Economic Growth Can Slow After A Certain Level

A 2013 study by the World Bank found that if the debt-to-GDP ratio exceeds 77% for an extended period, it slows economic growth. Every percentage point of debt above this level costs the country 0.017 percentage points in economic growth.

Emerging markets are even more sensitive to debt-to-GDP ratios. Each additional percentage point of debt above 64% will slow growth by 0.02 percentage points each year in these markets.

This reduction in growth keeps an economy from reaching its full output potential, because every time there is a gain in output, that gain is reduced by debt.

Also Check: American Coradius International Paypal Debt Collection

Formula And Calculation For The Debt

The debt-to-GDP ratio is calculated by the following formula:

Debt to GDP Total Debt of Country Total GDP of Country \begin & \text = \frac } } \\ \end Debt to GDP=Total GDP of CountryTotal Debt of Country

A country able to continue paying interest on its debtwithout refinancing, and without hampering economic growthis generally considered to be stable. A country with a high debt-to-GDP ratio typically has trouble paying off external debts , which are any balances owed to outside lenders. In such scenarios, creditors are apt to seek higher interest rates when lending.

Extravagantly high debt-to-GDP ratios may deter creditors from lending money altogether.

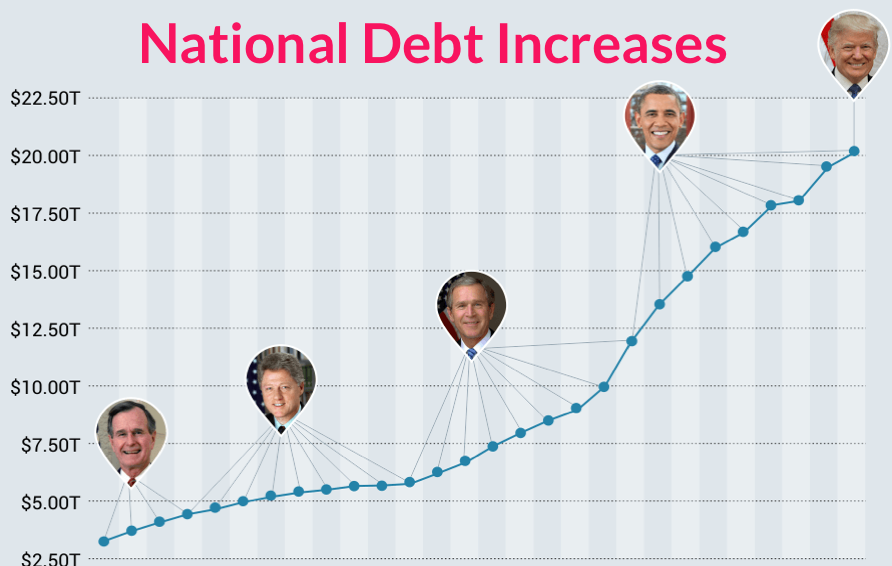

Why Is The Debt So High

As of March 2022, the U.S.s national debt stands at $30.2 trillion.Factors that contribute to the U.S.s high national debt include continued federal budget deficits, the government borrowing from the Social Security Trust Fund, the steady Treasury lending from other countries, low interest rates that promote increased investment, and raised debt ceilings.

Other factors that contribute to the high national debt include the inefficient healthcare system and the changing demographics of the country. Though the U.S. spends more than other countries on healthcare, health outcomes are not much better. In addition, the Baby Boomer generation are now becoming elders and seeking benefits and increased healthcare services. The government will spend, sometimes inefficiently, more on programs and services for the longer living older generations.

Read Also: Do You Claim Bankruptcy On Your Taxes

What Is The Current Us Debt Amount

Debt Held by the Public at the end of September 2021: $22.3 trillion. Debt Held by the Public at the end of September 2020: $21.0 trillion. The $2.8 trillion deficit in FY21 resulted in a $1.3 trillion increase in debt held by the public, with Treasury financing the rest of the deficit by drawing down existing cash balances.

Also Check: Debt Collection While On Disability

United States Government Debt: % Of Gdp

Key information about United States Government Debt: % of GDP

- United States Government debt accounted for 124.9 % of the country’s Nominal GDP in Jun 2022, compared with the ratio of 127.1 % in the previous quarter.

- US government debt to GDP ratio data is updated quarterly, available from Mar 1969 to Jun 2022.

- The data reached an all-time high of 132.4 % in Mar 2021 and a record low of 31.8 % in Sep 1974.

Related information about United States Government Debt: % of GDP

- In the latest reports, US National Government Debt reached 30,928.9 USD bn in Sep 2022.

- The country’s Nominal GDP reached 6,312.1 USD bn in Jun 2022.

View United States’s Government Debt: % of GDP from Mar 1969 to Jun 2022 in the chart:

You May Like: How To Know If You Should File Bankruptcy

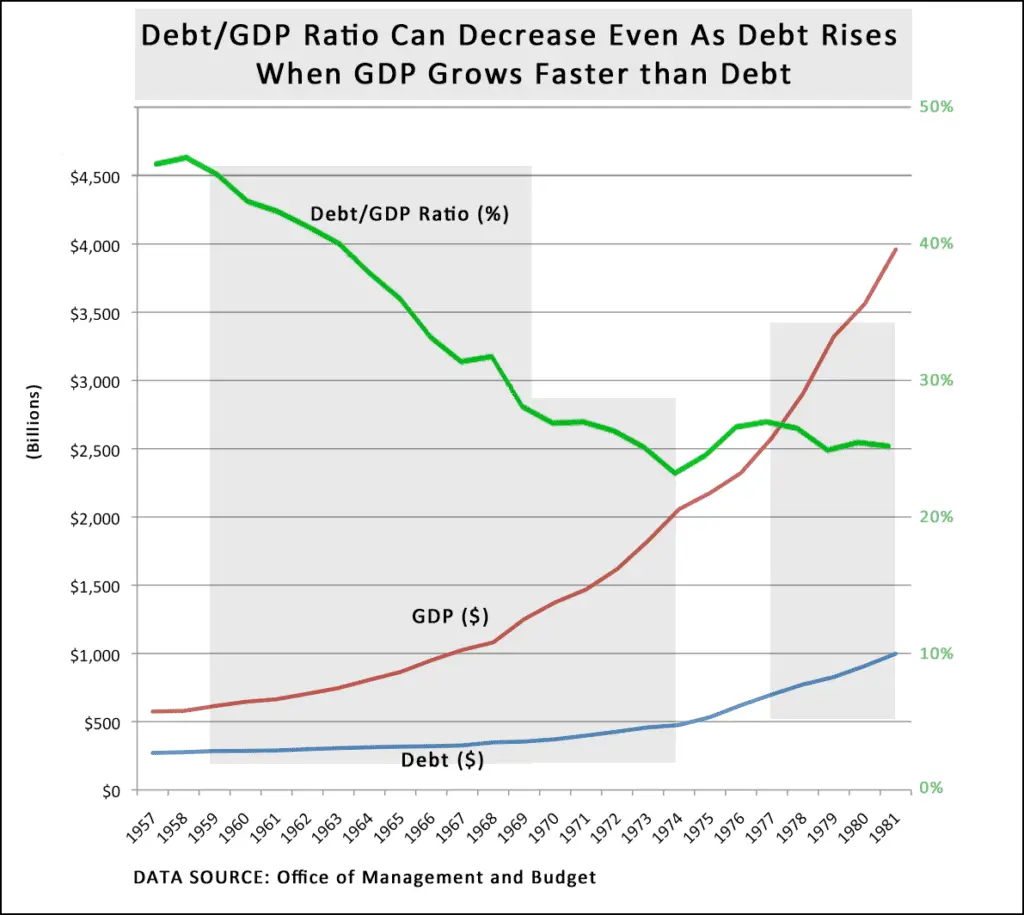

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Debt To Gdp United States

Nominal GDP sector composition, 2015 at 2005 constant prices

| No. |

|---|

There were approximately 160.4 million people in the U.S. labor force in 2017, the fourth largest labor force in the world behind China, India, and the European Union.The government employed 22 million in 2010. Small businesses are the nations largest employer, representing 37% of American workers. The second-largest share of employment belongs to large businesses employing 36% of the U.S. workforce.White collar workers comprise 44% of the workforce as of 2022, up from 34% in 2000.

The nations private sector employs 85% of working Americans. Government accounts for 14% of all U.S. workers. Over 99% of all private employing organizations in the U.S. are small businesses. The 30 million small businesses in the U.S. account for 64% of newly created jobs . Jobs in small businesses accounted for 70% of those created in the last decade.

As of December 2017, the unemployment rate in the U.S. was 4.1% or 6.6 million people. The governments broader U-6 unemployment rate, which includes the part-time underemployed, was 8.1% or 8.2 million people. These figures were calculated with a civilian labor force of approximately 160.6 million people, relative to a U.S. population of approximately 327 million people.

Read Also: What Are Advantages Of Filing Bankruptcy

Notable Companies And Markets

According to Fortune Global 500 2011, the ten largest U.S. employers were Walmart, U.S. Postal Service, IBM, UPS, McDonalds, Target Corporation, Kroger, The Home Depot, General Electric, and Sears Holdings.

Apple Inc., , IBM, McDonalds, and Microsoft are the worlds five most valuable brands in an index published by Millward Brown.

A 2012 Deloitte report published in STORES magazine indicated that of the worlds top 250 largest retailers by retail sales revenue in fiscal year 2010, 32% of those retailers were based in the United States, and those 32% accounted for 41% of the total retail sales revenue of the top 250. is the worlds largest online retailer.

Half of the worlds 20 largest semiconductor manufacturers by sales were American-origin in 2011.

Most of the worlds largest charitable foundations were founded by Americans.

American producers create nearly all of the worlds highest-grossing films. Many of the worlds best-selling music artists are based in the United States. U.S. tourism sector welcomes approximately sixty million international visitors every year. In a recent study by Salam Standard, it has been reported that the United States is the biggest beneficiary of global Muslim tourism spend, enjoying 24 percent share of the total Muslimtravel spend worldwide or almost $35 billion.

Recommended Reading: Who Can File Chapter 7 Bankruptcy

United States Bond Rating

On August 5, 2011, the bond rating service Standard and Poor’s, a company which rates the ability of institutions to repay their debt, lowered the United States federal government’s long-term debt rating from AAA to AA+ for the first time since their ratings began in the early 1940s and gave the government’s credit a negative outlook, warning that unless the rate of new government spending were reduced, there would be grounds for lowering the rating again.

Also Check: Does Filing For Bankruptcy Affect Credit

Here’s What House Speaker Mccarthy’s Chaotic Election Means For The Economy And Debt Ceiling

Concessions made by Speaker Kevin McCarthy heighten economic risk, experts said.

House Speaker Kevin McCarthy, R-Calif., emerged with gavel in hand on Saturday after fierce Republican negotiations, but the concessions he made in the process have heightened concern over a potential economic crisis later this year.

The empowerment of far-right House members in recent days has raised the risk of contentious, high-stakes negotiations over how the federal government should pay for past debts and allocate future spending, economists and budget experts told ABC News.

Failure to reach an agreement before fast-approaching deadlines would send financial markets into turmoil, raise interest rates at a moment when elevated borrowing costs already weigh on economic activity and all but ensure a recession, they added.

Within months, Congress will need to pass two measures in order to avert economic disruption: a debt-limit increase that allows the U.S. government to borrow money for past expenditures, ensuring that the nation continues paying creditors what it owes as well as a budget that keeps the government funded for next fiscal year.

The faction of conservative Republicans that exerted leverage in the speaker vote has indicated it would not raise the debt limit unless Democrats agree to significant spending cuts the Biden administration, however, has said it will not take part in policy negotiations conditioned upon the annual borrowing hike.

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

Read Also: What Is The Best Way To Prevent Foreclosure

The National Debt Affects Everyone

Given that the national debt has recently grown faster than the size of the American population, it is fair to wonder how this growing debt affects average individuals. While it may not be obvious, national debt levels directly affect people in at least five ways.

First, as the national debt per capita increases, the likelihood of the government defaulting on its debt service obligation increases, and therefore the Treasury Department will have to raise the yield on newly issued treasury securities to attract new investors.

This reduces the amount of tax revenue available to spend on other governmental services because more tax revenue will have to be paid out as interest on the national debt. Over time, this shift in expenditures will cause people to experience a lower standard of living, as borrowing for economic enhancement projects becomes more difficult.

Second, as the rate offered on treasury securities increases, corporations operating in America will be viewed as riskier, necessitating an increase in the yield on newly issued bonds. This, in turn, will require corporations to raise the price of their products and services to meet the increased cost of their debt service obligation. Over time, this will cause people to pay more for goods and services, resulting in inflation.

Dont Miss: How To Find Debt To Income Ratio

More: What The House Republicans’ New Rules Change From Speaker Power To Spending

Sharp spending cuts put forward by some Republicans, meanwhile, risk gridlock over next year’s budget, which could cause a government shutdown that halts some federal payments, economists and budget experts said.

“The events of last week are quite disconcerting,” Shai Akabas, director of economic policy at the Bipartisan Policy Center. “It’s going to make passing any legislation more difficult than usual, and it’s never easy under a divided government to start with.”

“It is a serious risk for the U.S. economy and for Americans’ financial wellbeing,” he added.

Here’s what you need to know about what recent turmoil in the House of Representatives means for the U.S. economy:

Don’t Miss: What Happens To Employees When A Company Files Bankruptcy

Imf Chief Heading To Zambia Says New Debt ’roundtable’ To Meet In February

International Monetary Fund Managing Director Kristalina Georgieva attends a news conference following a meeting at the Federal Chancellery in Berlin, Germany November 29, 2022. REUTERS/Michele Tantussi

WASHINGTON, Jan 12 – A new global sovereign debt “roundtable” that will include China, other creditors and some borrowing countries will meet for the first time next month on the sidelines of a Group of 20 finance officials meeting in India, IMF Managing Director Kristalina Georgieva said on Thursday.

Georgieva, the first person from an emerging market economy to head the International Monetary Fund, told reporters debt relief was critical for heavily indebted nations to avoid cuts in social services and other repercussions.

The Bulgarian economist, who has pushed hard for quicker movement on debt relief, said she would travel to Zambia in two weeks, and hoped the African country would become the second nation after Chad to complete a debt treatment process under the Common Framework.

The framework was set up by the Group of 20 major economies and the Paris Club of official creditors in October 2020 to help countries weather the COVID crisis, but it has been plagued by long delays.

Georgieva said reforms were needed, noting that Ghana was debating whether to seek relief under the G20 Common Framework, but remained concerned about how that process would work and how soon a debt treatment could be agreed.

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Read Also: How To File Bankruptcy In Michigan

What Is The Current Us Debt To Gdp

U.S. debt to gdp ratio for 2016 was 98.82%, a 2.07% increase from 2015.U.S. debt to gdp ratio for 2015 was 96.75%, a 0.4% increase from 2014.U.S. debt to gdp ratio for 2014 was 96.34%, a 0.27% increase from 2013.U.S. debt to gdp ratio for 2013 was 96.08%, a 1.91% increase from 2012.

The United States recorded a Government Debt to GDP of 128.10 percent of the countrys Gross Domestic Product in 2020. source: Office of Management and Budget, The White House 10Y 25Y 50Y MAX Chart Compare Export API Embed United States Gross Federal Debt to GDP

Content

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Don’t Miss: Pallets Liquidation For Sale

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

Definition Ofgeneral Government Debt

General government debt-to-GDP ratio measures the gross debt of the general government as a percentage of GDP. It is a key indicator for the sustainability of government finance. Debt is calculated as the sum of the following liability categories : currency and deposits debt securities, loans insurance, pensions and standardised guarantee schemes, and other accounts payable. Changes in government debt over time primarily reflect the impact of past government deficits.

You May Like: What Does Bankruptcy Petition Mean On Credit Report