A Brief History Of Us Debt

Investopedia / Sabrina Jiang

Nearly all national governments borrow money. The U.S. has carried national debt throughout its history, dating back to the borrowing that financed the Revolutionary War. Since then the debt has grown alongside the economy, as a result of increased government responsibilities, and in response to economic developments.

Federal Debt: Total Public Debt As Percent Of Gross Domestic Product

Observation:

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Release: Debt to Gross Domestic Product Ratios

Units: Percent of GDP, Seasonally Adjusted

Frequency: Quarterly

Notes:

Federal Debt: Total Public Debt as Percent of Gross Domestic Product was first constructed by the Federal Reserve Bank of St. Louis in October 2012. It is calculated using Federal Government Debt: Total Public Debt and Gross Domestic Product, 1 Decimal :GFDEGDQ188S = /GDP)*100

Tracking The Federal Deficit: August 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $198 billion in August, the eleventh month of fiscal year 2020. This deficitthe difference between $223 billion of revenues and $420 billion of outlaysis $3 billion less than last Augusts, although this apparent improvement is an illusion created by shifts in the timing of certain payments. Without these timing shifts, this Augusts deficit would have been $106 billion greater than last Augusts. The cumulative deficit in FY2020 has risen to $3.0 trillion, an increase of $1.9 trillion from this point last year.

Analysis of notable trends: Cumulative revenue for the fiscal year is down 1% from this point last year, while cumulative outlays are 46% higher. August repeated this asymmetry, with revenues 2% lower than last Augusts and outlaysnetting out the timing shifts described above27% higher.

Thanks to a strong economy, this years revenue through March had been running 6% above last years. Then COVID-19 hit, and revenues from April through August have come in 9% lower than last year, due to both the loss in economic activity and legislation responding to the pandemic.

CBO now projects that the total deficit this fiscal year will run to $3.3 trillion, more than triple last years and the largest deficit as a share of the economy since 1945.

You May Like: Foreclosed Property For Sale

Current Us National Debt

According to data published in February 2019, Americas national debt has hit a record high of $22 trillion. Thats a $2 trillion increase since President Trump was inaugurated in January 2017.

Public debt occurs when there is a deficit, which happens when government spending exceeds government revenues. When there is a deficit, the government doesnt have the freedom to let its payments slide until next month as we do. Instead, the federal government issues securities to be sold as a line of credit. Public debt is the cumulative total of budget deficits over the years.

Public debt was equivalent to about 77% of US GDP at the end of 2018, compared to 35% in Q2 of 2008, shortly before the Great Recession. The Congressional Budget Office predicts that without significant changes to current fiscal policies, the US deficit will drive public debt to 100% of GDP by 2028.

Us Debt And Foreign Loans 17751795

During the American Revolution, a cash-strapped Continental Congress accepted loans from France. Paying off these and other debts incurred during the Revolution proved one of the major challenges of the post-independence period. The new U.S. Government attempted to pay off these debts in a timely manner, but the debts were at times a source of diplomatic tension.

In order to pay for its significant expenditures during the Revolution, Congress had two options: print more money or obtain loans to meet the budget deficit. In practice it did both, but relied more on the printing of money, which led to hyperinflation. At that time, Congress lacked the authority to levy taxes, and to do so would have risked alienating an American public that had gone to war with the British over the issue of unjust taxation.

Under the U.S. Constitution of 1789, the new federal government enjoyed increased authority to manage U.S. finances and to raise revenues through taxation. Responsibility for managing debts fell to Secretary of the Treasury Alexander Hamilton. Hamilton placed U.S. finances on firmer ground, allowing for the U.S. Government to negotiate new loans at lower interest rates. In addition, the United States began to make regular payments on in its French debts starting in 1790, and also provided an emergency advance to assist the French in addressing the 1791 slave revolt that began the Haitian Revolution.

Read Also: How In Debt Is America

Public Debt And Intragovernmental Holdings

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

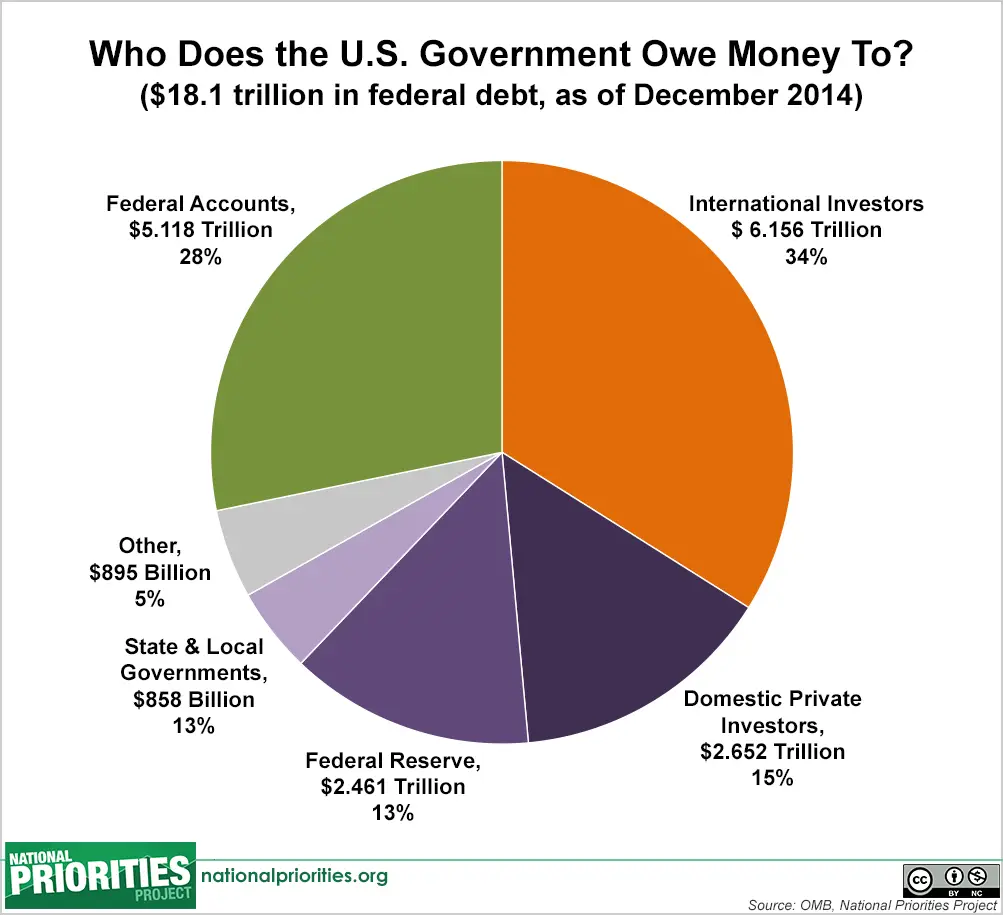

The Social Security Trust Fund owns a significant portion of U.S. national debt, but how does that work and what does it mean? Below, we’ll dive into who actually owns the U.S. national debt and how that impacts you.

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

Don’t Miss: How To File For Bankruptcy In Ca Without A Lawyer

Income Tax Calculator: Estimate Your Taxes

A big source of debt in Illinois are pension obligations. According to its states CAFR, Illinoiss net pension liability totaled $138.59 billion. Related to pension obligations are other postemployment benefits , including health, dental, vision and life insurance policies for state and university retirees. Illinoiss OPEB liability for the fiscal year 2019 totaled $54.52 billion. Indeed, OPEB liabilities are a significant issue for all indebted states. New York states net OPEB liability totaled $107.79 billion in 2019, which accounts for more than a third of the states nearly $292 billion in total liabilities.

How The Large Us Debt Affects The Economy

In the short run, the economy and voters benefit from deficit spending because it drives economic growth and stability. The federal government pays for defense equipment, health care, building construction, and contracts with private businesses. New employees are then hired and they spend their salaries on necessities and wants, like gas, groceries, new clothes, and more. This consumer spending boosts the economy. As part of the components of GDP, federal government spending contributes around 7%.

Over the long term, debt holders could demand larger interest payments, because the debt-to-GDP ratio increases, and this high ratio of debt to gross domestic product tells investors that the country might have problems repaying them. That’s a newerand worryingoccurrence for the U.S. Back in 1988, the national debt was only half of what the U.S. produced that year.

Weakened demand for U.S. Treasurys could increase interest rates and that would slow the economy.

Lower demand for Treasurys also puts downward pressure on the dollar because its value is tied to the value of Treasury securities. As the dollar value declines, foreign holders get paid back in a currency that is worth less than when they invested, which further decreases demand. Many of these foreign holders would become more likely to invest in their own countries. At that point, the U.S. would have to pay higher interest payments.

You May Like: How To Avoid Bankruptcy With Credit Cards

Definition Of Public Debt

Economists also debate the definition of public debt. Krugman argued in May 2010 that the debt held by the public is the right measure to use, while Reinhart has testified to the President’s Fiscal Reform Commission that gross debt is the appropriate measure. The Center on Budget and Policy Priorities cited research by several economists supporting the use of the lower debt held by the public figure as a more accurate measure of the debt burden, disagreeing with these Commission members.

There is debate regarding the economic nature of the intragovernmental debt, which was approximately $4.6 trillion in February 2011. For example, the CBPP argues: that “large increases in can also push up interest rates and increase the amount of future interest payments the federal government must make to lenders outside of the United States, which reduces Americans’ income. By contrast, intragovernmental debt has no such effects because it is simply money the federal government owes to itself.” However, if the U.S. government continues to run “on budget” deficits as projected by the CBO and OMB for the foreseeable future, it will have to issue marketable Treasury bills and bonds to pay for the projected shortfall in the Social Security program. This will result in “debt held by the public” replacing “intragovernmental debt”.

What Makes The Debt Bigger

The leading federal spending categories currentlySocial Security, Medicare/Medicaid and defenseare the same as in the 1990’s, when national debt was much lower relative to GDP. The U.S. remains the world’s largest economy and one of the richest countries. How, then, did the debt situation deteriorate? Numerous factors are in play.

You May Like: Who Owns Our National Debt

Recovery From The Civil War

The Civil War alone is estimated to have cost $5.2 billion when it ended and government debt skyrocketed from $65 million to $2.6 billion. Post-Civil War inflation along with economic disturbance from Europes financial struggles contributed to the vulnerable economic climate of the late 19th century.

The collapse of Jay Cooke & Co., a major bank invested in railroading, caused the Panic of 1873. Nearly a quarter of the countrys railroads went bankrupt, more than 18,000 businesses closed, unemployment hit 14 percent and the New York Stock Exchange began sinking.

This period of deflation and low growth continued for 65 months making it the longest depression, according to the National Bureau of Economic Research. During this time the government collected less money in taxes and the national debt grew.

The Politics Of National Debt

Disagreements about national debt have repeatedly preoccupied U.S. Congress. Whenever the national debt approaches the limit periodically reset by Congress, lawmakers are faced with a choice of raising the ceiling once again or letting the U.S. government default on its obligations, risking dire economic consequences. The U.S. government briefly shut down before Congress raised the limit in 2013. A similar standoff two years earlier led Standard & Poor’s to downgrade its U.S. credit rating.

In 2021, Congress narrowly averted a scheduled Oct. 1 government shutdown by passing a short-term funding bill, then raised the U.S. debt ceiling by $2.5 trillion to $31.4 trillion in December. That limit was expected to be reached in early 2023.

Americans profess to be concerned about the national debt in poll after poll, while also overwhelmingly supporting defense spending and outlays for Social Security and Medicare, and opposing tax increases.

As a result, elected officials too have been eager to be seen to be addressing the national debt, usually without linking it to the spending the debt enables or to the tax increases that a balanced budget would require.

Don’t Miss: Can Filing Bankruptcy Affect Your Job

Tracking The Federal Deficit: April 2019

The Congressional Budget Office reported that the federal government generated a $161 billion surplus in April, the seventh month of Fiscal Year 2019, for a total deficit of $531 billion so far this fiscal year. Aprils surplus is 33 percent less than the surplus recorded a year earlier in April 2018. If not for timing shifts of certain payments, the surplus would have been 5 percent smaller than the surplus in April 2018. Total revenues so far in Fiscal Year 2019 increased by 2 percent , while spending increased by 6 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Income tax refunds were down by 5 percent compared to last tax season, contrary to many analysts expectations. Further, outlays from the refundable earned income and child tax credits increased by 12 percent versus last year, reflecting expansions enacted in the Tax Cuts and Jobs Act of 2017. Net interest payments on the public debt continued to rise, up 13 percent compared to last year, largely as a result of higher interest rates and the nations steadily growing debt burden.

Tracking The Federal Deficit: June 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $173 billion in June, the ninth month of fiscal year 2021. Junes deficit was the difference between $450 billion in revenue and $623 billion in spending.

So far this fiscal year, the federal government has run a cumulative deficit of $2.2 trillion, the difference between $3.1 trillion in revenue and $5.3 trillion in spending. This deficit is nearly triple the shortfall over the same period in FY2019 , but is 19% lower than at the same point in FY2020. This is the first time in FY2021 that the cumulative deficit has decreased year-over-year.

Analysis of Notable Trends: Thus far in FY2021, year-over-year comparisons of deficit levels have largely reflected the trajectory of the COVID-19 pandemic and subsequent federal response. BPC expects this trend to continue through the rest of the fiscal year.

Cumulative year-to-date outlays are up 6% compared to the first nine months of FY2020 and are 58% greater than at this point in FY2019. These changes are indicative of continued spending towards COVID-19 relief programsin particular, refundable tax credits and supplemental unemployment compensationas every month to date in the current fiscal year has contained pandemic-related expenditures, whereas only March-June did for the relevant period last year.

You May Like: How Long Does Filing Bankruptcies Take

Us Debt: How Big Is It And Who Owns It

US federal debt is still a record high. This week it passed a milestone: the fourth straight year the deficit has passed the $1tn mark. As of today, the national debt stands at $16,066,241,407,385.80 .

It’s an issue that’s sure to come up in the first presidential debate this Wednesday.

So, how does the US borrow money? Treasury bonds are how the US – and all governments for that matter – borrow hard cash: they issue government securities, which other countries and institutions buy. So, the US national debt is owned mostly in the US – but the $5.4tn foreign-owned debt is owned predominantly by Asian economies.

Under President Obama’s first term, that figure has gone up from $3tn, a rise of 74.1%. Under George W Bush, it went up too – by 85% over the whole two terms – and 64% in his second term alone.

Holders of US Treasury bonds, $bn

The US Treasury releases the figures on this every quarter – we have made them more useable. So, who has the most?

It reflects a US national debt which has grown starkly, from $7.8tn in 2005 to busting through the US debt ceiling of $14.294tn last year – according to these day by day figures.

The full data is below. What can you do with it?

Fiscal Year 2021 In Review

The federal government ran a deficit of $2.8 trillion in fiscal year 2021, the difference between $4.0 trillion in revenues and $6.8 trillion in spending. This deficit was 12% lower than in fiscal year 2020, due to revenue increases outpacing expenditure growth. The FY2021 deficit, however, was almost three times that of FY2019 , as federal COVID-19 relief spending has continued to drive outlays to record highs. This years deficit amounted to approximately 13% of GDP, the second largest deficit as a share of the economy since 1945. Revenues tallied 18% of GDP, while spending rose to 30% of GDP.

Receipts totaled $4.0 trillion in FY2021an 18% year-over-year increasereflecting the general strength of the economy during the initial stages of the pandemic recovery. Individual income and payroll tax revenues together rose 15%, due to a combination of higher wages, increased employment, and payroll taxes that had been deferred by most employers from 2020 to 2021 per the CARES Act of March 2020. Corporate tax revenues increased by 75% in part due to higher corporate profits, and unemployment insurance receipts increased by 31% as states replenished their unemployment insurance trust funds.

Also Check: How To Improve Your Credit Score After Bankruptcy

Tracking The Federal Deficit: May 2019

The Congressional Budget Office reported that the federal government generated a$207 billiondeficit inMay, the eighth monthof Fiscal Year 2019, for a total deficit of $738 billionso far this fiscal year.Maysdeficit is41 percent more than the deficit recorded a year earlier inMay 2018. If not for timing shifts of certain payments, the deficit would have been7 percent larger than the deficit inMay 2018. Total revenues so far inFiscal Year 2019increased by2 percent , while spending increased by9 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Corporate income tax receipts were down by 9 percent compared to last year, reflecting the lower marginal corporate tax rate enacted in the Tax Cuts and Jobs Act of 2017. Further, customs duties increased by 78 percent versus last year, due to the imposition of new tariffs. On the spending side, Department of Defense spending increased by 10 percent compared to last year, particularly on military operations, maintenance, procurement, and R& D. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.