Stay Ahead Of The Curve

In the legal profession, information is the key to success. You have to know whats happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

- Access to case data within articles

- Access to attached documents such as briefs, petitions, complaints, decisions, motions, etc.

- Create custom alerts for specific article and case topics and so much more!

TRY LAW360 FREE FOR SEVEN DAYS

Navient Loses Student Loan Bankruptcy Battle But Long Fight Looms

- Nationwide class actions are unusual in bankruptcy

- Private student loan discharge restrictions being chipped away

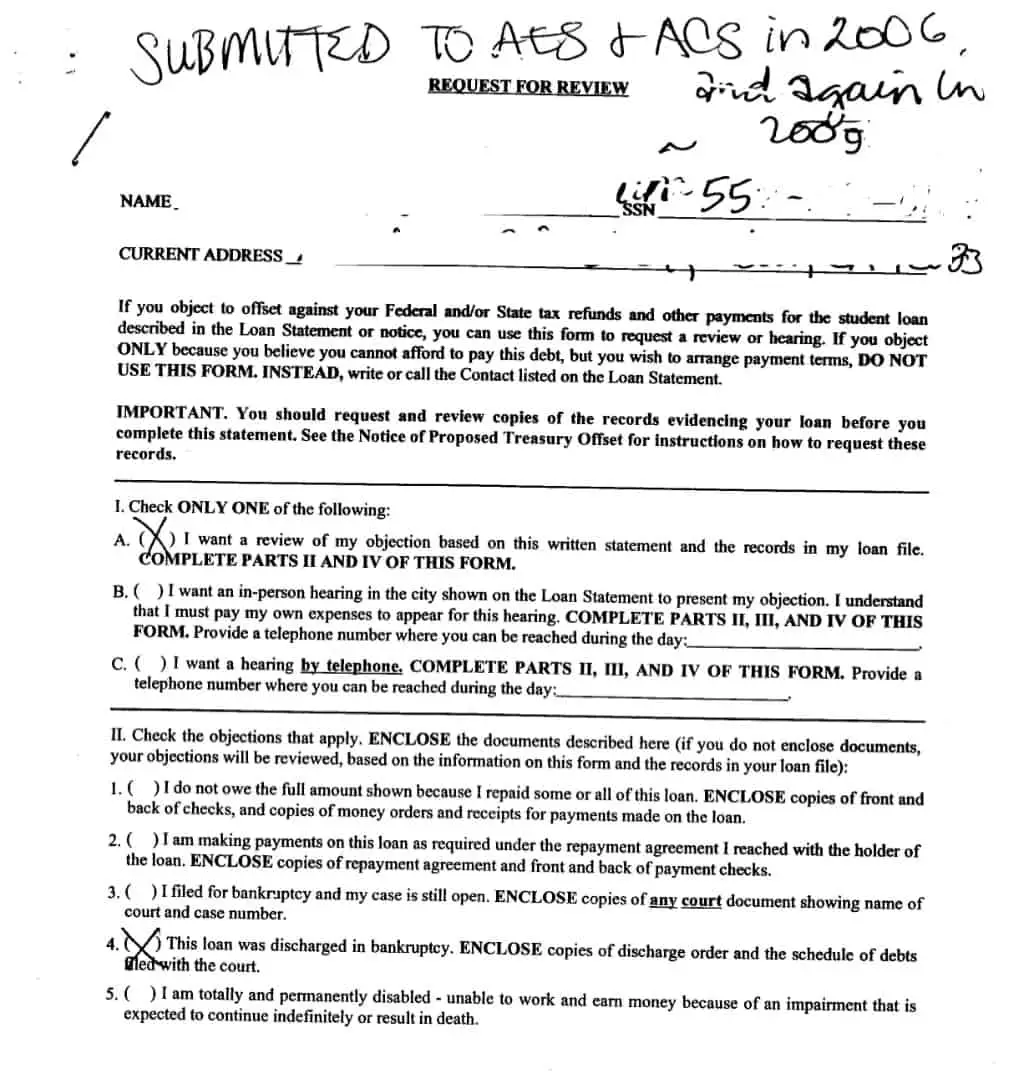

Private student loan borrowers won a nationwide injunction barring Navient Corp. from trying to collect on certain loans that they believe should have been discharged in bankruptcy, but their quest for financial relief from the debt servicer is just heating up.

Courts have chipped away in recent years at the long-held notion that a debtor cant wipe out any type of student loan debt in bankruptcy without a burdensome showing of undue hardship.

The plaintiffs, who sued Navient in a proposed class action in New York bankruptcy court, now want the class certified so they can seek further relief from privately issued student loans that exceeded college attendance costs. But getting any class certified is difficult in the first place, an ordeal that is exacerbated by certain precedents limiting a bankruptcy courts jurisdictional authority.

Still, the case against the massive loan servicer is being closely monitored, as the outcome could dramatically affect tens of thousands of student loans.

Youre talking about hundreds of millions of dollars still outstanding and hundreds of millions of dollars that have been paid back already, said plaintiffs attorney Adam Shaw of Boies Schiller Flexner LLP.

Every step of this case will be appealed to the extent appeals will be allowed, said John Rao, an attorney with the National Consumer Law Center.

Can I Discharge Both Federal And Private Student Loans

Yes, both federal and private student loans are eligible for discharge. Private student loans may be exempt from the undue hardship requirement. Some private student loans may not be qualified education loans and therefore dischargeable just like any other types of debts. Your private loan may not be a qualified loan if you borrowed more than the schools cost of attendance or you attended an illegible school. The burden of proof is on the lender to demonstrate that your private loans are qualified loans before you must show undue hardship.

Read Also: Who Filed For Bankruptcy

When Are Education Loans Made By Private Lenders Dischargeable

Section 523 of the U.S. Bankruptcy Code protects three types of education debt from discharge:

loans and benefit overpayments backed by the federal government or a nonprofit

qualified private educational loans

obligations to repay funds received as an education benefit, scholarship, or stipend.

If a loan meets one of those three requirements, you can get rid of it only if you prove you meet the undue hardship standard. Specifically, youll have to show two things:

-

You made a good faith effort to repay the debt.

-

Your current and future financial situation doesnt allow you to maintain a minimal standard of living for you and your dependents while making student loan payments throughout the repayment period.

Learn More: Can You File Bankruptcy on Refinanced Student Loans?

Recent Definitions Of Undue Hardship

Although not necessarily the same as undue hardship, financial hardship has a similar definition. Financial hardship is defined in the regulations for administrative wage garnishment as:

- An inability to meet basic living expenses for goods and services necessary for the survival of the debtor and his or her spouse and dependents.

Financial hardship is determined by comparing costs incurred for basic living expenses for the borrower, the borrowers spouse and the borrowers dependents with all income available to the borrower from any source. The regulations for administrative wage garnishment were added in 2003 and are based on the Debt Collection Improvement Act of 1996 . Although Congress did not initially define the term undue hardship, the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 added a definition of undue hardship at 11 USC 524:

- It shall be presumed that such agreement is an undue hardship on the debtor if the debtors monthly income less the debtors monthly expenses as shown on the debtors completed and signed statement in support of such agreement required under subsection is less than the scheduled payments on the reaffirmed debt. This presumption shall be reviewed by the court.

This is the equivalent of the first prong of the Brunner Test.

Recommended Reading: Can Irs Debt Be Included In Bankruptcy

Biden Administration To Make It Easier For Student Loan Borrowers To Discharge Debt In Bankruptcy

- The Biden administration announced on Thursday updated guidelines that will make it easier for those struggling with their student debt to discharge it in bankruptcy.

- Around 250,000 student loan debtors file for bankruptcy each year, but fewer than 300 walk away from their education debt in the proceeding, according to research published in the Duke Law Journal in December 2020.

The Biden administration announced on Thursday updated guidelines that will make it easier for those struggling with their student debt to discharge it in bankruptcy.

The new bankruptcy policy comes from the U.S. Department of Justice and the U.S. Department of Education, and allows federal student loan borrowers to prove that they’re experiencing financial distress requiring a fresh start. Under the rules, the agencies may recommend that a bankruptcy judge discharge a borrower’s student debt if they find their case warrants it.

Currently, it’s difficult, if not impossible, for someone to walk away from their federal student debt in a normal bankruptcy proceeding.

“Today’s guidance outlines a better, fairer, more transparent process for student loan borrowers in bankruptcy,” said Vanita Gupta, associate attorney general of the U.S.

More from Personal Finance:

Federal Reserve chairman Jerome Powell has said that he’s “at a loss to explain” why student loans are treated differently than other types of debt in the proceedings.

Private Student Loans Bankruptcy: Are They Dischargeable

#Bankruptcy

#1 Student Loan Lawyer

You may have heard that you cant file bankruptcy for student loans. Thats not entirely true. Its possible to discharge private and federal student loans in bankruptcy but the process is more burdensome than wiping out credit card debt, medical bills, and other types of debt

Federal student loans are less likely to be discharged in bankruptcy because they offer flexible, income-based repayment plans, deferments, forbearances, and loan forgiveness. Those things make it challenging for student loan borrowers to prove they have an undue hardship something that must be proven before any judge will even consider discharging a student loan debt of any kind.

But private student loan lenders dont offer the same types of benefits as the Department of Education. Although its still going to be a hard sell to the judge, its easier to file bankruptcy on private student loans and get a discharge. Plus, theres new bankruptcy law from cases and proposed legislation that may eventually allow borrowers to get rid of their private loans without having to jump through extra hoops.

Ahead, learn more about private student loan bankruptcy.

Struggling under the weight of your private loans? Settlement or student loan refinancing may be an option, depending on your finances. If youd like help figuring out your options, schedule a call to speak with a student loan lawyer.

You May Like: Liquidation Pallets Charlotte Nc

Bankruptcy Discharge Of Student Loans Requires Undue Hardship

Qualified education loans, which include all federal education loans and many private student loans, cannot be discharged in bankruptcy unless this would impose an undue hardship on the debtor and the debtors dependents . Loans made under a program that is funded in whole or in part by a nonprofit institution are similarly excepted from discharge.

Congress did not define what it meant by the term undue hardship. Since most bankruptcy court cases involve financial hardship, it seems that Congress wanted a harsher standard for student loans, one that presents an unreasonable or excessive burden. But, Congress left it to the bankruptcy courts to define the term.

Originally, Congress allowed student loans to be discharged if they have been in repayment for at least five years. Undue hardship was provided as an alternative for discharging student loans that had been in repayment for a shorter period of time. The option for a bankruptcy discharge after five years was increased to seven years in 1990 and eliminated entirely in 1998, leaving just the undue hardship option.

Most courts have adopted one of two standards for defining undue hardship, either the Brunner Test or the Totality of Circumstances Test .

Dont Miss: What Do You Lose When You File For Bankruptcy

Consider Hiring A Lawyer

While you dont technically have to go through a lawyer when filing bankruptcy on student loans, bankruptcy can be an incredibly complex process. It requires determining which type of bankruptcy youll file for and submitting an extra lawsuit, called an adversary proceeding . Going through it all alone could mean extra time, incorrect filings and, possibly, a lost case.

However, one thing to consider is that hiring a student loan lawyer could actually hurt your chances for discharging your student loans in bankruptcy, according to Fuller. Thats because some judges may feel that if you can afford fees for an attorney, then you can afford to be paying back something on your loans, which would disqualify you from experiencing undue hardship.

If you dont know a lawyer, dont worry. You can find one through the American Bar Association. You might be eligible for a lawyer at no cost to you through the Legal Services Corporation, an independent nonprofit created by Congress that offers financial support for civil legal aid to low-income Americans. Just make sure you pick a lawyer that specializes in bankruptcy and has very good reviews.

If you opt to handle your case yourself, a recent study by the American Bankruptcy Journal noted that debtors without a lawyer were just as likely to have their student loans discharged by a bankruptcy judge as those who worked with an attorney.

Also Check: How To File For Bankruptcy In Oregon

Can Private Student Loans Be Discharged In Bankruptcy

Before 1976, borrowers could discharge private and federal student loans in a bankruptcy, just like or medical debt. But the introduction of the U.S. Bankruptcy Code in 1978 caused a major shift with regard to student debt.

At the time, the intent of Congress was to protect educational loans from bankruptcy abuse. The amended bankruptcy code stated that funds received as an educational benefit would no longer be discharged unless the borrower could demonstrate undue hardship, which is no easy feat. To prove undue hardship, borrowers must demonstrate that paying back their loans would prevent them from maintaining a minimal standard of living and that their circumstances wont be changing anytime soon.

Since the ability to discharge private student loans became limited, theres been much debate on the subject. In recent years, there have been a number of major court rulings that made it possible to discharge private student loans. Yet attorneys caution that those rulings still dont necessarily mean that all private student loans are dischargeable in bankruptcy at least not without special circumstances.

It appears as though the courts will eventually answer this question, unless Congress acts first. However, until that happens, the bankruptcy code allows for private student loans to be discharged in bankruptcy only if borrowers can meet the undue hardship standard.

Private Student Loans Bankruptcy: Is It Getting Easier

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

If you need solutions for your student debt:

-

Find help: Options for legit student loan help resources and organizations to contact.

-

Pause payments: Find out the differences between student loan forbearance and deferment.

-

Get out of default: Learn the consequences of and remedies for defaulting on your student debt.

-

Declare bankruptcy: Explore how to discharge student debt in bankruptcy.

Student loan borrowers who seek to have their debt canceled in bankruptcy whats known as discharge typically find it an expensive process with standards that can be difficult to meet. But recent bankruptcy court rulings and lawmakers support of relief for overburdened borrowers may signal a change is coming for private student debt.

In July 2021, a New York-based federal appeals court refused to dismiss a lawsuit against Navient for violating a court order to discharge loans, and ruled that private student loans are not protected from discharge in bankruptcy.

These decisions could serve as a precedent for future bankruptcy cases involving student loans, says John Rao, an attorney with the National Consumer Law Center.

You May Like: How To Get A Bankruptcy Off Your Credit Report

Hidden Consumer Rights And Remedies Regarding Private Student Loans

Federal student loans are dischargeable in bankruptcy only based on undue hardship . Creditors have worked hard to foster the misconception that the same standard applies to all private student loans. See, e.g., Student Borrower Protection Center, Morally Bankrupt: How the Student Loan Industry Stole a Generations Right to Debt Relief Letter from Senators Durbin, Brown, Whitehouse, and Warren to CFPB Director Chopra . In fact, private student loans are generally dischargeable in bankruptcy unless they meet each of ten conditions described below.

This article provides practice tips to determine if a specific private student loan is generally dischargeable and provides advice on dealing with private student loans in bankruptcy. The article then turns to remedies available to consumers subject to collection efforts after their private student loans are discharged in bankruptcy. Also considered, even where there is no bankruptcy filing, are consumer remedies for misrepresentations made to a borrower that allege a private student loan is not generally dischargeable. The article concludes with a brief discussion of remedies for other abuses related to private student loans.

What These Dischargeable Loans Look Like

Lets look at those section that describe what an eligible education institution or qualified education loan really is.

According to this bankruptcy code section the loan may not be automatically discharged:

unless excepting such debt from discharge under this paragraph would impose an undue hardship on the debtor and the debtors dependents, for

an educational benefit overpayment or loan made, insured, or guaranteed by a governmental unit, or made under any program funded in whole or in part by a governmental unit or nonprofit institution or

an obligation to repay funds received as an educational benefit, scholarship, or stipend

any other educational loan that is a qualified education loan, as defined in section 221 of the Internal Revenue Code of 1986, incurred by a debtor who is an individual

Lets look first at what section 221 says:

d) Definitions For purposes of this section

Qualified education loan The term qualified education loan means any indebtedness incurred by the taxpayer solely to pay qualified higher education expenses

which are incurred on behalf of the taxpayer, the taxpayers spouse, or any dependent of the taxpayer as of the time the indebtedness was incurred,

which are paid or incurred within a reasonable period of time before or after the indebtedness is incurred, and

which are attributable to education furnished during a period during which the recipient was an eligible student.

Section 221 says:

You May Like: How Long Till Bankruptcy Is Discharged

Is All Guarantee Forgotten Ailment Of Bankruptcy Code

Many parties have criticized the Brunner test and its criteria for proving undue hardship. Some courts see the requirements as unnecessarily difficult to meet and struggle with the fact that sympathetic and unsympathetic debtors are held to the same standard.

But not all hope is lost for those seeking to discharge student loan debt in bankruptcy. Courts have strayed from the Brunner test and granted relief to those who had no disability to outstanding circumstances.

In Within the re Bronsdon , a 64-year-old woman claimed that she was unable to find employment and could not repay her student loans from law school. While this didnt prove that the debtors future ability to find a job was completely hopeless , the bankruptcy court nevertheless granted the discharge. Upon appeal from the ECMC, who claimed that the debtor did not exhaust other options, such as a consolidation program known as the Ford program, the First Circuit upheld the decision and allowed for the discharge. The court stated:

Havent There Been Cases Where People Still Got Rid Of Their Students Loans Through Bankruptcy

Absolutely. Though difficult, it is still possible to have student loans discharged through bankruptcy by meeting the undue hardship requirement. A 2011 study found that only 1 in 1,000 student loan borrowers who declared bankruptcy even tried to have their student loans discharged. However, those that did succeeded at a rate of 40%.

Section 523 of the Bankruptcy Code does not set out a specific test to determine what qualifies as undue hardship. The federal courts are split on what the appropriate standard should be for discharging student loan debt. The Second Circuit case, Brunner v. New York State Higher Education Services Corporation, established three requirements that determine whether undue hardship applies.

First, the borrower must demonstrate that if forced to repay the student loans, they will be unable to meet a minimal standard of living based on income and bills.

Second, the borrower must be unable to repay for a significant portion of the repayment period.

Third, they must have made good-faith efforts to repay the student loan.

If a bankruptcy court agrees that a borrower meets these three requirements, the court can discharge the student loan debt.

But bankruptcy courts in the Eighth Circuit and occasionally courts in the First Circuit reject Brunner and examine the totality of the circumstances instead.

Also Check: How Long After Bankruptcy Can You Apply For Credit