Whos Going To Make Money From Pg& Es Bankruptcy

Bankruptcy cases involving big corporations usually produce hundreds of millions of dollars in fees for lawyers, bankers and consultants. BlueMountain Capital Management, which owns PG& E stock and opposes the companys bankruptcy, says PG& Es last bankruptcy, filed in 2001, cost more than $400 million in fees. The current case could cost a lot more because lawyers hourly rates have gone up a lot since then.

The 2014 bankruptcy filing of Energy Future Holdings, a Texas utility, yielded professional fees of more than $600 million, according to data collected by Texas Lawbook.

Still, some legal experts say that processing many claims in one court can save money. Its going to produce some pretty big efficiencies, said Lynn M. LoPucki, a law professor at the University of California, Los Angeles.

PG& E has also asked the bankruptcy court to approve roughly $130 million of 2018 bonus payments to employees, who stand to get $5,000 to $90,000 each. The $130 million figure does not include the bonuses for 12 senior PG& E executives. The company has not yet asked the court to approve payments to those executives, although it noted that senior officers are typically eligible to receive bonuses in bankruptcy.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

What’s Next For Pg& e After Bankruptcy

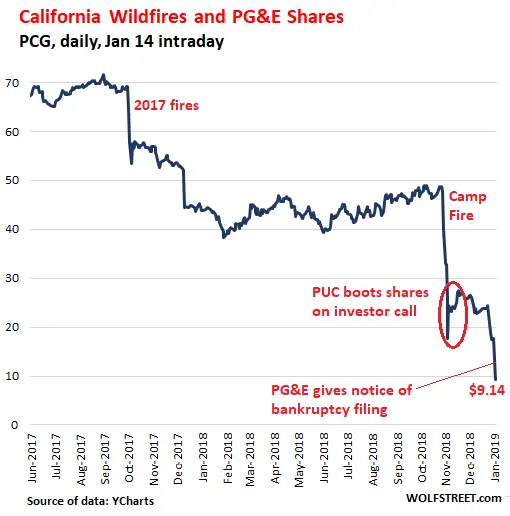

PG& E — Californias largest utility with 40% of ratepayers — gave notice that they are filing for Chapter 11 bankruptcy on January 14th. The expected claim from Camp Fire in November 2018 and fires from 2017 have lead PG& E to file Chapter 11. Per California bankruptcy laws, PG& E has to give employees two weeks notice to file bankruptcy and this will surely be a lengthy process that is unprecedented. It remains unclear how this will impact utility-scale and DG solar in California and has lead to many questions about the PG& Es future.

In the short-term, this should not affect DG solar in PG& E territory. PG& E will continue providing Net Metering credits and Net Metering is protected under law. Unless theres large employee defection, the bankruptcy will not impact interconnection applications and SGIP disbursements SGIP is also protected under state law and funds are reserved for storage deployments. Solar contractors should not anticipate any abrupt changes in 2018 despite key questions about PG& Es future and many uncertainties.

South San Joaquin Irrigation District

In 2009 the California Public Utilities Commission unanimously approved a resolution that would allow the South San Joaquin Irrigation District to purchase PG& E’s electric facilities in Manteca, Ripon and Escalon. In March 2016, San Joaquin County Superior Court Judge Carter Holly has rejected PG& E claims that South San Joaquin Irrigation District lacks sufficient revenues to provide electrical retail service to the cities of Manteca, Ripon, and Escalon and surrounding farms.” The Municipal Service Review found that SSJID’s customer rates would be 15 percent lower than PG& E rates.

Read Also: Bankruptcy Renting Apartment

Suspended Income Tax Payments

HMRC will apply a nil tax code when youre bankrupt. This tells your employer not to take any further income tax from your wages for the rest of the tax year . The extra money in your pay that results from this can be claimed by the trustee to form part or all of an IPA or IPO. If the IPA or IPO is wholly paid out of this extra income, it will stop when you start paying tax again.

The NT wont tell your employer youre bankrupt as an NT can be applied for a number of reasons.

Trump Never Loses Another Chance

Despite his many missteps, Trump has always rebounded and found new ways to pursue his interests. Trump shifted his business from developing projects to licensing and management deals after he had failed in the 1990s.

Trumps star rose to new heights when he was made a reality TV star as The Apprentice even though his casino business went bankrupt twice more. He capitalized on his fame to run for President in 2016, defeating two political dynasties, the Clinton and Bush families, on his way to becoming the White House.

Even if he loses in democrats2020 and experiences the same embarrassing setback as his hotel or casino failures, Trump will still be there. Trump has an extraordinary gift for selling that leads to more deals, sometimes with ex-partners who have reacted negatively to him but then warmed to him again.

Trump sued Deutsche Bank in 2008 to get some of his loan payments back. He was trying to sell condos in his Chicago tower. After two years of legal battles, the two sides settled, and Deutsche Bank began lending Trump money again in 2011. Trump likely hopes that 2020 voters will be equally forgiving.

Recommended Reading: New Car After Chapter 7

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Sacramento Electric Gas And Railway Company

In 1906, PG& E purchased the Sacramento Electric, Gas and Railway Company and took control of its railway operations in and around Sacramento. The Sacramento City Street Railway began operating under the Pacific Gas & Electric name in 1915, and its track and services subsequently expanded. By 1931 the Sacramento Street Railway Division operated 75 streetcars on 47 miles of track. PG& E’s streetcars were powered by the company’s hydroelectric plant in Folsom. In 1943, PG& E sold the rail service to Pacific City Lines, which was later acquired by National City Lines. Several streetcar lines were soon converted to bus service, and the track was abandoned entirely in 1947.

During this same period, Pacific City Lines and its successor, National City Lines, with funding from General Motors, Firestone Tire, Standard Oil of California , Phillips Petroleum, and Mack Trucks, were buying streetcar lines and rapidly converting most of them to bus service. This consortium was convicted in 1949 of federal charges involving conspiracy to monopolize interstate commerce in the sale of buses and supplies to National City Lines and its subsidiaries. The actions became known as the Great American Streetcar Scandal or the General Motors Streetcar Conspiracy.

Recommended Reading: Chapter 13 And Renting An Apartment

Trump Castle Associates 1992

In less than a year he was back in bankruptcy court for his other Atlantic City casinos. This bankruptcy included the Trump Plaza Hotel in New York, the Trump Plaza Hotel and Casino in Atlantic City as well as the Trump Castle Casino Resort. He gave up half his interest in the New York Plaza to Citibank, but retained his stake in the casinos.

Trump Castle Hotel And Casino

This one was opened in 1985 and went bankrupt in the year 1992. This property was also located in Atlantic City, and Trump had the most difficulties in covering its operational cost. To recover from the situation, the Trump association sold a 50% stake to the bondholders. However, the casino is still operating under new owners and a new name- the Golden Nugget.

Recommended Reading: Why Does President Trump Lie So Much

Also Check: How Many Times Did Donald Trump Declare Bankruptcy

What Is Pg& es Role In Californias Wildfires

Equipment owned and maintained by the utility sparked at least 17 of the 21 major wildfires that burned through California in 2017, according to the California Department of Forestry and Fire Protection, making the company responsible for some of the damage that resulted. The authorities recently cleared the company of responsibility in an 18th fire in 2017, a giant blaze that killed 22. State officials are still investigating the utilitys role in the fire of 2018.

This month, the utilitys chief executive left the company. PG& E has been cited for safety violations in recent months and was ordered to reinspect its entire grid for hazards.

Pg& e Incidents And Settlements: Pg& e Has Faced Problems With Contamination Fires And Explosions

Since the 1950s, PG& E has faced problems with contamination, wildfires and explosions that have impacted California residents, its customers and stockholders.

Not all of the cases settled by PG& E were officially deemed the company’s fault, however, these incidents have shaped how people view the company.

Hinkley groundwater contamination: 1952-1966

According to Sedina Banks, author of “The ‘Erin Brockovich Effect’: How Media Shapes Toxics Policy,” in 1987, PG& E reported their natural gas compressor station in Hinkley, a small town 120 miles northeast of Los Angeles, contaminated the water supply for the town.

The contamination occurred between 1952-1966, however, PG& E did not report the contamination to the local water board until years later. After examining their practices, PG& E reported it contaminated the water supply with chromium-6, which is one form of the metallic element chromium.

Nearly 650 people affected by the contamination sued PG& E with the legal aid of Erin Brockovich. The company settled for $333 million.

Trauner Fire: 1994

PG& E was convicted of 739 counts of criminal negligence for failing to trim trees near its power lines. The untrimmed trees were said to be the main reason for the Trauner Fire. This resulted in $2 million in fines. The fire started in August 1994 and burned a dozen homes, a school in a small Nevada County town.

Substation Electrical Fires of 1996 and 2003

Pendola Fire: 1999

Sims Fire and Fred’s Fire: 2004

Carmel Gas Explosion: 2014

Don’t Miss: Filing Bankruptcy In Milwaukee Wi

Pg& e: California Utility Firm Files For Bankruptcy After Deadly 2018 Wildfires

Company is facing hundreds of lawsuits from victims of recent fires and tens of billions of dollars in potential liabilities

Faced with potentially ruinous lawsuits over Californias recent wildfires, Pacific Gas & Electric Corp filed for bankruptcy protection Tuesday, in a move that could lead to higher bills for customers of the nations biggest utility and reduce the size of any payouts to fire victims.

The Chapter 11 filing allows PG& E to continue operating while it puts its books in order. But it was seen as a possible glimpse of the financial toll that could lie ahead because of global warming, which scientists say is leading to fiercer, more destructive blazes and longer fire seasons.

The bankruptcy could also jeopardize Californias ambitious program to switch entirely to renewable energy sources.

PG& E cited hundreds of lawsuits from victims of fires in 2017 and 2018 and tens of billions of dollars in potential liabilities when it announced earlier this month that it planned to file for bankruptcy.

The bankruptcy filing immediately puts the wildfire lawsuits on hold and consolidates them in bankruptcy court, where legal experts say victims will probably receive less money.

Theyre going to have to take some sort of haircut on their claims, said Jared Ellias, a bankruptcy attorney who teaches at the University of California, Hastings College of the Law. We dont know yet what that will be.

Collusion With Regulatory Agencies

In 2014, a California state government investigation revealed that some top executives of PG& E had been in regular communications with high-ranking officials at the state regulatory body California Public Utilities Commission for years. PG& E and also been allegedly “judge-shopping” during this time. PG& E Vice President of Regulatory Affairs Brian Cherry, Senior Vice President of Regulatory Affairs Tom Bottorff, and Vice President of Regulatory Proceedings Trina Horner were all fired after the email scandal was revealed.

Recommended Reading: Did Donald Trump Declare Bankruptcy

Pacific Gas And Electric Company

Pacific Gas and Electric Company| Type |

|---|

| 1905 117 years ago |

| Headquarters |

The Pacific Gas and Electric Company is an American investor-owned utility with publicly traded stock. The company is headquartered in the Pacific Gas & Electric Building, in San Francisco, California. PG& E provides natural gas and electricity to 5.2 million households in the northern two-thirds of California, from Bakersfield and northern Santa Barbara County, almost to the Oregon and Nevada state lines.:27

Overseen by the California Public Utilities Commission, PG& E is the leading subsidiary of the holding company PG& E Corporation, which has a of $3.242 billion as of January 16, 2019. PG& E was established on October 10, 1905 from the merger and consolidation of predecessor utility companies, and by 1984 was the United States’ “largest electric utility business”. PG& E is one of six regulated, investor-owned electric utilities in California the other five are PacifiCorp, Southern California Edison, San Diego Gas & Electric, Bear Valley Electric, and Liberty Utilities.

Net Energy Metering Likely Wont Be Impacted At All

Under Californias program, customers who generate excess electricity and send it to the grid are given a credit by PG& Eessentially, the company buys electricity from homeowners. While PG& E may be struggling financially, it is obligated by state law to cooperate in the NEM program.

Thus, homeowners should expect that they will continue to be compensated fairly for the electricity they generate, both in terms of NEM credits and net surplus compensation . The same is true of businesses and organizations that participate in the Self-Generation Incentive Program .

Recommended Reading: Taco Bell Filing Bankruptcy

Does The Debtor Have The Right To A Discharge Or Can Creditors Object To The Discharge

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtors discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge. To object to the debtors discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an adversary proceeding.

The court may deny a chapter 7 discharge for any of the reasons described in section 727 of the Bankruptcy Code, including failure to provide requested tax documents failure to complete a course on personal financial management transfer or concealment of property with intent to hinder, delay, or defraud creditors destruction or concealment of books or records perjury and other fraudulent acts failure to account for the loss of assets violation of a court order or an earlier discharge in an earlier case commenced within certain time frames before the date the petition was filed. If the issue of the debtors right to a discharge goes to trial, the objecting party has the burden of proving all the facts essential to the objection.

Nevada Early Voting Latino Turnout Controversy

On November 8, 2016, Trump filed a lawsuit claiming early voting polling places in Clark County, Nevada, were kept open too late. These precincts had high turnout of Latino voters. Nevada state law explicitly states that polls are to stay open to accommodate eligible voters in line at closing time. Hillary Clinton campaign advisor Neera Tanden says the Trump campaign is trying to suppress Latino voter turnout. A political analyst from Nevada, Jon Ralston tweeted that the Trump lawsuit is insane in a state that clearly allows the polls to remains open until everyone in line has voted. Former Nevada Secretary of StateRoss Miller, posted the statute that states voting must continue until those voters have voted. Miller said: If there are people in line waiting to vote at 7 pm, voting must continue until everyone votes. We still live in America, right?

Also Check: How Much Does It Cost To File Bankruptcy In Ky

Will A Judge Allow The Bankruptcy

PG& E says the fire liabilities from 2018 and 2017 will exceed $30B and are more than their insurance can provide. However, does that mean PG& E is not solvent? Wall Street Analysts have value PG& Es equity at $20B in December 2018 and it was still an investment grade company. Also, PG& E hasnt received any judgment against yet, it will be several years before the litigation is finished, and its likely that PG& E will settle their claim at a discount to face value. If PG& E can continue to operate properly profitability the next couple of years, they will have sufficient solvency to pay the claims.

Criminal History: The San Bruno Gas Explosion

Aside from hundreds of counts of negligence due to not cutting trees near power lines, PG& E was convicted of five felony counts of pipeline safety violations that led to the 2010 San Bruno Gas Explosion and one felony count of obstruction of justice for lying to officials.

Due to this conviction, the company was placed on probation until 2022, paid a $3 million fine, and served 10,000 hours of community service.

You May Like: Certified Bankruptcy Petition Preparer

A Tactic Not A Necessity

Nettie Hoge, executive director of The Utility Reform Network in San Francisco, speculated that PG& E may be attempting to pressure the governor to come through with a more generous bailout package.

This is not a necessity, she said. Its just a tactic.

Trading in PG& Es stock was halted before yesterdays announcement. When trading resumed in the final hour of the session, PG& Es share price plunged almost 37 percent to close at $7.20.

Shares of Edison International, parent company of Southern California Edison Co., also tumbled on the news, shedding almost 35 percent to close at $8.25.

Nevertheless, Edison CEO John Bryson said he does not expect PG& Es bankruptcy to affect his utilitys parallel bailout negotiations with Sacramento.

We at Southern California Edison continue to believe that working out a comprehensive solution to our current crisis is a preferable course to take, he said. PG& Es decision does not change our position.

Edison tentatively has agreed to sell its power lines to the state for about $2.8 billion. Similar talks with PG& E have dragged on for months, with little if any progress.

Read Also: What Is Epiq Bankruptcy Solutions Llc