Pay Off Some Existing Debt

Eliminating existing debt is one of the easiest ways to lower your debt-to-income ratio. But which debts should you choose?

Generally, it pays to focus on your debt that comes with the highest interest rate attached to it. If you owe money on a credit card, that probably fits the bill. In fact, it’s smart to work on tackling before other debts because too much of it can also drag down your actual credit score. And if your isn’t great, that could stop you from getting approved for a mortgage — even if your debt-to-income ratio improves.

Consolidating your debt could also lower the interest rate you pay on it. And that could result in lower monthly payments and a lower debt-to-income ratio.

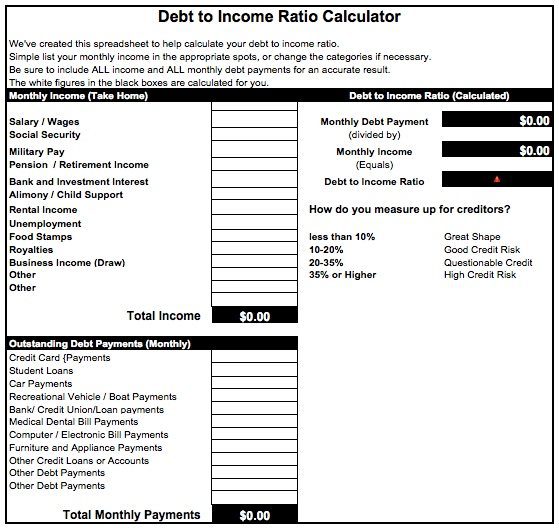

Calculate Debt To Income Ratio

So, how do you figure out your debt to income ratio? Its actually pretty quick and painless.

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

Recommended Reading: Pallets Liquidation For Sale

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Don’t Miss: How To Be A Bankruptcy Lawyer

Reduce Your Student Loans

If student loans are taking a big bite out of your monthly funds, there are several ways to request help. For federal loans, these include:

- Consolidation Consolidate multiple federal student loans into a single Federal Direct Loan. While it may extend the life of the loan , it can provide relief by lowering your monthly debt payment and potentially locking in a lower interest rate.

- Reduced payments Under a Federal Direct Loan, you can apply for either income-based payments or Pay as You Earn plans if youre struggling financially or have a large family. In addition to reduced monthly payments , you may end up with loan forgiveness after 20 or 25 years instead of paying the entirety of the owed amount.

- Deferment You can request deferment to temporarily stop your monthly payments for up to three years each based on either unemployment or economic hardship. While this only postpones loan repayment, it can lower your DTI ratio immediately by removing that amount from your current monthly debt.

- Forbearance This is a final step before defaulting on the loan. It entails telling the government theres no way you can repay it as is. This can result in lower monthly payments and/or some degree of loan forgiveness if you can prove your financial situation merits it. Be wary of the pros and cons of mortgage forbearance before you consider this option.

Why Do I Need To Know My Debt

The reason your DTI ratio matters is because lenders use it as a way to determine your ability to manage your monthly bills, lifestyle, and any potential loan that they may extend you. In other words, if youre ever looking to get a major loan such as a mortgage, car loan, or student loan, you want to ensure that your current debt-to-income ratio is low enough to take on additional debt.

If your gross monthly income is $5,000, then your monthly debts should be no more than $2,150. At face value, that sounds pretty reasonable since that would leave you with $2,850 for the rest of your monthly expenses right? Not exactly.

Remember, the debt-to-income ratio is based on gross income. When you factor in the average taxes you would pay as a Canadian resident, your gross income of $5,000 per month is a net income of about $4,100 a month. After you pay your monthly debts, that leaves you with $1,250 in disposable income. That leftover income needs to cover all your other expenses, including vacations, retirement savings, insurance, raising children, and much more.

Recommended Reading: Can You Discharge Medical Bills In Bankruptcy

Recommended Reading: Can You File Bankruptcy And Keep Your Home

Fastest Ways To Lower Your Debt To Income Ratio

Lenders use a number of metrics to determine what kind of rates a borrower is eligible for. One of the most important is debt-to-income ratio , which refers to the discrepancy between how much debt a borrower is holding and their current level of income.

So why is this metric so important, and what can you do to improve it? Weve got the answers you need below.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Don’t Miss: Which Of The Following Phrases Best Summarizes Chapter 13 Bankruptcy

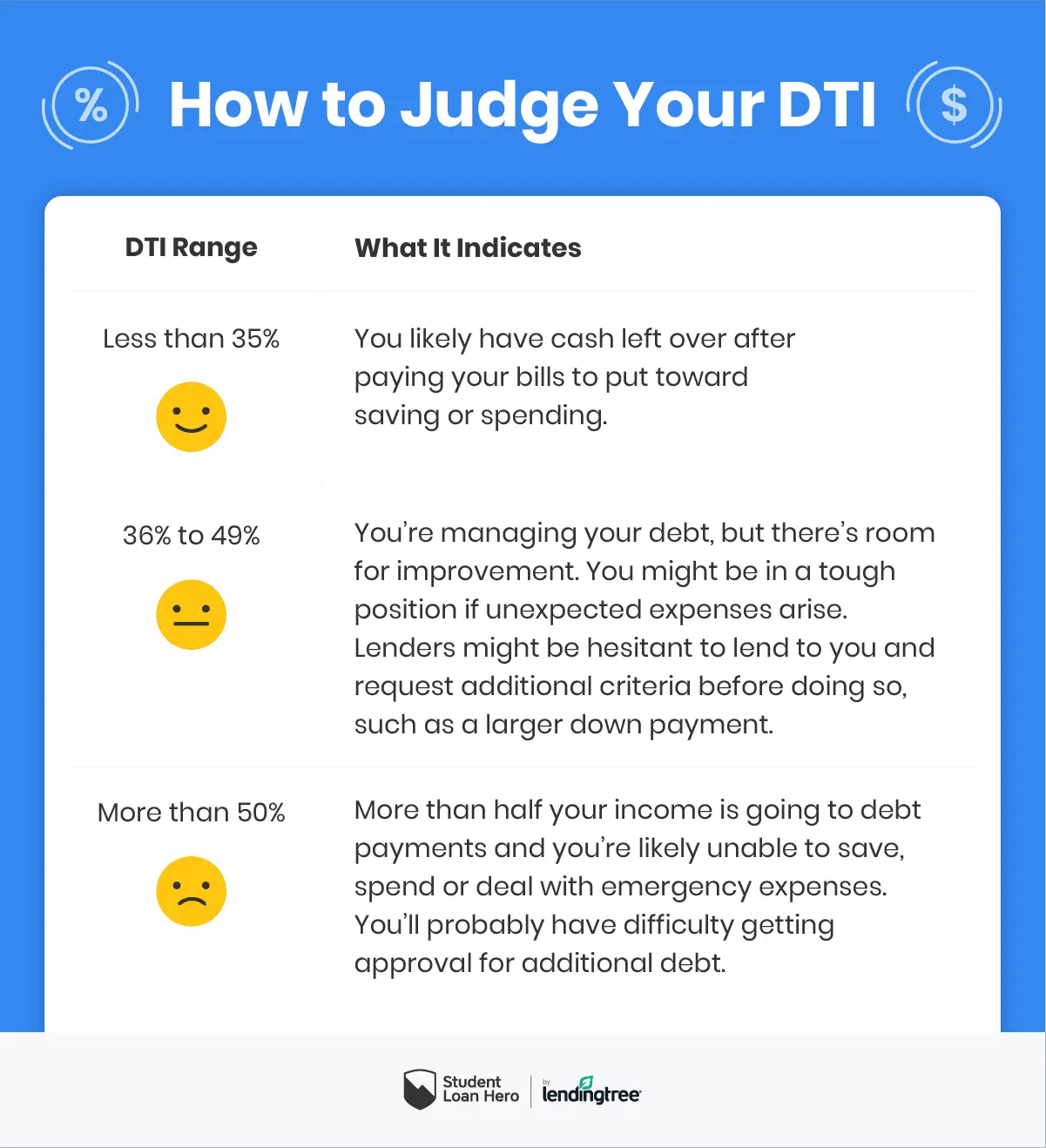

Why Does Your Dti Ratio Matter

Lenders may consider your DTI ratio as one factor when determining whether to lend you additional money and at what interest rate. Generally speaking, the lower a DTI ratio you have, the less risky you appear to lenders. The preferred maximum DTI ratio varies. However, for most lenders, 43 percent is the maximum DTI ratio a borrower can have and still be approved for a mortgage.

Why Does Your Debt To Income Ratio Matter

Your debt to income ratio shows how much debt you have for every dollar you earn. If your ratio is high, it means you owe a lot compared to your income. It could be very difficult for you to get out of debt, save money or even make your minimum monthly payments. A high debt to income ratio could also prevent you from getting approved for other loans or a mortgage.

If your ratio is low, it suggests that you are in good financial shape. Lenders like to see a low debt-to-income ratio as it could mean that you are at lower risk of defaulting on a loan or credit card payments.

Recommended Reading: What Are The Pros And Cons Of Bankruptcy

Target Debt With A High Bill

When youre trying to improve your debt-to-income ratio, your biggest priority will be lowering your monthly debt obligations in relation to your income. So it makes sense to target debt not based on its overall size, but on the size of your monthly payments for that debt.

For example, lets say you owe $1,000 on a line of credit and your minimum monthly payment is $100, so 10% of the debt. At the same time, you owe $500 on a credit card and your minimum monthly payment comes to $125, so 25% of the debt.

Even though the overall debt on your credit card is much smaller, paying it off will do more to improve your debt-to-income ratio because your payment represents a larger portion of the balance.

Want To Learn More About Our Debt Solutions

Fill out this form and we’ll be in touch.

*JGW Debt Settlement, LLC d/b/a JG Wentworth has partnered with Even Financial, Inc to provide this loan referral service. JG Wentworth is not a lender and cannot ultimately decide whether or not you are approved for a loan. JG Wentworth does not determine or influence the amount of money you may receive from using this referral services.

-

Structured Settlements

All hours are Eastern Time

Mon – Thurs: 8 am – 11 pm

Fri: 8 am – 9 pm

Sat: 9 am – 6 pm

-

All hours are Eastern Time

Mon – Thurs: 8 am – 11 pm

Fri: 8 am – 9 pm

Sat: 9 am – 6 pm

Recommended Reading: When Does A Bankruptcy Come Off Credit

Looking Into Loan Forgiveness Or Debt Settlement

If the above methods don’t work, you may want to look into loan forgiveness or debt settlement. However, these should be last resort methods.

Both debt settlement and loan forgiveness can have long-lasting impacts on your credit score. Even though you’ll have lowered your DTI, your credit score may be too low to secure funding.

Also, loan forgiveness is typically only available with federal loans. Consider consulting with a financial expert before deciding to settle your debt or seek out loan forgiveness.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

Don’t Miss: How To File Your Own Bankruptcy In Illinois

Negotiate To Lower Your Interest Rates

Sometimes theres a catch 22. You want to apply for a consolidation loan but cant get approved because your DTI is too high. Unfortunately, some lenders will use your current ratio and not factor the change after a consolidation. So, youll need to negotiate with your credit card companies and lenders instead. If youre successful, a lower APR can mean lower payments.

Lower Interest On Debt

The lower your interest rate, the faster you can pay the debt off in full. There are several ways to lower your rate. The first is to call the lender and ask for a reduction in the rate. If you’ve been working with a particular financial institution for years, they know your reputation for paying on time and may want to keep you as a customer enough to lower the rate.

Or, you can consider consolidating higher-interest debt into a single personal loan with a lower interest rate. Say you have three credit cards, each carrying an interest rate between 15% and 17%. If you can land a personal loan at 5% and use the funds to pay the credit cards off, you’ll save money, pay your debt off faster, and quickly lower your DTI.

If your credit score is strong, you also have access to some pretty great credit cards with 0% introductory offers. Here’s how these offers work: A credit card company offers 0% interest for a set period to new customers. You use the 0% offer to pay off outstanding debt or transfer outstanding credit card balances to the new card. You save money by not paying interest as long as you pay the new credit card off in full before the promotional period ends. In addition, your DTI drops with each payment.

Also Check: How To File Bankruptcy In Wisconsin

How To Lower Debt

A faster way to impact your DTI ratio is by paying off some of your revolving debt. By reducing that monthly debt number, you actually make a bigger difference than if you had increased your income by the same amount.

For example, lets say you were still making $5,000 but were able to dump $1,500 of monthly debt. Now your DTI is /$5000 = $1500/$5000 = 30%. You just cut your DTI by 30% instead of the 14% improvement you got from making more money.

Again, is this easy? No. If it were easy to pay off debt, everyone would be in a much better place financially.

Why Are Dti Ratios Different

Different banks use different DTIs and different loan programs use different DTIs. VA and FHA typically limit borrowers to a 52 percent DTI, but in some circumstances may increase that percentage slightly. Fannie Mae allows up to a 45 percent DTI on some loans, but you must have great credit. With credit scores under 700 you typically would have to have your DTI under 36 percent. If your score is significantly lower than that, It might be time to consider credit repair.

As you can see this can all get very confusing trying to figure out yourself. Here is a link to the Fannie Mae lending matrix which is even more confusing. The best thing to do is to talk to a lender and if your DTI is high, work on lowering it.

Don’t Miss: What Percent Of Chapter 7 Bankruptcies Are Dismissed

How Do Student Loans Affect Your Debt

As with any other debt obligation, the monthly payments on your student loans are factored into your debt-to-income ratio. In some cases, mortgage lenders may treat student loans differently than other types of debt, but theyre almost always in the formula.

To give you an idea of how student loans can impact your DTI, lets say you earn $5,000 in gross monthly income and have the following debt payments:

- Mortgage loan: $1,400

- Auto loan: $400

In total, your DTI is about 44%, which puts you just over the line to obtain a qualified mortgage, meaning that the loan meets the federal requirements to ensure that you can repay it.

Without the student loan payment, however, your DTI would be roughly 38%, below the 43% threshold for qualified mortgage loans.

Also Check: How Does Debt Consolidation Affect Your Credit Score

Does Debt To Income Ratio Affect Mortgage Rate

4.3/5Debt-to-Income Ratiosratioincomedebtsratiosinterest ratedebtsmortgagefull answer

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Also Know, how do mortgage lenders calculate debt to income ratio? Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax, or gross, income. Most lenders look for a ratio of 36% or less, though there are exceptions, which we’ll get into below. Debt-to-income ratio is calculated by dividing your monthly debts by your pretax income.

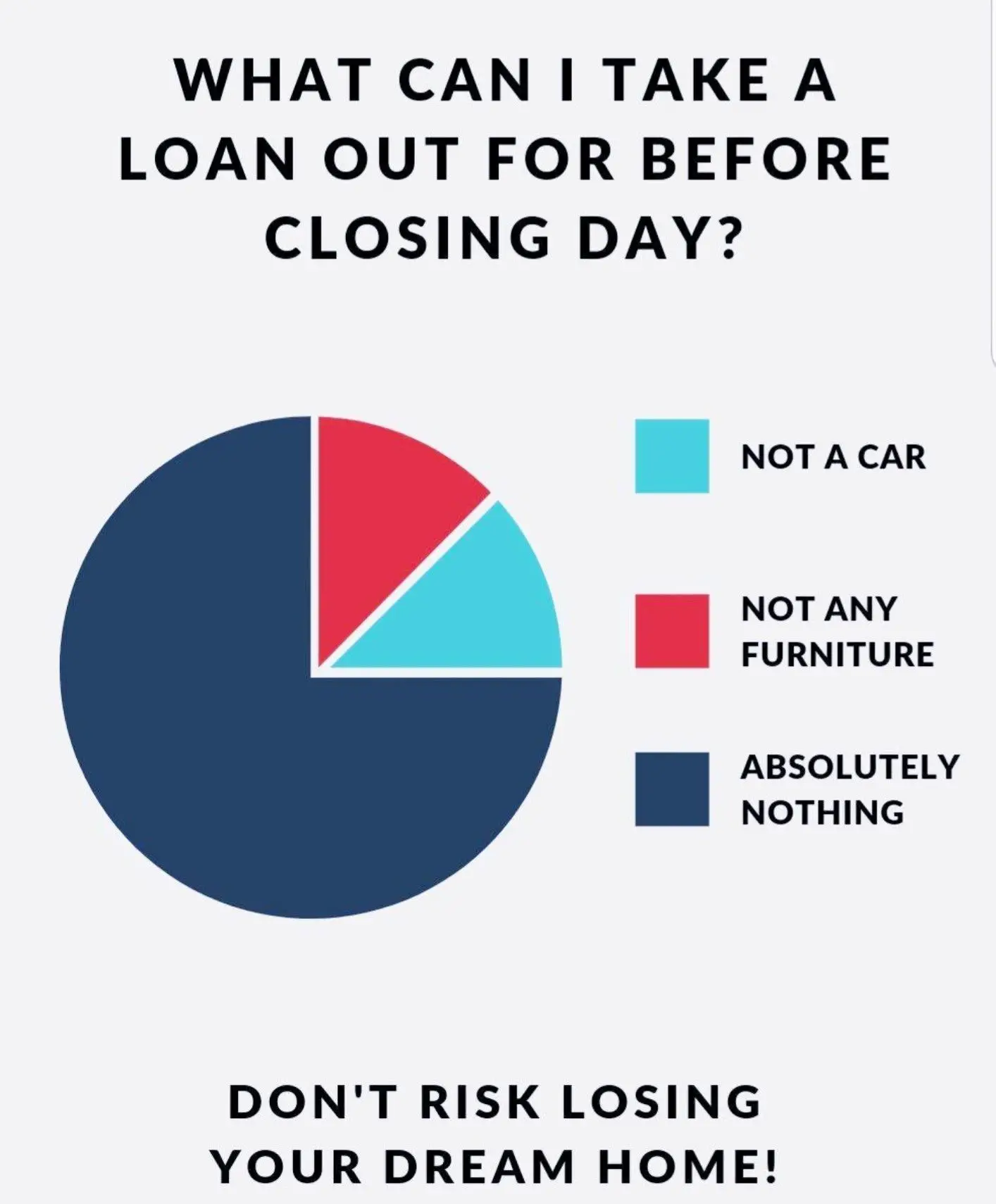

Subsequently, question is, do you include current mortgage in debt to income ratio?

Don’t include your current mortgage or rental payment, or other monthly expenses that aren’t debts . 2) Add your projected mortgage payment to your debt total from step 1. 3) Divide that total number by your monthly pre-tax income. The resulting percentage is your debt-to-income ratio.

How can I lower my debt to income ratio quickly?

How to lower your debt-to-income ratio

mortgage

Also Check: Bankruptcy Attorney In Maryland

Take On A Side Hustle

Have time to spare? Consider getting a side hustle to earn extra income. This can be anything from becoming a ride-share or delivery driver to turning a hobby or interest into a side business or providing consulting or coaching services.

Just make sure that your side hustle never puts your main hustle at risk!

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Recommended Reading: The Back End Ratio Or Total Debt Ratio Includes