How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Whats Included In Your Dti Ratio

Our tool calculates your back-end DTI ratio using potential mortgage payments and the following recurring debts:

-

Child support and alimony

-

Personal loan or other monthly debts

Of course, these probably arent your only monthly expenses. Your back-end DTI ratio can also include what you spend on food, utilities, gas, insurance or entertainment, in addition to proposed mortgage payments. Although lenders may not inspect your back-end ratio to this detail, its important to look carefully at these costs so your true monthly financial obligations are represented.

Ideally, your total DTI ratio should be under 36%. Keep this in mind when deciding what affordable means for you.

You May Like: Do You Lose Your Car If You File For Bankruptcy

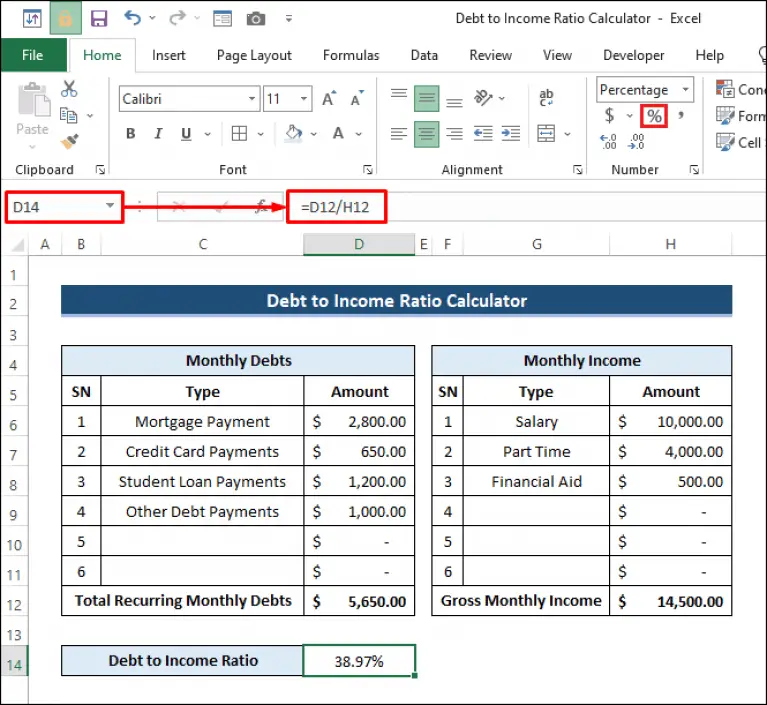

Debt: Income = Gross Monthly Debt: Gross Monthly Income

Where

Gross Monthly Debt = All the debt payments to be made monthly at the time of calculating the ratio

Gross Monthly Income = The monthly income earned by you.

Fullerton India offers a personal loan eligibility calculator as well as a personal loan EMI calculator online. This will automatically calculate the amount of personal loan you are eligible for depending on your income and existing obligations, as well as the EMI you will have to pay every month for a certain interest rate and tenure. Thus, the personal loan eligibility calculator primarily factors in the Debt-income ratio.

If Your Dti Is Greater Than 50%

This is a sure sign of financial distress. If you spend over half your income paying bills, youre probably struggling elsewhere and have a low likelihood of being able to contribute towards your savings. This sort of financial situation isnt sustainable and you could potentially be headed for bankruptcy. Consider seeking professional help to reduce debt levels as quickly as possible.

Get professional help to clean up errors in your credit report. |

Read Also: How Long Chapter 7 Bankruptcy On Credit Report

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

Read Also: How Does Bankruptcy Affect Tax Return

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Cut Back On Credit Card Purchases

Scaling back on unnecessary expenses is always a fiscally responsible move, but reducing your dependence on credit card purchases, in particular, will help you meet your DTI goals. Its way too easy to spend beyond your means by relying on credit cards and racking up more debt in the process. Credit card interest payments are another cost you simply dont want to deal with if youre trying to lower your debt-to-income ratio.

Excessive unpaid credit card balances also impact your , which is another important factor that lenders will weigh when considering your mortgage application. So, for the sake of your homebuying aspirations, put the credit card back in your wallet whenever possible.

Don’t Miss: How Long Do Bankruptcy Restrictions Last

S To Decrease The Debt

1. Decrease monthly debt payments

Consider an outstanding $50,000 student loan with a monthly interest rate of 1%. Scenario one involves an individual who is not repaying their principal debt, while scenario two involves an individual who has paid down $30,000 of their principal debt.

As illustrated above, as an individual pays down more of their principal debt, the monthly interest payments decrease.

2. Increase gross income

Consider two scenarios with a monthly debt payment of $1,500 each. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario two is $5,000. As such, the debt-to-income ratio would be as follows:

DTI Ratio = $1,500 / $3,000 x 100 = 50%

DTI Ratio = $1,500 / $5,000 x 100 = 30%

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Also Check: How Often Can You File Bankruptcy In Ga

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Bankruptcy Friendly Auto Loans

If Your Dti Is Between 3650%

It will be challenging to get approved for loans or financing if your DTI is within this rangeespecially for a mortgage or auto loan. Youll likely need a larger down payment or have greater cash reserves than someone with a lower DTI.

You may be able to quickly improve your DTI ratio by making extra payments towards a particular debt or increasing your monthly income, perhaps by taking on a part-time job. If you cant eliminate at least some of your debt effectively on your own, its time to explore debt relief. Less debt improves your debt ratio, as well as your credit score. Its a win-win.

What Is The Debt

The debt-to-income ratio is a metric used by creditors to determine the ability of a borrower to pay their debts and make interest payments. The DTI ratio compares an individuals monthly debt payments to his or her monthly gross income. It is a key indicator that lenders use to measure an individuals ability to repay monthly payments and accumulate additional debt.

Recommended Reading: What Happens When Business Files Bankruptcy

What Does Your Debt

| DTI | What it means |

|---|---|

| Less than 36% | You have a good amount of debt relative to your income, which should make it easier to maintain financial stability. If you apply for new financing, you should have little trouble getting approved, as long as your credit score is high enough to qualify. |

| 37-41% | This is within a normal range of how much debt you should have relative to your income. However, you may need to eliminate some debt before you apply for your next loan or line of credit. This will make it easier to ensure you can get approved. |

| 41-45% | Having this much debt will make it difficult to find a lender that will extend you a new line of credit. You should take action to reduce debt and stop making new charges on your credit cards until youve paid off some of your balances. Consider options, like debt consolidation, that can make it easier to pay off your balances. |

| More than 50% | This much debt is bad for your financial health and you need to get help immediately. This much debt may make it difficult to pay off on your own, since you have too much debt to qualify for do-it-yourself options, like debt consolidation loans. Call to review your options for relief with a trained credit counsellor. |

How lenders use debt-to-income ratio during loan underwriting

Talk to a trained credit counsellor to find the best way to eliminate debt for your needs and budget.

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Also Check: Can One Spouse File Bankruptcy In Illinois

What Dti Is Required For A Mortgage

There are many different types of mortgages available, and each have their own requirements for approval. For a conventional loan, the absolute maximum DTI limit may be somewhere around 50% – whereas an unconforming loan such as a VA jumbo loan might allow DTI ratios up to 60%. Depending on the type of loan you are interested in, the DTI requirement will look different.

Debt To Income Ratio Requirements

Lenders View on Debt to Income Ratio

The DTI ratio is a very important requirement for most lenders as it demonstrates the ability of the borrower to make their debt payments. The following table provides information regarding DTI levels:

| DTI Range | |

|---|---|

| This is a good DTI ratio and is accepted by most lenders | |

| 36% < DTI < 42% | This is an average DTI ratio, it is within the acceptable region for lenders, however, it will be difficult to borrow more funds |

| 42% < DTI < 50% | This is a bad DTI ratio as it is too high for most lenders making it very difficult to borrow or take loans |

| DTI > 50% | This is a very poor DTI ratio and will result in rejection by a majority of lenders. It will also be very difficult to pay off the debt. |

What is the Debt to Income Ratio Requirement for different Mortgages?

Different mortgage programs have different DTI ratio requirements:

| Mortgage Program | |

|---|---|

| USDA Home Loan | 41% |

Conventional loans allow a DTI ratio of up to 50%, however, this will result in very high mortgage rates and other strict requirements by the lender. The majority of lenders will not accept a DTI ratio of 50% most lenders will typically want a DTI ratio of less than 43%. FHA loan,VA loan, and USDA loanDTI ratios are relatively lower than conventional loans as these programs’ main goal is to promote homeownership without putting additional debt burden on borrowers.

Is my Credit Score affected by the Debt to Income Ratio?

Read Also: What Are Liquidation Pallets

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Can You Afford That Big Purchase

If you are considering a major acquisition, you should take into account the new purchase as you work out your debt-to-income ratio. You can be sure that any lender considering your application will do so.

You can use an online calculator, for example, to estimate the amount of the monthly mortgage payment or new car loan that you are considering.

Comparing your “before” and “after” debt-to-income ratio is a good way to help you determine whether you can handle that home purchase or new car right now.

When you pay off debta student loan or a credit cardrecalculating your debt-to-income ratio shows how much you have improved your financial status.

For example, in most cases, lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. To get a qualified mortgage, your maximum debt-to-income ratio should be no higher than 43%. Let’s see how that could translate into a real-life situation.

Don’t Miss: How Many Medical Bankruptcies A Year

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

How To Find Debt To Income Ratio

The debt-to-income ratio is basically a calculation of – all your monthly debt payments divided by your gross monthly income. Your monthly debt repayments include all your existing loan EMIs as well as credit card EMIs. Your gross monthly income is your monthly salary which you get after all tax deductions.

Also Check: Houses That Are Foreclosed