Medical Costs In The Us

1. National health expenditure reached $3.8 trillion in 2019.

In 2019, the nation increased its healthcare-related expenditure by 4.6% compared to 2018. Data shows that American health expenditure accounted for 17.7% of the GDP. Medicare spending grew to $799.4 billion, or by 6.7%.

The 2020 update is yet to be released. According to CMS estimates, the figure will reach $4.01 trillion. But the Covid-19 health crisis is likely to have an adverse effect on the total amount, just like on the other medical bankruptcies statistics on this list.

2. The average medical insurance premium has increased by over 50% in the past decade.

The average annual employer-sponsored family premium was $21,342 in 2020. This is a 4% increase from the previous year. Since 2010, the cost has gone up by 55%.

And the national average premium for a benchmark marketplace plan in 2021 is $452 a month.

3. Americans spend an average of $5,000 a year on out-of-pocket health care costs.

This figure includes insurance, medical supplies, and prescribed drugs. For comparison, in 1984, the typical household spent about $2,500 a year on healthcare. Unsurprisingly, insurance accounts for most of that increase, having skyrocketed by a whopping 740%.

4. Drug prices rose 4.2% in the second half of 2020.

Not only insurance costs are rising.

The latest GoodRXs semi-annual update shows that drugmakers have hiked the prices of a total of 589 medications.

Medical Bills Are The Biggest Cause Of Us Bankruptcies: Study

Bankruptcies resulting from unpaid medical bills will affect nearly 2 million people this yearmaking health care the No. 1 cause of such filings, and outpacing bankruptcies due to credit-card bills or unpaid mortgages, according to new data. And even having health insurance doesn’t buffer consumers against financial hardship.

The findings are from NerdWallet Health, a division of the price-comparison website. It analyzed data from the U.S. Census, Centers for Disease Control, the federal court system and the Commonwealth Fund, a private foundation that promotes access, quality and efficiency in the health-care system.

“A lot of Americans are struggling with medical bills,” said NerdWallet Health Vice President Christina LaMontagne.

NerdWallet estimates that households containing 1.7 million people will file for bankruptcy protection this year.

Even outside of bankruptcy, about 56 million adultsmore than 20 percent of the population between the ages of 19 and 64will still struggle with health-care-related bills this year, according to NerdWallet Health.

And if you think only Americans without health insurance face financial troubles, think again. NerdWallet estimates nearly 10 million adults with year-round health-insurance coverage will still accumulate medical bills that they can’t pay off this year.

High-deductible insurance plans requiring consumers to pay more out-of-pocket costs are a challenge for many households.

Obamacare ‘Not a Panacea’

Is It Possible To Get Rid Of Medical Debt Via Bankruptcy

Yes, medical debt is a kind of obligation that may be discharged via bankruptcy.

Medical debt is classified as unsecured debt under bankruptcy law. Unsecured debt is defined as debt that is not secured by any property or assets that you possess. Bankruptcy is often used to discharge unsecured obligations such as credit card debt, medical debt, and so on.

On the other hand, secured debts are debts secured by assets that the creditor may seize if the debt is not paid. A house mortgage is an example of a safe debt if you default on your payments, the bank may foreclose on your home.

You are no longer responsible for repaying your medical debt if you file for bankruptcy and have it discharged. Once a medical bill has been dismissed, the hospital, doctors office, or collection agency can no longer send you notifications or contact you to collect the amount.

You May Like: What Is Bankruptcy Code In India

Bankruptcy Comes From Unavoidable Circumstances

At Joseph P. Doyle, our Chicagobankruptcy lawyer, strongly believes you can fix your financial situation with our legal assistance. Bankruptcy is a solution that caneliminate a large portion of ones debt, no matter what the cause. Below, our firm has explained the most common causes of bankruptcy in more detail.

Every day,thousands file for bankruptcy to get out of a serious debt problem they are facing. This is the result of a serious issue that is affecting bank individuals bank accounts and lives. This is not just a circumstance that occurs without cause. It comes from an unavoidable circumstance or as a consequence of an action. Whatever the reason, bankruptcy, is the primary go-to solution for many whose financial states have gone out of control. There many causes of bankruptcy, but they can all lead to the samesolution.

The common causes of bankruptcy include:

- Expensive Medical Bills caused by a disability or illness

- Poor Financial Management related tostudent loans, purchasing acar orhome, etc.

- Reduced income or job loss

- Unexpected emergencies, such as a car breaking down or catastrophic damage to your property

If an unforeseen tragedy has taken place and caused your financial circumstance to become negative, it is important to understand what the initial cause was so that it can be effectively solved.

To learn more about how to recover from severe debt, call to discuss your options.

Recommended Reading: Will Bankruptcy Get Rid Of Irs Debt

‘were Letting People Have Insurance Plans They Cant Afford’

The U.S. spends significantly more money per capita on health care $10,586 while the next three countries of Germany, the Netherlands, and Australia trail far behind.

What I think has to happen is we really need to look at our health care system writ large and think about the financing part of it, Sesso said. Are people really insured in a way that they need to be? Why are we allowing people to have health insurance plans that they cant afford, meaning that the deductibles are clearly higher than what their income is and what their means are?

According to the Kaiser Family Foundation, the average single deductible in 2019 was $1,931 while the average family deductible was $3,655.

Americans are paying the price: Quality health care is unaffordable for an estimated 46 million Americans, according to a recent Gallup survey, and a LendingTree survey of 1,550 people in March found that a majority of Americans have been in medical debt at costs averaging between $5,000 to $9,999.

LendingTree found that emergency room visits , visits with doctors and specialists , childbirth and related care , and dental care were the leading causes.

Sesso likened the overall situation with medical debt to that of the subprime mortgage crisis back in 2008.

READ MORE:

Read Also: How Many Times Can You File Chapter 7 Bankruptcy

Column: Crowdfunding For Medical Expenses Is Rising When It Should Be Eradicated

It should be obvious as a fundamental principle that in a civilized country, crowdfunding for direct medical expenses should be utterly unnecessary.

Its also virtually unique to the U.S. among developed countries when experts from Japan and Europe were asked by the PBS program Frontline about the prevalence of medical bankruptcy in their countries, some had trouble even comprehending the question.

Whats clear about the financial consequences of the American system of healthcare financing, which places much of the burden on households, is that theyre widespread and scandalous. One signpost is the rise of crowdfunding campaigns via platforms such as GoFundMe to raise money for families facing medical bills. In a civilized country, public appeals for help with medical bills shouldnt exist. Yet GoFundMe reports that it hosts more than 250,000 medical campaigns per year, raising more than $650 million a year.

500,000 Americans will go bankrupt this year from medical bills.

Sen. Bernie Sanders

Us Medical Debt And Insolvency By Demographics

24. 26% of Americans aged 18-64 struggle with paying their medical bills.

More than one-fourth of Americans struggle with healthcare costs, according to a recent study. The studys medical debt statistics show that among the participants who reported issues paying their medical expenses, 53% were uninsured, and 20% were insured. Among those with private insurance, 26% had a high, and 15% had a low deductible. About 47% of the participants had a disability, while 22% had no disabilities.

25. More women than men struggle with medical debt in the US.

Out of all female participants, about 29% said they were struggling with medical debt in the past 12 months. This compares to 23% for male participants.

26. Hispanic and African Americans are more affected by healthcare debt than White Americans.

The KFF/NYT medical bankruptcies statistics established that 32% of Hispanics and 31% of African Americans struggled with medical debt. Among White Americans, only 25% reported issues with paying medical bills.

27. The South Census Region in the United States struggles the most with healthcare debt.

Also Check: Can You File Bankruptcy On State Taxes

The Variables Of The Reports

Researchers disagree on the evidence for medical bills causing bankruptcies. The biggest problem in answering this question is that those filing for bankruptcy aren’t required to state the reason.

As a result, estimates are based on surveys. Therefore, the answer will depend on how researchers phrase their questions, and how the survey respondents define the cause of their bankruptcy.

A variety of factors cause bankruptcies. Many people with medical debt have other debts as well. They may also have a lower income, little savings, or have lost a job.

Medical debts are generally unexpectedmany Americans live paycheck to paycheck due to the cost of living, low wages, or living beyond their means. A sudden medical bill causes havoc in the financial lives of struggling people.

Almost a third of the respondents surveyed by KFF claimed they weren’t aware that a particular hospital or service wasn’t part of their plan. One in four found that their insurance had denied their claims.

Many insured people are not aware that their policies have limits. High deductibles and co-payments can cause high debts, and annual/lifetime limits can cause an insurance plan to run out. Some insurance policies and companies will deny claims or cancel the insurance policy.

Negotiate A Settlement With The Medical Provider

To start, make sure you’ve resolved all insurance payment issues. Once you have gotten all of the available insurance coverage, consider negotiating a settlement with the creditor. If the bill was for uninsured medical costs, then the medical provider might waive a percentage of the bill. Many hospitals and other medical providers routinely waive or discount bills for uninsured patients.

Recommended Reading: How To Rebuild Credit After Bankruptcy

This Is The Real Reason Most Americans File For Bankruptcy

- Two-thirds of people who file for bankruptcy cite medical issues as a key contributor to their financial downfall.

- While the high cost of health care has historically been a trigger for bankruptcy filings, the research shows that the implementation of the Affordable Care Act has not improved things.

- What most people do not realize, according to one researcher, is that their health insurance may not be enough to protect them.

Filing for bankruptcy is often considered a worst-case scenario.

And for many Americans who do pursue that last-ditch effort to rescue their finances, it is because of one reason: health-care costs.

A new study from academic researchers found that 66.5 percent of all bankruptcies were tied to medical issues either because of high costs for care or time out of work. An estimated 530,000 families turn to bankruptcy each year because of medical issues and bills, the research found.

Other reasons include unaffordable mortgages or foreclosure, at 45 percent followed by spending or living beyond one’s means, 44.4 percent providing help to friends or relatives, 28.4 percent student loans, 25.4 percent or divorce or separation, 24.4 percent.

While the findings are consistent with past studies on bankruptcy, the data also highlight a key new factor: whether the Affordable Care Act has reduced the burden of medical debt for people.

More from Personal Finance:Medicare for All could take center stage in the 2020 election. Here’s what that means

What Is Medical Debt

The SIPP shows that in 2017, 19% of U.S. households carried medical debt, defined as medical costs people were unable to pay up front or when they received care. Among households with medical debt, the median amount owed was $2,000, meaning half had more and half had less.

Like other debt, medical debt means that households have less money to spend on other essential items, such as food and housing. People with medical debt, or at risk of accumulating medical debt, may also forgo needed medical care or treatment. Medical debt can also lead to bankruptcy.

Also Check: Houses For Sale Foreclosure

Column: Health Insurance Companies Are Useless Get Rid Of Them

Private health insurers contribute nothing to healthcare except costs. Its time to throw them out.

Responding to Dranove and Millenson, they observed that narrowing the debts listed in bankruptcy filings to medical bills probably conceals the role of medical expenses in those cases. Thats because families may take intermediate steps to pay those bills before financially throwing in the towel. Responses by families themselves indicate that medical debts that wound up as credit card balances, second mortgages, payday loans, collection lawsuits, and so on are some of the most important indicators of medical bankrupcies…. Medical debt often appears as credit card debt or mortgage in court records.

As for the California data, Himmelstein, Woolhandler and Warren responded that the study was flawed in treating hospitalization as the sole indicator of a medical problem that could lead to financial distress. Families can be overwhelmed by nonhospitalization bills, including emergency care, physical therapy or prescriptions, not to mention the costs of treating chronic conditions that never result in a hospital stay but drain household accounts year in and year out.

Medical Bankruptcy In The United States 200: Results Of A National Study

The American Journal of Medicine, August 2009

Abstract

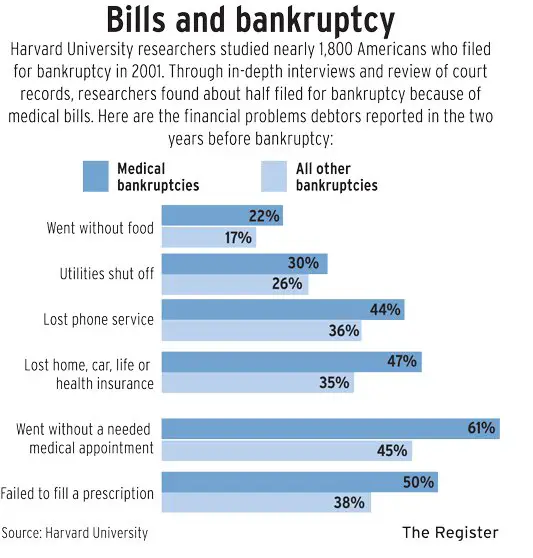

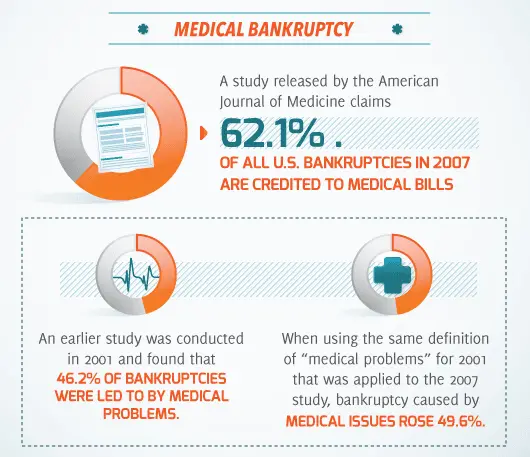

BACKGROUND: Our 2001 study in 5 states found that medical problems contributed to at least 46.2% of all bankruptcies. Since then, health costs and the numbers of un- and underinsured have increased, and bankruptcy laws have tightened.

METHODS: We surveyed a random national sample of 2314 bankruptcy filers in 2007, abstracted their court records, and interviewed 1032 of them. We designated bankruptcies as medical based on debtors stated reasons for filing, income loss due to illness, and the magnitude of their medical debts.

RESULTS: Using a conservative definition, 62.1% of all bankruptcies in 2007 were medical 92% of these medical debtors had medical debts over $5000, or 10% of pretax family income. The rest met criteria for medical bankruptcy because they had lost significant income due to illness or mortgaged a home to pay medical bills. Most medical debtors were well educated, owned homes, and had middle-class occupations. Three quarters had health insurance. Using identical definitions in 2001 and 2007, the share of bankruptcies attributable to medical problems rose by 49.6%. In logistic regression analysis controlling for demographic factors, the odds that a bankruptcy had a medical cause was 2.38-fold higher in 2007 than in 2001.

CONCLUSIONS: Illness and medical bills contribute to a large and increasing share of US bankruptcies.From the Discussion

Don’t Miss: How To Build Credit Score After Bankruptcy

Medical Debt In Bankruptcy

If you can’t settle the debt and it looks as if the creditor may pursue you for payment, then your good credit is going to take a hit anyway because a collection action will show up on your credit report. Also, if the provider sues you and gets a judgment, it can garnish your wages or take other collection action.

Not only can filing for bankruptcy wipe out your debt, but the sooner you file, the sooner you’ll be back on the road to financial recovery.

Schedule A Consultation Today

The health care industry is characterized by complex medical bills, ludicrous insurance premiums, and exorbitant out-of-pocket expenses. In recent years, the life expectancy in America has noticeably declined with the rise of health care costs. If you find yourself struggling financially, its important to explore your options with a qualified bankruptcy attorney.

At Bach Law Offices, Inc., our Northbrook bankruptcy lawyers have a comprehensive understanding of the laws and regulations associated with this challenging legal process. Despite misconceptions, bankruptcy can protect both you and your family from the consequences of mounting medical debts. During your appointment, our knowledgeable and compassionate legal team can evaluate your case, thoroughly explain your legal options, and develop a strategy that achieves your legal objectives. With our help, you can start the next chapter of your life debt-free and prepared for the future.

Read Also: Has United Airlines Filed For Bankruptcy

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Americans Likely Owe Hundreds Of Billions Of Dollars In Total Medical Debt

A new KFF analysis of government data estimates that nearly 1 in 10 adults or roughly 23 million people owe medical debt. This includes 11 million who owe more than $2,000 and 3 million people who owe more than $10,000.

The analysis is based on data from the 2020 Survey of Income and Program Participation, a nationally representative survey that asks every adult in a household whether they owed money for medical bills in 2019 and how much they owe. It looks at people with medical debt of more than $250.

The 2020 survey suggests Americans collective medical debt totaled at least $195 billion in 2019, though with quite a bit of uncertainty. A small share of adults account for a huge share of the total, with considerable variation from year to year. The estimate is significantly higher than other commonly cited estimates, which generally rely on data from credit reports that may not capture medical debts charged to credit cards or included in other debts rather than being directly owed to a provider.

Other findings include:

Its not yet clear how the pandemic and resulting recession affected medical debt. Many people lost jobs and income early in the pandemic, which could have led to more difficulty affording medical care. At the same time, many people delayed or went without care, so fewer people may have been exposed to costly medical care. Shifts in insurance coverage and COVID-related cost-sharing waivers could also affect what people had to pay out-of-pocket.

Topics

You May Like: Can You Keep Your House In Bankruptcy Canada