Do Mortgage Lenders Use Gross Or Net Income

For taxpayers who earn wages or a salary, mortgage lenders typically look at gross income. Thats your income before state and federal income tax deductions, health insurance premiums, and Social Security or Medicare taxes.

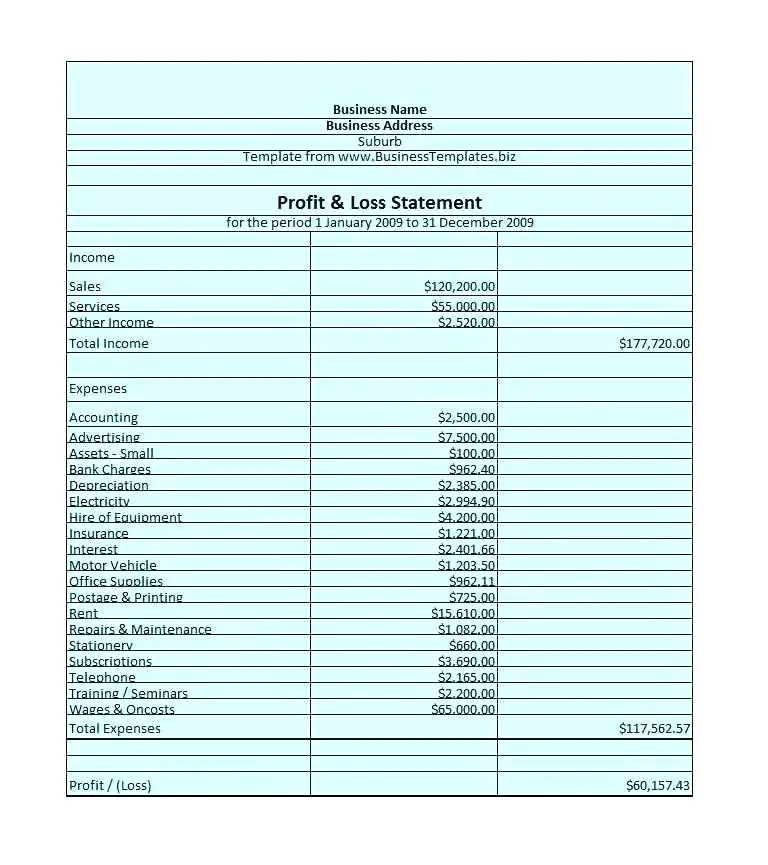

Its different for self-employed borrowers. Self-employed taxpayers usually reduce their tax liability by writing off work-related expenses: travel expenses, subscriptions, rents, etc.

This method saves money at tax time by lowering taxable income. But it can also have a negative effect on mortgage eligibility.

From a lenders point of view, a lower taxable income just looks like a lower income. A lower income raises the debt-to-income ratio one of the key factors lenders check.

How Much Income Do I Need For A 500k Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

How Do I Calculate My Gross Monthly Income For Self

Add up all your income for the previous two years and then divide that number by 24 to see your gross monthly income. To count as income for your lender, your income should come from a source thats at least two years old and you should have proof you expect the income to continue at least three more years.

Also Check: How To File Bankruptcy Chapter 7 Yourself In Indiana

Plan Ahead To Make Mortgage Qualifying Easier

If youre self-employed and want to buy a home, it helps to plan in advance. Work with a mortgage professional and involve your accountant as well.

You can change the way you write off your business expenses, and the amount of taxable income you show. Alternatively, you can amend previous tax returns to show higher income from the past.

Note that some deductions wont hurt you. Underwriters add them back into your taxable income:

Deductions like meals are subtracted from your income.

You and your accountant can check out the form underwriters use and see how lenders will view your income right now.

How Does A Mortgage Underwriter Calculate Income

Income calculations are based on the last two years worth of the applicants income statements. In certain situations, one year of documentation is adequate. The income calculation is processed more quickly with automation and AI.

Capacity was founded in 2017 by David Karandish and Chris Sims, and is part of the Equity.com incubator. Proudly headquartered in St. Louis.

Privacy Overview

You May Like: How To File For Bankruptcy Chapter 7 In Ny

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Bonus Commissions And Overtime

One really common mistake that I see made is a failure to dig into income, and make sure that certain income streams can be used. Because these income streams can be variable in nature, they are not calculated the same way as your salary, or hourly pay.

There are two things that an underwriter will look at to determine how to calculate this income.

If your variable income is steady or increasing on your current YTD pay stub, it will be averaged over the previous 2 years, including YTD. When the lender orders a Verification of Employment, we need your employer to break out your variable income. We will take 2014, 2015 and YTD, and divide it the calculated months. This average is used as your variable income calculation.

If the variable income stream is decreasing, its possible that the underwriter will not feel comfortable using it at all when calculating your income. This can sometimes be overcome with a good explanation for the decrease, as long as you can show that it was a one time or temporary occurrence that caused the dip.

Don’t Miss: How Often Can You File Bankruptcy In Indiana

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

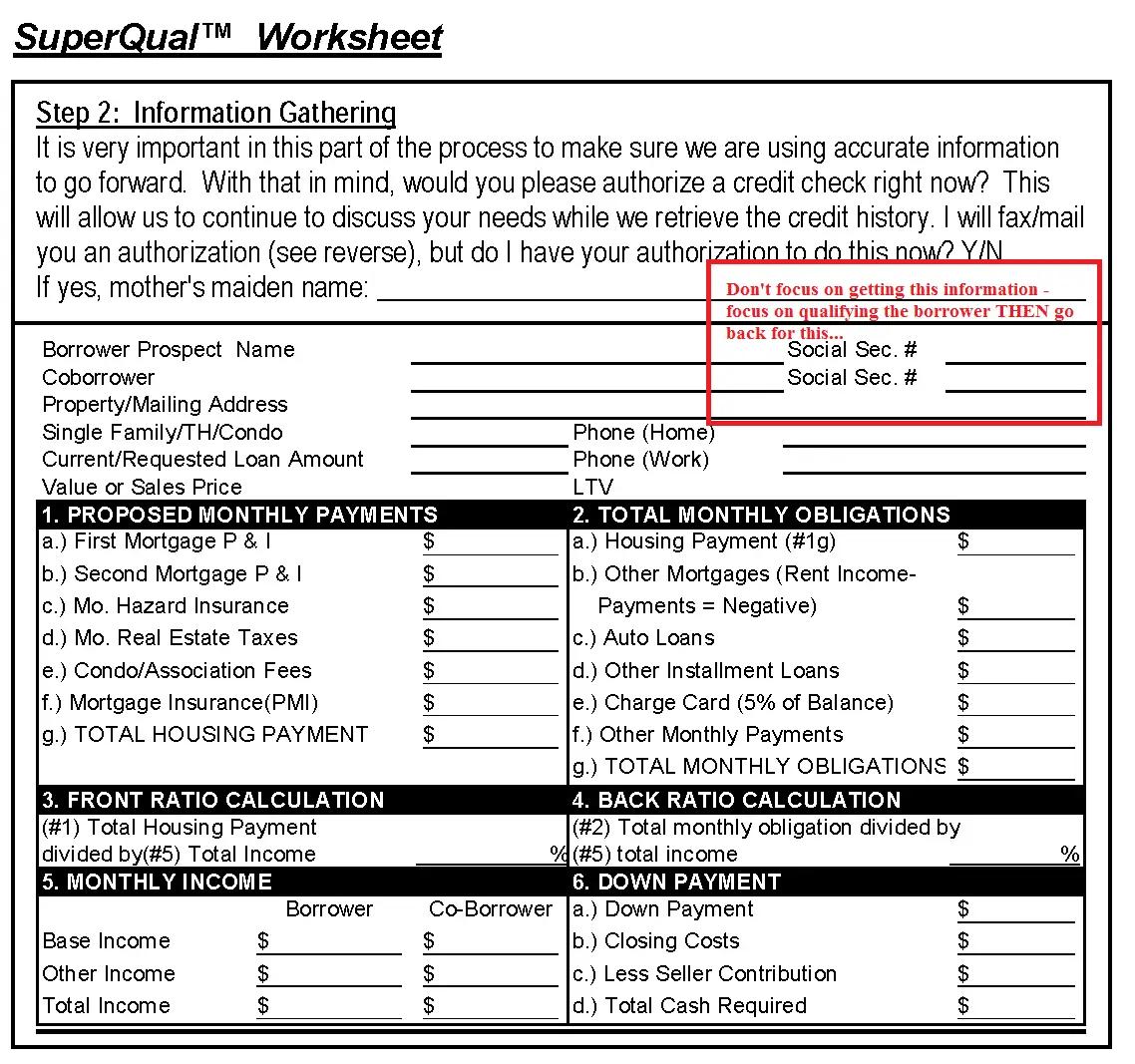

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Also Check: How To File For Bankruptcy In Ca Without A Lawyer

Conventional Loans For Self

Conventional, conforming loans are mortgages eligible for purchase by Fannie Mae or Freddie Mac. The majority of U.S. mortgages are conforming loans.

Fannie Mae and Freddie Mac will qualify self-employed borrowers after at least two years of self-employment or, with at least one year of self-employment, plus a documented history of at least two years earning comparable income in a comparable role.

Aside from these guidelines, conforming loans require:

- 620 minimum credit score

- Loan amount within conforming loan limits

If your credit report reveals good credit and you have a moderate to large down payment , a conventional mortgage is often the most affordable option.

Home buyers who put at least 20% down can avoid private mortgage insurance on these loans. The same goes for homeowners who refinance with at least 20% home equity. Avoiding PMI can save you a lot compared to, say, an FHA mortgage.

Getting Started With The Mortgage Underwriting Process

If youre looking to get a mortgage and have all of your documents in order, youre ready to start comparing loan offers. Ideally, youll want to find the loan with the lowest interest rate and fees and the most favorable terms.

As you shop around, consider what type of loan will suit your situation some mortgages are better for lower-income borrowers, for instance, or those with poorer credit in addition to how long you plan to stay in the home and what you can reasonably afford.

Read Also: Can You Keep Your Home If You File Bankruptcy

Can I Have 2 Mortgages At The Same Time

This comes as a surprise to most, but theres no law stopping you from having multiple mortgages, though you might have trouble finding lenders willing to let you take on a new mortgage after the first few! Each mortgage requires you to pass the lenders criteria, including an affordability assessment and credit check.

Do Mortgage Lenders Look At Gross Or Net Income

Gross income is the sum of all your wages, salaries, interest payments and other earnings before deductions such as taxes. While your net income accounts for your taxes and other deductions, your gross income does not. Lenders look at your gross income when determining how much of a monthly payment you can afford.

You May Like: Will Bankruptcy Stop Wage Garnishment

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

You May Like: When Will Foreclosures Start

How Underwriters Calculate Overtime Income

As previously stated, youll need to create a few documents that will give a more accurate picture of your earnings. There are several methods for calculating overtime income for qualification. For example, if you have a long and consistent track record of financial success, in which no significant differences have occurred in the last few years, it may be taken at face value.

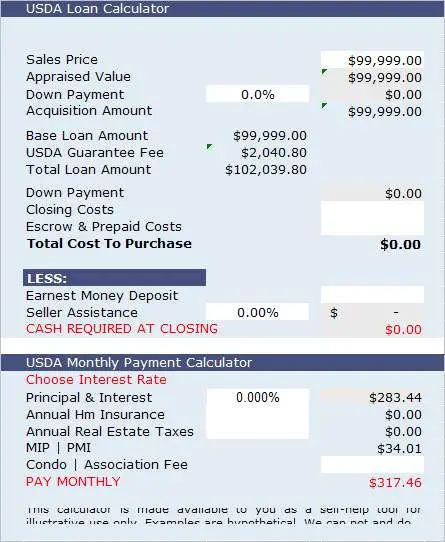

However, If the income amounts are not varied throughout the previous two years of history, we may use the average of the two years to determine qualification. Additionally, if you want to take out a mortgage through a government-insured program like FHA, USDA, or VA, there may be additional conditions for these programs to consider overtime earnings.

To be eligible for an FHA loan, your lender must average out your most recent two years of income to determine if you have the appropriate amount of earnings and you must have at least two years extra pay for it to be considered in this criteria. Before applying, its crucial that you familiarize yourself with each program and its requirements.

How Much Of This Income Do Lenders Accept

Most lenders only take 80% of your wrap income into account and ignore that your tenant is paying for council rate and other outgoings. As a result, your investing grinds to a halt.

Some lenders arent as conservative with investors earning wrap and rent to buy income.

The secret to success with wrapping properties is in choosing lenders with low , low and a credit department with an appetite for investors with wrap income.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Don’t Miss: Do You Lose Your House With Bankruptcy

How Does Mortgage Underwriting Work

Theres a lot that goes on in the mortgage underwrite process, and it all starts with the underwriter verifying the information youve provided on your application. Factors such as your income, combined debts, and past history of borrowing will be looked at. The underwriting team will call your employer to confirm that you work there and what your income is, for instance.

A copy of your credit report will be looked at to identify what your credit score is. Borrowers with low credit scores will often have a much harder time getting approved for a mortgage, as they are considered to be much riskier borrowers that place lenders at increased risk.

The home that you want to purchase with the loan will also be looked at in order to make sure that the property offers sufficient collateral for the loan. Theyll also want to ensure that the property is worth the amount you agreed to pay for it. As such, a professional appraiser will be sent out to the property to assess the current market value of the property.

Once the appraisal has been conducted, the legal history of the propertys title will be looked at by a title company. If there are any issues with title – such as liens or claims – the lender may be less willing to extend a loan until such issues have been cleared up. A title insurer will then issue an insurance policy that guarantees the works accuracy. Lenders will require this policy to be in place to protect both the property owner and the lender.

Time And Second Job Income

Many people have part time, or second jobs to help make ends meet, or to supercharge your savings. Part time employment and second job income can only be used if you have a 2 year history of working part time, or a second full time job.

If you do have a 2 year history of this type of income stream, it is calculated similar to other variable income streams and will be averaged over the past 2 years, including your YTD income. This type of income calculation also will take into consideration consistency of income, and whether or not it is steady, increasing or decreasing.

Read Also: How To View Bankruptcy Records Online

When Is Predicted Rental Income Accepted For Underwriting

Sometimes, rental income cant be proven via a tax return. Say, for example, youve just purchased the property, or you purchased the property in the middle of the year and only show a portion of the rental income on your tax return.

In that case, the rental income would be considered predicted and may be used under certain circumstances for underwriting purposes. Again, its a matter of being able to show proof of the propertys income potential.

If the renter has a tenant, lenders will take a percentage of the income thats outlined on a lease and use that to determine projected rental income. They usually use 75% of your total reported income 25% is subtracted to account for potential vacancies and ongoing maintenance.

If theres no tenant, the lender will have an appraiser do an audit of the property and use comparables of rental prices for similar properties in the area to estimate the potential rental income.

When is predicted rental income not acceptable?

Predicted rental income is not always acceptable for underwriting, though. First and foremost, you may have a problem getting it counted if it cannot be documented . This is because lenders sometimes request copies of checks as proof that the rent is regularly being paid on time.

Dont Miss: Chase Recast Calculator

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

You May Like: How Long After You File Bankruptcy Is It Discharged

Why Do Most Banks Only Accept 80%

The reason lenders use only 80% of your rent is that they assume that 20% of the rent you receive will be used to pay for managing agents fees, council rates, strata levies, repairs and to cover for any vacancies.

However, each lender has a different policy, so its best to call us on 1300 889 743 or complete our and our mortgage brokers will help you apply for a loan with the right lender.

How To Calculate Commission Income For A Mortgage

/how-to-calculate-commission-income-for-a-mortgage/

Many people choose a commission-based income instead of an hourly-based salary. A commission can provide an individual with the chance to earn more money. This type of worker gets paid a specific amount based on their accomplishments.

Commissions mean you can earn more per month. But it also means you could receive next to nothing if your prospects dont pan out. Its also more challenging to calculate your income. This is due to the fluctuating nature of commissions.

You could have a difficult time qualifying for a mortgage if you work on commissions. Your income is a critical factor when it comes to home loans. It doesnt mean you cant get a loan through. You can apply for home mortgage loans. But you must know how to calculate commission income for a mortgage.

Don’t Miss: Can You Keep Your House If You File Bankruptcy

How Long Does Mortgage Underwriting Take

The mortgage underwriting process can take anywhere from a few days to a few weeks, depending on whether the underwriter needs additional information from you, how busy the lender is, and how streamlined the lenders practices are.

The quicker you compile your documents and respond to the lenders requests for information, the smoother and speedier the process can be.

Keep in mind, however, that underwriting is just one part of the overall lending process. You can expect to completely close on a loan in 40-50 days.