Usda Debt To Income Ratio

Maximum USDA DTI limits work similarly FHA loans. Whats different about USDA loan income requirements is there is also a maximum income that a borrower can make. That maximum limit varies based upon area and is connected to area median income. Baseline USDA loan debt-to-income ratio limits are:

- 41% Bottom Ratio

Like other programs, these baseline debt to income ratio for USDA loan programs can be exceeded with a Guaranteed Underwriting System approval, which is the USDA version of the AUS.

How Is The Debt

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

Also note that mortgage insurance premiums are included in these figures.

Read Also: Does Rocket Mortgage Service Their Own Loans

Also Check: How To File For Bankruptcy In Az

What If My Debt To Income Ratio Is Too High

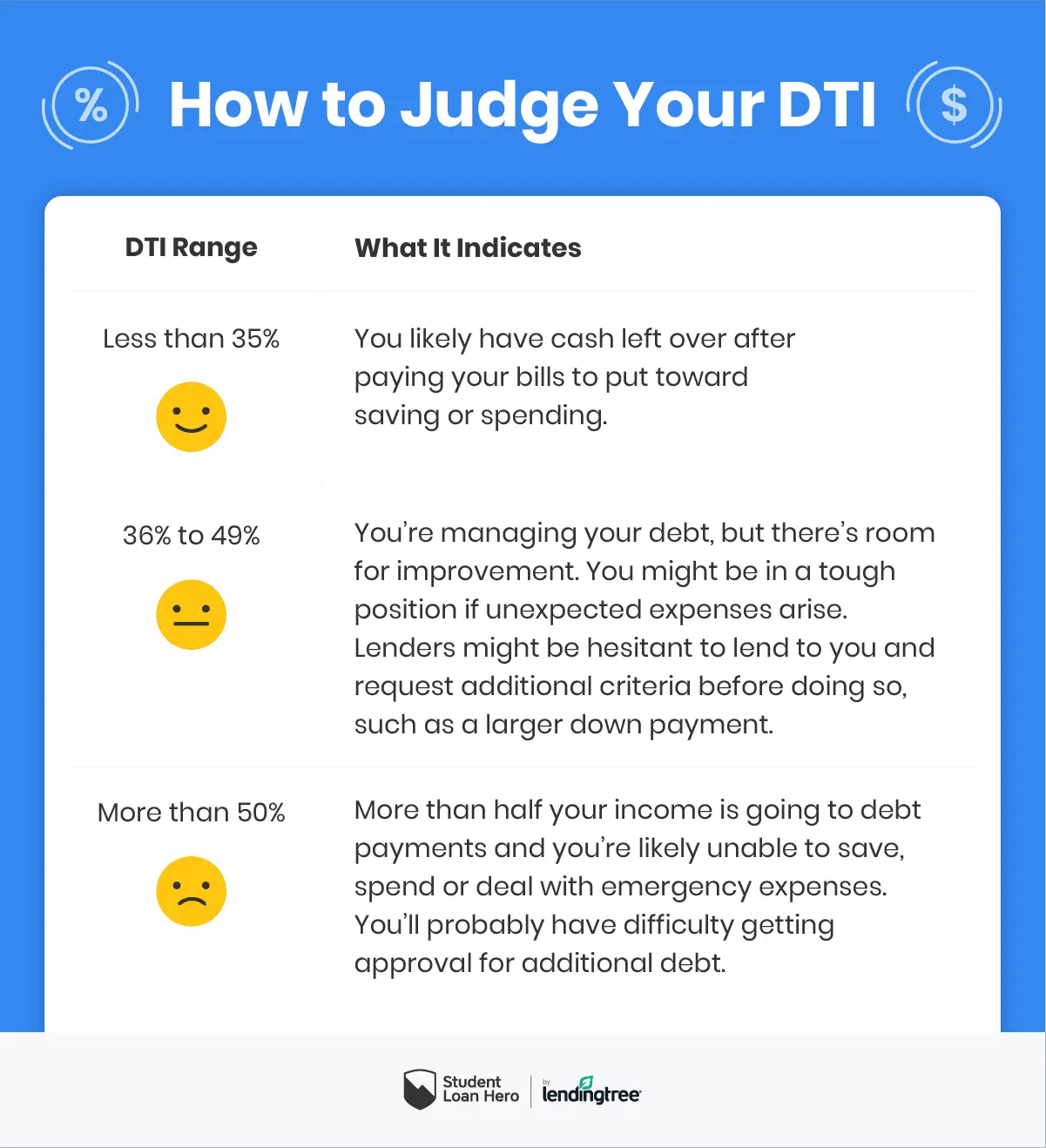

Impact of a High Debt-to-Income Ratio A high debt-to-income ratio will make it tough to get approved for loans, especially a mortgage or auto loan. Lenders want to be sure you can afford to make your monthly loan payments. High debt payments are often a sign that a borrower would miss payments or default on the loan.

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

Read Also: Is It Easy To File Bankruptcy

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom you’ve always wanted.

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

You May Like: How Can Bankruptcy Affect My Spouse

Do Usda Loans Look At Debt

The USDA and lenders consider income only from borrowers and co-borrowers when evaluating debt ratios and whether you can afford a mortgage. But theyll look at the entire household income when evaluating whether you fall under the qualifying income guidelines for your area.

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

Recommended Reading: Can You File Bankruptcy On A Title Loan

Dti Limits For Key Loan Types

Here are the acceptable DTI ratios for conventional, FHA, VA, and USDA loans.

| Loan type |

| 44% or less |

Although the table above shows the maximum acceptable DTI ratios for different mortgages, keep in mind that different lenders have different standards for each loan program they offer. Also, some lenders may require a higher or lower DTI ratio, based on its underwriting guidelines, your credit score, down payment amount, and income.

What Is The 28 36 Rule

A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 28/36 rule. According to this rule, your mortgage payment shouldnt be more than 28% of your monthly pre-tax income and 36% of your total debt. This is also known as the debt-to-income ratio.

Don’t Miss: How To Declare Bankruptcy In Pa

Whats Not Included In Your Dti

- Car insurance premiums

- Pool cleaning bills

- Maid service and so on

At the same time, a lot of items arent included in your debt-to-income ratio. Examples include car insurance, health insurance, and various monthly expenses like cell phone bills and cable bills.

Additionally, stuff like a monthly pool cleaning bill or gardening bill likely wont be included.

This isnt a sure thing, but generally this type of stuff isnt included in your debt-to-income ratio, though it might already be factored in because the DTI limits assume you have these other expenses.

Thats why lenders dont allow DTI ratios up to 100% theres a big buffer to account for these everyday expenses we all incur.

Anyway, lets assume youve got $1,000 in monthly liabilities on your credit report thanks to some credit cards and a car loan, and a proposed housing payment of $2,000, including insurance and taxes. If we combine those two figures, we come up with $3,000.

Now simply take that $3,000 in monthly debt and divide it by our original monthly income figure of $8,333. That gives us a debt to income ratio of 36%. This number is below the maximum and should be sufficient to get a mortgage, as long as you qualify otherwise.

The debt-to-income ratio is a great way to find out how much house you can afford, as well as the maximum mortgage payment you qualify for. Simply add up all your liabilities and your proposed mortgage payment plus taxes and insurance to see what type of loan you can take out.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: How Long After Filing Bankruptcy Can You Buy A House

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

How To Lower Your Dti Ratio

If youve run the numbers and youre concerned that your DTI isnt as low as youd like it to be, there are two main ways you can decrease it: reduce your debt or increase your income. Lowering your DTI can make the mortgage process go smoother, so it might be worthwhile if you have time before you apply for a new mortgage or refinance.

Here are a few DTI reduction strategies to consider:

-

Pay down or pay off your car loan before applying for your mortgage.

-

Start paying off your credit cards in full, one by one.

-

If possible, refinance or consolidate current loans to reduce your monthly payments.

-

Consider adding a co-borrower with a low DTI to your loan.

-

Pick up a side gig or part-time job to help pay down debt.

-

Expecting a raise or promotion in the next few months? Consider waiting to apply until it goes through.

-

Consider using some of your down payment savings to pay down debt. Just make sure youll meet down payment guidelines, which can be as little as 3% to 5%.

You May Like: What Happens When Someone Files For Bankruptcy

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Don’t Miss: Buy House In Foreclosure

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Debt To Income Ratio Overlays: How Do Underwriters Calculate Dti

Debt To Income Ratios are the total monthly minimum payments a borrower has divided by the gross monthly income.

- What is included in calculating debt to income ratios by mortgage underwriters ?

- The amount of the balance does not matter

- However, the minimum monthly payment does

- Auto payments, student loan payments, minimum credit card payments, installment monthly payments, and the proposed principal, interest, taxes, insurance are all included

- If the proposed property that the home buyer is purchasing has homeowners association dues then the HOA monthly fees are also included in the calculation of the borrowers debt to income ratios

- Other debts that are calculated by mortgage underwriters in calculations of the borrowers debt to income ratios include the following:

- child support payments

- minimum payment agreements made with judgment creditors

- the internal revenue service if the borrower has a tax lien

- alimony payment if applicable

- other monthly minimum payments that the borrower has that reports on the borrowers credit report

Expenses such as monthly medical insurance premiums, automobile insurance premiums, cell phone bills, telephone bills, cable bills, water bills, scavenger monthly services, water bills, electric bills, school tuition, and gas bills do not count and are not used as monthly expenses in the calculations of debt to income ratios by mortgage underwriters.

You May Like: States That Are In Debt

Whats The Maximum Dti For A Home Loan

Be mindful that each mortgage lender may have its own eligibility requirements and maximum DTI. Generally, though, a good debt-to-income ratio is around 36% or less and not higher than 43%.

Here are the common maximum DTI ratios for major loan programs:

- Conventional loans : 45% to 50%

- VA loans: No max DTI specified, but borrowers with higher DTI could be subject to additional scrutiny

- USDA loans: 41% to 46%

- Jumbo loans: 43%

Who Benefits From The Higher Dti Ratio Limit

Borrowers who have strong credit scores and a steady income but live in expensive housing markets are likely to benefit the most from the DTI change, says Michael Fratantoni, chief economist with the Mortgage Bankers Association.

Thats because they otherwise wouldnt qualify for a conventional loan, and theyd have to take out a jumbo loan, he adds.

Jumbo loans are also called nonconforming loans because the loan amount exceeds the limits established by Fannie Mae and Freddie Mac.

While most properties in the U.S. have a loan limit of $548,250, some in higher-cost areas have a higher limit of $822,375, according to the Federal Housing Finance Agency.

That said, the average borrower wont suddenly have more access to mortgage credit because of a higher DTI ratio limit, Fratantoni says.

After all, he notes, lenders may also look at your credit payment history, FICO score, income and credit utilization to determine if you can repay your loan.

Don’t Miss: File Chapter 7 Bankruptcy Online

It Works In Tandem With Your Credit Score

Though your DTI does not directly impact your credit score, it is closely associated with your credit utilization. If your DTI ratio and your ratio are both low, youll have a better chance of being approved for loans. Keep in mind: most lenders do not advertise maximum debt-to-income ratios, but instead provide guidelines that offer some flexibility. For example, a common guideline is the 28/36 rule used by some lenders to assess borrowing capacity. According to this rule, a household should only spend 27% of its gross monthly income on housing expenses, and no more than 36% on debt expenseslike car payments and credit cards.

Max Dti Ratio For Usda Loans

- Generally set at 29/41 max

- But automated underwriting may allow higher limits

- Such as 32/44 max with compensating factors

- And minimum credit cores of 680

For USDA loans, the max DTI ratios are set at 29/41. However, if the loan is approved via the Guaranteed Underwriting System , these ratios can be exceeded somewhat, similar to FHA/VA loans. If the loan is manually underwritten, the limits may be exceeded if loan is eligible for a debt ratio waiver.

Long story short, if you have a credit score of 680 or higher, solid employment history, and the potential for increased earnings in the future, you may get approved for a USDA loan with higher qualifying ratios. But theyre still pretty strict.

You May Like: Where Do You Go To File Bankruptcy