to note that Chapter 7 bankruptcy will remain on your credit report and affect your credit scores for 10 years from the filing date.

Although Chapter 7 will remain on your credit report for this length of time, it doesnt necessarily mean that it will prevent you from obtaining any kind of credit moving forward. In fact, many people are able to apply and obtain credit after filing for Chapter 7 bankruptcy. Additionally, you may even be able to get a car loan after filing for bankruptcy. But keep in mind that you will most likely have a high-interest rate.

What Is The Effect Of Filing Bankruptcy

The filing of a bankruptcy petition triggers an automatic stay that prevents creditors from collecting debts. Most creditors cannot take any action during the course of an open bankruptcy without permission of the court. Notably, filing bankruptcy will:

- Stop bill collectors from calling

- Stop wages from being garnished

- Stop most pending civil court proceedings

- Temporarily stop foreclosures and possibly delay evictions

Once a bankruptcy is successfully completed, most of a persons debt is permanently erased . This means creditors cannot collect on the discharged debt.

You May Like: How To File Bankruptcy In Nh

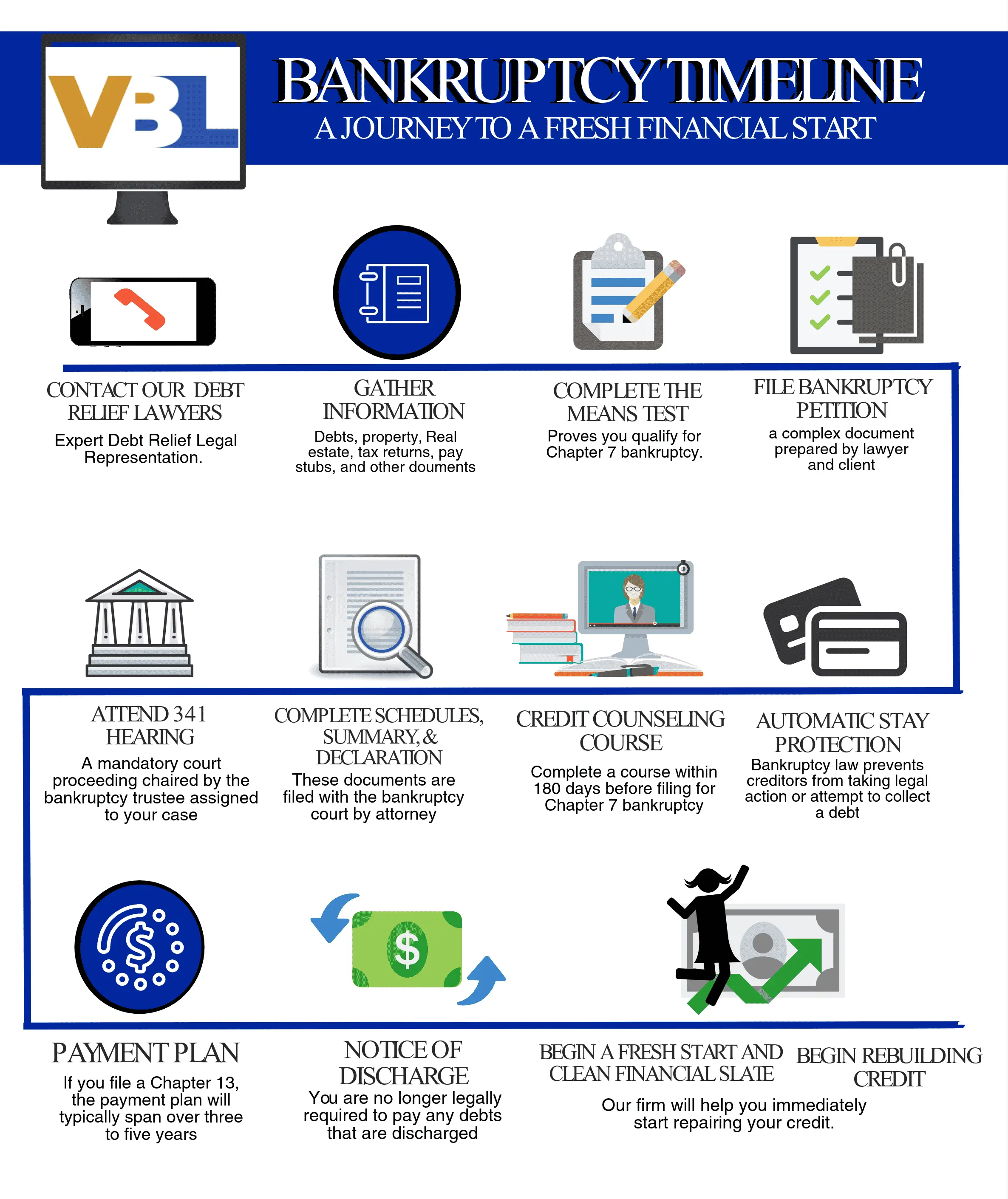

Take Bankruptcy Course 2

Even though you took a course before you filed your Nevada bankruptcy, a second course is required as well. While the first course helped you make the decision about whether filing bankruptcy in Las Vegas is the best option for you, the second course helps educate you on your financial future and how to make good decisions to avoid having to file bankruptcy again in the future. Your Chapter 7 discharge will not be granted until this course is completed. The course may be taken online and takes about an hour. As before, itâs important to take the course through an approved provider. Once done, find out whether theyâll file your certificate of completion with the Court for you. If they donât, itâs important that you submit it to the Court.

Why Should I Hire An Attorney

The Chapter 7 bankruptcy process in Nevada is complex and intricate. There are many procedures that must be followed closely when preparing the documents required to file for bankruptcy. It is imperative that you know whether your property is exempt or subject to liquidation and whether you have debts that cannot be discharged.

It is important to understand what property might be protected and what property might be subject to liquidation. The experienced Nevada bankruptcy attorneys at 702-Defense can guide you through the complex Nevada bankruptcy procedure and ensure that your property and your assets will be protected from creditors to the fullest extent possible. To discuss your individual circumstances, contact the firm today.

Contact Our Nevada Firm

Read Also: How Much Is Our National Debt

Nevada Meeting Of The Creditors

In Nevada, individuals filing for bankruptcy will be required to attend a meeting of the creditors. The meeting of the creditors, often called the trustees meeting, will be presided over by the trustee. At the meeting of the creditors, the trustee and any creditors will have the opportunity to investigate and inquire into the financial condition of the person filing for bankruptcy.

Even though the name suggests otherwise, from a practical standpoint, few creditors actually attend the meeting of the creditors. During the meeting, the trustee will review the documents and financial disclosures filed by the individual in order to determine whether the individual filing for bankruptcy has improperly concealed or disposed of any non-exempt assets.

The trustee is required to ask the individual filing for bankruptcy several questions, including:

- Whether the individual listed all of his or her assets.

- Whether the individual listed all of his or her debts.

- Whether the the documents the individual submitted are accurate.

The individual filing for bankruptcy will be required to answer these questions, and more, under oath during the meeting. The trustee is not limited to asking the pre-determined questions required by law. The trustee may also ask questions specifically about the individuals debts and other personal information.

Chapter 7 Bankruptcy In Las Vegas What You Need To Know

Individuals and businesses with overwhelming debt often seek Chapter 7 bankruptcy protection, commonly called liquidation or straight bankruptcy. While considering Chapter 7 bankruptcy, it is advised that you contact ourLas Vegas Bankruptcy Lawyerfor a free debt evaluation. In order to file Ch 7 bankruptcy in Las Vegas, one must meet eligibility requirements. Next, if this debt relief option is right for your specific debt situation, our experienced legal team provides the representation necessary for a successful resolution to your bankruptcy case.

Chapter 7 is referred to as a straight bankruptcy. It is a straightforward process that allows a debtor to discharge, or erase most debts. Therefore, retaining a fresh start and a clean financial slate is paramount. Also, a chapter seven bankruptcy discharges many types of financial obligations. Plus, after eliminating these debts, individuals, eliminate the stress of late payments, wage garnishments, potential repossession or foreclosure, and lawsuits stemming from debt.

Read Also: Buying Bank Owned Homes

How Chapter 7 Bankruptcy Works In Nevada

Many people we speak with care about two things:

When comparing debt-relief options, Chapter 7 bankruptcy often wins in both categories over alternatives such a Chapter 13 bankruptcy, debt negotiation, debt management, and debt payoff planning. Lets explore those variables in greater detail.

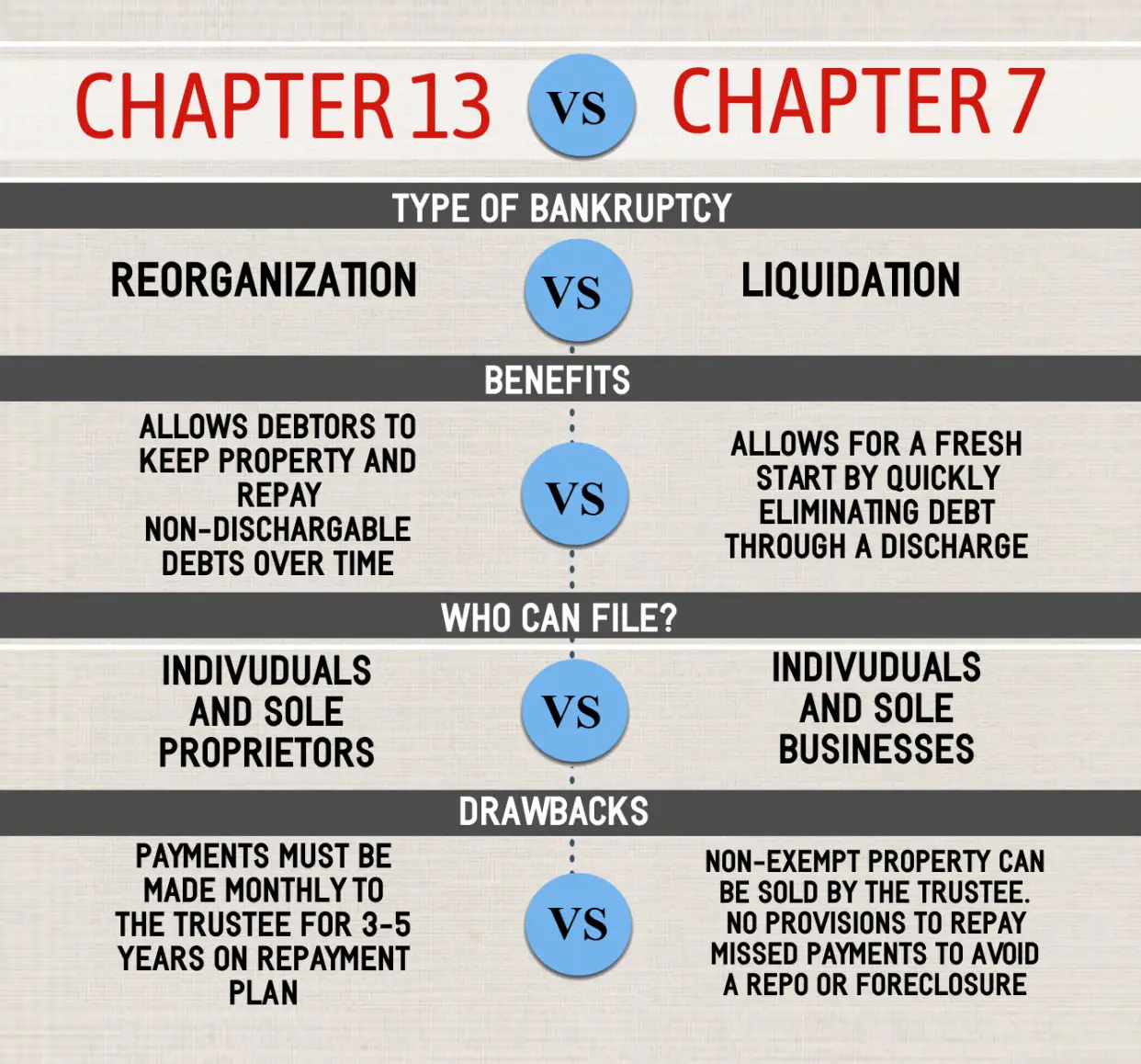

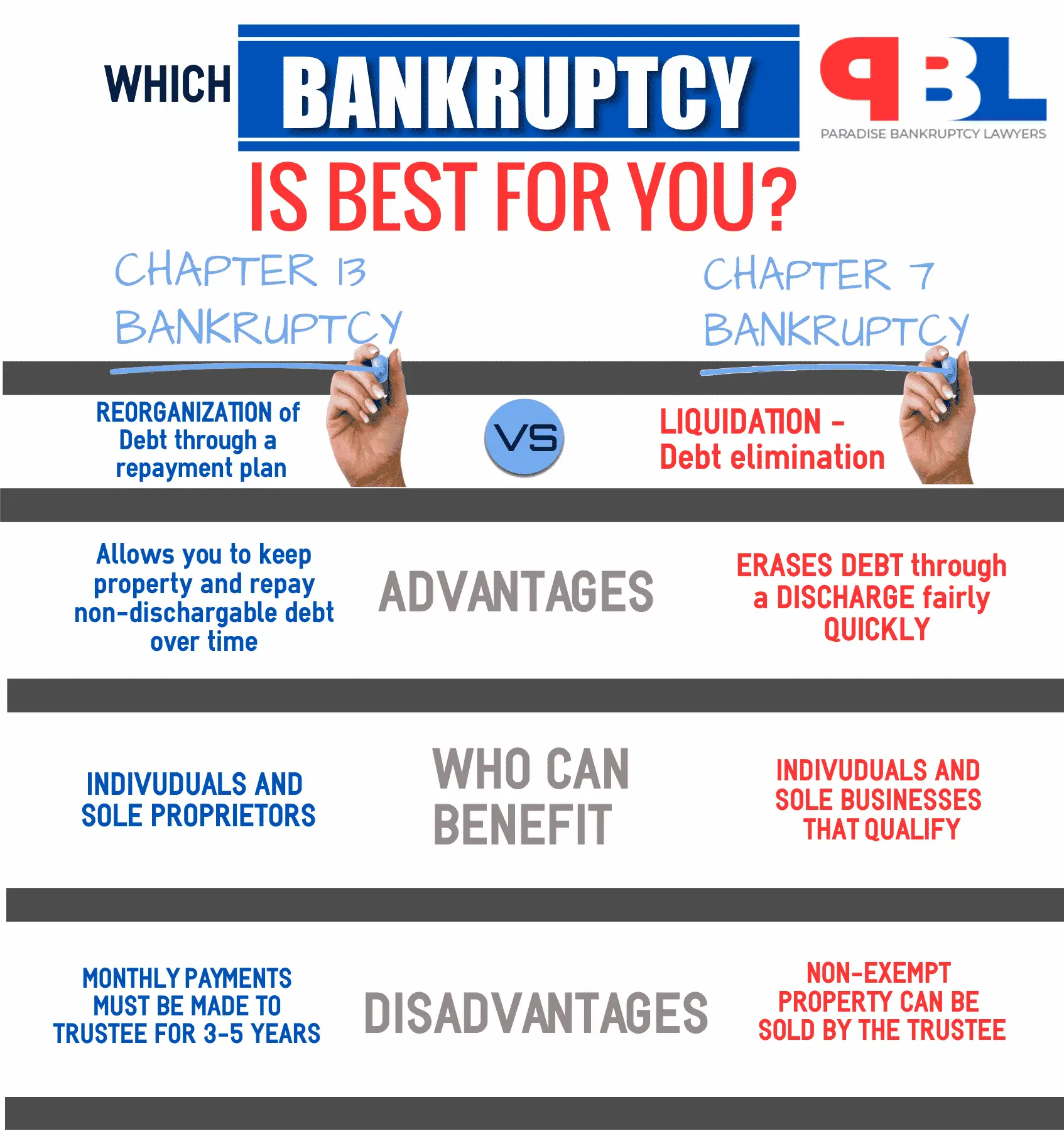

What Is Chapter 13 Bankruptcy

A Chapter 13 bankruptcy provides a reorganization of debts by allowing the debtor to either partially or fully repay debts through a three to five year repayment plan. Chapter 13 allows you to keep some or all of your property. In exchange, you must pay the trustee all of your monthly disposable income for three to five years, and the trustee in turn pays your creditors. Upon successful completion of a Chapter 13, your remaining dischargeable debts are eliminated.

The total of payments over the three to five years must be enough to pay at least the full amount of all mortgage arrears, back taxes, payments for retained secured items, child support and spousal support arrears, and a trustee fee.

You May Like: What Are The Consequences Of Filing Bankruptcy

Liquidating Assets And Discharging Debts

Under section 726 of the bankruptcy code, a creditors claim to the property of the bankruptcy estate are organized into six hierarchical classes. Creditors with the highest class of claim will be paid first. Once each creditor with the highest class of claim has been paid, the next class of claims will be paid, and so on until the assets of the bankruptcy estate are exhausted.

Generally, many of the individuals debts will be forgiven in a Chapter 7 case. Once a debt has been discharged, creditors may no longer attempt to collect that debt through legal actions or other methods.

However, not all debts may be forgiven in a Chapter 7 bankruptcy. Some common debts that may not be forgiven include:

- Alimony and child support debts

- Student loan debts

- Penalties and fines from violations of the law

- Income tax debts

Completing The Relevant Bankruptcy Paperwork

After qualifying to file Chapter 7 bankruptcy, a debtor must fill out all bankruptcy forms. The debtor should be honest with all the information that he or she provides. A Chapter 7 bankruptcy filing can get dismissed on the grounds of inaccurate information. The information disclosed includes the debtors earnings, liabilities, and assets. Upon completing all the required forms, the next step is to file a Chapter 7 bankruptcy petition. This petition officially marks the beginning of the bankruptcy proceeding.

Bankruptcy lawyers in Las Vegas know what paperwork must be completed and filed. They also know the deadlines their clients must meet. Working with an aggressive lawyer, therefore, increases the odds of a successful outcome in a Chapter 7 bankruptcy case.

Read Also: How Do You Rebuild Credit After Bankruptcy

Our Chapter 7 Bankruptcy Attorneys Can Give You The Financial Freedom You Want Without The Headache

When youre at the end of your rope, you might wonder if Chapter 7 bankruptcy is best for you. Chapter 7 bankruptcy is a way to wipe out most of your debts and begin with a clean state. If youre considering filing for bankruptcy, there are some things that you should know about how the process works.

Our Chapter 7 bankruptcy attorneys have years of experience helping thousands of deserving people just like you. We can help you harness Nevadas bankruptcy laws to erase your debts and get the fresh start that you deserve.

Can You Afford Chapter 13 Bankruptcy

Lets say you do not qualify for a Nevada Chapter 7 bankruptcy and are wondering whether you should pursue a Chapter 13 bankruptcy. Can you afford it? It may be odd to ask whether you can afford bankruptcy, but its an important question to ask.

To understand whether you can potentially afford a Chapter 13 bankruptcy, you may want to take the Chapter 13 calculator below to estimate whether you can afford the monthly payment.

Also Check: How Long Does Bankruptcy Affect My Credit Rating

Chapter 7 Bankruptcy Nevada: 3 Things You Need To Know

You may have experienced a financial hardship and are considering filing bankruptcy in Nevada, specifically Chapter 7 bankruptcy.

There are 3 important things to consider when pursuing Chapter 7 bankruptcy in Nevada:

Chapter 7 bankruptcy is the most common bankruptcy in the United States. For example, I would not be surprised if the majority of the 7,892 bankruptcies filed in Nevada in the year ending June 30th, 2021 were Chapter 7 bankruptcy.

Lets get started to understand why Chapter 7 is a popular choice in Nevada.

Who Is Eligible To File For Chapter 7 Bankruptcy Protection

Chapter 7 bankruptcy is a powerful debt relief tool. Unfortunately, it is not available to all consumers. In determining your eligibility for Chapter 7, Nevada uses a means-test. If your monthly income is greater than the states median when adjusted for household size, you may not be able to file for Chapter 7. Though, in some cases, you may still be eligible if your expenses are especially high. In the event that you are not eligible for Chapter 7 bankruptcy, there are other legal options available. Contact a Las Vegas Chapter 13 bankruptcy attorney to learn more.

Recommended Reading: How Bad Will Bankruptcy Affect My Credit

Chapter 7 Las Vegas Exemptions

All of the exemptions have a limit that we can discuss at your first consultation. We will work with you in your Chapter 7 Las Vegas every step of the way. We know this can be a bit scary for people but rest assured we do this day in and day out. And, you arent the first or the last person that has to declare bankruptcy, there are many people declaring it every day.

Other assets that are saved in a Chapter 7 Las Vegas are tools of the trade, retirement accounts and certain wages. Bankruptcy is designed to help one get out of debt and back to a functioning member of society. It is not meant to leave a person without anything. And, they dont expect you to start over from scratch. It is a tool to get back on your feet. And, Chapter 7 Las Vegas is nothing to be ashamed of.

Am I Eligible For Las Vegas Chapter 7 Bankruptcy

A variety of factors are examined when deciding whether or not a person has enough disposable income to pay off their debts. Many who pass the means test will apply for Chapter 7 bankruptcy. If you fail the means test, which means you have enough disposable income to cover your debts, you will still be able to file for Chapter 13 bankruptcy. The bankruptcy trustee named to manage your case under Chapter 7 will sell any nonexempt property and allocate the proceeds to your creditors.

Read Also: How To Calculate Your Monthly Income

Common Legal Terms Explained

Personal jurisdiction Requirement that a particular court have authority over a person, in order to bind that person to the judgment of the court, based on minimum contacts. International Shoe Co v. Washington is a landmark Supreme Court case outlining the scope of a state courts reach in personal jurisdiction.

Do I Qualify To File For Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a means-test bankruptcy. Youre eligible to file for Chapter 7 bankruptcy in Nevada if your income is below the median income in the state for a family of your size. Even if your income is above the median income in the state, you still qualify for Chapter 7 bankruptcy if your disposable income after expenses is so low that you cant make meaningful payments on your debt. To qualify, you may not have received a Chapter 7 bankruptcy discharge within the last eight years.

Our team can help you evaluate your income to determine if you are eligible to file for a Chapter 7 bankruptcy. If you dont qualify, we can help you explore other types of bankruptcy proceedings that can help get you back on your feet.

Read Also: Pallets Of Items For Sale

Do You Qualify For Chapter 7 Personal Bankruptcy

A Chapter 7 personal bankruptcy filing is also known as liquidation bankruptcy. The means test determines if you qualify by looking at your income and debt. Although Chapter 7 bankruptcy discharges some of your debts, it doesnt eliminate all debt. Contact a Las Vegas attorney to determine if you are eligible for Chapter 7.

Chapter 7 Bankruptcy Nevada Income Limits

The Nevada median income figures for the Means Test are adjusted periodically, based on IRS and Census Bureau data. Nevada median income for bankruptcy cases filed on or after April 1, 2022, is:

| # of People | |

|---|---|

| 9 | $138,340 |

For Nevada households with more than 9 members, add $9,000 for each additional family member. You should always double-check the US Trustees website for the most current figures when calculating the Means Test.

Recommended Reading: Can You Get A Mortgage After Filing Bankruptcy

We Help You Examine Your Options

While bankruptcy can give you a fresh start financially, our Nevada bankruptcy lawyers understand that bankruptcy is not the right choice for everyone. We will never push you into choosing bankruptcy instead, our bankruptcy attorneys will help you explore your many options and understand how each will affect you.Bankruptcy is not the only solution available to you if you are facing significant debt or foreclosure. An experienced Las Vegas bankruptcy attorney can also help with loan modification to restructure a mortgage, debt settlement, debt consolidation loans, budgeting, and other solutions to preserve your credit and protect your assets.

So How Do I Qualify For Chapter 7 Bankruptcy In Nevada

Chapter 7 bankruptcies are intended for people who cannot afford to pay any portion of their debts. However, you must first pass an income evaluation to qualify for a bankruptcy discharge in Chapter 7.

If you pass the Nevada bankruptcy means test , you can erase most unsecured debts through Chapter 7. Unsecured debts discharged in Chapter 7 include medical bills, personal loans, some old income tax debt, old utility bills, credit card debts, and most personal judgments. Unsecured creditors hold debts that are not secured by collateral.

Read Also: Chapter 7 Bankruptcy Car Loan

Las Vegas Chapter 13 Lawyers

LAS VEGAS DEBT RELIEF

Chapter 13 bankruptcy is the second most popular chapter of bankruptcy in Nevada. Thus, chapter 13 bankruptcy is something that may work better for people who have regular income. Additionally, filing a Chapter 13 in Nevada immediately stays or stops any creditor action such as: wage garnishment, repossession, foreclosure, seizure, and all creditor attempts at collection, including phone calls and letters. Whereas, our Las Vegas bankruptcy lawyer can assist.

Also, in a chapter 13 bankruptcy, a person files a plan with the federal bankruptcy court and agrees to pay all debts such as car loans, mortgage arrears, and unseen debts in an affordable monthly payment plan over a three to five-year period. Our Nevada bankruptcy lawyer works with you and stays on the case from start to finish throughout the chapter 13 filing which could take up to five years.

WHAT IS A LAS VEGAS CHAPTER 13 BANKRUPTCY?

Payments in these plans can be as low as $100 a month. Therefore, the amount of the monthly payment factors on the filers debt, income, assets, and situation. Keep in mind, each chapter 13 case is unique, however, our Las Vegas bankruptcy attorney can give you an approximate chapter 13 plan payment.

Who Can File For Chapter 7 In Nevada

An individual, corporation, partnership, or other business organization may file for Chapter 7. This, however, does not mean that all individuals and business organizations are eligible to file for Chapter 7.

Before filing for Chapter 7 bankruptcy in Nevada, an individual must first complete a pre-filing credit counseling course. To view a list of approved credit counseling providers in Nevada, refer to the Department of Justice website.

Under Nevada bankruptcy law, the determination of eligibility for Chapter 7 is determined in part by a means test. The means test measures the average household income of the individual filing for bankruptcy against the average household income of Nevada residents.

You May Like: What Happens If You Declare Bankruptcy In Ontario