Biden Administration Offers New Path To Discharging Student Debt In Bankruptcy

The Justice and Education Departments said the process would be more fair and consistent for people in bankruptcy seeking relief on their federal student loans.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

As President Bidens broad plan to cancel student debt for millions of borrowers faces mounting legal challenges, his administration took a separate step that could make it easier for the most vulnerable student borrowers to clear their debts: through bankruptcy.

Unlike credit card bills, medical bills and other consumer debts, student loans arent automatically wiped away in bankruptcy. Borrowers are required to file a separate lawsuit to try to do so. Its stressful, costly and notoriously difficult to meet the strict legal tests to succeed, and most debtors dont even try.

But, on Thursday, the Justice Department, in coordination with the Education Department, announced a new process that it said would help ensure that people in bankruptcy seeking relief on their federal student loans were treated more fairly, with clearer guidelines about what types of cases would result in a discharge.

As a result, the process became too burdensome for those who were most distressed.

Some courts take the test a step further, and require borrowers to demonstrate a certainty of hopelessness.

Possible Alternatives To Student Loan Bankruptcy

Filing for bankruptcy can definitely bring some much-needed relief if youre struggling financially. However, the consequences of filing for bankruptcy are long-lasting, which is why it should be your last resort.

If the main issue at hand is that youre unable to keep up with your student loan payments, but are okay balancing everything else without them in the picture, make sure you explore the following options before you make a decision.

- Contact consumer advocacy organizations. If youre worried about defaulting on your student loans, national organizations can help you apply for repayment options, investigate debt payoff plans or explore loan rehabilitation.

Student Loans In Bankruptcy New Possibilities For Discharge

Since 1998, unlike credit card bills, medical bills and other consumer debts, student loans have not been automatically wiped away in bankruptcy. Borrowers have been required to file a separate lawsuit within their bankruptcy filing, to try to do so. This process for the most part has been stressful, costly and notoriously difficult to meet the strict legal tests to succeed, and most borrowers have not even tried, unless they suffered a severe hardship, such as a disabilityuntil now.

On November 17, 2022, the Biden Administration provided the Department of Justice with a memorandum developed in coordination with the Department of Education regarding requests to discharge student loans in bankruptcy cases.

The new guidance advises DOJ attorneys to now stipulate to certain facts demonstrating that a debt would impose an undue hardship, and recommend to the Bankruptcy Court that a Borrowers student loan be discharged if three conditions are satisfied:

that the Borrower presently lacks an ability to repay the loan that the Borrowers inability to pay the loan is likely to persist in the future and the Borrower has acted in good faith in the past in attempting to repay the loan.

At the present time, this analysis can only be undertaken by the DOJ and the DOE as part of a pending bankruptcy case.

Factors to be Determined

Consideration of a student loan debt discharge requires an evaluation of a Borrowers present, future, and past financial circumstances.

You May Like: Can You Get A House After Bankruptcy

Eligibility For Loan Forgiveness

In order to be eligible for loan forgiveness, a borrower must have loans held by the U.S. Department of Education and have an individual income of less than $125,000 .

The federal government has additional student loan forgiveness programs, including public service loan forgiveness, income-driven repayment forgiveness, teacher loan forgiveness, military service, AmeriCorps and other options.

Why Can’t You Declare Bankruptcy On Student Loans

You can file bankruptcy on student loans and get a fresh start but its a challenge. Unlike other types of debt that go away automatically at the end of a bankruptcy case e.g., medical bills, credit card debt, repossessions, and so on you have to file a separate lawsuit to get rid of both federal and private student loans.

In the lawsuit, youll need to overcome decades of case law and convince a judge of one of two things. First, repaying your federal student loans will cause you an undue hardship. Thats hard to do because the Education Department offers affordable monthly payments with income-driven repayment plans and student loan forgiveness programs that wipe out your remaining balance if you work in public service, pay for 20+ years, or suffer a permanent disability.

Learn More: What Happens to Private Student Loans in Bankruptcy?

Don’t Miss: Can You File Bankruptcy If You Owe Back Taxes

Private Vs Federal Student Loans

If you have private loans, it might be easier to pass the undue hardship test, since private lenders may not let you arrange for lower payments. If you have a federal student loan, it may be harder to pass the test, as there are many repayment options for borrowers, some of which let you pay little to nothing for a time.

However, even for federal loans, if something happens that makes it impossible to pay your loans, such as becoming disabled and unable to work, you may be able to pass the test and have your student loan discharged.

In addition, you may be able to have your student loans discharged in situations where there was fraud or misrepresentations by a college, such as if your college falsely certified you to be eligible for student loans or signed your loan application or promissory note without your permission. In these situations, you should consult with a student loan lawyer immediately.

Justice Department And Department Of Education Announce A Fairer And More Accessible Bankruptcy Discharge Process For Student Loan Borrowers

The Department of Justice, in close coordination with the Department of Education, announced today a new process for handling cases in which individuals seek to discharge their federal student loans in bankruptcy. The new process will help ensure consistent treatment of the discharge of federal student loans, reduce the burden on borrowers of pursuing such proceedings and make it easier to identify cases where discharge is appropriate. The Associate Attorney General distributedguidance outlining the new process to all U.S. Attorneys.

Congress has set a higher bar for discharging student loan debt compared to other debt borrowers who seek to discharge their loans through bankruptcy must demonstrate that they will suffer undue hardship unless the debt is discharged. Although the bankruptcy judge makes the final decision whether to grant a discharge, the new process announced today provides Justice Department attorneys with clear standards for recommending discharge to the judge without unnecessarily burdensome and time-consuming investigations. The new process will also help borrowers who did not think they could get relief through bankruptcy more easily identify whether they meet the criteria to seek a discharge.

You May Like: How To File Bankruptcy Without An Attorney

What Else Is Involved In The New Bankruptcy Discharge Process For Student Loans

More specifically, there are now higher standards when it comes to discharging student loan debt via bankruptcy. That is, borrowers must prove to the bankruptcy judge that they will suffer an undue hardship unless their student loan debt is discharged. But on the flip side, this new process helps borrowers easily identify whether they meet the criteria to get their student debt discharged which they would not have realized otherwise.

In addition, the bankruptcy judge will receive comprehensive recommendations from the Justice Department without the need to conduct lengthy investigations. With that being said, the undue hardship analysis will be conducted as follows:

Biden Administrations New Rules Come After Courts Blocked Its Mass Debt

The Biden administrations decision to make it easier to discharge student loans in bankruptcy could offer a new safety valve for debtors who have exhausted other options for getting out from under heavy debt loads.

The move, announced Thursday, comes as President Bidens broader plan for mass student-debt cancellation is in limbo after being blocked . That plan calls for canceling up to $20,000 in debt for borrowers under certain income thresholds. It would render up to 20 million people free of debt, around half of all student-loan borrowers, if courts allow it go forward.

Continue reading your article witha WSJ membership

Recommended Reading: Can You Get A Discover Card After Bankruptcy

Biden Administration Announces Changes To Federal Student Loan Bankruptcy Policies

This week, the Education Department and Justice Department announced new policy guidance that would alter how the Biden administration handles undue hardship bankruptcy discharge requests by federal student loan borrowers.

The new process will leverage Department of Education data and a new borrower-completed attestation form to assist the government in assessing a borrowers discharge request, according to the U.S. Department of Justice in a press release on Thursday. The Justice Department, in consultation with the Department of Education, will review the information provided, apply the factors that courts consider relevant to the undue-hardship inquiry and determine whether to recommend that the bankruptcy judge discharge the borrowers student loan debt. In other words, there may be some cases specific to a borrowers overall circumstances in which the federal government may decide not to oppose a federal student loan bankruptcy discharge, clearing the way for a borrower to eliminate their federal student loan debt without having to complete a full adversary proceeding.

Advocacy groups praised the administrations reform.

Contact Us For A Free Consultation

If you have questions about your student loan or any other debt, the seasoned and compassionate Ohio debt-relief attorneys at Fesenmyer Cousino Weinzimmer offer a free consultation to evaluate your entire financial situation. Even if total discharge is not possible, we can help you explore other options, such as negotiating with the lender to get more favorable terms and modification or consolidation of the student loan debt.

If you want to try to get your student loans canceled, you have to start an adversary proceeding during your bankruptcy to present facts to prove undue hardship. Our attorneys can examine your individual situation, determine the best way to prove undue hardship, and present this information to the courts. Whether or not your student loans can be discharged, if you are overwhelmed with debt and are struggling to make even minimum monthly payments on credit cards, a home mortgage and your student loans, bankruptcy can be a way to make a fresh start.

Delaying can only worsen your situation, so call the Ohio bankruptcy attorneys at Fesenmyer Cousino Weinzimmer today so we can determine what debt relief solutions will work best for you.

Also Check: What Can Bankruptcy Do For You

Consider Other Options Before Bankruptcy

Obtaining a bankruptcy discharge of your student loans is not easy, and fortunately there are other steps desperate borrowers can take before making this last-ditch effort.

“In proceedings where clients of ours have tried , if they can’t prove that they have no hope of paying back the debt, then the Department of Education usually responds by telling the borrower to enroll in an income-based repayment plan,” Hornsby explains.

Federal income-driven repayment plans recalculate your monthly bill based on any changes in your income. Your monthly student loan payment is therefore reflective of how much you can afford to pay.

Hornsby suggests income-driven repayment plans such as Pay As You Earn and Revised Pay As You Earn . With these programs, your credit score won’t be ruined like it would in bankruptcy proceedings, plus you’ll only need to pay 10% of your discretionary income. After the repayment period ends, any remaining balance is forgiven.

If your monthly payment is just too high, consider refinancing your student loans. Through refinancing, you can both score a lower interest rate and extend your loan term so that your monthly payments are lower. Though this means more months, or years, of interest collecting, it can help you in the immediate term if you are tight on cash.

How The New Process Works

An American debtor that requests a discharge of federal student loans in bankruptcy will be asked to provide relevant information to the government. They must complete an attestation form that asks for information about their income and expenses.

The attestation asks a debtor to provide documents that evidence the debtors stated income. These may be tax returns, or where appropriate, pay stubs or other documents that prove income.

The DOJ attorney may seek additional evidence when necessary to support representations in the attestation. The Department of Education provides the debtors account history and loan details to the DOJ. The debtor will receive that information when they get the attestation form.

The debtor is required to sign the attestation under penalty of perjury .

Also Check: How Much Is Bankruptcy Chapter 7 In Ohio

Can Your Debts Be Erased In Student Loan Bankruptcy Yes Heres How

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Note that the government has paused all repayment on federally held student loans through the end of 2022, with no interest to be charged during that period and no loans to be held delinquent or in default.

* * *

Can you file bankruptcy on student loans? Although its rarely an easy process, yes, it is possible to discharge either federal or private student loans in court, though youd have to prove undue hardship to do so.

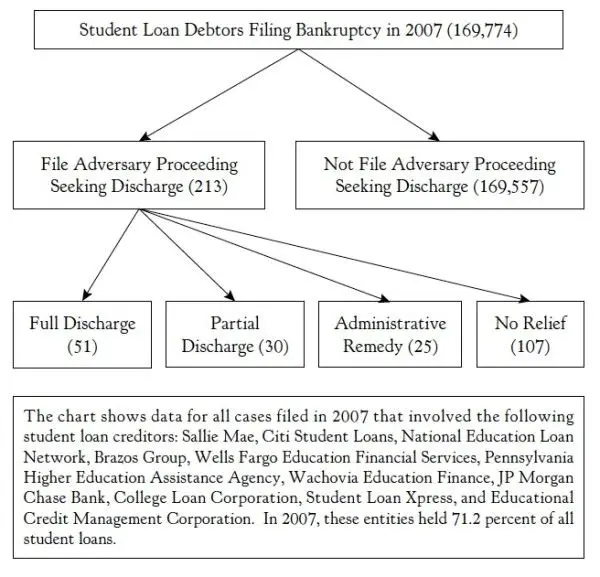

About 4 out of 10 Americans who file for bankruptcy are able to have their student loans discharged, yet only 0.1% of student loan borrowers even attempt to, according to a study by the American Bankruptcy Law Journal.

If youre successful, your outstanding student loan debt may be partially or fully discharged. However, it doesnt always work. Heres what you need to know before filing bankruptcy on student loans:

Proving Undue Hardship In Student Loan Bankruptcy

For now, the burden is on borrowers to establish their qualifications for undue hardship that satisfy the court theyre in front of. While it might seem easy to prove financial dire straits, that isnt always the case, according to Michael Fuller, a bankruptcy attorney.

You have to be in a somewhat extreme situation, Fuller said. It is often people who are sick, people who are on disability or people who have an extreme financial situation that is not going to improve.

For instance, Fuller said he recently worked pro bono with a single mother of four kids who owed several hundred thousand dollars on student loans. While she was employed, the woman was unable to make payments on her loans. When filing bankruptcy on her student loans, Fuller was able to demonstrate the debt caused undue hardship for her and her dependents and had her outstanding loans discharged.

Read Also: Does Filing Bankruptcy Affect Taxes Owed

How To File Bankruptcy: Listing Student Loans On Bankruptcy Schedules

This is part of our series on How To File Bankruptcy.

Though student loans arent dischargeable in a bankruptcy case unless you take extra steps, that doesnt affect how you list them.

The bankruptcy lawyer knew the basic rule a student loan cant be discharged in a bankruptcy case without a separate judicial determination of undue hardship.

Looking at his clients federal student loan debt, he listed them alongside the tax debts as priority claims.

Sitting in a downtown Los Angeles meeting of creditors room, the lawyer was confused when he was told to move the student loan debts elsewhere.

Just goes to show that even a lawyer who prides himself on being a seasoned bankruptcy can miss the boat once in awhile.

Timing Of A Bankruptcy Discharge For Chapter 7

The timing of the discharge in bankruptcy varies depending on the chapter under which the case is filed. In a Chapter 7 case, the court typically grants the discharge when the time for filing a complaint objecting to a discharge and the time fixed for filing a motion to dismiss the case for substantial abuse expire.

This is 60 days following the first date set for the “341 meeting” of the creditors. Usually, this meeting occurs about four months after the date the debtor files the petition with the clerk of bankruptcy court.

Also Check: Banked Owned Homes For Sale

Potential Revocation Of Discharge

The bankruptcy court has the ability to revoke a discharge under certain circumstances. For example, a trustee, a creditor, or the U.S. bankruptcy trustee can request that the court revoke the debtors discharge in a Chapter 7 bankruptcy case if there are allegations that the debtor:

- Fraud. Obtained the discharge fraudulently.

- Property. Did not disclose the fact that they acquired, or became entitled to acquire, property that would be considered part of the bankruptcy estate.

- Impropriety. Committed one of several acts of impropriety in U.S. Code Title 11 Section 727, such as refusing to obey a lawful order of the court other than an order to respond to a material question or to testify.

- Audit. Failed to explain any misstatements discovered in an audit of their case or provide documents or information requested in an audit.