How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Dont Miss: How Much Is Monthly Payment On 600 000 Mortgage

Personal And Mortgage Information

- Annual income Enter your gross income, which is your total income before taxes and other payroll deductions, like your health insurance and retirement plan contributions. Lenders base your income on your gross income, not your net income.

- Mortgage term This can be anywhere from 10 to 30 years, but entering 30 years will have the lowest payments, and enable you to qualify for the highest loan amount.

- Interest rate This is the rate you expect to pay on the loan youll receive. Based on current rates, 7% is a safe estimate. But be aware that based on your credit situation, you may not qualify for the lowest rate available.

The Amount You Have Left Over Each Month

Some lenders calculate a minimum amount that we should have left over each month after fixed payments and a living allowance are deducted.

This is called UMI and varies from bank to bank.

For a couple, the calculations are based on combined income. For someone with children, lenders will expect to see less surplus.

If youre borrowing a large amount of the purchase price, lenders will expect you to have more spare income. This is so you can deal better with any future uncertainties like a rise in interest rates or a reduction in income. For example, if someone is borrowing 95%, some banks will want to see a UMI of $750 to $1,000 a month.

Don’t Miss: When Would Someone Be Restricted From Filing For Bankruptcy Brainly

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

Read Also: Does Cash Out Refinance Increase Mortgage Payment

Determine Your Down Payment

It helps to know how much you can provide as down payment before you start looking for a home. The size of your down payment may have an impact on the amount you get pre-approved for. Plus, down payments of less than 20% of the purchase price of a home require mortgage default insurance, whereas down payments that are 20% or above may not.

Recommended Reading: Credit Cards For Bankruptcies Unsecured

Conventional Mortgage Approval: Fannie Mae And Freddie Mac

Freddie Mac and Fannie Mae loans allow FICO scores as low as 620. They also approve mortgages with loan-to-value ratios as high as 95% or 97%. That means you need to make a down payment of at least 3-5%.

In addition, the two corporations will buy mortgages with maximum debt-to-income ratios of 45% under their standard guidelines.

However, this does not mean that you can get approved with a low down payment and a high DTI and a poor credit score.

If your credit score is on the lower end, for instance, you might need a bigger down payment or extra cash reserves. A larger down payment can also help you get approved if your debt-to-income ratio is on the high end .

According to the ICE Mortgage Technology Origination Insights Report, the average borrower using a conventional loan has a credit score in the mid-700s and more than 20% down.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

You May Like: What Should My Mortgage Be

Recommended Reading: Filing Bankruptcy Chapter 7 In Ohio

Things That Could Change Your Home Affordability Calculator Results

-

Your credit score

Your measures your current and past history of managing credit. A credit score above 740 usually helps you snag the lowest rate and monthly payment, which means you can potentially afford a more expensive home.

-

Your monthly income

Lenders look for a stable monthly income, which means a salary or hourly wage will give you a home affordability number you can count on. If youre self-employed or receive variable commission income, youll need to average out your income based on your tax returns for the past two years.

-

Your total monthly debt

Lenders take a look at how much debt you have now, and how much youll have with your new mortgage payment. They take both of these sums and divide them by your gross monthly income to determine two types of DTI ratios:

- Your front-end DTI ratio. This figure divides your new house payment by your income, and most lenders prefer that it doesnt exceed 28%.

- Your back-end DTI ratio. Lenders add all your debt to your new house payment and then divide it by your income, and most prefer a DTI ratio of about 43%.

Your loan term

Youll be able to afford a bigger home with a longer repayment term, such as 30 years. However, a shorter term can save you thousands in interest charges, if the higher payment doesnt strain your monthly budget.

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

Read Also: How Much Is A Bankruptcy Lawyer In Ny

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Recommended Reading: Does A Mortgage Loan Cover The Down Payment

Recommended Reading: What Happens At A Bankruptcy Trustee Meeting

What You Should Do Next

Find a reputable home mortgage lender. Granville Homes has over 40 years of award-winning service and is proud to simplify the home mortgage process with Granville Home Loans. Granville Home Loans Officers have experience with home loans such as FHA, Conventional, VA, Jumbo, USDA, and more. They will connect you with the best possible mortgage available to ensure you qualify for your dream home. Click the link below to get in touch with an experienced Granville Home Loans Officer today.

Recommended Reading: What Information Do You Need To Prequalify For A Mortgage

Calculate How Much House You Can Afford

Before you get your sights set on your dream home, make sure you can afford it.

Estimate how much house you can afford to buy by using the 28/36 rule. This refers to your debt-to-income ratio, or the total amount of your gross monthly income thatâs allocated to paying debt each month. For example, a 50% DTI means you spend half of your monthly pre-tax income on debt repayment.

Ideally, your âfront-endâ DTI, which includes only your mortgage-related expenses, should be below 28%. Your âback-endâ ratio, which includes the mortgage and all other debt obligations, should be no more than 43%, though under 36% is ideal.

If your DTI is too high, youâll need to work on reducing or eliminating some existing debt before you apply for a home loan.

And remember, your monthly loan payment is just one piece of the puzzleâthereâs also interest, homeowners insurance, property taxes and, potentially, homeowners association fees. Youâll also need to consider how much of a down payment you can contribute, and whether youâll be required to pay private mortgage insurance .

There are also plenty of online calculators that can help you run the numbers.

Recommended Reading: What Are The Types Of Bankruptcies

Close On Your Mortgage

Once your lender is ready to close on your loan, you’ll bring a check for your down payment and will sign the necessary documents to put your mortgage into place. You’ll also have to pay closing costs on your loan, which can amount to 2% to 5% of your mortgage amount. Most lenders let you roll your closing costs into your mortgage and pay them off over time.

Whether you’re a first-time home buyer or are moving from one home to another, it’s important to know how much house you can afford. Crunch those numbers carefully before you make an offer on a house so you don’t wind up overspending on a home and regretting it after the fact.

How To Calculate Your Debt

To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

Next, determine your gross monthly income.

Take your total debt payments and divide that number by your gross monthly income. Lets say for this example that your monthly income is $4,000. Then your total monthly debt payments divided by your gross monthly income is $1,100 ÷ $4,000, or 0.275. We can convert the result to a percentage: 0.275 x 100% = 27.5%.

Read Also: How Does Insolvency And Bankruptcy Code Work

After Youve Set Your Budget

Once youve factored in all the costs and found the monthly mortgage payment that fits your budget, talk with your lender and have them help you translate that payment into a realistic mortgage, loan or home equity line of credit amount.

When comparing different loans or lines of credit, make sure you clearly understand their terms and would feel comfortable with the monthly payments throughout the life of the loan or line of credit. And if a lender says you can afford more than what youve budgeted, seriously consider whether this would be a stretch for you and dont hesitate to stick to a smaller amount. If a lender tries to pressure you into accepting a loan or monthly payment youre not comfortable with, choose a different lender.

You may also want to consider prequalification. While prequalification doesnt give you a loan commitment or a guarantee, its a good first step to see the amount and type of loan a lender could offer you.

Finally, keep in mind how much you can afford to borrow without putting the rest of your financial plans on hold. This can help you build a stronger future, because youll be better informed and better equipped to be a successful homeowner.

What Is A Good Income To Buy A House

Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender.

The higher your credit score, the better the interest rate you are offered therefore, you might be able to own a higher priced home than someone with a low credit score.

Don’t Miss: How To File For Bankruptcy In Az

The Monthly Payment Is Higher Than Pre

Mortgage pre-approvals simulate the purchase of generic homes at specific purchase prices. But, when buyers make offers on real homes, those approvals use real numbers.

As part of the final approval, lenders replace pre-approval numbers with real numbers:

- The purchase price of the home

- The expected down payment

- The homes real estate tax bill

- The expected homeowners insurance premium

- The homes monthly assessment, if applicable

If the newly-calculated housing payment is higher than expected, the buyers pre-approval may be invalidated.

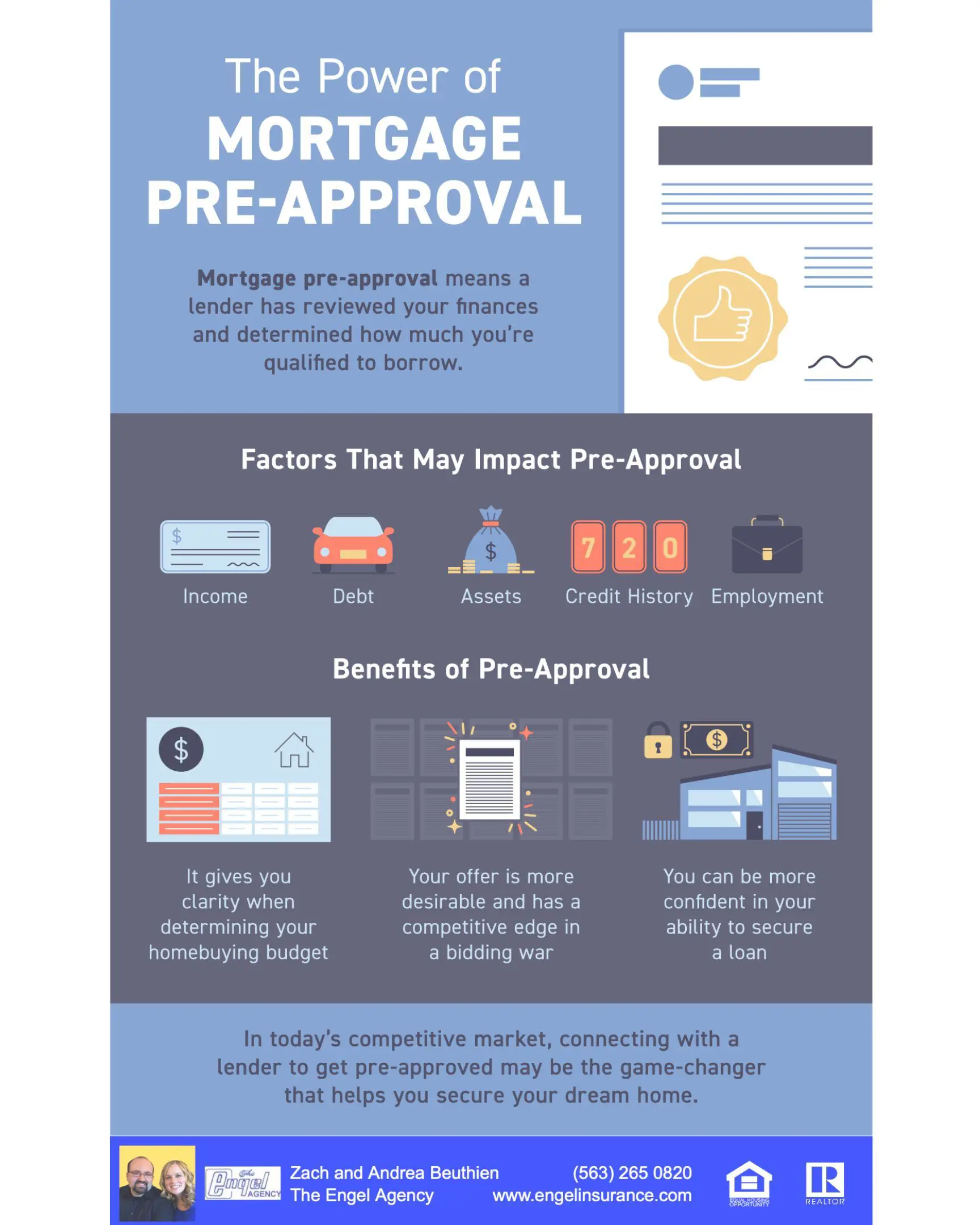

Why Should You Get Pre

There are many reasons why you should get pre-approved. The most important reason is that you will get an accurate idea of how much home you can afford. This can help to target your home search and ensure you only look at houses that are truly in your price range. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Some sellers might even require buyers to submit a pre-approval letter with their offers, though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. A pre-approval letter can make you stand out in a competitive real estate market. If you make an offer on a house without a pre-approval, your offer may not be taken as seriously as an offer from another person with a pre-approval.

You May Like: Whats The Monthly Mortgage Payment

Don’t Miss: Are Tax Debts Discharged In Bankruptcy

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyâll also look at your assets and debts, your credit score and your employment history. From all of this, theyâll determine how much theyâre willing to lend to you.

However, the amount you may qualify to borrow isnât necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They donât take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

Overcoming Common Challenges To Qualify For A Mortgage

The three most common barriers to homeownership are:

If you get rejected for a mortgage based on any of these three factors, it may feel like all is lost. However, it may be possible to overcome these challenges, often in less time than you might think.

Recommended Reading: Can You Buy A Home While In Bankruptcy