What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Check Your Mortgage Eligibility

A high debt-to-income ratio can make it tougher to get a home loan. Fortunately, lenders have some flexibility when it comes to mortgage requirements. If your DTI is high but youre a reliable borrower in other respects, theres a good chance you could still qualify. To find out, check your eligibility with a lender.

Know How Much House You Can Afford

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

The 28/36 rule of thumb is a mortgage benchmark based on debt-to-income ratios that homebuyers can use to avoid overextending their finances. Mortgage lenders use this rule to decide if theyll approve your mortgage application.

Heres how the 28/36 rule of thumb works, as well as what it includes and excludes, plus example calculations and some caveats for using the rule.

Don’t Miss: Bank Of America Reos

Mortgagesthat Consider Higher Dtis

Thereare those mortgage vehicles that are available for borrowers who have a largerDTI ratio. FHA loans cap DTI ratios at 57 percent and VA loans cap DTI ratiosat 60 percent . There are othermortgage lenders and investors who will consider higher debt-to-income ratioswhen looking at a borrowers all-around financial picture, assets and propertyequity.

Loans Which Dont Use Dti For Approval

Mortgage lenders use DTI to see whether homes are affordable for a U.S. home buyer. They verify income and debts as part of the process.

However, there are several high-profile mortgage programs which are more flexible about the DTI calculation. These include loan options from the FHA, the VA, and Fannie Mae and Freddie Mac.

Read Also: Income Vs Home Loan Amount

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

What Is The Debt

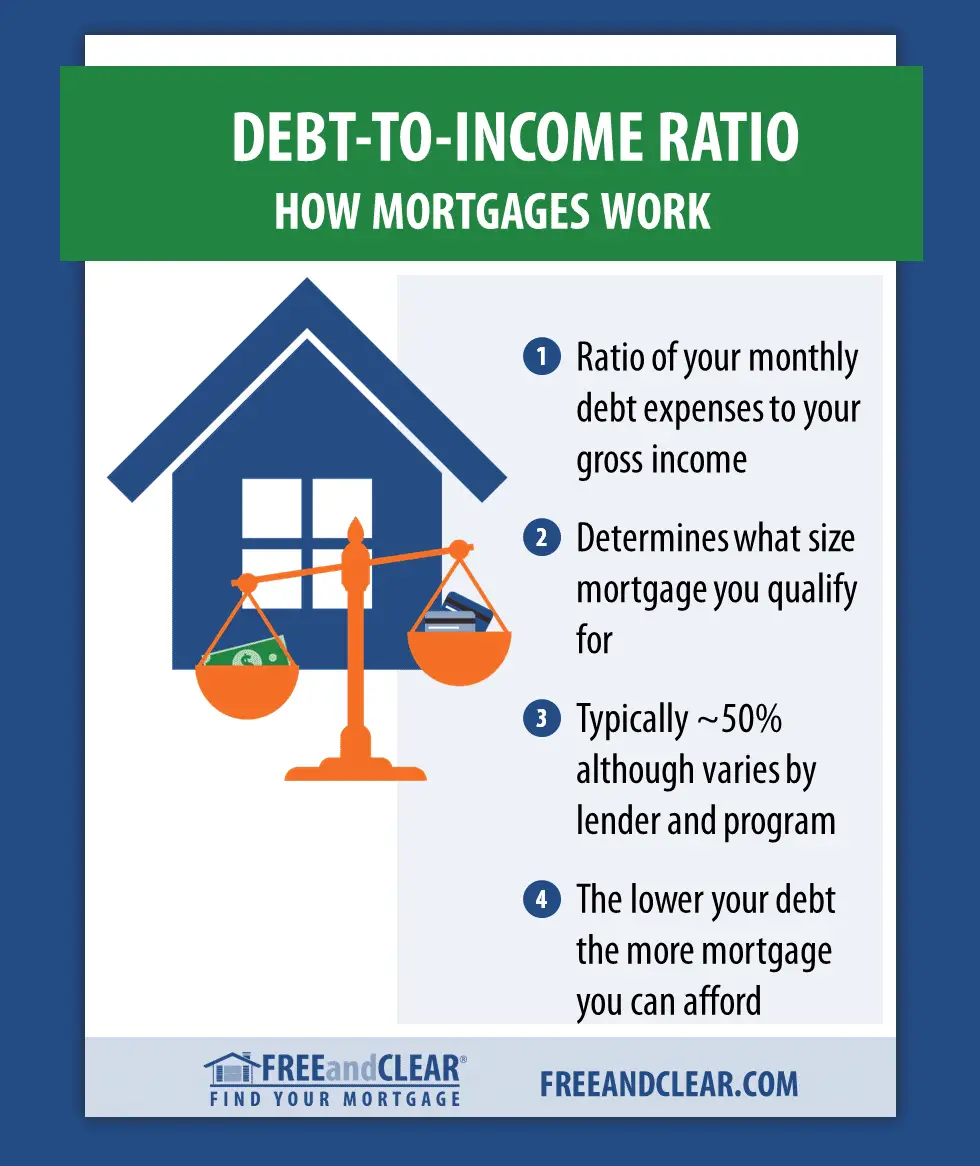

Expressed as a percentage, your debt-to-income ratio for a mortgage is the portion of your gross monthly income spent on repaying debts, including mortgage payments or rent, credit card debt and auto loans.

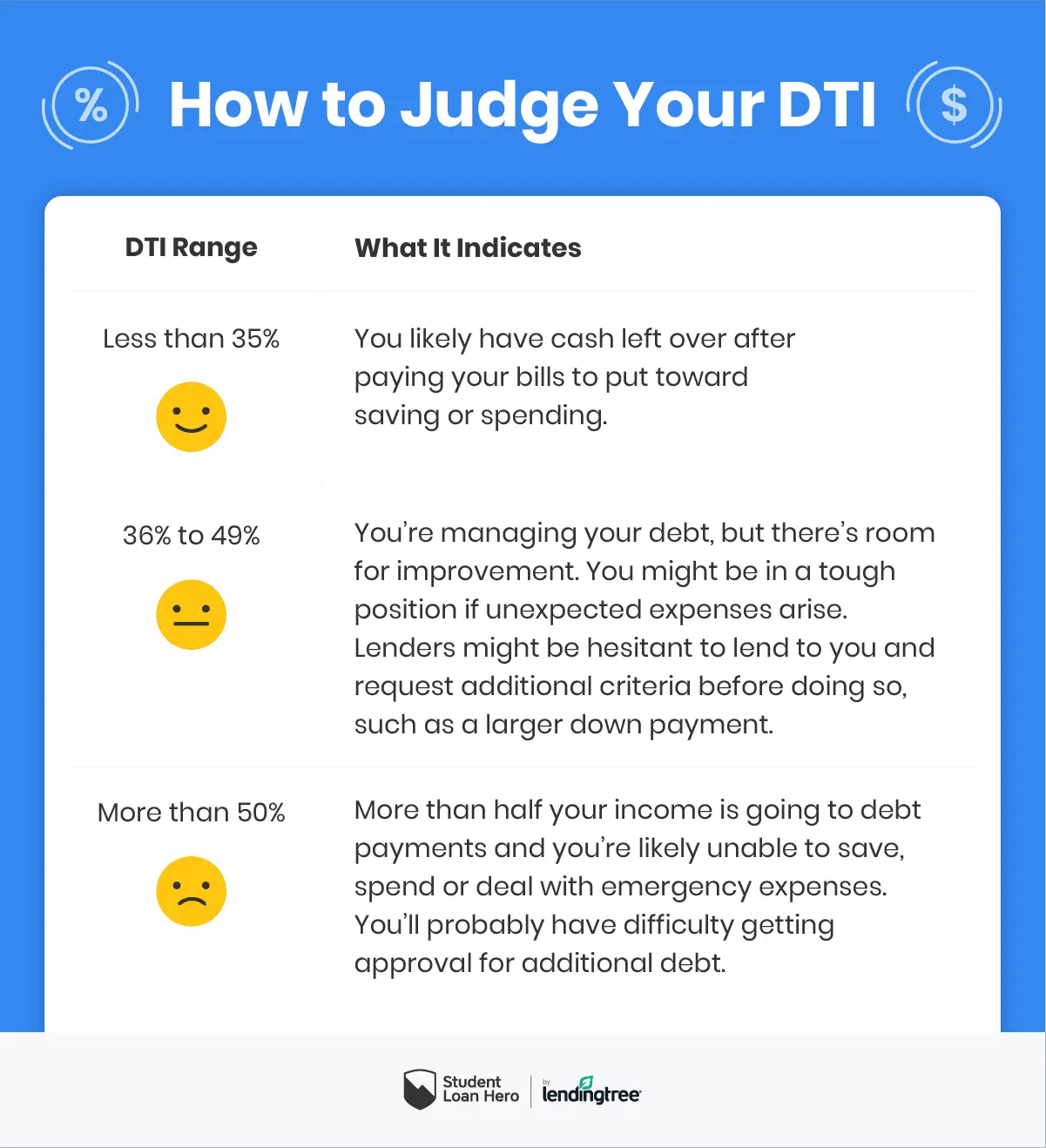

Lenders might hesitate to work with someone who has a higher DTI ratio because theres a larger risk that the borrower might not repay their loan if they have other significant debt payments.

Read Also: What Does It Mean To Declare Bankruptcy

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

Lenders Who Accept High

Several lenders do not have a maximum debt-to-income ratio, meaning that your application will not automatically be declined on this basis. Instead, they will review applications on their individual merits, based on a wider range of affordability factors. These lenders include Leek United Building Society, Foundation Home Loans, and Metro Bank.

Recommended Reading: Average American Credit Card Debt

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Read Also: How Do You File For Bankruptcy In Ca

What Else Is Included In Dti

Your debt-to-income ratio also considers auto loans, minimum credit card payments, installment loans, student loans, alimony, child support, and any other expenses you must make each month. It doesn’t typically include recurring monthly charges for utilities, internet service, cable or satellite TV, mobile phone subscription or other charges for ongoing services or other things where the cost is newly incurred each month.

To calculate if you have the required income for a mortgage, the lender takes your projected monthly mortgage payment, adds your expenses for credit cards and any other loans, plus legal obligations like child support or alimony, and compares it to your monthly income. If your debt payments are less than 36 percent of your pre-tax income, you’re typically in good shape.

What if your income varies from month to month? In that case, your lender will likely use your average monthly income over the past two years. But if you earned significantly more in one year than the other, the lender may opt for the year’s average with lower earnings.

Note: Your required income doesn’t just depend on the size of the loan and the debts you have but will vary depending on your mortgage rate and the length of your loan. Those affect your monthly mortgage payment, so the mortgage income calculator allows you to take those into account as well.

How Our Mortgage Rates Are Calculated

NextAdvisors mortgage interest rate averages are pulled from Bankrates daily rate data.. These overnight rates are based on a specific borrower profile, which only includes loans for single-family homes with a loan-to-value ratio of 80% or better. Bankrate is part of the same parent company as NextAdvisor.

This table has current average rates based on information provided to Bankrate by lenders from across the country:

Average mortgage interest ratesAlso Check: What Is The Difference Between Bankruptcies

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

Calculating Your Mortgage Payment

This mortgage calculator can answer some of the most challenging questions in the home search journey, short of talking to a lender, including what kind of payment can I afford? How much do I need to make to afford a $500,000 home? And how much can I qualify for with my current income?

We’re able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford.

While determining mortgage size with a calculator is an essential step, it won’t be as accurate as talking to a lender. Get pre-approved with a lender today for exact numbers on what you can afford.

Read Also: How To File Bankruptcy Chapter 7 Yourself In Indiana

Does Dti Ratio Affect Your Credit Scores

Your DTI ratio may not directly impact your credit scores. But there are some indirect ways that your DTI or income can impact your credit scores.

For example, your credit utilization ratio may account for nearly 30% of your credit scores. And it looks at outstanding balances on your credit cards relative to your total available credit. Reducing your credit utilization ratio will also reduce your DTI ratio and could improve your credit scores.

But a loss of income could make it difficult to pay your bills on time. And late or missed payments could affect your credit scores. Thatâs because a loss of income can change your DTI ratio.

Avoid Taking More Credit

Keep your debt from growing by avoiding more debt. Do not take a car loan or personal loan before getting a mortgage. This increases your DTI ratio, which is apparent when lenders review your profile. Also avoid making large credit card purchases before applying for a mortgage. If you know something can wait, be patient before taking out another loan for a large expense. Again, having too many debts on your profile is a red flag for lenders.

Don’t Miss: Can Judgements Be Discharged In Bankruptcy

Lender Standards For Debt

Lenders want to know how well you’re making ends meet and how much home you can actually afford. The lower your DTI, the less debt you owe and the more able you are to make monthly loan payments.

Lenders consider both your front-end ratio, which is the percentage of mortgage you pay relative to your income, and your back-end ratio, which measures your total debts, including mortgage expenses, against your income. It can be helpful to know how your spending and savings can impact your future homeowning goals, too.

| Mortgage Industry Term | |

|---|---|

| Total Fixed Payment Expense Debt-to-Income Ratio | .43 |

How Much Of A Mortgage Can I Afford

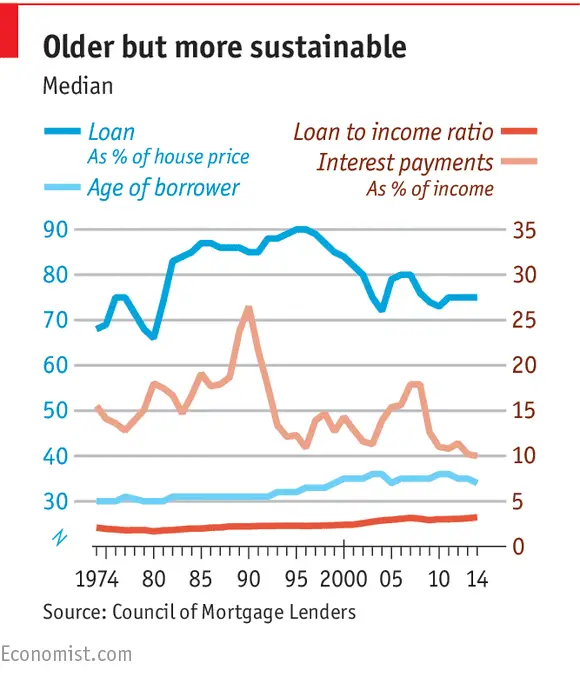

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Read Also: How To Lower Debt-to-income Ratio For Mortgage

Proving Your Income For A Mortgage As An Employee

If youre a W-2 employee, proving your income is straightforward if not a little tedious.

Your mortgage lender will usually ask for recent pay stubs at first. You may also have to provide a copy of your last W-2 form. Lenders will usually contact your employer for verification later in the mortgage application process.

Its also common for your lender to contact your employer one last time right before they finalize the mortgage approval process. This check is to make sure that youre still employed.

If you have commission income or other variable income, your lender might ask for proof similar to a self-employed borrower.

Understand Your Dti Ratio Before Seeking Mortgage Approval

Entering the real estate market for the first time can be daunting. Before doing so, its important that you have your finances in order. After checking your credit report, you can look into determining your DTI ratio.

The DTI ratio measures how much of your income goes toward debt. The lower the DTI, the more likely lenders are to approve you for a mortgage. Understanding your DTI allows you to better determine the maximum amount that you can spend on a home.

If you have a high DTI, there are some things that you can do to lower it. Focus on reducing your overall debt. You can either put down a larger down payment or reduce your back-end debt by using a tool like Tally, which can help you pay down your current credit card balances.

Recommended Reading: How Long Does Bankruptcy Take Once You File

Calculating Debt For A Mortgage Approval

For most mortgage applicants, calculating debt is more complex than calculating income. Not all debt on a credit report should be included in your DTI, and some debt which is not listed on a credit report should be used.

Lenders split debts into two categories: front-end and back-end.

- Front-end ratio: Includes debts that relate to housing expenses: your mortgage payment, property taxes, and homeowners insurance premiums, for example

- Back-end ratio: Includes minimum payments to your credit card companies, car payments, and student loan payments as well as your total monthly housing payment

Too Much Debt To Buy Or Refinance A Home Heres Your Plan

When you apply for a mortgage, the lender will make sure you can afford it.

Doing so involves comparing your debts and your income formally called your debt-to-income ratio, or DTI.

If your DTI is too high, you could have a hard time getting approved for a mortgage. However, there are ways to make the numbers work, even with a higher DTI.

In this article

Also Check: How To Apply For Bankruptcy In Michigan

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

What Is Your Debt

If you’re considering taking out a home loan, you need to know the rules regarding your DTI — that’s your debt-to-income ratio for mortgage loans. That’s because your debt-to-income ratio is one of the key factors that determines loan approval.

The best mortgage lenders consider a number of criteria when deciding whether to approve you for a mortgage. However, your debt-to-income ratio for mortgage loans is especially important. Mortgage companies want to know you’re not getting in over your head financially. If your debt-to-income ratio is too high, you may be denied a home loan. Even if you’re accepted, you might have to pay a higher interest rate on your mortgage.

Jump To

Don’t Miss: Help With Credit Debt

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

Don’t Miss: Is It Bad To File Bankruptcy