Let Our North Carolina Chapter 13 Bankruptcy Lawyers Help You

Schedule a free consultation with our North Carolina bankruptcy law firm today to discuss whether Chapter 13 might be an option for you. Our bankruptcy lawyers work with individuals and businesses throughout North Carolina, including in Wake, Harnett, Johnston, Durham, Orange, Granville, Vance, Franklin, Warren, Nash, Lee, Chatham, and Moore counties.

More resources:

How Much Do You Pay Back In Chapter 13

When following your Chapter 13 bankruptcy payment plan, youll be required to make regular payments for three to five years, depending on your income. If you make on-time payments for the duration of your plan, the rest of your debt will be discharged at the end of the term. If you opt to pay your debts off early, you may be required to pay the entirety of the debt you claimed in your bankruptcy case and youll have to get permission from the court.

A Chapter 13 Attorney Can:

- Help you explore alternatives to Chapter 13 bankruptcy, such as loan restructuring or debt consolidation loans.

- Prepare your bankruptcy petition paperwork.

- Draft your repayment plan proposal.

- Advocate on your behalf when creditors object to your repayment proposal and help you make revisions when necessary.

If you are considering filing for Chapter 13 bankruptcy, schedule a free, confidential, no-obligation initial case evaluation today. Then, contact an Ohio Chapter 13 bankruptcy attorney from Amourgis & Associates, Attorneys at Law.

We can tell you more about your legal rights and your options for dealing with your debt. We can put you back on the path to financial health. Our firm is conveniently located at six offices in Ohio Akron, Cincinnati, Independence , Columbus, Beavercreek, and Canfield.

You May Like: Credit Counseling Vs Debt Consolidation

What Does A Chapter 13 Repayment Plan Look Like

Priority debts get paid first and in full. These include most tax debts.

Secured debts involve collateral examples include auto loans and home loans. Filers must pay secured lenders at least the value of the collateral if they want to keep it.

Unsecured debts are those that have no collateral, such as credit card debt. They are paid last and may not be paid in fullor at all. The bankruptcy court will look at the debtors disposable income in deciding how much money unsecured creditors should get.

A Chapter 13 repayment plan usually takes three or five years, depending on the debtors monthly income and family size. A filer earning less than the state median for similar households generally can take three years. Anyone earning more than the state median for their household size will be given five years.

When payments are completed according to the plan, any leftover debt is discharged. Discharged means the debt is no longer owed, even if the creditor didnt get the full amount. Not all debts are dischargeable. Home mortgages, alimony, child support, some taxes, student loans and debts resulting from criminal activities cannot be discharged.

To fulfill the terms of the plan, the debtor must make all payments on time and cant take on new debts without the courts approval.

Federal Tax Refunds During Bankruptcy

You can receive tax refunds while in bankruptcy. However, refunds may be subject to delay or used to pay down your tax debts. If you believe your refund has been delayed or offset against your tax debts you can check on its status by going to our Wheres My Refund tool or by contacting the IRS Centralized Insolvency Operations Unit at . The unit is available Monday through Friday from 7 a.m. to 10 p.m. eastern time.

Also Check: Definition Of Chapter 7 Bankruptcy

What Is Chapter 13 Bankruptcy

Chapter 13 bankruptcy is the second most common type of bankruptcy people file after Chapter 7 bankruptcy. Arguably, Chapter 7 bankruptcy gives you the biggest benefit because it allows you to wipe away your debts completely without having to repay any amount to your creditors. Even still, your goals and personal circumstances may not warrant filing a Chapter 7 bankruptcy.

To be eligible to file a Chapter 7, youâll first need to meet the income requirements. If your income is below the median income for your household size in your state, you will most likely qualify to file a Chapter 7. You are not automatically disqualified from filing a Chapter 7 if your income is above the median household income in your state. However, you will need to pass the means test to assess your eligibility to file a Chapter 7 if your household income is above the median for your state.

Unlike the Chapter 7 income requirements that you have to meet to qualify for Chapter 7 bankruptcy relief, you can qualify to file a Chapter 13 bankruptcy regardless of whether your income is below the median income level or whether you pass the means test. Nonetheless, your income will play a factor in determining whether filing a Chapter 13 case is a feasible option for you.

What Are Alternatives To Chapter 13 Bankruptcy

The process to file bankruptcy is long, stressful and costly. When youre struggling to keep food in the fridge and bills at bay, you might think Chapter 13 Bankruptcy is your only optionbut its not.

Listen, Chapter 13 Bankruptcy is just another debt management tactic. But instead of providing complete relief, it brings years of headache and financial setback. It should be used as a last resort only.

Please hear this: There is hope on the other side of all the financial stress youre feeling. There is hope when creditors are calling and letters are piling up on the kitchen table. You are not hopeless.

Heres the truth: There are other ways to get out of debt and come out on the other sidewithout filing for bankruptcy or worrying about your credit score. Not only will these bankruptcy alternatives give you relief from the endless piles of bills, but theyll also give you your life back:

Read Also: Where Can I Buy Pallets Of Merchandise

Recommended Reading: How Long Does Filing Bankruptcies Take

What Happens After The 341 Meeting Of Creditors

The trustee will set a date for a confirmation hearing. This is the hearing in which the judge will determine if your plan meets the requirements of Chapter 13. We call it a hearing, but in most cases, you dont need to go to court. We know ahead of time if the plan meets the requirements of Chapter 13. If it doesnt, we just amend your plan!

Plan confirmation serves as a formal approval of your plan. It locks it in stone so-to-speak. This is a big milestone in Chapter 13 because you normally get certain privileges back when your plan is confirmed. You can start rebuilding your credit, for example. It also makes it easier to get a new car.

You will also need to take a second credit counseling course called a Debtor Education Course or Financial Management Course. You must file the certificate of completion to receive your Chapter 13 discharge. We have more on that in our article what happens after I file a Chapter 13 bankruptcy petition?

The Chapter 13 Plan And Confirmation Hearing

Unless the court grants an extension, the debtor must file a repayment plan with the petition or within 14 days after the petition is filed. Fed. R. Bankr. P. 3015. A plan must be submitted for court approval and must provide for payments of fixed amounts to the trustee on a regular basis, typically biweekly or monthly. The trustee then distributes the funds to creditors according to the terms of the plan, which may offer creditors less than full payment on their claims.

There are three types of claims: priority, secured, and unsecured. Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. Secured claims are those for which the creditor has the right take back certain property if the debtor does not pay the underlying debt. In contrast to secured claims, unsecured claims are generally those for which the creditor has no special rights to collect against particular property owned by the debtor.

The plan must pay priority claims in full unless a particular priority creditor agrees to different treatment of the claim or, in the case of a domestic support obligation, unless the debtor contributes all “disposable income” – discussed below – to a five-year plan.11 U.S.C. § 1322.

Recommended Reading: How Many Bankruptcies In The Us

How Do I Apply For Bankruptcy

The unfortunate reality of bankruptcy is that it will cost some moneymore if you hire legal help, which you probably should . All filings have to go through U.S. bankruptcy courts, where the cost to file is $335 for Chapter 7 and $310 for Chapter 13. However, you can ask the court to either waive your fee or let you pay with monthly installments. You’ll also have to take debtor education courses if you file on your own.

And that’s just the beginning. There’s a list of documents you’ll need to take care of, as well as the specific repayment proposal you need to submit for Chapter 13. That proposal gets reviewed by a court-appointed trustee, who contacts your creditors before approving your submission. Overall, neither filing is an easy process to handle on your own, and even minor mistakes on your end could be a setback for your case.

So, whether you file for Chapter 7 or Chapter 13 bankruptcy, it’s typically a good idea to hire a lawyer to help you petition. A bankruptcy attorney’s price depends on the nature and complexity of your filing, with Chapter 13 filings on the pricier end, but the price tag doesn’t necessarily mean a lawyer is out of the question for you. Discuss payment plans with potential attorneys, check out local pro-bono lawyers and legal aid offices, or use an online tool like Upsolve to cover your bases when it comes to bankruptcy.

Failing To Make Your Chapter 13 Plan Payments

In Chapter 13 bankruptcy, you can keep all of your property , but you must pay back some or all of your debts through a Chapter 13 repayment plan. Chapter 13 plans typically last three to five years, and the court will enter your discharge upon successful completion of all plan payments. If you stop making your Chapter 13 plan payments, the court will typically dismiss your bankruptcy.

Read Also: Which Bankruptcy Chapter Is Right For Me

Final Chapter 13 Discharge

Once the repayment period is over, you will likely receive a discharge of some of your debts. Obtaining a discharge in Chapter 13 bankruptcy will not eliminate all debts.

Exceptions to a Chapter 13 discharge include:

- Claims for child support and spousal support

- Educational and student loans

- Any driving under the influence liabilities

- Criminal fines and restitution obligations

- Certain long-term obligations that extend beyond the term of the plan

- Any debts not provided for in a wage-earner plan

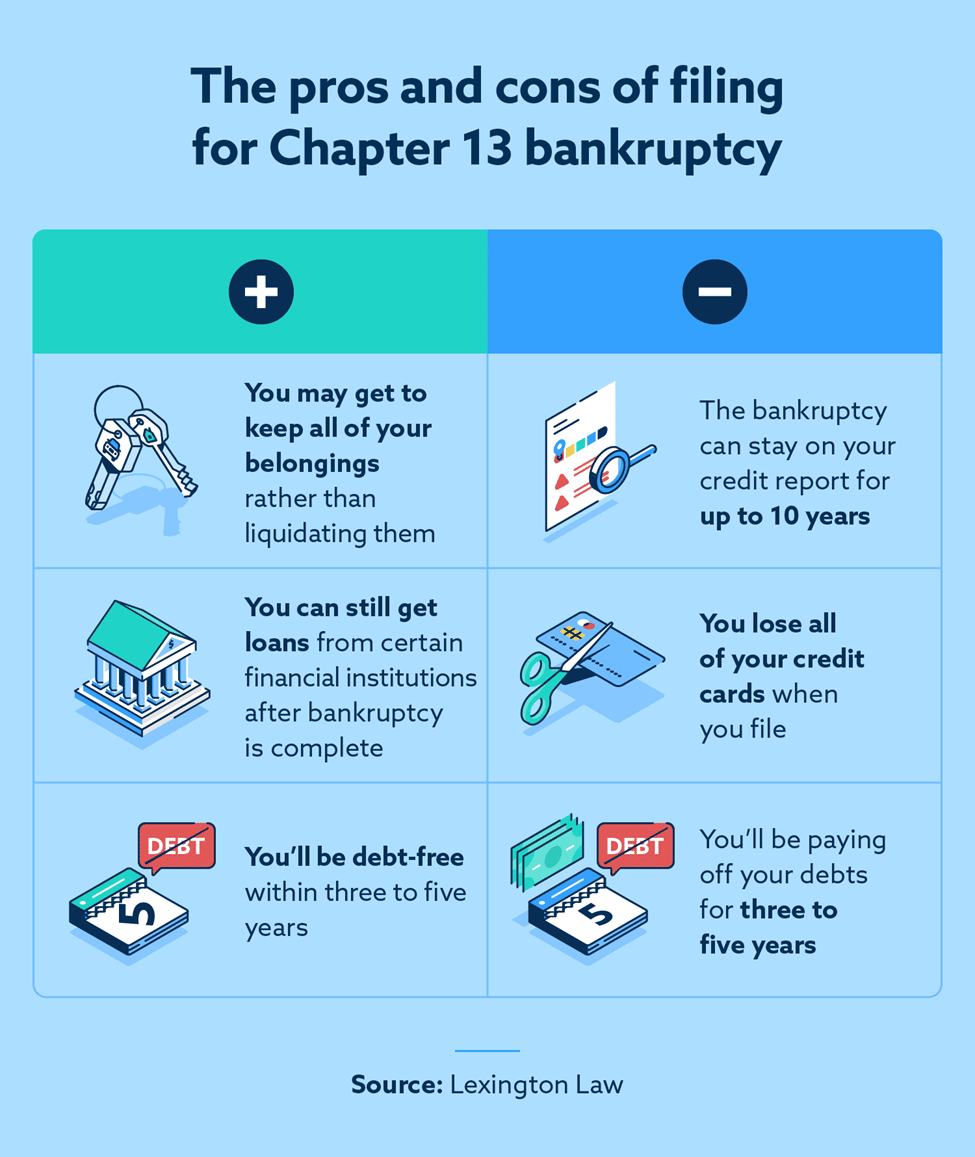

Chapter 13 Bankruptcy Disadvantages

- First, it can be more difficult to qualify for Chapter 13 than other types of bankruptcy.

- Even if you do qualify for a Chapter 13 bankruptcy, you may have to give up some of your property, including your home equity, to repay your creditors.

- The debtor must make a monthly payment for 3-5 years to pay back either a portion or all of the debt or debts, depending on the debtors income and equity in assets according to their Chapter 13 repayment plan.

- A discharge is not granted until the 5-year period is up and all payments have been made.

- There are debt limitations.

- Chapter 13 bankruptcy can remain on your credit report for up to seven years, which can make it difficult to get credit for your credit score in the future.

In conclusion, filing for Chapter 13 bankruptcy involves having a debt liquidation plan in which you pay creditors over time, thus not losing your house or car. Chapter 13 bankruptcy is a legal procedure that stops foreclosure, repossession, wage garnishment, and collection actions. In Chapter 13 bankruptcy, you get to keep most assets, but debts are not dischargeable. Chapter 13 bankruptcy is a type of debt relief for individuals, families, and small businesses.

Contact us at DexterLaw.com for more details on how you can get the help you deserve today. You may also schedule a free consultation here.

Also Check: Best Way To Buy Foreclosed Homes

Life After Chapter 13 Bankruptcy

Chapter 13 can be useful for people with serious debts who worry about losing their homes to bankruptcy. If you adhere to your repayment plan, youll have a new lease on financial life.

Unsecured debts will be gone, but mortgages and car payments might linger. Hopefully, youll have developed the habits needed to meet those obligations.

Types Of Claims In North Carolina Bankruptcy Cases

Claims from creditors will be categorized as priority, secured, and unsecured.

- Priority claims are given special status under bankruptcy law. Priority claims include most taxes and the cost of the bankruptcy proceeding. In general, a Chapter 13 plan must pay priority claims in full.

- Secured claims involve those with collateral , where the creditor can take back the property if the debt is not paid. In order to keep the collateral, the debtor must pay the creditor at least the value of the collateral.

- Unsecured claims are those without collateral, such as medical bills, credit card debt, and personal loans. Non-priority unsecured claims do not need to be paid in full under the plan, but projected disposable income must go toward these claims throughout the applicable commitment period. Unsecured creditors must receive at least what they would have been paid if assets had been liquidated under a Chapter 7 bankruptcy.

You May Like: Can You Include A Judgement In A Bankruptcy

When Should You File For Bankruptcy Chapter 13

Chapter 13 bankruptcy may be a good route for those who are struggling to pay their bills and are taking funds from their retirement accounts to make ends meet. Bankruptcy may also be a wise option if you have a debt-to-income ratio of 50% or more. Before filing for bankruptcy, take an in-depth look at your finances and consider other ways of paying down your debts.

Voted Best Customer Service Experience Of Any Bankruptcy Law Firm In Minnesota

Even from the first conversation I had on the phone regarding their services, I knew I was going to choose them. I made an appointment for the following week and was welcomed with no judgement. The whole process was fast and efficient. I worked personally with Misty, Samantha, and Callie but everyone there was extremely helpful when I had questions. There was little to no paperwork and they did most of the work for me. My only regret was not filing sooner!

– Megan W.

The staff at Kain & Scott were amazing! They make you feel very comfortable from the first time you step in the door. Everything is well organized and they respond quickly to any questions you have. Shout out to Wes, Calli, Megan, Sarah, and Lindsey you all were great in helping me get my life back. Keep up the good work!!

– Toby A.

– Maurice W.

Stellar customer service and you have the how can I help you staff! You made my future easier to handle and I have so much more confidence especially with your staff behind me. I appreciate all your help and time you spend helping me address my credit.

– Nancy N.

– Scott K.

Also Check: Can You Be Denied A Job Because Of Bankruptcy

Clients Often Choose To Work With The Sasser Law Firm Because We Provide:

- Attorney accessibility. At Sasser Law Firm your consultation and signing appointments will be with an attorney and throughout your North Carolina chapter 13 bankruptcy case, the firms attorneys are accessible.

- Thorough case evaluations. Our North Carolina attorneys will review your household income, assets, expenses, and the kind of debt you have to determine what your options are.

- Honesty and integrity. We will be straightforward about whether we think filing for bankruptcy is right for you. This is a big decision, and we will not pressure you into making a move you are not comfortable with. We will also tell you if we dont think bankruptcy is appropriate based on the fact.

- Estimated repayment amount. Our goal is to project as closely as possible what the final Chapter 13 repayment amount will be based on the facts we are provided. We also aim to make the Chapter 13 plan payment as short and as low as possible.

- Quick action. To protect against the foreclosure of a home or vehicle repossession, we often file Chapter 13 bankruptcy cases on an expedited basis sometimes on the very day, a client first walks in the door.

- Tenacious representation. Some chapter 13 cases are filed, confirmed, performed, and discharged without difficulty. But if issues arise during the case we will fight for you. Plan confirmation does not end our involvement in seeking to represent you and assist you.

Your Guide To Chapter 13 Bankruptcy

Any bankruptcy filing comes with questions. It can be a complex process, so you need to know what to expect. If youre filing for Chapter 13 bankruptcy in Las Vegas, knowing what to expect can help you prepare and give you confidence. From our bankruptcy lawyer Nevada team, here is Chapter 13 bankruptcy explained.

Don’t Miss: Deals For Me Now.com

If You Are Filing Chapter 7

Your case will generally be discharged after approximately three months. You will receive a Notice of Discharge from the Court eliminating your debts. Under a Chapter 13 bankruptcy, the Court issues a discharge once you have made all your payments. After discharge, creditors are prohibited forever from collecting these discharged debts.

Robert N. Honig, Attorney at Law116 S. York Street, Suite 215Elmhurst, Illinois 60126