What Was The National Debt After The Revolutionary War

Shortly after the American Revolutionary War , public debt grew to more than $75 million and continued to swell considerably over the next four decades to nearly $120 million. However, President Andrew Jackson shrank that debt to zero in 1835.

How much was the national debt in 1791?

He said, A national debt, if it is not excessive, will be to us a national blessing.. By 1791, he estimated the federal governments debt to be $77.1 million. To help raise money, federal bonds were issued by the Government. 1775 Paying for the American Revolutionary War was the start of the countrys debt.

Facts About The National Debt

Congressional leaders and the White House recently agreed on a two-year spending deal that would raise the national debt limit. The deal, which still must be approved by the full Congress, would increase federal spending and suspend the debt ceiling until after the 2020 presidential election.

With federal spending and debt back in the news, its a good time for an update of our primer on the U.S. national debt, the debt limit and interest payments on the nations credit line:

1The federal governments total debt stands at $22.023 trillion as of the end of June, according to the Treasury Departments monthly reckoning. Of this amount, nearly $22 trillion is subject to the statutory debt ceiling, leaving just $25 million in unused debt capacity.

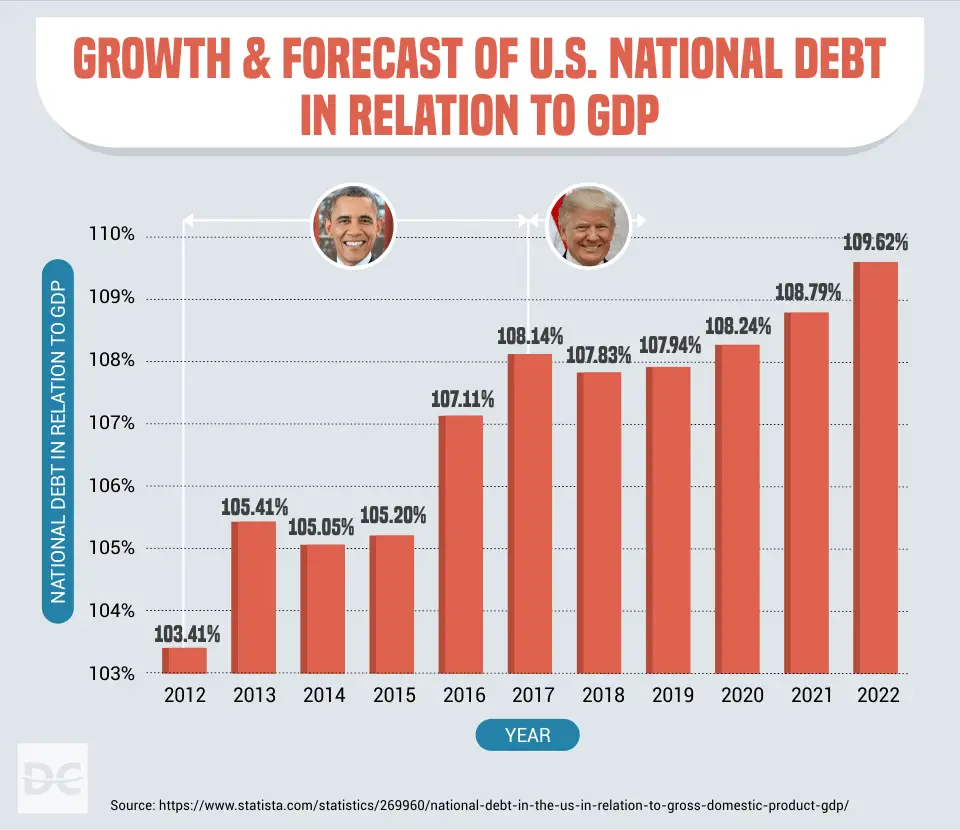

2The nations debt is now bigger than its gross domestic product, which was an estimated $21.06 trillion in the first quarter of 2019. Debt as a share of GDP grew throughout the 1980s and early 1990s, then leveled off before rising steeply during and after the 2008 financial crisis. The overall debt load has just about equaled or exceeded GDP since late 2012, which had not previously been the case since the end of World War II.

Note: This is an update to a post originally published on Oct. 9, 2013.

Job No : Fund The Government

Rather than pass a dozen funding bills in turn, lawmakers are poised to roll all the spending bills for the massive federal government into one bill that could approach or exceed $1.5 trillion.

The problem is that theyre still negotiating, and Republicans and Democrats in the Senate have not reached an agreement on how much the government can spend, much less the specifics. Theyre still $26 billion apart, according to Republican Sen. Richard Shelby of Alabama. The most likely current scenario is the House and Senate each pass short-term, one-week funding bills to keep the lights on while they continue to hash out the larger funding bill.

While officials have emphasized a government shutdown is unlikely, federal agencies have been warned to prepare for one per standard procedure.

One major looming question is whether Senate Republicans and Democrats can agree on a bill to fund the government for a full year or whether they have to punt to the next Congress. Democrats will want to avoid that fate since the GOP-controlled House will likely insist on spending cuts as soon as it can. Read more in CNNs full report that includes reporting from Capitol Hill and the White House.

Don’t Miss: Should I File For Bankruptcies

Bad Information On Debt Relief

Cody Hounanian, executive director of the Los Angeles-based Student Debt Crisis Center, said the mobilization effort is needed because information gaps could harm borrowers if they dont file the required online application. Some borrowers, he said, didnt see an application immediately when the program was announced Aug. 24 and now are unsure what to expect.

Hounanian said older borrowers, in particular, could be at risk if theyre not willing or able to complete the online application when it becomes available.

You can sign up to receive updates at www.ed.gov/subscriptions. Youd provide an email address to the U.S. Department of Education and click on the top box NEW!! Federal Student Loan Borrower Updates.

Others will try to get the word out too. Farmington Hills-based GreenPath Financial Wellness is hosting a free webinar from 8 p.m. to 8:30 p.m. on Oct. 6 called Student Loan Forgiveness what you need to know

To register online to attend, see

Another issue: Some social media sites, Hounanian said, are spreading misinformation, particularly targeting Black and Brown borrowers, wrongly suggesting that they should avoid applying because the forgiveness program is simply a way for the government to collect more taxes.

There may be some reason for confusion, but experts say borrowers should still apply for debt relief.

Read Also: How Do You Say Bankruptcy In Spanish

Figure Out Who Will Be In Charge

Its not yet clear who will lead Republicans in the House next year, much less how they would react to an immediate funding fight if only a short-term spending bill can get through by January.

The current GOP leader, Kevin McCarthy, does not yet have the votes of many of the most conservative Freedom Caucus Republicans, and hes being encouraged to take more concrete stands against spending. Finding a funding agreement that can pass through the House and the Senate and get President Joe Bidens signature gets much more difficult starting January 3.

Read Also: Us Bankruptcy Court District Of Delaware

What Is Intragovernmental Debt How Big Is It

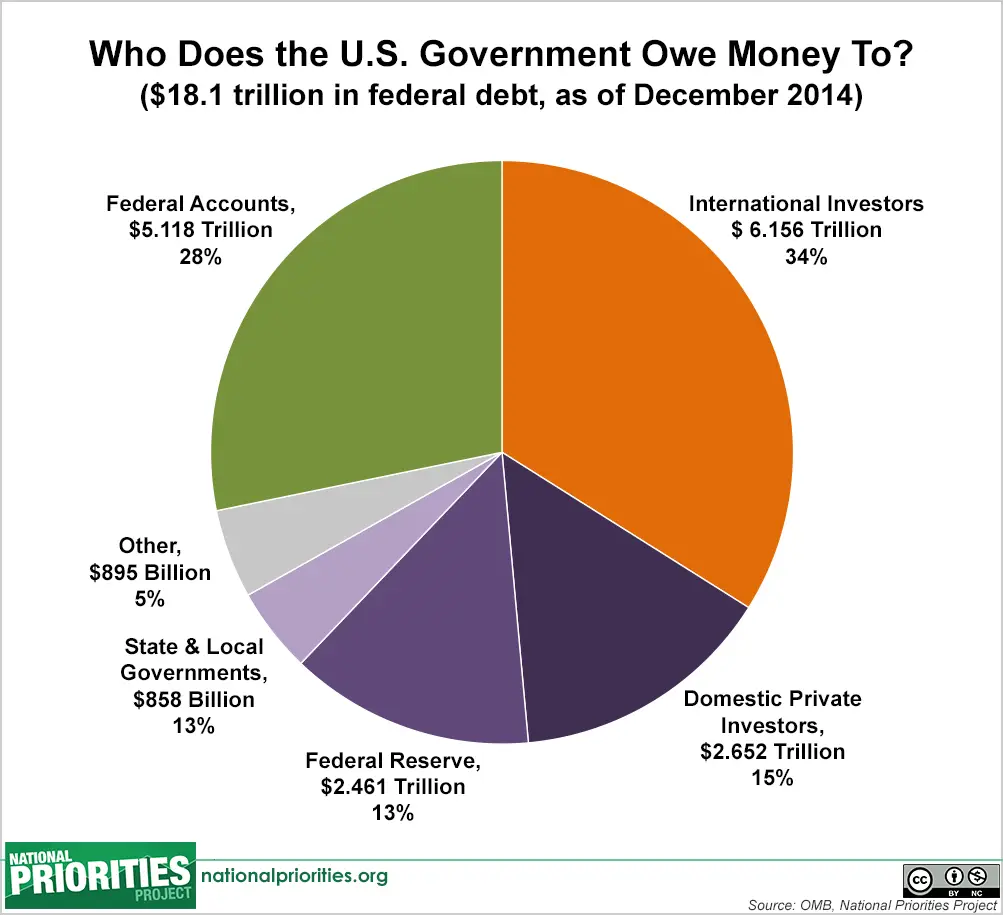

Intragovernmental debt is debt that one part of the government owes to another part. In almost all cases, it is debt held in government trust funds, such as the Social Security trust funds. These debts represent assets to the part of the federal government that owns it , but a liability to the part of the government that issues them , and so they have no net effect on the government’s overall finances.

As of today, intragovernmental debt totals $6.5 trillion, up from $4.8 trillion a decade ago. However, it is projected to fall to $5.1 trillion by the end of FY 2031, as some major trust funds will soon be forced to begin selling off the debt they hold in order to continue covering their expenses.

How Do Current Debt Levels Compare Historically

Both gross and public debt are at all-time highs in nominal dollars, which is perhaps not surprising since the federal government has been running deficits for each of the past 20 fiscal years. As a percent of GDP, both are high by historical standards. Debt held by the public is currently around 98 percent of GDP, which is higher than any time in history other than in fiscal years 1945, 1946, and 2020, when unprecedented borrowing occurred to finance the World War II effort and to fight COVID-19. Even during those two periods, the record for debt was 106 percent of GDP in 1946 and 100 percent in 2020, both of which the federal government will surpass by 2031.

Gross debt currently amounts to 125 percent of GDP, which is the second-highest total in history, just short of the all-time record of 128 percent of GDP in 2020. By 2031, public debt will be at its highest level in history as a share of GDP, while gross debt will be slightly below todays level.

You May Like: What Are The Two Most Common Types Of Consumer Bankruptcies

What Is The Current National Debt

As of Oct. 8, 2022, the total U.S. national debt was $31.1 trillion, after crossing the $30 trillion mark for the first time in February. At the end of 2019, prior to the COVID-19 pandemic, the national debt was $23 trillion. One year later, it had risen to $27.7 trillion. Since then, it has increased by more than $2 trillion.

Q& a: Gross Debt Versus Debt Held By The Public

On January 31, 2022, the federal government’s gross debt exceeded $30 trillion for the first time. This mark serves as an important reminder of the nation’s unsustainable rising national debt. At the same time, the nominal amount of gross debt is just one of a few measures of debt and is actually considered less economically meaningful than some other measures such as debt held by the public as a share of Gross Domestic Product . This explainer will lay out everything you need to know about the different measures of debt and what they mean for the government’s fiscal situation.

Also Check: What’s The Us Debt

Why Shareholders Look At Debt

Debt is an important factor in the capital structure of a company, and can help it attain growth. Debt usually has a relatively lower financing cost than equity, which makes it an attractive option for executives.

However, due to interest-payment obligations, cash-flow of a company can be impacted. Having financial leverage also allows companies to use additional capital for business operations, allowing equity owners to retain excess profit, generated by the debt capital.

Looking for stocks with low debt-to-equity ratios? Check out Benzinga Pro, a market research platform which provides investors with near-instantaneous access to dozens of stock metrics including debt-to-equity ratio. .

What Is The Debt Ceiling

The debt ceiling is the legal limit set by Congress on how much the Treasury Department can borrow, including to pay debts the United States already owes. Since it was established during World War I, the debt ceiling has been raised dozens of times. In recent years, this once routine act has become a game of political brinkmanship that has brought the United States near default on several occasions, CFRs Roger W. Ferguson Jr. writes. Ferguson and other experts argue that the debt ceiling should be scrapped entirely. The only other advanced economy to have one is Denmark, and it has never come close to reaching its ceiling.

Recommended Reading: How Many Times Has Donald Trump Filed Bankruptcy

National Debt And Budget Deficit

The federal government creates an annual budget that allocates funding towards services and programs for the country. This is made up of mandatory spending on government-funded programs, discretionary spending on areas such as defense and education, and interest on the debt. The budget deficit can be thought of as the annual difference between government spending and revenue. When the government spends more money on programs than it makes, the budget is in deficit.

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

Don’t Miss: Liquidation Goods For Sale

A Brief History Of Us Debt

Debt has been a part of this country’s history from the beginning, starting with the overseas borrowing undertaken to finance the American Revolution.

Despite the effects of the Vietnam War, War on Poverty social programs, and oil price shocks, the U.S. debt-to-GDP ratio declined from 40% in 1966 to 31% by 1980. It rose to 52% by 1990 in the wake of the tax cuts and spending increases advocated by President Ronald Reagan. The debt-to-GDP ratio rose from 64% in 2008 to 100% by 2012, amid the fallout from the Great Recession. Bipartisan relief packages in response to the C0VID-19 pandemic raised the debt-to-GDP ratio from 107% in late 2019 to 135% by mid-2020 from there the ratio declined to 121% by mid-2022.

History shows the debt-to-GDP ratio tends to rise during recessions and in their aftermath, as you would expect. GDP shrinks during a recession, while government tax receipts decline and safety net spending rises. The combination of higher budget deficits with lower GDP serves to inflate the debt-to-GDP ratio. Deep recessions like those in the 1980s and in 2008-2009 can have particularly pronounced and prolonged effects on the national debt, making it less sustainable.

What Is The Difference Between The National Debt And A Budget Deficit

A federal budget deficit happens when the government doesnt bring in enough revenue to cover all of the nations expenses. The opposite of a deficit is a surplus, which is when revenue exceeds spending Theres money left over. Deficits and surpluses are measured on an annual basis each fiscal year.

When the government needs to raise money to balance the budget, the US Treasury sells securities. These include Treasury bills , Treasury notes , or Treasury bonds .

All of these securities are government debt instruments upon which the purchaser expects to make a return on investment. Debt issued by the US government is generally considered a very low-risk investment, so returns are typically small.

While a deficit refers to a single year, national debt is cumulative. Its all the money the government has borrowed to cover annual budget deficits and currently owes to creditors. This number is continually changing as some debts are paid off, and new debt is issued. When the government runs a deficit, debt grows. When theres a surplus, it can use the extra money to pay down debt.

You May Like: Current Us Debt 2022

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

What Age Should You Be Debt Free

Kevin OLeary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. Its at this age, said OLeary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Don’t Miss: How To File Bankruptcy In Mn

Try The Island Approach

The Island Approach is a strategy that involves using a collection of credit cards, with each serving a specific purpose. For example, you could transfer your existing debt to a 0% balance transfer credit card to save on finance charges and get out of debt sooner. You could use a rewards card or two, perhaps one with travel rewards and one with cash back, or maybe a store credit card, for purchases that youll be able to pay off by the end of the month. This will enable you to get the best possible collection of terms and also tell you when youre overspending. Finance charges on your everyday spending cards will signal a need to cut back.

Biden Administration Kicks Off Student Loan Debt Forgiveness Process Before Application Window Opens

In August, President Biden announced his decision to cancel up to $10,000 in student loan debt for individuals making less than $125,000 a year

The Biden administration on Thursday is kicking off its efforts toward forgiving student loan debt, sending updates on the process via email before the window to apply opens next month.

In August, President Joe Biden announced his decision to cancel up to $10,000 in student loan debt for individuals making less than $125,000 a year or as much as $20,000 for eligible borrowers who are also Pell Grant recipients.

An email from the Department of Education sent to Americans who signed up for updates and obtained by CNN Thursday offered some details on who is eligible and what to expect in the process.

In October, the US Department of Education will launch a short online application for student debt relief. You wont need to upload any supporting documents or use your FSA ID to submit your application, the email said.

It continued, Once you submit your application, well review it, determine your eligibility for debt relief and work with your loan servicer to process your relief. Well contact you if we need any additional information from you.

Dont Miss: Emergency Fund Or Pay Off Debt

Also Check: Should I File For Bankruptcy For Credit Card Debt

The Politics Of National Debt

Disagreements about national debt have repeatedly preoccupied U.S. Congress. Whenever the national debt approaches the limit periodically reset by Congress, lawmakers are faced with a choice of raising the ceiling once again or letting the U.S. government default on its obligations, risking dire economic consequences. The U.S. government briefly shut down before Congress raised the limit in 2013. A similar standoff two years earlier led Standard & Poors to downgrade its U.S. credit rating.

In 2021, Congress narrowly averted a scheduled Oct. 1 government shutdown by passing a short-term funding bill, then raised the U.S. debt ceiling by $2.5 trillion to $31.4 trillion in December. That limit was expected to be reached in early 2023.

Americans profess to be concerned about the national debt in poll after poll, while also overwhelmingly supporting defense spending and outlays for Social Security and Medicare, and opposing tax increases.

As a result, elected officials too have been eager to be seen to be addressing the national debt, usually without linking it to the spending the debt enables or to the tax increases that a balanced budget would require.