Try A More Forgiving Program

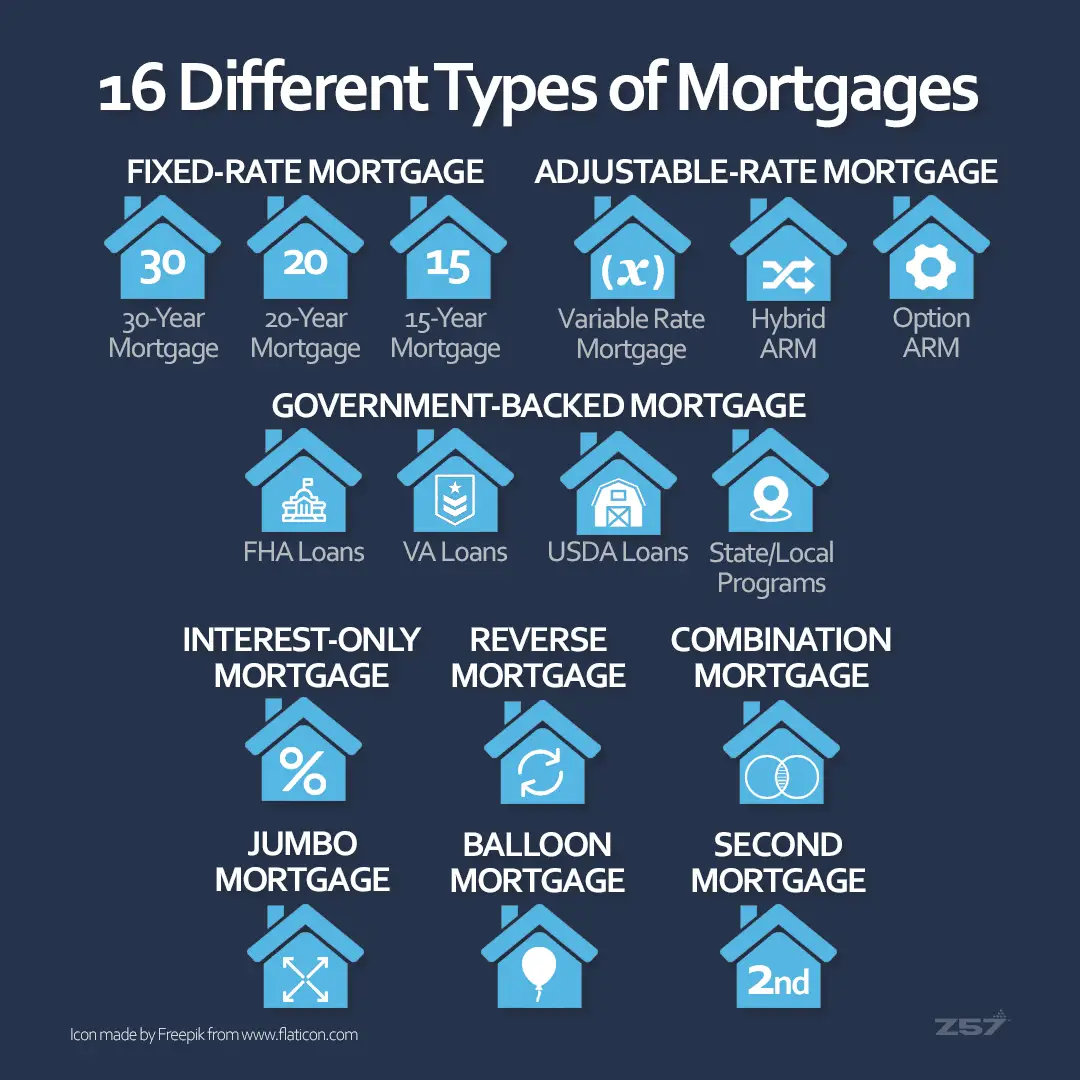

Different programs come with varying DTI limits. For example, Fannie Mae sets its maximum DTI at 36 percent for those with smaller down payments and lower credit scores. Forty-five is often the limit for those with higher down payments or credit scores.

FHA loans, on the other hand, allow a DTI of up to 50 percent in some cases, and your credit does not have to be top-notch.

Likewise, USDA loans are designed to promote homeownership in rural areas places where income might be lower than highly populated employment centers.

Perhaps the most lenient of all are VA loans, which is zero-down financing reserved for current and former military service members. DTI for these loans can be quite high, if justified by a high level of residual income. If youre fortunate enough to be eligible, a VA loan is likely the best option for high-debt borrowers.

Why Does Dti Matter

As mentioned above, DTI is one of the factors mortgage lenders look at when deciding whether or not a borrower is eligible for a loan. DTI gives lenders a pretty clear picture of exactly how much additional debt a borrowers budget has room for.

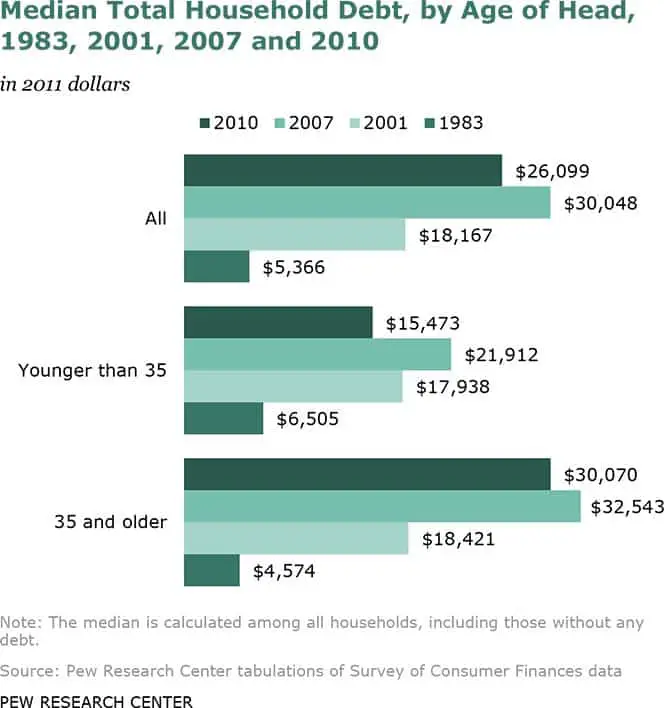

Debt-to-income can be a frustrating metric for would-be homebuyers especially young ones still getting financially established as it can preclude even those with high incomes and good credit histories from getting approved for mortgage loans.

However, DTI is only one measure lenders use to qualify borrowers, and certain programs do offer mortgages to borrowers with higher debt-to-income ratios.

How High Dti Affects Debt Consolidation

Mortgage lenders generally offer the best terms to borrowers with a DTI below 43%. You can still get a mortgage with up to a 50% DTI, but the interest and other costs will likely be higher.

Unsecured personal debt consolidation loans have tighter DTI limits. It generally takes a DTI of 36% or less to get the best interest rates and other terms. Many lenders wonât loan to borrowers whose DTIs are over 43% at all.

Even if approved, a high-DTI borrower may have to pay more interest on a debt consolidation loan than for the loans being consolidated. This can make a debt consolidation loan a much less attractive tool for managing debt.

Recommended Reading: How Does Filing For Bankruptcy Help You

Calculating Income For A Mortgage Approval

Mortgage lenders calculate income a little bit differently than you may expect. Theres more than just the take-home pay to consider, for example.

Lenders also perform special math for bonus income give credit for certain itemized tax deductions and apply specific guidelines to part-time work.

The simplest income calculations apply to W-2 employees who receive no bonus and make no itemized deductions.

For W-2 employees, the lender will typically look at your pay stubs and use the year-to-date average to determine your gross income and your monthly household income.

Which Lenders Offer The Lowest Mortgage Rates

The truth is no mortgage lender has a clear edge when it comes to mortgage rates. Each has its own specific methods for calculating which rates to charge which borrowers, so the lender with the best rate for one person might not have the best offer for another. It really depends on individual circumstances.

This is why its so important to look into a variety of lenders and see what they can offer you. Using tools, such as our rate comparison tool, can help you compare mortgage rates for your specific situation and give you a good idea of what rates you may qualify for. You can also get ahead by checking your credit score before you apply for a mortgage, to better understand your financial standing.

Recommended Reading: How Many Years After Bankruptcy Can You Buy A Home

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

How Can I Lower My Debt

If you do need to lower your debt-to-income ratio in order to qualify for a mortgage loan, there are many ways to do so!

The most obvious answer is to work on paying down your debts, but approaching this project strategically can help you lower your debt-to-income ratio faster. Our debt related calculators may help you develop a plan.

Because every lenders parameters are different, its best to talk to your lender specifically to see what they require from their borrowers and how you might be able to shift your finances around to meet their eligibility needs. For instance, a lender might be willing to drop an installment loan from your ratio calculation if you can pay it down sufficiently up-front, even if there are some payments left. A lender may also be able to give you specific advice about which debts to focus on first.

Quontic is one of only 3% of U.S. banks bearing a CDFI certification. That shows were committed to providing financial services to underserved communities and one of the most important ways we do so is by offering a wide range of mortgage loans, including Community Development Loans that require little income verification to qualify.*

Additionally, we offer interest-bearing checking and savings accounts that can help you put your money to work. After all, you already work hard enough.

You May Like: Amazon Liquidation Pallets San Antonio

Getting A Mortgage With A High

Are you considering buying a home but arent sure if its possible with your student loan, car payment or other debts? Getting a mortgage with existing debt or a high debt-to-income ratio can seem challenging, but there are ways to secure a mortgage even if you have other debts. While lenders look at more than just your debt when determining if you qualify for a home loan, your debt-to-income ratio plays a significant role in whether youre ready for a mortgage.1 Learn how to calculate this ratio, why its so important, and the steps you can take to get your finances in order for future homeownership. These will help you determine what you qualify for if you feel that your debt might be an issue.

Mortgage With High Debt May Not Be Best Plan

You might find a lender that will approve you for a mortgage when your debt-to-income ratio is high. But that doesn’t mean that adding a monthly mortgage payment to your existing debt load is a smart move.

“If more than 50% of your pre-tax income is going to debt before you pay for groceries, entertainment, transportation and travel expenses, then I would consider paying down your debt before applying for a mortgage to buy a house,” says Elysia Stobbe, branch manager with Linthicum, Maryland-based NFM Lending.

If you don’t? Stobbe says you’ll be house-rich but cash-poor. This means that while you might be able to afford your mortgage payment each month, you won’t have enough leftover cash to pay for repairs for your house or furnishings. You might not be able to save for retirement or even afford all your groceries for the month. This could cause you to run up credit card debt as you struggle to pay for daily living expenses.

Related: How Much House Can I Afford? More Than You Think

Also Check: What Are The Alternatives To Bankruptcy

Pay Off The Loans You Have

If you can, try to double or triple up on your loan payments to get rid of them faster. If you have credit card balances, the more you pay off, the lower your balance will be. The lower your balance on your credit cards, the lower your monthly payments will be which will directly affect your debt-to-income ratio.

High Dti Mortgage Lenders

If you are buying a home or looking to refinance, the first thing you need to determine is whether you will be able to qualify based upon your current income level. For a conventional loan, you must make enough so your back-end DTI ratio does not exceed 43%.

I will take you through the basic income requirements, so you know how much is needed to qualify for a mortgage. I will explain which programs and options exist if you need a lender who will allow for higher DTI ratio. Then, I will review the optimal payment and mortgage scenario for wealth building. First an education on how it is all calculated.

Don’t Miss: Can You File Bankruptcy After Being Served

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Read Also: House Up For Auction

What Is The Difference Between Front

Youll sometimes see a lender express maximum DTI ratios in pairs, such as 29%/41%. This is because theyre expressing two separate figures: front-end DTI and back-end DTI.

Front-end DTI is calculated using only housing-related debts and expenses, such as your mortgage, property taxes, and homeowners insurance.

Back-end DTI is calculated using all of your monthly debt repayments, including housing and the others listed above, and is also the number most often used by lenders to assess your eligibility. For the purposes of this article, all the specific debt-to-income ratios well mention are back-end DTI.

Tips For Getting A Mortgage

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, a financial advisor can help you create a financial plan to invest for the future. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

You May Like: Does Filing For Bankruptcy Affect Credit

Explore Other Options To Lower Your Payments

Reducing your monthly payments can help improve your DTI, and refinancing may be one way you can do that. For example, you might be able to substantially lower your required monthly payments if you refinance a bunch of high-interest debt into a low-interest personal loan. In this case, while your total debt balance won’t change, your new monthly payment will be lower.

Some mortgage lenders may still disqualify you based on your total loan balance, or based on the fact you recently applied for new credit, so ask your lender how they’d view this action.

Of course, you may decide it makes sense to do it anyway, even if it doesn’t immediately enable you to get a mortgage loan. After all, who doesn’t want to lower their monthly payments? Just be sure you don’t lengthen your repayment timeline so much that you also raise your total interest costs.

What Is A High Dti Anyway

Your debt-to-income ratio equals your debt payments divided by your gross income.

There are two measures of DTI — the first is a front-end or top-end ratio. It is the total of your monthly mortgage, property taxes and property insurance payments divided by your gross monthly income.

If you earn $8,000 per month and your mortgage principal, interest, taxes and insurance equals $2,000 per month, your front-end ratio is 25%. That’s $2,000 / $8,000.

The second measure is more important. It’s called the back-end or bottom-end ratio. The back-end ratio adds your other monthly payments to the mix — minimums on credit cards, auto loans, student loans and the like. it does not include living expenses like food and utilities.

So if your other loan payments total $1,000, your back end ratio is / $8,000. That’s 37.5%. When lenders just say “DTI” or “debt-to-income ratio,” they are referring to the back-end ratio. That’s the key number for most mortgage programs.

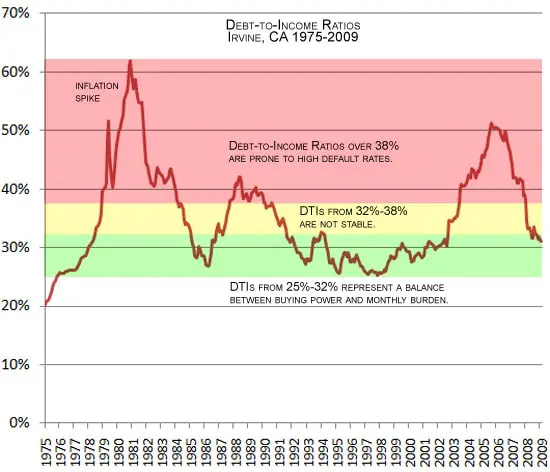

What is a high DTI? Generally, programs get a little more restrictive for DTIs over 36%. You might need a better credit score or bigger down payment to qualify. But most programs will allow a high DTI — as high as 43% for a well-qualified applicant. And some will let you go as high as 50% with the right compensating factors.

Related: How to Get Preapproved for a Mortgage

Recommended Reading: What Do You Lose When You File For Bankruptcy

Over $23 Billion Of Mortgage Funded In History Working With You

Matrix Mortgage Global mortgage agents and brokers understand the significance of responsible borrowing and lending. Unfortunately, it was an expensive lesson many learned from the Global Financial Crisis in 2008 that happened because irresponsible mortgage lending qualifications were unchecked.

Enjoy the peace of mind from knowing that you are working with someone who has a deep understanding of the mortgage industry and will work smart to get you the best possible deal.

What Is The Debt

The specific DTI required to qualify for a mortgage depends on the mortgage lender, as well as other financial markers like down payment amount and credit score.

For instance, Fannie Mae, which sets the standards for conventional loans, sets a maximum DTI of 36%, though it can go up to 45% for those with higher down payments and/or better credit scores.

Government-subsidized loans, on the other hand, such as FHA, USDA and VA loans, generally offer more lenient DTI maximums. For USDA loans, the maximum DTI is 41% for FHA loans, its 43% , and VA loans dont carry a specific maximum DTI, but requires additional financial scrutiny for those whose ratio is above 41%.

Recommended Reading: What Is Debt To Income Ration

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

What Is A Good Dti Ratio For A Personal Loan

To understand how lenders view a good DTI for a personal loan, its useful to first learn how DTI ratio figures into mortgages. There are two types of DTI in the mortgage market:

Although the exact definition of a good DTI ratio varies with each personal loan provider, its a good bet that the 36% value is key.

However, mortgages are secured, and personal loans are not. It stands to reason that a provider of unsecured personal loans would consider only a lower DTI ratio to be good since the lender assumes more risk when a loan is not collateralized.

Therefore, a good DTI ratio for a personal loan is probably 15% or less.

You May Like: Wholesale Lots For Sale

Scale Down The Amount You Need To Borrow

Finally, if you reduce the amount you want to borrow on your home loan, you’ll also lower your monthly debt obligations. This could bring your DTI below the permissible level and allow you to get approved. You could do this by either buying a less expensive home or making a larger down payment so you don’t have to borrow as much.

You should also rate shop carefully among mortgage lenders. If you can find a lender with a lower interest rate, you’d also lower your monthly payment and potentially bring your DTI to an allowable level.

Stacie Killgore October 23 2021

OMG there are no words to express my gratitude for what you have done for me and my family. I wasnt sure you were even going to be able to help me but I gave a shot and I am sooooo grateful I found you. Anyone in need of a dedicated loan officer and team this is the place. Thank you guys so much. I will always be in debt to you. PD: Joan, Mark says the BBQ is coming soon!!! LOL

Read Also: Can You File Bankruptcy Separate From Your Spouse