Dti Limits Used In Qualifying Borrowers

Conforming loans

In the United States, for conforming loans, the following limits are currently typical:

- Conventional financing limits are typically 28/36 for manually underwritten loans. The maximum can be exceeded up to 45% if the borrower meets additional credit score and reserve requirements.

- FHA limits are currently 31/43. When using the FHA’s Energy Efficient Mortgage program, however, the “stretch ratios” of 33/45 are used

- VA loan limits are only calculated with one DTI of 41.

Nonconforming loans

Back ratio limits up to 55 became common for nonconforming loans in the 2000s, as the financial industry experimented with looser credit, with innovative terms and mechanisms, fueled by a real estate bubble. The mortgage business underwent a shift as the traditional mortgage banking industry was shadowed by an infusion of lending from the shadow banking system that eventually rivaled the size of the conventional financing sector. The subprime mortgage crisis produced a that revised these limits downward again for many borrowers, reflecting a predictable tightening of credit after the laxness of the . Creative financing still exists, but nowadays is granted with tighter, more sensible qualification of customers.

Historical limits

Work On Paying Down Debt

Paying off loans and bringing down debt balances can improve your debt-to-income ratio. To free up cash flow you can use to pay down your debt faster, give your budget a second look.

You may find ways to cut down on monthly expenses such as by:

- Shopping for a lower-cost cell phone plan

- Reducing how often you get food delivery or takeout

- Canceling streaming services you no longer use

When deciding which debt to pay down first, borrowers often use one of two strategies. The debt avalanche method involves targeting your highest-interest debt first, while continuing to make minimum payments on all other debts. This strategy helps you save money on interest over time. The other method, debt snowball, has borrowers focus on the debt with the lowest balance first, while keeping up with the minimum payments on other debts. It helps borrowers stay motivated by giving them small wins on their path to getting out of debt.

If youre unsure how to approach your debt, you could sign up for free or low-cost debt counseling with a certified credit counselor. These professionals can provide personalized financial advice, help you create a budget and provide useful tools that can teach you about money management. You can search for a certified credit counselor through the Financial Counseling Association of America or the National Foundation for Credit Counseling .

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

You May Like: How To Declare Bankruptcy For Student Loans

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Read Also: Where To File Bankruptcy In Indiana

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt ratio means.

Read Also: How To File Bankruptcy Without A Lawyer In Mississippi

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

A High Dti May Make It Difficult To Juggle Bills

Spending a high percentage of your monthly income on debt payments can make it difficult to make ends meet. A debt-to-income ratio of 35% or less usually means you have manageable monthly debt payments. Debt can be harder to manage if your DTI ratio falls between 36% and 49%.

Juggling bills can become a major challenge if debt repayments eat up more than 50% of your gross monthly income. For example, if 65% of your paycheck is going toward student debt, credit card bills and a personal loan, there might not be much left in your budget to put into savings or weather an emergency, like an unexpected medical bill or major car repair.

One financial hiccup could put you behind on your minimum payments, causing you to rack up late fees and potentially put you deeper in debt. Those issues may ultimately impact your credit score and worsen your financial situation.

Don’t Miss: Will My Spouse’s Bankruptcy Affect Me

It Provides A Snapshot Of Your Overall Financial Health

If your DTI ratio is below 36%, its a pretty good indicator that youre able to take on and manage new debt responsibly. If your DTI is over 43%and particularly if its over 50%youll likely need to pay down some debt or find other sources of income before lenders will approve you for a mortgage or personal loan.

Should You Apply For A Mortgage With A High Dti

The average non-mortgage debt per person in 2021 was $25,112, according to a report by the credit bureau Experian. Unfortunately, these high debt balances can make it more difficult to qualify for a mortgage. You might find yourself wondering if its worth applying for a mortgage with a DTI thats near the top of your lenders allowed range.

First, know that theres little harm in simply applying for preapproval to see if you might qualify for a loan and how much you might qualify for. While there will be a hard inquiry on your that might lower your credit score by a few points, it can provide you with some valuable information.

Next, consider what your monthly budget would look like with a mortgage payment. The DTI requirements are there to reduce the risk for the lender, but they also help protect you as the borrower from getting in over your head.

You dont want to stretch yourself too thin and become house poor, which is when you buy as much home as possible, and then it takes up a majority of your income each month and youre penny-pinching or cant save for other goals, says Brittney Castro, the in-house CFP for the financial planning app Mint and the founder and CEO of Financially Wise.

Recommended Reading: How Much Money Can You Have When Filing Bankruptcy

It Works In Tandem With Your Credit Score

Though your DTI does not directly impact your credit score, it is closely associated with your credit utilization. If your DTI ratio and your ratio are both low, youll have a better chance of being approved for loans. Keep in mind: most lenders do not advertise maximum debt-to-income ratios, but instead provide guidelines that offer some flexibility. For example, a common guideline is the 28/36 rule used by some lenders to assess borrowing capacity. According to this rule, a household should only spend 27% of its gross monthly income on housing expenses, and no more than 36% on debt expenseslike car payments and credit cards.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Recommended Reading: How Many Years After Bankruptcy To Buy A House

What Is The Ideal Debt To Income Ratio To Get A Personal Loan

A Debt-Income ratio of 21% – 35% is considered a very good ratio.

You are considered to be in a good financial condition when your debt-income ratio is between 20-35% and may find it easy to get a personal loan. If your debt-income ratio is between 35%-60%, there is a chance that your loan may get approved, but at a higher rate of interest. Applicants whose debt-income ratio is higher than 60% may find it very difficult to get a loan.

Please note that debt-income ratio is only one of the eligibility criteria for a personal loan. Your loan approval will also depend on a number of other factors. To know more, please check our personal loan eligibility criteria.

Must Read:What is Minimum Salary Required For a Personal Loan?

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Read Also: Can You Keep Your Car When You File Bankruptcy

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Tips For Getting A Mortgage

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, consider hiring a financial advisor who can help you plan and invest for the future. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

Also Check: How To Build My Credit After Bankruptcy

Lowering Your Businesss Debt

- In what areas could money be saved? Talk to vendors to brainstorm ideas.

- Are there ways to buy in bulk to reduce costs?

- How can your business tweak its purchasing so that extra inventory and supplies dont sit on the shelves?

- What are the interest rates on your businesss loans? Are they good rates?

- If your business sells multiple products, which ones are selling the best?

- Which ones have the best margins ?

- What is the standard margin for the industry?

- What combination of price raising and cost lowering can get your margin to the sweet spot? How does this position your business and its pricing against its competitors?

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

Read Also: Can You Rent With A Bankruptcy

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

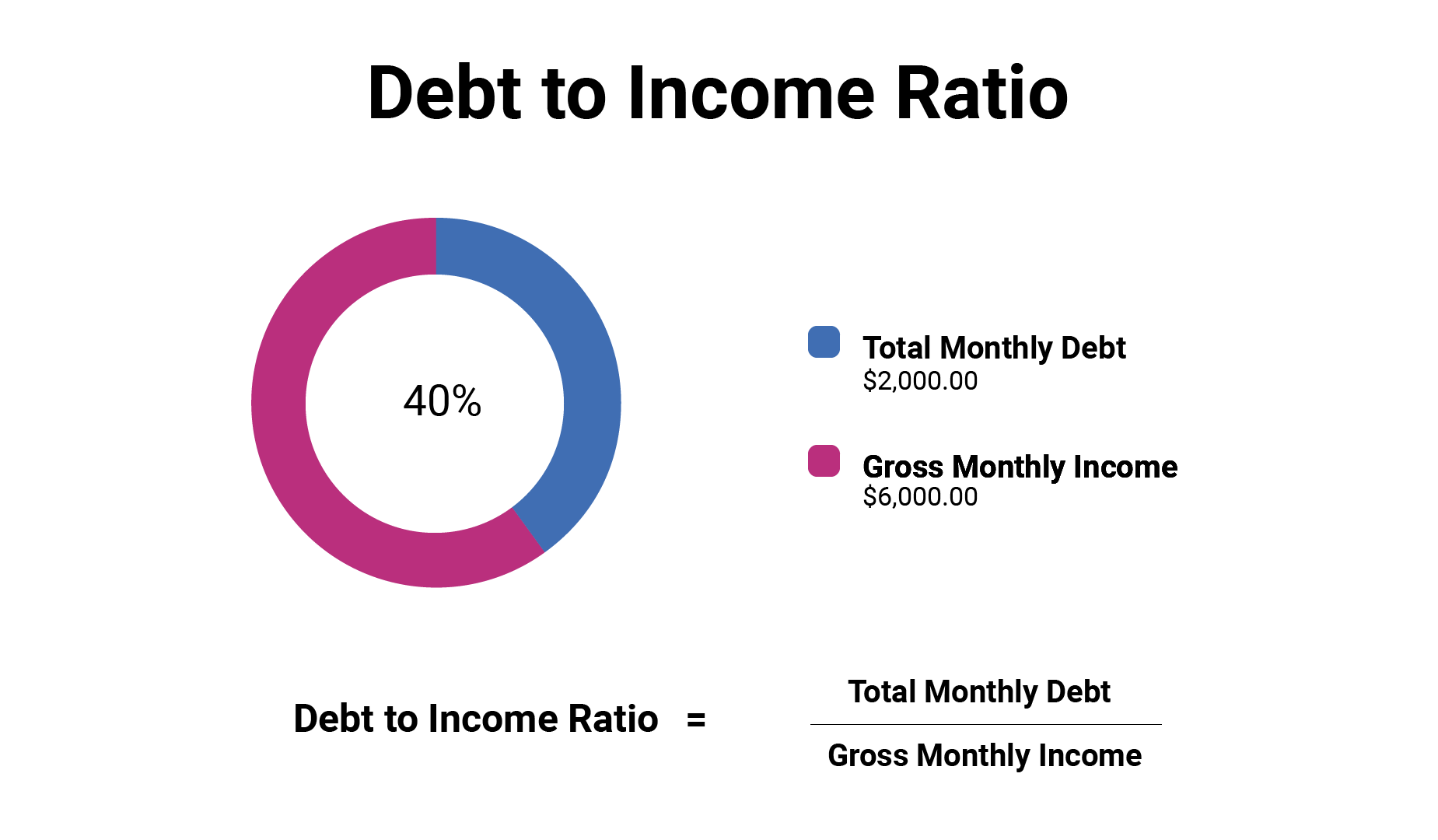

How Do You Calculate Your Debt

Now that you know what a debt-to-income ratio is, how do you go about calculating it? Thankfully, it is a fairly simple process and shouldnt take you that long at all to figure out. It is calculated by dividing the debt payments you make each month by how much money you make each month, the number is normally presented as a percentage.

For example, if you make $4,000 a month and have debt that includes a $1,000 mortgage payment and a $500 car loan payment, you will have a debt-to-income ratio of 37.5%. So, the calculation we made for that was $1,500 divided by $4,000 . We got .375, and then we turn that number into a percentage and get 37.5%!

But the question you are probably asking is what does that number mean? If you have a low DTI ratio, you have a good balance between debt and income and are in no real danger of not being able to keep up with your debt, even if an emergency comes up. However, if you have one that is high, it can sometimes signal that you are carrying too much debt for how much money you are making. Also, having a high DTI ratio can simply make it hard for you to pay bills every month with so much of your income going to your debt payments.

Is your car loan payment worth more than your car? Heres what to do.

What is a Good Debt-to-Income Ratio?

Interested in getting serious about paying down your debt? Check out this infographic.

Read Also: Do Bankruptcies Show Up On Background Checks