Reduce Your Monthly Debts

The fastest way to lower your DTI is to pay down your existing loan and credit card balances.

One strategy is to pay off your smallest loans first, which will free up cash to put toward larger debts like car payments and student loans.

Another option for reducing your credit balances is to refinance your high interest and high balance loans. Rather than let a high interest rate inflate what you owe, try shopping around for a lower rate.

How Much Should Your Debt

Whether you are taking out a mortgage for the first time or refinancing a loan you already have, lenders examine your DTI to assess the level of risk they will incur by lending to you. Typically, the higher your DTI the riskier you are to lenders, because it indicates you may be less financially able to make your mortgage payments. In turn, this can affect how much lenders are willing to let you borrow and at what interest rate.

Lenders usually prefer conventional loan borrowers to have a debt-to-income ratio of 36% or below meaning roughly a third of your gross monthly income goes toward fixed debt payments and the rest is yours to spend on remaining wants and needs. Depending on the state of your financial health in other aspects, like your , you may qualify for a loan with a DTI up to a maximum of 50%. Loans backed by the government, like FHA loans, typically accept borrowers with DTI ratios up to 43% and may go up to 57% in certain cases.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Get Clarity On Your Dti With A Pre

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. Youll undergo a soft credit check that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure youll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

You May Like: Where To File Bankruptcy In Indiana

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: What Does Filing Bankruptcy Do To Your Credit

How To Calculate A Down Payment Amount

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

How Lenders Look At Dti

If you want to get a sense of how lenders look at DTI, you can break it out into a front-end and back-end ratio.

The front-end ratio only takes into account housing-related expenses, such as your monthly mortgage principal and interest, real estate taxes, homeowner’s insurance, and any other required add-ons .

The back-end ratio adds your remaining debts, such as minimum credit card and loan payments, on top of your estimated mortgage.

Here’s an example DTI ratio calculation based on $6,000 of gross monthly income:

Read Also: How Much Do Collection Agencies Pay For Debt

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program that waives traditional DTI rules.

Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available only to military borrowers who already have a VA loan. Homeowners must also show theres a benefit to refinancing their existing home loan either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

How Your Dti Is Used By Lenders

When you apply for a mortgage, lenders will look at DTI, your credit history and your current credit scores. Why? Because all this information taken together can help them better understand how likely you will be to repay any money they loan to you. While there’s no immediate way to improve a credit score, certain actions can help , and can start you on a better path today. Think about:

- Pay down existing debt, especially revolving debt like credit cards. This will help improve both your DTI and your credit utilization ratio.

- Pay all bills on time every month. Late or missed payments appear as negative information on credit reports.

- Avoid applying for any new credit, as too many hard inquiries in a short time frame could affect your credit scores.

- Use your existing credit wisely. For example, make a small purchase with a credit card and pay off the full balance right away to help establish a positive payment history.

http://www.investopedia.com/terms/f/front-end-debt-to-income-ratio.asp

You May Like: Debt Of The Us

The True Cost Of Owning A Home

Remember, you will pay more than just the mortgage payment when you own a home. You are now responsible for the maintenance and repairs on the home. On average, expect to pay 1% of your homes value in home maintenance and repairs per year. Of course, youll have years that you pay more or less than this amount, but its a good rule of thumb.

You also have to pay utilities to keep the house running. Try to get an estimate of these costs before deciding on a home/mortgage. This way you have a true idea of what a home will cost you rather than suffering payment shock once you take the mortgage.

Do your research on the real estate taxes and homeowners insurance too. You can obtain both figures easily either from the seller or by calling the county and insurance agents yourself. Do the real estate taxes historically increase each year? This may affect your decision too.

Before you take on a mortgage, know all of the details. Owning a house means more than paying just the mortgage. Keeping your mortgage to income ratio low can help keep your mortgage affordable as long as possible. Use the mortgage program rules as a guide, but figure out what you can best afford in order to ensure smooth sailing moving forward.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Read Also: Amazon Pallets For Sale Miami

Va Debt To Income Ratio

VA Loans evaluate borrower income differently than other popular mortgage counterparts. To meet VA debt to income requirements, qualified veterans or their spouses can have bottom ratios as high as 50% or greater if theyre approved through an automated underwriting system. VA loans also employ a Residual Income approach to evaluate veteran income. VA residual income guidelines

- VA Residual Income Requirements

A High Dti May Make It Difficult To Juggle Bills

Spending a high percentage of your monthly income on debt payments can make it difficult to make ends meet. A debt-to-income ratio of 35% or less usually means you have manageable monthly debt payments. Debt can be harder to manage if your DTI ratio falls between 36% and 49%.

Juggling bills can become a major challenge if debt repayments eat up more than 50% of your gross monthly income. For example, if 65% of your paycheck is going toward student debt, credit card bills and a personal loan, there might not be much left in your budget to put into savings or weather an emergency, like an unexpected medical bill or major car repair.

One financial hiccup could put you behind on your minimum payments, causing you to rack up late fees and potentially put you deeper in debt. Those issues may ultimately impact your credit score and worsen your financial situation.

You May Like: In And Out Merchandise Liquidation

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: Do You Lose Your House When Filing Bankruptcy

Add Fixed Monthly Debts

The first step in calculating the debt-to-income ratio is adding up all your existing monthly debt obligations. These expenses may include:

- Student loan payment

- Existing rent or house payment

- Monthly alimony or child support payments

- Wage garnishments or installment payments on back taxes.

Take how much you pay each month for each of these items and add them all together. This is how much you pay each month in debt.

Also Check: How To Build Credit Score After Bankruptcy

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Also Check: What To Expect At Bankruptcy Trustee Meeting

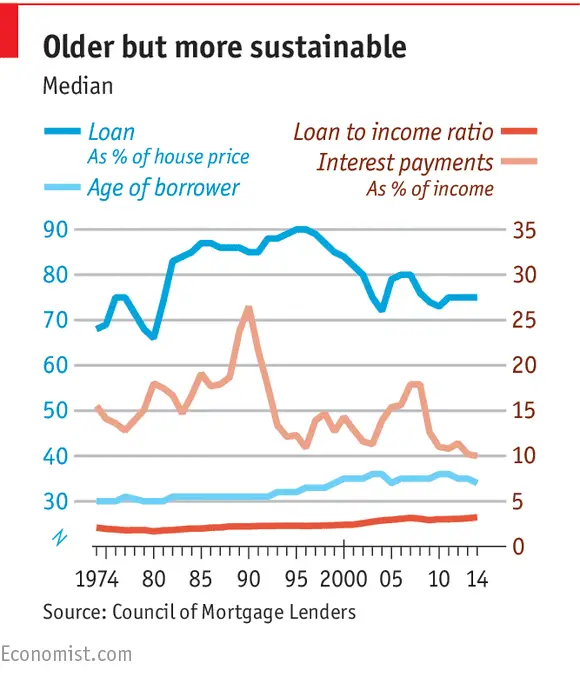

Mortgage Approval: Whats Behind The Numbers In Our Dti Calculator

Your debt-to-income ratio matters when buying a house. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. DTI is calculated by dividing your monthly debt obligations by your pretax, or gross, income.

In most cases, lenders want total debts to account for 36% of your monthly income or less. Nonconventional mortgages, like FHA loans, may accept higher a DTI ratio, but conventional mortgages may not be as flexible.

Lenders consider low DTI as important as having a stable job and a good credit score. When evaluating your mortgage application, DTI tells lenders how much of your income is already spoken for by other debts. If the percentage is too large, its a clue you may have trouble paying your monthly mortgage payments, and lenders will be reluctant to approve your loan.

Hate surprises? Estimating your DTI with the NerdWallet calculator before submitting your mortgage application can help you understand how much house you can afford.

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Recommended Reading: Can You File Bankruptcy After A Judgement

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

Read Also: Bankruptcy Discharge Date Lookup

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

How Is The Debt

The debt-to-income ratio can be calculated using these two formulas:

Gross debt service ratio

This corresponds to the percentage of your gross income that goes towards housing fees for the home youâre looking to buy. Generally speaking, you need a GDS between 32% and 39% to get a loan, but your bank may require a lower ratio.

To calculate it:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Multiply the total by 100. 3. Divide the new total by your gross monthly income.

Total debt service ratio

This is the percentage of your gross monthly income that goes towards housing fees for the home youâre looking to buy, in addition to your other debts. Your TDS shouldnât exceed 44%, but a lender may require a lower ratio. Usually, a TDS under 40% is good enough to get a loan.

To calculate TDS:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Add your other monthly financial commitments to this total: Loans, typically 3% of the limit on each of your credit cards and lines of credit , child support and alimony, as well as any other debt payments. 3. Multiply the total by 100. 4. Divide the new total by your gross monthly income.

To calculate these ratios, you can use the Canada Mortgage and Housing Corporationâs debt service calculator.

Read Also: Pallets Of Returns For Sale

You May Like: How Long Do Foreclosures Take