How Do I Opt Out Of Secondary Credit Bureaus

Opting Out of Getting Prescreened Offers

Your Complete Guide On How To Remove Items From Lexisnexis

Are you concerned about negative information appearing on your LexisNexis report? Maybe youre worried about an old bankruptcy showing up, or perhaps theres an inaccurate judgment against you. Whatever the case may be, if you want to remove items from your LexisNexis report, youll need to follow a specific process.

In this guide, well walk you through everything you need to know about removing items from your LexisNexis report and what happens afterwards. Well discuss the different types of information that can appear on your report, how long negative information stays on your report, and what you can do to get rid of it. Well also provide some tips on how you can avoid negative information appearing on your report in the first place.

Keep reading to learn more about how to remove items from your Lexis Nexis report.

Robust Assets In Every Practice Area

No industry is spared from involuntary bankruptcy, which means bankruptcy proceedings overlap with all areas of the law. There are instances when youll need a firm grasp of corporate governance in Chapter 11 filings or be required to reference real estate laws when facing a Section 363 sale.

To differentiate yourself in a competitive practice area, stay up-to-date with the latest in every practice area. Leverage the power of Practical Guidance to fully understand how bankruptcy litigation interacts with other legal topics. Access up-to-date practical guidance for 20+ practice areasthe latest news, law reviews and The Practical Guidance Journal offering analysis on the current state of each practice area.

Ready to learn more? See what else the Practical Guidance service offers.

Recommended Reading: When Is Bankruptcy The Right Choice

Lexisnexis Removed Dismissed Chapter 13 From Credit File

Good Morning Everyone,

I have been in a never ending loop with the reporting of this chapter 13 for 5 years and FINALLY I have gotten the help I need. I disputed it because of incorrect reporting. But I disputed it through the CFPB with this information. I received an email from LexisNexis stating that they needed a copy of my SS card and license to authenticate me and of course I was reluctant but I sent it anyway. I received a call from LexisNexis on Thursday night stating that the Chapter 13 was being suppressed from my credit file with them and they would be sending a letter. My question to you is do I need to send the letter as documentation to each reporting CRA or go through the dispute process and wait for the result. My concernt is that they will say that the Chapter 13 was verified from the courts but I seriously want this thing to be handled the right way with as less confusion as possible. Any advice would be great.

Honestly, you will need to dispute it with each bureau. What one CRA determines in their investigation does not mean that the other CRAs will fall in line and change their reporting based on the 1st CRA’s investigation findings. Each bureau will do their own investigation and determine their own findings.

Good luck!

220 | EQ 550 | TU 498 | EX 505 721 | EQ | TU | EX 670 TU EX

How To Remove Negative Items Related To Identity Theft

If you believe youve been a victim of identity fraud, you should first file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

After you report the incident, make sure to take the following steps:

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact the credit bureaus through phone or mail to dispute any credit information that doesnt belong to you

- Place a security freeze and fraud alert on your credit report

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Also Check: How To Pay Collections

How To Remove Irs Liens And Bankruptcy From Your Credit History

Most items on your credit file are reported by the creditor or debt collector who is making the claim. But not everything appearing on your credit file is reported the same way. A notice of tax lien, for example, is first recorded in your county recorders office .

The county does not report these items to anyones credit file, so if you dont make this assumption, or if you ask the clerk of court or the county recorder what it is reporting to individual credit reports, you will discover that its not the county.

Lexis Nexis is a third party credit reporting agency that collects public records data and reports some of it to personal credit files. Its legal name is LexisNexis Risk & Analytics Group Inc. and I guess it must be profitable or fit its business model to collect this data and report it to your file.

Maybe its selling some type of risk management service, but do we really care about that? No. The only thing that matters here is that this reporting agency made a report to your credit file without a permissible purpose.

This means that because you didnt consent to this company making reports to your credit file and it never gave you credit, the credit item can be removed under the provisions and penalties of the Fair Credit Reporting Act. The fine for refusing to remove the item is $1,000, plus actual damages.

Example :

RE Dispute for credit item

LexisNexis reported the following item to my credit file without a permissible purpose:

Sincerely,

Sincerely,

How Do I Block Sagestream

If you would like to opt-out, you may do so using one of the following options:

Don’t Miss: Can You File Bankruptcy On Rent To Own Furniture

How Long Do It Take To Opt Out Of Lexisnexis

Thank you for your interest in the LexisNexis information suppression program. Your request to have information suppressed from publicly facing public records products has been received and is in process. Please note that it may take up to 30 days to suppress your information from LexisNexis products and services.

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Don’t Miss: Foreclosure Homes Com Reviews

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

How To Remove Items From Lexisnexis

Protect your online privacy and remove your personal information from over 100 data brokers.

LexisNexis was one of the first data brokers established. It pioneered electronic legal documents in the 1970s. The company’s information has grown exponentially since then.

LexisNexis has become a favorite of professionals in government, law enforcement, and risk management due to its rich information and high-quality results.

The LexisNexis police report is a powerful tool for research. This also makes it one of the most dangerous to online privacy.

LexisNexis is home to one of the largest electronic databases worldwide for legal and public records. LexisNexis’ public records database contains more than 84 million public records from more than 10,000 different sources. These records include public, private, regulated, and emerging data as well as derived data.

LexisNexis, unlike many other search engines, is a premium service. According to the company’s website, it sells 150 reports on customers.

- 283 Million active customer reports

- 1.5 billion bankruptcy records are monitored monthly

- Business contact records for 77 million

- 330 million unique cell phone numbers

- 11.3 billion unique address and name combinations

- Motor vehicle registrations in excess of 6.6 billion

- Personal property records for 6.5 billion

Although it is easy to submit a LexisNexis Opt-Out, this doesn’t necessarily mean that the company will honor your request.

You May Like: Tv Pallets For Sale

Can You Remove A Bankruptcy On Your Own

Like all negative item disputes, its entirely possible to complete the process on your own. However, removing a bankruptcy from your credit report early can be a lengthy and tedious process that doesnt guarantee results.

You can dispute the bankruptcy either by stating an inaccuracy of the information on your credit report or by asking the credit bureau how it verified your bankruptcy. As with any dispute, they must respond to your procedural request letter within 30 days.

In most cases, theyll say that they verified it with the courts, but this is unlikely. So you must then contact the court to ask how they verified your bankruptcy.

If they respond that they never verified it, you should get that statement in writing, send it to the credit bureau, and ask them to remove the bankruptcy.

This method isnt guaranteed, but it might be worth trying. Otherwise, enlist the help of a credit repair company to navigate the process for you.

Credit repair companies are highly experienced at disputing negative items on credit reports. They specialize in getting bankruptcy filings deleted from your credit report. Credit repair services also work to remove other negative information included in the bankruptcy, like charge-offs and collections.

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

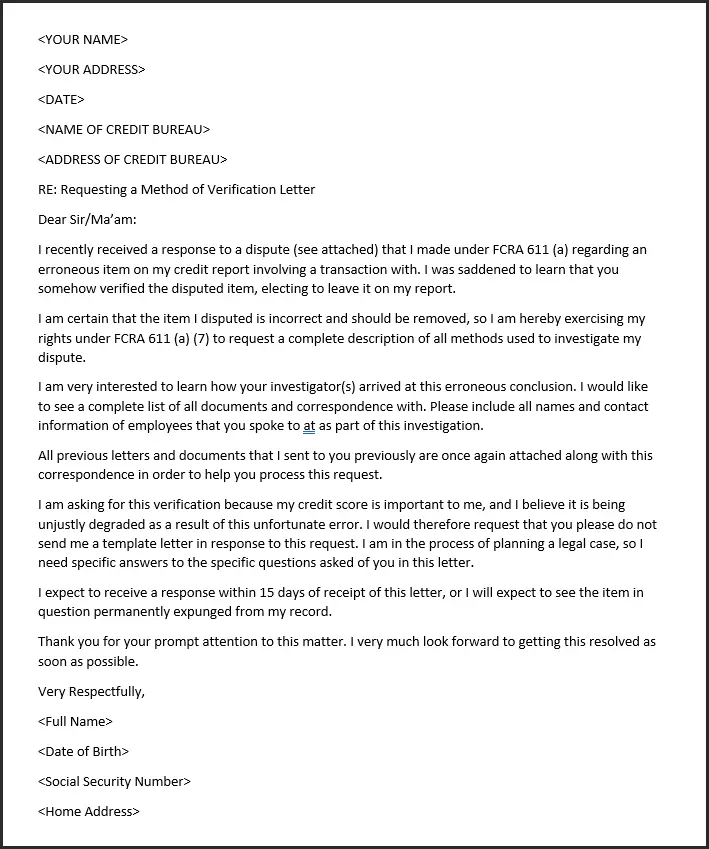

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Also Check: Filing Bankruptcy Chapter 7 In Ohio

Hire A Credit Repair Service

Disputing errors can be time consuming, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, remember there are consumer protection laws that regulate how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they have been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Recommended Reading: Where Can I Buy Overstock Pallets

S: How To Remove Bankruptcy From Credit Reports

Do you feel overwhelmed by your past financial decisions? Do you wish you knew how to remove bankruptcy from your credit report?

Understanding . Let’s make it simple. So, are you ready to take the next steps to help your credit get healthy?

We have talked to multiple friends and family who have struggled with bankruptcy. It has become a widespread occurrence in today’s society.

Let’s make your experience with credit accessible and straightforward.

We have gathered the best tips and tricks on how to remove bankruptcy from credit reports so you can improve your credit and improve your life.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history and help you organize your budget or place you in a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

You May Like: What Happens After You File Bankruptcy

Get Your Bankruptcy Removed Today

If youre looking for a reputable credit repair company to help you dispute your bankruptcy and repair your credit, consider working with Lexington Law.

Give them a call at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Can I Look Myself Up On Lexisnexis

You can get your LexisNexis report by going to the company’s website, calling 1-866-897-8126, or mailing a printable request form. You will need to provide your first and last name, address, date of birth, and either your SSN or your driver’s license number and state to request your LexisNexis report.

Don’t Miss: How To Remove Bankruptcy Off Credit Report

Hire A Credit Repair Company

These steps I am going to walk you through are how to remove bankruptcy from your credit report yourself. But there are professional companies that can help below

You can also ask them about removing dismissed bankruptcies credit report.

- or Call For Free Consultation Now:

All you have to do is give them a call for a free consultation to see what they can do for you.

Working with a professional is an excellent option for people who are busy, looking for a stress-free solution, or want to make sure an expert is handling the situation.

|

Pros |

|

|---|---|

|

Someone Else Does The Work |

Cell |

How Does Negative Lexisnexis Info Affect Reputation Management

Negative information on your LexisNexis report can negatively affect your reputation management. This is because data brokers like LexisNexis sell your personal information to businesses, which can then be used to make decisions about you.

For example, if you have negative information on your LexisNexis report, a business may decide not to extend credit to you. This can make it difficult to get loans, credit cards, and other financial products. In simple terms, this negative information has the potential to harm your online reputation.

You can take steps to improve your credit score, which will in turn help improve your LexisNexis report. This includes things like paying your bills on time, maintaining a good credit utilization ratio, and disputing errors on your credit report.

You should also consider freezing your credit, which will prevent businesses from accessing your credit report. This can be especially helpful if youre worried about identity theft.

If you have negative information on your LexisNexis report, its important to take steps to improve your reputation management. This includes working on your credit score and taking steps to prevent identity theft. You should also consider freezing your credit to prevent businesses from accessing your credit report.

Read Also: What Happens If You File Bankruptcy On Your Home

How To Remove A Bankruptcy From Your Credit Report

The first thing you want to do is grab a copy of your free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion. You can do this at AnnualCreditReport.com. You are entitled to one free credit report every 12 months.

When disputing a bankruptcy, youll need to write a credit dispute letter to each of the three credit bureaus. Make sure the wording of your dispute doesnt make it sound frivolous. Stick to the facts, and dont get emotional. Sometimes, the less you say, the better.

Yes, you have certain protections under the Fair Credit Reporting Act , but the credit bureaus also have protocols in place to shut down consumers who dont have legitimate disputes.

Remember the burden of proof is on the credit bureaus and they have 30 days to prove it. If they cant, it must be removed from your credit report.

Once youve sent your letters to the credit reporting agencies, youll usually have to wait about 3-4 weeks for a response. If the bankruptcy doesnt get removed, you can try sending a follow letter or consider hiring a professional.