How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

How To Calculate Your Frontend Debt

The following procedures may get used to calculate your frontend debt-to-income ratio:

- Compute your total monthly debts.

- Subtract your monthly gross income from the total of your loans. Your take-home pay gets left over after all monthly deductions and taxes.

- To get your DTI ratio, convert the number into a percentage.

Debt In An Fha Dti Calculation

When you apply for a loan, you’ll need to disclose all debts and open lines of credit even those with without current balances. In a lender’s mind, a zero-balance open line of credit is a risk, because you’re only one shopping spree away from being in more debt.

Make sure that your DTI calculations include all student loans, all credit card payments and auto loans. Your auto and estimated mortgage payments should include amounts for monthly auto and homeowner insurance premiums. You also will need to include any loans you’ve received from family or friends, medical payments, alimony or child support and other regular monthly amounts owed.

Let’s use the following example to calculate a back-end debt ratio:

Also Check: How Much Do Lawyers Charge To File Bankruptcy

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

Whats The Difference Between Front

Mortgage lenders often look at your front-end and back-end debt-to-income ratios when they review your loan application. Your front-end DTI includes just your housing costs in relation to your income. Lenders frequently want your front-end debt-to-income ratio to be below 28%.

Your back-end DTI includes your housing costs as well as the cost of other monthly debt payments on student loans, car loans, credit cards, and more in relation to your income. Mortgage lenders frequently want your back-end debt-to-income ratio to be below 36%.

Read Also: Can You Declare Bankruptcy On Credit Cards

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Importance Of Debt To Income Ratio

This debt to income ratio is important, as it is an indicating factor of how much of your income is spoken for each month. These fixed payments decide whether there is enough cash flow to meet all monthly financial obligations. In general, the lower the debt to income ratio, the better the cash flow and a higher chance that loans will be repaid. Also, the lower the debt to income ratio is, the easier it will be to qualify for credit for future major purchases.

Read Also: How To File Bankruptcy And Keep Your Home

Monitor Your Dti And Your Credit For Better Access To Credit

Even if you don’t anticipate needing to apply for credit anytime soon, it’s a good idea to keep an eye on your DTI and your credit score to make sure you’re ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian’s free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You’ll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Pay Off Your Most Expensive Loan First

Your most expensive loan is the loan with the highest interest rate. By paying it off first, youre reducing the overall amount of interest you pay and decreasing your overall debt. Then, continue paying down debts with the next highest interest rates to save on your overall cost. This is sometimes referred to as the avalanche method of paying down debt.

Don’t Miss: How To Get A Dismissed Bankruptcy Off Your Credit Report

Talk To Freedom Mortgage About Buying A Home

Freedom Mortgage is committed to fostering homeownership across America. We can help you buy a home with a conventional, VA, FHA, or USDA loan. Visit our Get Started page or call one of Freedom Mortgage’s friendly loan advisors at .

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Also Check: How Do I Find Foreclosed Homes

Whats Included In Your Dti Ratio

Our tool calculates your back-end DTI ratio using potential mortgage payments and the following recurring debts:

-

Child support and alimony

-

Personal loan or other monthly debts

Of course, these probably arent your only monthly expenses. Your back-end DTI ratio can also include what you spend on food, utilities, gas, insurance or entertainment, in addition to proposed mortgage payments. Although lenders may not inspect your back-end ratio to this detail, its important to look carefully at these costs so your true monthly financial obligations are represented.

Ideally, your total DTI ratio should be under 36%. Keep this in mind when deciding what affordable means for you.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: Pay Off Debt Online

This Calculator Figures Monthly Mortgage Payments Based On The Principal Borrowed The Length Of The Loan And The Annual Interest Rate

. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. The debt-to-income ratio is one. Debt-To-Income Ratio – DTI.

To understand how debt-to-income ratio impacts mortgage approval refer to the table below. Automated underwriting Manual underwriting. In recent years total mortgage debt has been growing at a rate of roughly 35 to 37 annually.

Chase recommends that consumers have a DTI of 40 or lower. Calculate your debt-to-income ratio. Another important lending criteria is debt-to-income DTI ratio.

This ratio is known as the debt-to-income ratio and is used for all the calculations of this calculator. 28 of your income will go to your mortgage payment and 36 to all your other household debt. The following data from the Federal Reserve shows how mortgage debt has grown over time.

Estimates regarding minimum. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines vary widely.

Enter in your total unsecured debt this includes credit cards personal loans medical bills and other unsecured debts. A number of fuel ratios may be used eg 241 321 401 501 etc. Learn about debt-to-income and use our free DTI calculator to divide your monthly income by your monthly debt payments.

Bagikan Artikel ini

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Don’t Miss: California Bankruptcy Exemptions 2021

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Lender Standards For Debt

Lenders want to know how well you’re making ends meet and how much home you can actually afford. The lower your DTI, the less debt you owe and the more able you are to make monthly loan payments.

Lenders consider both your front-end ratio, which is the percentage of mortgage you pay relative to your income, and your back-end ratio, which measures your total debts, including mortgage expenses, against your income. It can be helpful to know how your spending and savings can impact your future homeowning goals, too.

| Mortgage Industry Term | |

|---|---|

| Total Fixed Payment Expense Debt-to-Income Ratio | .43 |

You May Like: Bankruptcy Friendly Auto Loans

Pay More Than The Minimum

Pay off your debt and save on interest by paying more than the minimum every month. The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal. Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply.

What Should Your Debt

Creditors will also consider your DTI ratio when applying for a mortgage refinance. As with mortgage loans, a higher DTI will make it much harder to get approved for refinancing your home loan. Check our refinance calculator to determine if refinancing your mortgage is the right choice for you.

- For cash-out refinance, Chase recommends that consumers have a DTI of 40% or lower.

- Rocket Mortgage states that most lenders prefer consumers which have a DTI of 50% or lower when applying for mortgage refinance.

Don’t Miss: How Many Times Can You File Bankruptcy In Tn

Pay More Than Once A Month

Pay your credit card bills more than the required once per month. This may make it easier to stay on track of how much you owe. Paying your credit card bill regularly may also lower your balance/utilization ratio. The credit utilization ratio is the percentage of your total available credit that is currently being used. The utilization ratio is one of the components used by credit reporting agencies to calculate your credit score.

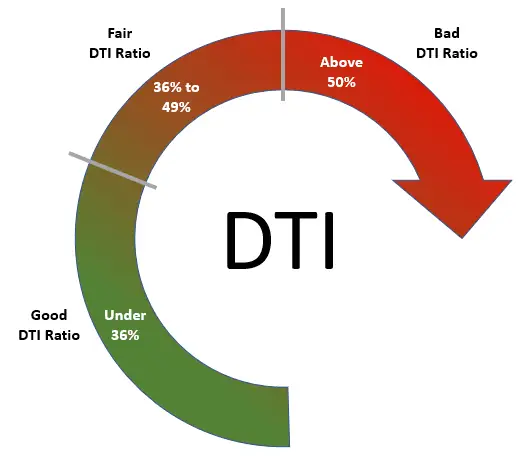

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

You May Like: How To Get A Mortgage After Bankruptcy And Foreclosure

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

What Is The Difference Between Debt

Both calculations evaluate your risk as a borrower, but consider different factors of your financial profile.

The DTI ratio considers your income and all monthly debt obligations to see how much money goes into paying off your debt. Lending institutions use the DTI ratio to evaluate borrowers, but it doesn’t impact your credit score.

The credit utilization rate is a key evaluating factor of your credit score. This calculation measures your credit usage by comparing your maximum credit limit to your outstanding balance. Unlike the DTI ratio, the credit utilization rate only considers revolving credit credit cards, personal credit lines and HELOCs. It doesn’t factor in installment debt or your monthly income.

You May Like: Income To Debt Ratio Formula

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

Recommended Reading: How To Refinance A Car After Bankruptcy

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.