What Is The Debt Ceiling

The debt ceiling is the legal limit set by Congress on how much the Treasury Department can borrow, including to pay debts the United States already owes. Since it was established during World War I, the debt ceiling has been raised dozens of times. In recent years, this once routine act has become a game of political brinkmanship that has brought the United States near default on several occasions, CFRs Roger W. Ferguson Jr. writes. Ferguson and other experts argue that the debt ceiling should be scrapped entirely. The only other advanced economy to have one is Denmark, and it has never come close to reaching its ceiling.

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

How Did The Debt Get Where It Is Today

More on:

The United States has run annual deficitsspending more than the Treasury collectsalmost every year since the nations founding. The period since World War II, during which the United States emerged as a global superpower, is a good starting point from which to examine modern debt levels. Defense spending during the war led to unprecedented borrowing, with the debt skyrocketing to more than 100 percent of gross domestic product in 1946.

Recommended Reading: How Long Does Bankruptcy Chapter 7

Consequences Of Us Debt At $50 Trillion

With the US set to breach the $50 trillion mark in debt by 2030, here are five things we should start thinking about sooner rather than later.

1. Raising taxes will not solve the problem. Of course, it could help reduce the deficit some, but it would be more of a token. That is just the reality. From the Tax Foundation, here are the real numbers as of 2017.

If we double taxes on the top 25%, it would only bring in another $1.3 trillion, assuming people didnt change their behavior.

A less-shocking 20% to 25% increase would only bring in about $3 billion to $400 billion, and would have to raise rates on incomes above $83,000.

Not exactly the rich. They already think they pay their fair share.

If we raise taxes next year in the teeth of a recession, it will only make the recession worse. If we raise taxes but they dont actually take effect until 2023 and then get phased in? That would probably avoid creating a double-dip recession.

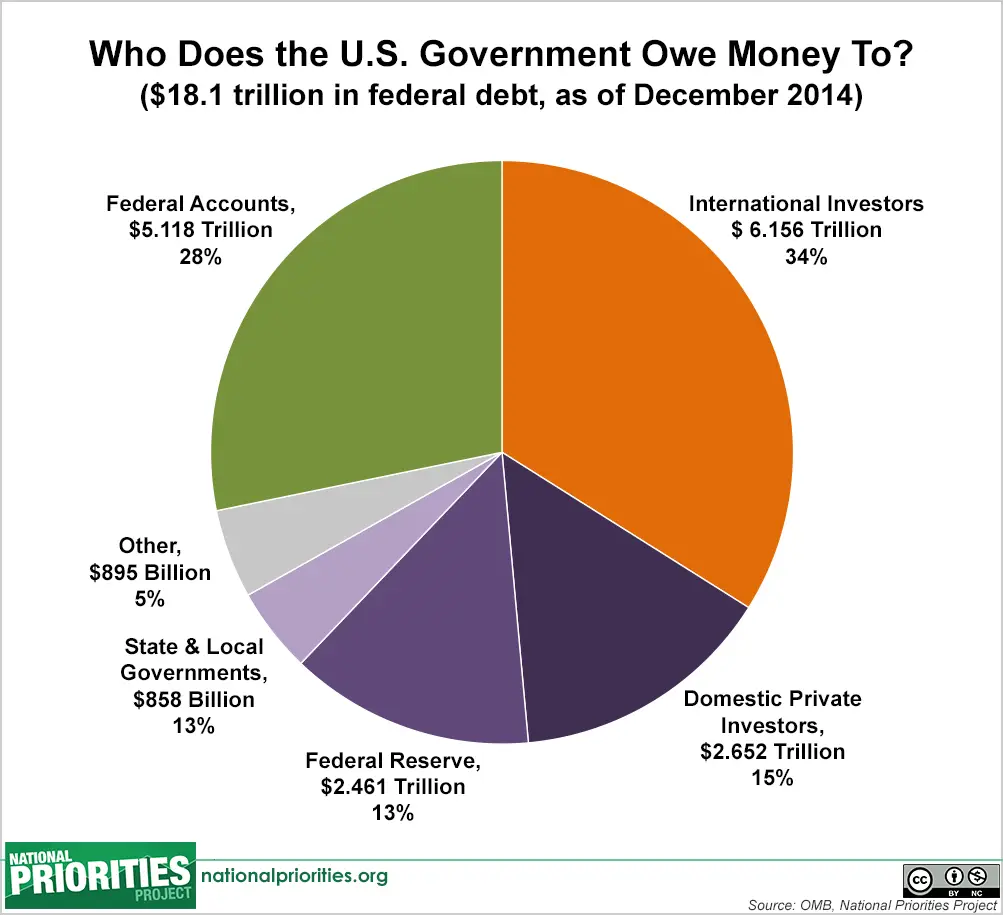

Current Foreign Ownership Of Us Debt

Japan owned $1.32 trillion in U.S. Treasurys in July 2021, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $1.07 trillion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $579.8 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Ireland is next, holding $324.3 billion. Luxembourg, Switzerland, Cayman Islands, Brazil, Taiwan, and France round out the top 10.

Recommended Reading: Do It Yourself Bankruptcy Chapter 7 Software

How Much Does Rising Us Debt Matter

The massive borrowing due to the pandemic, along with Bidens big spending plans, has renewed debate over the peril posed by the national debt. Some economists fear that the United States will become stuck in a debt trap, with high debt tamping down growth, which itself leads to more debt. Others, including those who subscribe to the so-called modern monetary theory, say the country can afford to print more money.

Some say that servicing the debt could divert investment from vital areas, such as infrastructure, education, and the fight against climate change. There are also fears it could undermine U.S. global leadership by leaving fewer dollars for U.S. military, diplomatic, and humanitarian operations around the world. Other experts worry that large debts could become a drag on the economy or precipitate a fiscal crisis, arguing that there is a tipping point beyond which large accumulations of government debt begin to slow growth. Under this scenario, investors could lose confidence in Washingtons ability to right its fiscal ship and become unwilling to finance U.S. borrowing without much higher interest rates. This could result in even larger deficits and increased borrowing, or what is sometimes called a debt spiral. A fiscal crisis of this nature could necessitate sudden and economically painful spending cuts or tax increases.

Understand Inflation And How It Impacts You

- Inflation 101: Whats driving inflation in the United States? What can slow the rapid price gains? Heres what to know.

- Changing Behaviors: From driving fewer miles to downgrading vacations, Americans are making changes to their spending because of inflation. Heres how five households are coping.

A larger amount of debt makes the United States fiscal position more vulnerable to an increase in interest rates, the C.B.O. said in its long-term budget outlook.

In a recent report, Brian Riedl, a senior fellow at the Manhattan Institute, a conservative think tank, pointed to the C.B.O.s prediction that the average interest rate on 10-year Treasury notes would rise from 1.6 percent to 4.9 percent over the next 30 years. He estimates that if interest rates exceed that forecast by just a percentage point, it will mean another $30 trillion in interest costs during that time.

Mr. Riedl described policymakers who expected interest rates to remain low indefinitely as hubristic and said it was risky to assume that low rates would keep the debt stable over time.

The economy is unpredictable, and we should never take low interest rates and inflation for granted, Mr. Riedl said in an interview.

The interest on the debt could soon be the fastest-growing part of the federal budget.

In recent months, the budget deficit has started to shrink as a stronger economy has boosted tax receipts and as government payments of pandemic relief money have slowed.

Recommended Reading: How Long After Bankruptcy Can You Refinance Your Home

Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .

What Causes The National Debt To Increase

Sometimes the government needs to increase spending to stabilize the economy, and protect Americans and businesses from unexpected economic conditions.

During The Great Recession , for example, Congress passed legislation injecting $1.8 trillion into the economy. But that pales in comparison to the $4.5 trillion the Trump and Biden administrations have pumped into the economy since the Covid pandemic began in March 2020.

However, there are other reasons the national debt increases, even during years where spending is moderate and the economy is in good shape.

Read Also: Can Bankruptcy Stop Foreclosure In Florida

How Much Is The Us National Debt In 2021

On Dec. 31, 2021 the US national debt stood at $28.4T. That was relative to an economy that generated a gross domestic product of $23T. That made the debt-to-GDP ratio 1.05 Put another way, the national debt was around 105 percent of GDP.

This ratio is much higher than the US has seen for most of its history. The peak occurred just after World War II, when the ratio was 112 percent. In 2018, the US had the fourteenth highest debt-to-GDP ratio in the world.

In 2019, the government collected about $3.5T in revenue while spending $4.4T. Thus, there was a nearly $1T federal deficit in 2019, which was added to the national public debt.

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

Recommended Reading: Does Bankruptcy Mess Up Your Credit

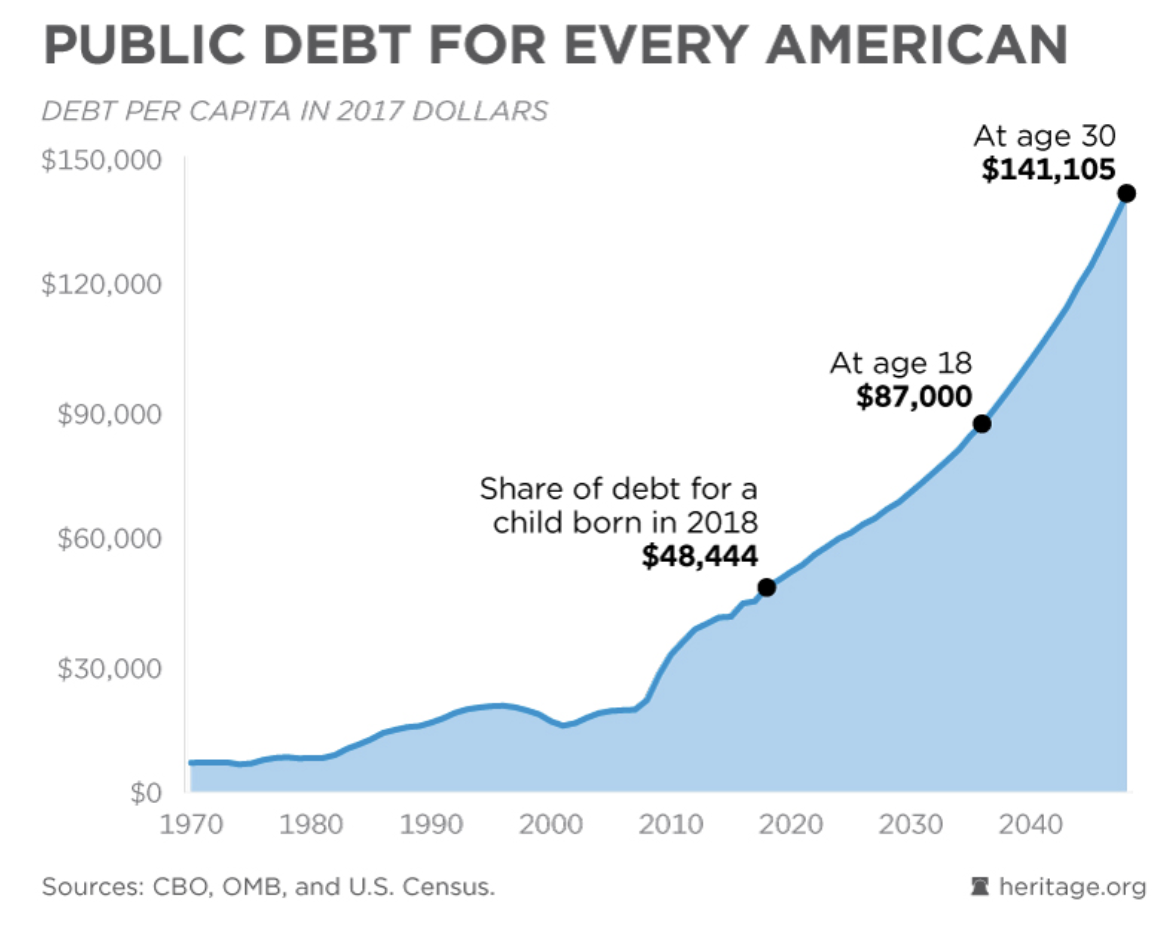

Taking National Debt Personally

While voters are not fans of national debt on principle, the debt-to-GDP ratio makes for a lackluster rallying point in practice, since even economists can’t agree on what percentage is too high.

Hence efforts to frame the national debt burden in easily understood terms. One popular tactic is to divide national debt by the population to determine debt per capita. Dividing the U.S. national debt of $30.5 trillion as of July 2022 by an estimated U.S. population of 332.4 million as of Jan. 1, 2022 yields national debt per capita of nearly $92,000, which sounds like a lot.

Fortunately, the per capita apportionment of government debt ignores the fact that no individual, not even a child, can hope to repay debt in a currency they create, the way the U.S. government and many other sovereign borrowers do. The improbability of default by a sovereign borrowing in its own currency is what marks out such debt as a “safe asset” relative to credit issued to private borrowers. In this sense, national debt can be thought of as an interest-bearing currency supplementing the interest-free banknotes. Like currency, national debt is a government obligation serving as an asset and store of value for its owners.

First What Can We Expect In A Recession

It’s always helpful to go back and review recession outcomes so that we can manage our expectations. While every recession varies in terms of length, severity and consequences, we tend to see more layoffs and an uptick in unemployment during economic downturns. Accessing the market for credit may also become harder and banks could be slower to lend, because they’re worried about default rates.

Read more: The Economy Is Scary. Here’s What History Tells Us

As the Federal Reserve continues to raise rates to try to clamp down on inflation, we’ll see an even greater increase in borrowing costs — for mortgages, car loans and business loans, for example. So, even if you qualify for a loan or credit card, the interest rate will be higher than it was in the prior year, making it harder for households to borrow or pay off debt. We’re already seeing this in the housing market, where the average rate on a 30-year fixed mortgage was recently approaching nearly 6%, the highest level since 2009.

During recessions, as rates go up and inflation cools, prices on goods and services fall and our personal savings rates could increase, but that all depends on the labor market and wages. We may also see an uptick in entrepreneurship, as we saw in 2009 with the Great Recession, as the newly unemployed often seek ways to turn a small business idea into reality.

Read Also: Can Filing Bankruptcy Clear Irs Debt

Will Interest Rates On My Loans And Debts Go Up

As the Federal Reserve continues to raise interest rates to try to curb inflation, adjustable interest rates are set to increase — ratcheting up the APRs of credit cards and loans, and making monthly payments more expensive. Ask your lenders and card issuers about low-interest credit options. See if you can refinance or consolidate debts to a single fixed-rate loan.In past recessions, some financial institutions were hesitant to lend as often as they did in “normal” times. This can be troubling if your business relies on credit to expand, or if you need a mortgage to buy a house. It’s time to pay close attention to your , which is a huge factor in a bank’s decision. The higher your score, the better your chances of qualifying and getting the best rates.

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

You May Like: Does Bankruptcy Save Your Home From Foreclosure

Student Loan Repayment Statistics

Since the start of the Covid-19 pandemic, student loan payments have been flipped on their head. Federal student loan payments have been paused nationwide since March 2020, and the majority of federal loans are currently in forbearance.

At the beginning of 2020, just 2.7 million borrowers had their federal loans in forbearance. That number had shot up to 24 million borrowers by the end of 2021. However, this reprieve is set to expire in May 2022, when federal student loan payments are expected to resume.

Here are the current repayment statuses of the federal Direct Loan program.

| Status | |

|---|---|

| $112 billion | 5.1 million |

Private student loans, on the other hand, received no widespread forbearance options during the pandemic. The majority of private student debt is actively in repayment. In the third quarter of 2021, 74% of private loans were in repayment, 17.5% were deferred, 6% were in a grace period and 2.4% were in forbearance.

Sources: Federal Student Aid, MeasureOne

What Is The Difference Between The National Debt And A Budget Deficit

A federal budget deficit happens when the government doesnt bring in enough revenue to cover all of the nations expenses. The opposite of a deficit is a surplus, which is when revenue exceeds spending Theres money left over. Deficits and surpluses are measured on an annual basis each fiscal year.

When the government needs to raise money to balance the budget, the US Treasury sells securities. These include Treasury bills , Treasury notes , or Treasury bonds .

All of these securities are government debt instruments upon which the purchaser expects to make a return on investment. Debt issued by the US government is generally considered a very low-risk investment, so returns are typically small.

While a deficit refers to a single year, national debt is cumulative. Its all the money the government has borrowed to cover annual budget deficits and currently owes to creditors. This number is continually changing as some debts are paid off, and new debt is issued. When the government runs a deficit, debt grows. When theres a surplus, it can use the extra money to pay down debt.

You May Like: Will Filing Bankruptcy Clear My Student Loans