What Does Filing Involve

The process of filing Chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. Youre not required to hire an attorney, but it is recommended that you go through this process with professional guidance from an attorney.

Here are some of the things you should be prepared to do during a Chapter 7 bankruptcy.

You May Like: Can You Lease A Car While In Chapter 7

How Chapter 11 Works

A chapter 11 case begins with the filing of a petition with the bankruptcy court serving the area where the debtor has a domicile, residence, or principal place of business. A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements. 11 U.S.C. §§ 301, 303. A voluntary petition must adhere to the format of Form B 101 of the Official Forms prescribed by the Judicial Conference of the United States. Unless the court orders otherwise, the debtor also must file with the court:

If the debtor is an individual , there are additional document filing requirements. Such debtors must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. 11 U.S.C. § 521. A married couple may file a joint petition or individual petitions. 11 U.S.C. § 302.

Bankruptcy Can Stop Collection Activities Eliminate Most Types Of Debt And Allow You To Reorganize Your Debts And Catch Up On Missed Mortgage Or Car Loan Payments

When you’re experiencing severe financial issues, filing for bankruptcy can be a powerful option to help you get over significant money obstacles. Unfortunately, bankruptcy can’t solve every financial problem. Before you file, it’s important to define your goals and to understand how bankruptcy can help you achieve them.

In this article, we will cover

- how bankruptcy can help you solve some difficult financial issues

- the limitations of bankruptcy and what it is not designed to accomplish

- the differences between Chapter 7 and Chapter 13, the two types of bankruptcy that consumers file most often

- bankruptcy’s two most powerful tools, the automatic stay and the discharge, and

- additional resources you might find helpful as you’re exploring how bankruptcy can help you get a fresh start.

Don’t Miss: How To File Bankruptcy In Washington State

Secured Debts Versus Unsecured Debts

Anyone can file for bankruptcy relief regardless of how small or large their debt is. When you file for bankruptcy, you are required to list all the debts you owe. The court does not consider all debt equally.

It recognizes two types of debtsecured and unsecuredas follows:

- Secured debts are those where the original loan was backed up with property or collateral. Common secured debt includes a mortgage or vehicle loan.

- Unsecured debts are those where the original loan was offered based solely on your credit. These typically include credit cards, medical bills, and other bank loans.

Your bankruptcy lawyer will explain how the court weighs each type of debt. He will also clarify which debts are dischargeable depending on the bankruptcy chapter you choose.

Complete a Case Evaluation form now

What Happens To Your Information

Any previous name included in the bankruptcy petition will appear on the bankruptcy order, and in the:

- notice of your bankruptcy, which is permanently recorded in the Gazette but excluded from search engine results one year and three months after publication

- Individual Insolvency Register which will be removed within three months of your discharge

You May Like: Can You File Bankruptcy On Personal Property Taxes

What To Do Before Filing For Bankruptcy

Bankruptcy is generally considered a last resort for people who are deep in debt and see no way to pay their bills. Before filing for bankruptcy, there are alternatives that are worth exploring. They are less costly than bankruptcy and likely to do less damage to your credit record.

For example, find out if your creditors are willing to negotiate. Rather than wait for a bankruptcy settlementand risk getting nothing at allsome creditors will agree to accept reduced payments over a longer period of time.

In the case of a home mortgage, call your loan servicer to see what options may be available to you. Some lenders offer forbearance , repayment plans , or loan modification programs .

Even the Internal Revenue Service is often willing to negotiate. If you owe taxes, you may be eligible for an offer in compromise, in which the IRS will agree to accept a lower amount. The IRS also offers payment plans, allowing eligible taxpayers to pay what they owe over time.

Suspended Income Tax Payments

HMRC will apply a nil tax code when youre bankrupt. This tells your employer not to take any further income tax from your wages for the rest of the tax year . The extra money in your pay that results from this can be claimed by the trustee to form part or all of an IPA or IPO. If the IPA or IPO is wholly paid out of this extra income, it will stop when you start paying tax again.

The NT will not tell your employer youre bankrupt as an NT can be applied for a number of reasons.

Read Also: How To Legally Stop Paying Your Mortgage

What You Keep When Filing For Bankruptcy

Laws were created to help protect your property during bankruptcy, called bankruptcy exemptions however, exemptions vary depending on the process and the state.

Common federal bankruptcy exemptions are listed below. Married couples filing jointly can double the exemption amount, and all amounts are shown for cases filed after April 1, 2022. These numbers will be adjusted again on March 31, 2025.

What Are The Best Times To File Bankruptcy

If your obligations are so overwhelming that it is impossible to make your payments on time, you might consider declaring bankruptcy. Bankruptcy is designed to give individuals, businesses and governments the opportunity to either wipe away a portion of their debts or start over.

It is not a good idea to consider bankruptcy if you have a lot of debt or are in a temporary financial crisis. Filing bankruptcy can have serious consequences and you will not be able to get out of jail. If you have tried to pay your debts but are still finding yourself in a financial bind, bankruptcy should be considered as an option.

Also Check: Can You Get A Mortgage Loan After Bankruptcy

Avoid Foreclosure Or Repossession

If you are facing foreclosure or repossession, bankruptcys automatic stay can stop the process and provide you time to negotiate with the lender or bring your account current. If you cannot cure your default in a short period, you can catch up on payments and keep your home by filing for Chapter 13 bankruptcy.

Need Help Declaring Bankruptcy We Can Help

When you hire our bankruptcy attorneys at Consumer Action Law Group, we make sure that your case goes smoothly and we are there for any questions that you may have. We have been helping consumers with bankruptcy cases for more than 10 years and have had thousands of successful cases.

We offer a free consultation to callers, so feel free to call us and speak your mind about your given situation. Our bankruptcy attorneys will be able to discuss them with you. Call our firm today at .

Also Check: Deals 4 Me Now.com

Appointment Or Election Of A Case Trustee

Although the appointment of a case trustee is a rarity in a chapter 11 case, a party in interest or the U.S. trustee can request the appointment of a case trustee or examiner at any time prior to confirmation in a chapter 11 case. The court, on motion by a party in interest or the U.S. trustee and after notice and hearing, shall order the appointment of a case trustee for cause, including fraud, dishonesty, incompetence, or gross mismanagement, or if such an appointment is in the interest of creditors, any equity security holders, and other interests of the estate. 11 U.S.C. § 1104. Moreover, the U.S. trustee is required to move for appointment of a trustee if there are reasonable grounds to believe that any of the parties in control of the debtor “participated in actual fraud, dishonesty or criminal conduct in the management of the debtor or the debtor’s financial reporting.” 11 U.S.C. § 1104. The trustee is appointed by the U.S. trustee, after consultation with parties in interest and subject to the court’s approval. Fed. R. Bankr. P. 2007.1. Alternatively, a trustee in a case may be elected if a party in interest requests the election of a trustee within 30 days after the court orders the appointment of a trustee. In that instance, the U.S. trustee convenes a meeting of creditors for the purpose of electing a person to serve as trustee in the case. 11 U.S.C. § 1104.

As discussed above, a trustee is appointed in each subchapter V case. 11 U.S.C. § 1183.

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order should not have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

You May Like: How Do You Declare Bankruptcy In England

Which Debts Are Not Discharged In Bankruptcy

The following debts are not forgiven in personal bankruptcy:

If you have luxury item purchases or cash advances received immediately prior to the bankruptcy filing, creditors can challenge that, saying these were premeditated transactions, and have them excluded.

Another consideration: A bankruptcy discharge is personal and protects you. But it does not eliminate the debt itself. For example, if you had a co-signer on a home loan and you file for bankruptcy, the lender can still seek to collect the debt from the person who co-signed the loan. This is important to remember if you have family members or friends co-sign a loan, but are not going to file for bankruptcy.

The Us Trustee Or Bankruptcy Administrator

The U.S. trustee plays a major role in monitoring the progress of a chapter 11 case and supervising its administration. The U.S. trustee is responsible for monitoring the debtor in possession’s operation of the business and the submission of operating reports and fees. Additionally, the U.S. trustee monitors applications for compensation and reimbursement by professionals, plans and disclosure statements filed with the court, and creditors’ committees. The U.S. trustee conducts a meeting of the creditors, often referred to as the “section 341 meeting,” in a chapter 11 case. 11 U.S.C. § 341. The U.S. trustee and creditors may question the debtor under oath at the section 341 meeting concerning the debtor’s acts, conduct, property, and the administration of the case.

In North Carolina and Alabama, bankruptcy administrators perform similar functions that U.S. trustees perform in the remaining forty-eight states. The bankruptcy administrator program is administered by the Administrative Office of the United States Courts, while the U.S. trustee program is administered by the Department of Justice. For purposes of this publication, references to U.S. trustees are also applicable to bankruptcy administrators.

Don’t Miss: What Happens When You Declare Bankruptcy Uk

How Much Debt Do You Need To File Chapter 7 Bankruptcy

This is assessed by seeing if you meet the means test requirements. You would be eligible to file Chapter 7 bankruptcy if your current monthly earnings is less than the state median limit. If your CMI is higher than the state median income, you cannot qualify. The means test is based on a person having greater discretionary income than they save in their income tax return and the primary spending expense.

Discover The Benefits Of Filing For Bankruptcy

When you are seeking bankruptcy protection, our firm represents individuals and small business owners who want to file Chapters 7 and13 bankruptcy cases. We can help you navigate through the more complex filings of debt reorganization through Chapter 11 bankruptcy and with Chapter 12 bankruptcy for family farmers.

You might also be able to retain your assets even if you file for bankruptcy. If you are ready to file for bankruptcy protection and to start eliminating crippling debt, contact the team members at Farmer & Morris Law, PLLC by calling today.

Also Check: Epiq Bankruptcy Solutions Llc Letter

Don’t Miss: If You File For Bankruptcy Which Debts Are Forgiven

When To Stop Digging A Hole You Can’t Escape

Most of us feel we have a moral obligation to pay what we owe if we can. But typically that ship has sailed by the time people realize they need to consider bankruptcy. They can continue trying to chip away at debts they may never be able to repay, prolonging the damage to their credit scores and diverting money they could use to support themselves in retirement. Or they can recognize an impossible situation, deal with it and move on.

If you can pay your bills, obviously you should. If youre struggling, check out your options for debt relief. But bankruptcy may be the best option if your consumer debt the kinds listed above that can be erased equals more than half your income, or if it would take you five or more years to pay off that debt even with extreme austerity measures.

Heres what you need to know:

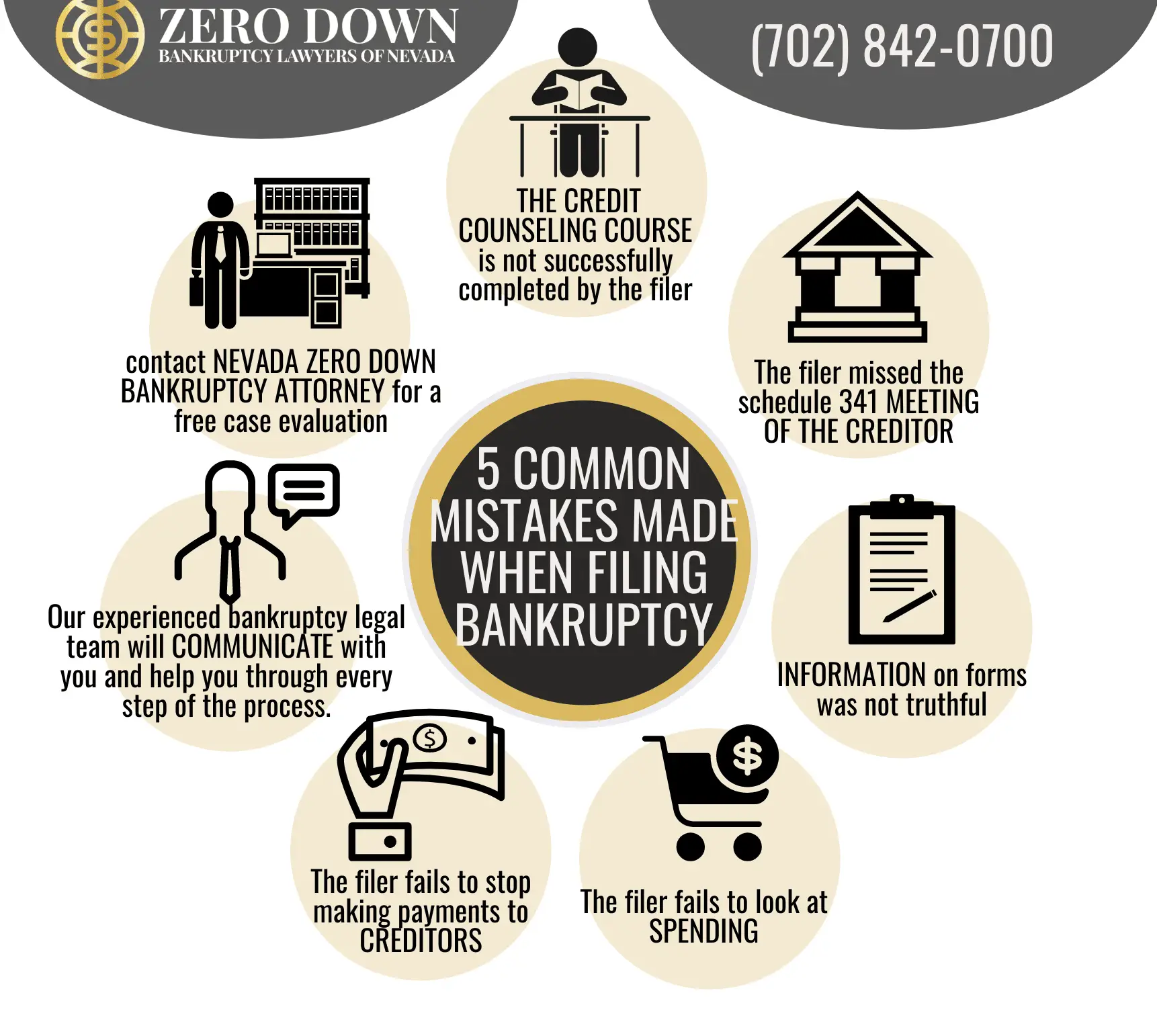

You need a bankruptcy attorney: Its easy to make a mistake in the complicated paperwork, and an error could cause your case to be dismissed. If that happens, you end up with no relief but still have credit scores tanked by the bankruptcy filing.

Dont wait too long: Theres a misconception that people file bankruptcy at the drop of a hat or when they still have other options. The reality for most is quite different. Some drain assets, such as their retirement accounts, that could have been protected from creditors in bankruptcy. People throw good money after bad until they have no money left to seek relief.

Debt That Can’t Be Forgiven

While bankruptcy can eliminate a lot of debt, it can’t wipe the slate completely clean if you have certain types of unforgivable debt. Types of debt that bankruptcy can’t eliminate include:

- Most student loan debt .

- Court-ordered alimony.

- A federal tax lien for taxes owed to the U.S. government.

- Government fines or penalties.

Also Check: How Do You File For Bankruptcy In Kansas

What Happens To Your Credit Rating After Discharge

The official receiver will not tell the credit agencies when your bankruptcy ends. You might need to ask the credit agencies to update their records to include details of your discharge.

The bankruptcy can stay on your record for 6 years after the date of the bankruptcy order.

Read more on this in the Information Commissioners Office Credit explained document.

Bankruptcy Under Chapter 7

Chapter 7 is personal liquidation bankruptcy. Chapter 7 is a personal liquidation bankruptcy. The trustee appointed by the court to manage your assets will pay all of your obligations.

Any remaining unsecured debts will be discharged. The amount of assets that can be exempted depends on the state. Unsecured debts include credit card balances or medical expenses that dont have collateral.

The means test will make it more difficult to qualify for Chapter 7 than Chapter 13. If your income is below the states median income for your family size , then you will pass the means test to be eligible for Chapter 7.

You can subtract certain costs from your income to determine whether it is below the minimum income threshold.

You can either pass or fail the means test to see if you are eligible for Chapter 7 bankruptcy. Or, file a Chapter 13 bankruptcy.

Read Also: Does Filing Bankruptcy Erase Student Loans

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.