About Usa Debt Clockcom

USA Debt Clock.com is the current incarnation of our debt monitoring efforts. Begun in 1987 with the Macintosh Desk Accessory named USDebtDA we’ve been tracking the debt over the years.

USA Debt Clock.com is updated as frequently as the U.S. Treasury releases figures. Some Debt Clocks merely take the national debt at the beginning of the Federal Fiscal year , the projected value at the end of the Fiscal Year and then average. This is a great method to determine the approximate debt at any point in time. USA Debt Clock.com uses the information supplied by the Treasury as often as it is released so we get a much more accurate value of the national debt. This could be in the Billions of dollars – which in budgets measure in the Trillions is often a drop in the bucket.

For UNfunded liabilities, information is derived from the most accurate values available, but will vary more than the National Debt since it is a future project based on accounting principles.

Why The Debt Clock Is Important

The U.S. national debt is the sum of all outstanding debt owed by the federal government. It’s an accumulation of each year’s budget deficits. About three-fourths of the national debt is public debt, which is held by individuals, businesses, and foreign governments that bought Treasury bills, notes, and bonds. The government owes the rest to itself, mainly to Social Security and other trust funds, and that’s known as intragovernmental holdings.

The debt clock shows how much the U.S. government owes its citizens, other countries, and itself. Most federal revenue comes from individual taxes. The government counts on you to pay the debt back one day. Corporations pass their tax costs through to you by raising prices. In other words, you, your children, and your grandchildren must pay 100% of the debt through higher taxes. The higher tax burden that the level of U.S. debt causes dampens expectations. It’s a big threat to the quality of life for future generations.

On Dec. 14, 2021, the debt ceiling was raised again. The increase of $2.5 trillion set the new limit around $31.4 trillion. This increase constituted the largest dollar amount increase of the national debt.

When Was The Debt Clock Installed

Real estate investor Seymour Durst created the debt clock in 1989. At that time, the national debt was almost $3 trillion and 50% of the gross domestic product . It was initially installed on 42nd Street and Sixth Avenue in New York City. Durst is famously quoted as saying, If it bothers people, then it’s working.

Durst also bought front-page newspaper ads to further express his concern about the growing national debt. He conveyed a prophetic message in his 1991 message: “Federal debt soaring, national economy shrinking, soon the twain shall meet.”

The debt clock faithfully recorded the increasing U.S. debt until 2000. That’s when the prosperity of the 1990s created enough revenue to reduce the federal budget deficit and debt. It seemed as if the debt clock had accomplished its goal.

Unfortunately, that prosperity didnt last. The 2001 recession and the 9/11 terrorist attacks meant lower revenues and higher government spending, which added to the debt. The national debt exceeded $6 trillion by July 2002more than double what the national debt was when the clock was initially installed. The Durst Corporation reactivated the clock at that time. When the debt exceeded $10 trillion in September 2008, one more digit had to be added.

The national debt has grown by more than $18 trillion since the financial crisis in 2008. In 2020 alone, the national debt hit four new milestones. The table below highlights several national debt milestones from 2017 through 2021.

| Debt Milestone |

|---|

Read Also: How Long Does It Take To File For Bankruptcy

Are We Helpless When It Comes To The National Debt

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

- Pay your taxes: According to the IRS, the federal government loses $1 trillion each year due to unpaid taxes.

- Put pressure on your Congressional reps: Call or write to your Representatives and Senators in support of tax code reform, increased funding for the IRS to track down tax cheats and closing loopholes that give the countrys most profitable companies tax bills that are lower than most Americans.

- Follow your reps voting history: If youre curious how your Representatives and Senators have voted on fiscal policy issues, thats easy to check. You can use voting history to back up your concerns when writing or calling your reps.

- Learn about healthcare reform: While national healthcare remains a contentious topic, it could pay to learn how other countries control healthcare costs and how those policies could benefit you, your neighbors and the impact rising healthcare costs has on the national debt.

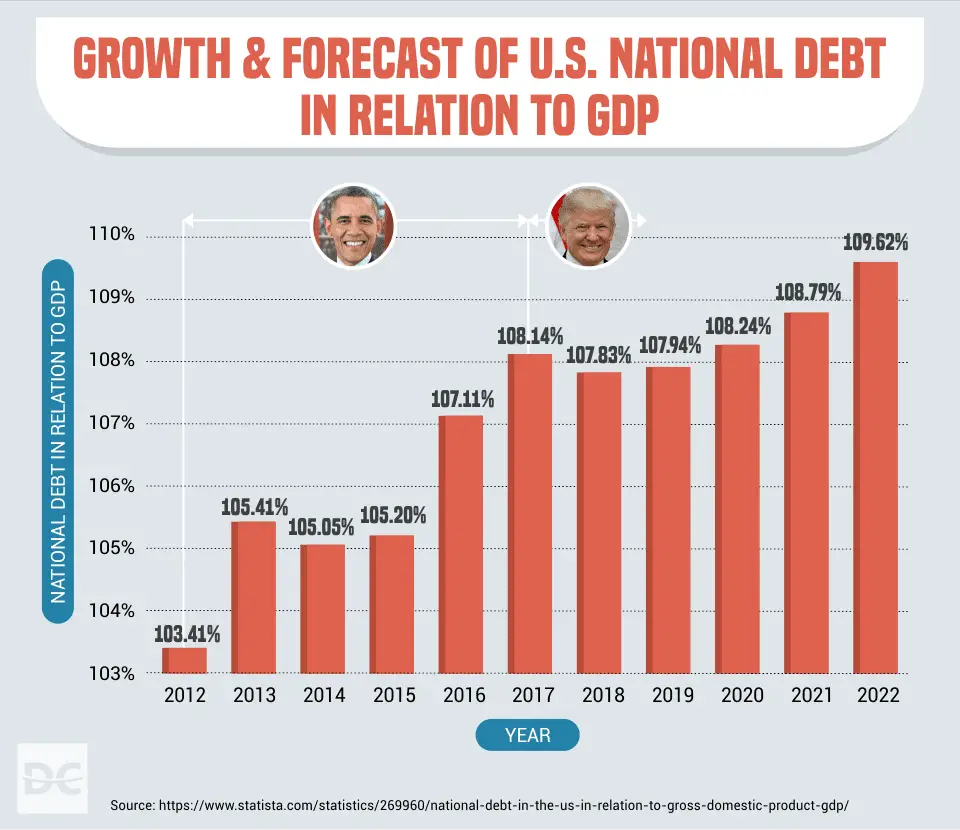

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isnt unique in this regard. The rest of the developed world has seen similar trends.

While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome, he says.

The Types Of Presidential Decisions That Impact National Debt

Presidents can have a tremendous impact on the national debt. They can also have an impact on the debt in another presidentâs term. When President Trump took office in January of 2017, for the first nine months of his presidency, he operated under President Obamaâs budget which didnât end until September, 2017. So for most of a new presidentâs first year in office, he isnât accountable for the spending that takes place. As strange as this may seem, itâs actually by design to allow time for the new president to put a budget together when in office.

Read Also: Pallet Lots For Sale

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Inflation Forecasts: Economists misjudged how much staying power inflation would have. Next year could be better but theres ample room for humility.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

But instead of panicking, the financial markets are viewing this seemingly bottomless need for borrowing benignly. The interest rate on the 10-year Treasury note also known as its yield is roughly 0.7 percent, far below where it was a little over a year ago, when it was about 2 percent.

Expectations for economic growth and inflation are the crucial drivers of interest rates, and such low rates very likely mean investors expect a long period of piddling growth. But they also signal that investors see almost no chance that the United States, which has one of the best track records of any borrower on earth, will stiff them by defaulting.

Even so, the experience over the last decade has drastically shifted the way economists and investors think about how the United States funds itself.

Who Owns Most Of Us Debt

The largest percentage of US debt is held by foreign investors. International investors hold 29.5% of all US debt. However, these investors hold 40% of all debt held by the public, which amounts to about $6.7 billion. In terms of countries, the US Treasury department lists Japan and China as the largest foreign investors, holding 18% and 15%, respectively, of all foreign securities.

Don’t Miss: How Do You File Bankruptcy With No Money

What Is The Us Debt Ceiling

The United States Congress oversees all American government departments including the Treasury. Until 1917, the Treasury had to seek the approval of Congress for every bond auction. Since then, the debt-raising capability of the Treasury has been limited by a debt ceiling that is set by Congress.

The debt ceiling covers all US government debt, including intragovernmental holdings.

The debt ceiling is stated as an amount rather than a percentage of GDP.

How Is The Debt Ceiling Raised

Inflation and legislation that expands government activities require the debt ceiling to be raised.

If the debt ceiling is not raised, the Treasury must resort to alternative measures to raise funds. Once those measures are exhausted, the government would go bankrupt. Politics can result in Congress refusing to raise the debt ceiling to gain concessions on other areas of policy.

Don’t Miss: Why You Should File For Bankruptcy

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

How Has The Covid

According to the Congressional Budget Office, debt held by the American public will rise to 98% of GDP due to the economic impact of the coronavirus pandemic and legislative actions taken as a result. The CBO says that the main driver of the increased debt is a federal budget shortfall of $3.3 trillion, the largest since 1945.

You May Like: How Long Does It Take To File Bankruptcy In California

The Us National Debt Clock Is Ticking Why People Are Now Paying Attention

- US national debt reaches $30.5tn in summer 2022

- Why the US national debt will never be paid back

- How USD remains globes main reserve and trading currency

The U.S. National Debt Clock doesnt track hours or minutes, but for many people it shows that the nation is running out of time. For others, not so much. The National Debt Clock display near Times Square in New York City registers government debt in real time, so the numbers are constantly flickering at the end of the 14-digit string, which currently shows a national debt of $30.5 trillion. Similarly, the U.S. debt clock website tracks debt in real time and breaks it down into debt per citizen and debt per taxpayer .

The purpose of these debt clocks is to make people aware of the size of the national debt and how quickly it is growing, but the question of debts and deficits is a vexed one open to interpretation.

When interest rates are quite low, as they have been since the 2008 financial crisis, people worry less about the size of the debt. Modern monetary theory, which gained some currency in recent years, says any country with its own fiat currency can issue debt virtually without limits.

United States National Debt: What Affect Does Hiding $5 Trillion From The Books Have On The Us Debt Clock

The United States is one of the world’s most eager consumers of national debt. Due to the high volume of new US national debt being added on an irregular basis, this clock is regularly updated.

US Treasury & USA.gov website. US national debt statistics include Intragovernmental Holdings.

November 8, 2022

Disclosure:

In this guide to the United States National Debt, we discuss the amount of the countrys debt, whats included in it, who manages the debt, the countrys debt ceiling, how it raises loans, and who holds the US debt.

Read Also: How Long Is Chapter 7 Bankruptcy On Your Credit Report

The Debt Clock Tracks The Us National Debt

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

The national debt clock tracks the U.S. debt. It surpassed $31 trillion in October 2022. The clock sits at Anita’s Way, between One Bryant Park and 151 West 42nd Street on Sixth Avenue in New York City.

You don’t need to travel to see the debt clockyou can visit the U.S. Treasury website, Debt to the Penny, to download the current and archived amount of U.S. national debt.

National Debt And Budget Deficits

It takes a lot of money to keep the U.S. government running, and much of it is borrowed money. The federal government has a budget deficit whenever it spends more money than it brings in through taxesin other words, when expenditures are higher than revenues. Deficits must be financed by borrowing money. Interest must be paid on borrowed money, which adds to the deficit. As budget deficits add up year after year, they create the national debt. When the federal government takes in more money than it spends in a year, it is said to have a budget surplus.

Also Check: Can You Cancel A Chapter 13 Bankruptcy

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Where Can I Trade Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Recommended Reading: Why Would You File For Bankruptcy

Total Federal Agency Debt In 2023

Chart C.01a: Recent Federal Agency Debt

At the end of FY 2023 the federal agency debtin the United States is guesstimated to be $11.92 trillion.

Agency debt is debt issued by federal agencies andgovernment-sponsored enterprises, and is not included in the total gross debt of the federal government.

Get more information about Agency Debt here.

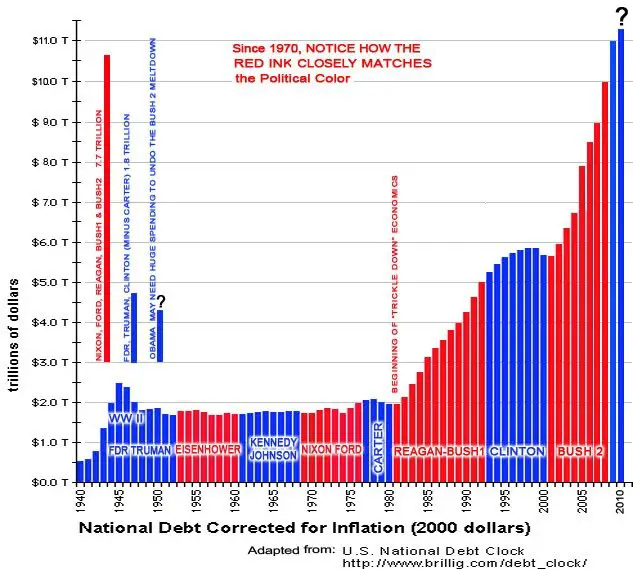

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

You May Like: How To File For Bankruptcy Without A Lawyer In Maryland

Why Is The National Debt So High

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each years deficit adds to our growing national debt.

Historically, our largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

The National Debt Clock

In most years, the government spends more money than it takes in. The yearly difference in those amounts is the deficit. If you add up all the annual deficits plus the occasional annual surplus, you get the nations total debt as seen in the U.S. National Debt box on the U.S. Debt Clock. You will also see other important figures as you view the U.S. Debt Clock. Discuss some of your observations with your class.

Content adapted from USDebtClock.org and Treasury.gov

You May Like: Who Owns Our National Debt

Who Is In Charge Of The Us National Debt

US government debt is the responsibility of the Treasury Department. Money is raised in the form of bonds, which are known as Treasury bonds, Treasury bills, or T-bills.

Bonds are sold in auctions, which are conducted by the Federal Financing Bank each sale event can raise a maximum of $15 billion.

Does The Federal Reserve Sell United States Government Bonds

The Federal Reserve Bank is a private institution and not a part of the US Treasury. As such, the Fed does not have the right to issue government bonds.

However, it is allowed to buy bonds and it is by this mechanism that the Federal Reserve enabled the US Treasury to raise funds during the 2008 financial crisis without increasing interest rates.

Quantitative Easing

The US government needed a large amount of money to help refund banks that were in trouble. The Fed bought Treasury bonds from US banks and also directly from the Federal Financing Bank. As a result of this action, which is called quantitative easing, the Federal Reserve is now a major holder of US government debt.

You May Like: Does Filing Bankruptcy Affect Getting Student Loans