Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Also Check: Are Mortgage Discount Points Worth It

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

Also note that mortgage insurance premiums are included in these figures.

Read Also: Does Rocket Mortgage Service Their Own Loans

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

Read Also: Did Boy Scouts File For Bankruptcy

Have A Low Dti And Are Ready To Apply For A Loan In Kansas Or Missouri

Since 1997, Metropolitan Mortgage has been helping countless buyers secure the mortgage products they need to help finance such a large purchase. With various mortgage programs offered, we are the number one mortgage resource for borrowers in Missouri, and the rest of the Midwest region, including Kansas and Missouri. We have been a family-run business since 1997 and work hard to help borrowers realize their dreams of buying a home. Contact us today if you have questions about applying for a mortgage.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Also Check: How Many Times Has Bloomberg Filed For Bankruptcy

How Can You Improve Your Debt

Fortunately, there are a handful of ways you can lower your debt-to-income ratio if its not as good as youd like it to be.

Lowering your debt-to-income ratio comes down to one of two things: Making more money, lowering your debt, or a combination of both, Rosa said.

Below are a handful of ways you can improve your DTI:

Now that you know what a good debt-to-income ratio is, you can take steps to improve it before applying for new credit. Pushing your DTI in the right direction can help you ensure youll not only secure a loan, but youll get one with optimal terms.

What Should You Do To Make Sure Your Dti Ratio Doesnt Derail Your Mortgage Application

Although a lower DTI is better, some lenders are more flexible than others. In fact, you may be able to find loan options with a DTI as high as 50% in some cases. If you have a high ratio, youll need to shop around more carefully to find a lender willing to work with you.

Another option may be to pay off debt. If youre able to reduce what you owe and eliminate some debts or lower your monthly payments, you should hopefully be able to get your DTI to a level that makes you a more competitive borrower.

Since this can also help your , you may just find that youre offered a much better deal on a mortgage if you work to pay down some of your debt before applying for one. The savings on interest over time can be considerable, so its worth working on debt paydown if you can.

Read Also: How Do I Get A Mortgage Statement

Don’t Miss: Can You File Bankruptcy On Hospital Bills

Save More Money For Your Down Payment

Mortgage lenders will be more willing to work with you if you can come up with more money for the down payment. This money can be used directly as a down payment to lower the mortgage principal, or you could use it to buy points, which lowers your interest rate and thereby your monthly mortgage payment.

Try using the Lower.com app. In the app, we match the first $500 you save in your HomeFund Account for the down payment on your house, plus additional milestone rewards, making it easy to set up and monitor the progress youâre making toward buying your home. Plus, your high-yield savings account pays 0.75 percent APY interest, the best rate around for savings accounts.

We also let you track your credit score and shop around for the best mortgage rates. This way, when youâre ready to make the move, you know your finances will be good to go, too.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Read Also: California Bankruptcy Exemptions 2021

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

Recommended Reading: Does Bankruptcy Clear All Debt Canada

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

What Is Front End Dti

The front-end DTI ratio, also known as the housing ratio is the maximum acceptable percentage of your monthly gross income that can be spent on total housing costs every month.

These housing costs consist of mortgage loan repayments , homeowners insurance, and property taxes.

These costs may also include possible housing-related expenses such as homeowner association fees, flood insurance, and private mortgage insurance.

Even if you pay some of these expenses every year or every six months, the lender will calculate their monthly cost and include them in the debt portion of your debt-to-income ratio.

Recommended Reading: How Many Points Does A Bankruptcy Affect Your Credit Score

What Can I Do As A Borrower

To prepare for your home loan application, its usually best you cut out or at least reduce unused debt facilities.

For example, if you have a $2,000 limit on your credit card but find that you rarely use this amount per month, consider cancelling it.

Another example is expenses that arent vital and can be easily cut from your spending such as entertainment subscriptions, going to the pub, gym memberships, going to music festivals or sporting events, or simply eating take-away on a regular basis.

Please call us on 1300 889 743 or fill in our and we can weigh up your home loan options.

There are lenders out there that dont apply debt to income ratios caps.

If Youre Applying For A Mortgage There Are Two Types Of Debt

If youre in the market for a mortgage, you should also consider front and back end debt-to-income ratios. When youre applying for a mortgage, lenders will likely look at debt-to-income ratio in two ways.

- The front-end ratio is used to determine if you can repay your mortgage. A front-end DTI ratio includes your projected monthly mortgage payment, insurance, property taxes, homeowners association fees, but does not include other monthly expenses like student loans or credit card debt. You should only have to worry about your front-end ratio when youre applying for a mortgage.

- The back-end ratio is an overall measure of debt compared to your income. It includes all of your monthly debts, like credit cards and student loan debt, in addition to any household payments. As such, this number tends to be higher than front-end ratios, but it is the more common measure of your DTI.

Also Check: Which Mortgage Lenders Use Transunion

You May Like: How To File Bankruptcy Chapter 13

How To Calculate Your Debt

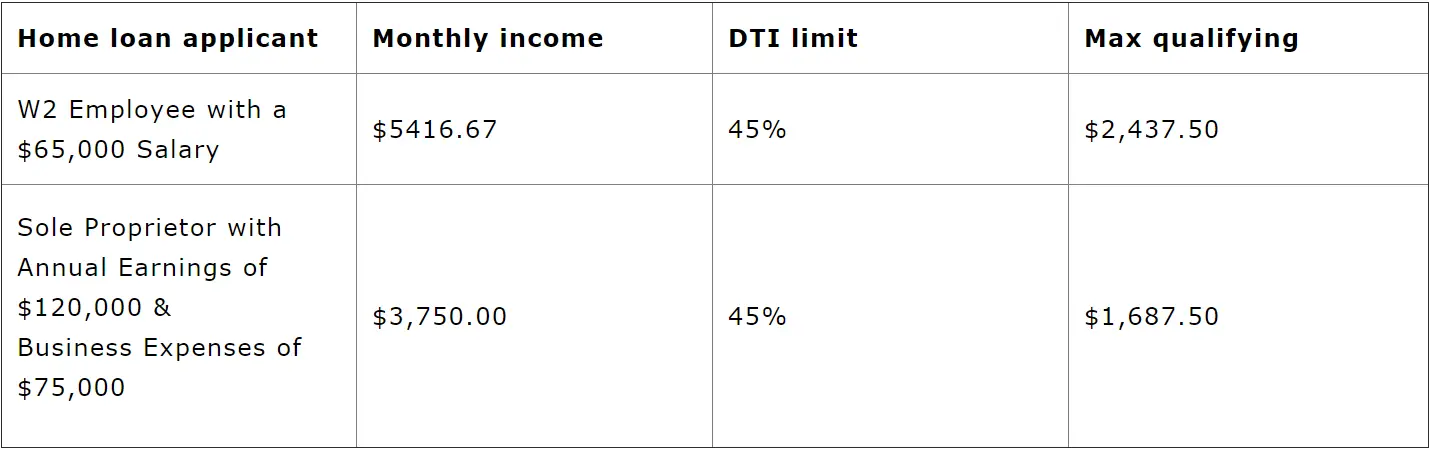

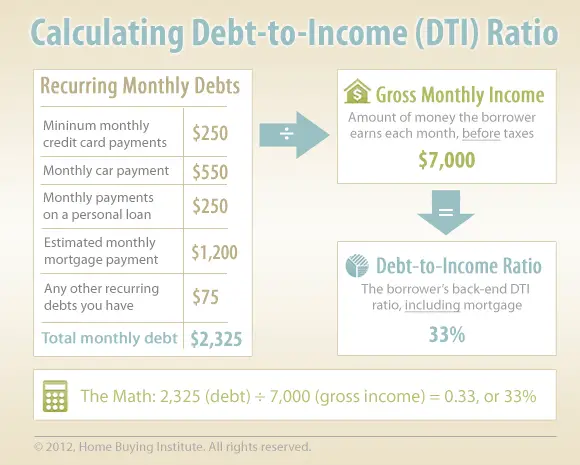

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

Guidelines For An Affordable Mortgage

Everybody wants an affordable mortgage that leaves them enough money each month to enjoy life to the fullest while paying off their home.

The following tips will help you acquire an affordable mortgage:

1. Keep Monthly Costs Below 42% of Your Income: Keep all credit cards, loans, home insurance costs, bank obligations, mortgage principal, and interest lower than 42% of your gross income.

2. Understand the Benefits of 5% Down Payments: If you have 5% to put down on a property, some lenders will give you mortgages with no closing costs. However, you must make sure you can truly afford this deposit. First-time homebuyers who cant afford a large down payment but would otherwise qualify for a home loan may be eligible for a 3% down payment mortgage.

3. Plan Ahead for Future Maintenance: Consider monthly maintenance costs and factor these into your budget.

4. Dont Be Greedy: Loan approvals arent always perfect for your circumstances. Weigh your financial situation before agreeing to something that you cant afford.

5. Factor in all Expenses: Remember to work out moving expenses, home inspections, appraisal fees, utilities, furniture, and temporary storage.

Buying a new home is an exciting process. However, you must do the math and figure out what percentage of income will be saved for your mortgage while still living comfortably. Luckily, we can help. If youre buying a new home, we can help get you pre-approved and funded for a super-fast loan.

Don’t Miss: Do Medical Bills Go Away With Bankruptcy

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

How Student Debt Affects Dti For Fha Loans

If youre a first-time homebuyer with student loan debt, the great news is its going to get a lot easier to qualify for an FHA loan.

An FHA loan is a type of mortgage backed by the Federal Housing Administration . To qualify for an FHA loan, you generally must have a FICO score of at least 580 and a debt-to-income ratio of 43% or less, including student loans.

Under the old FHA lending guidelines, 1% of your student loan balance goes toward your DTI. If your student loan balance is $100,000, that means $1,000 goes toward shop around and compare home loans to find the best option for your situation.

Dont Miss: Does Chase Allow Mortgage Recast

Read Also: Where To Buy A Car After Bankruptcy

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

What Is The Maximum Dti For Va Loan

The VA doesn’t set a maximum DTI ratio but does provide lenders with the guidance to place additional financial scrutiny on borrowers with a DTI ratio greater than 41%.

The VA views the DTI ratio as a guide to help lenders, and it doesn’t set a maximum ratio that borrowers must stay under. But the VA doesn’t make home loans, and mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrower’s credit, finances and more.

Also Check: How Does Bankruptcy Affect Your Credit Rating

Your Idr Payment Calculation May Differ Depending On The Loan Program

When you apply for a mortgage, lenders consider your debt-to-income ratio to determine if and how much you can borrow. If you’re making student loan payments, those payments affect your DTI.

When it comes to paying back your student loan debt, you have a choice of different repayment plans. Some of your options include income-driven repayment plans that base the amount of your payments on a percentage of your income. Heres what you need to know about your IDR plan and the way it impacts your DTI and mortgage eligibility.