How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

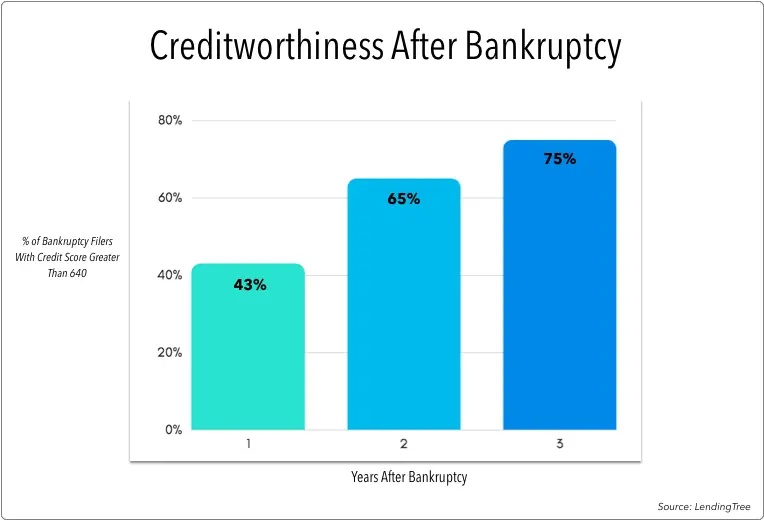

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Check Your Credit Report

Check your credit report every few months to be aware of the factors influencing your credit score. Compare each entry in the report to your own financial records to ensure that debt balances and account histories are accurate. Dispute any inaccurate or fraudulent listings in your report as quickly as possible to avoid negative impacts. Personally contact any companies that have legitimately listed defaults or missed payments, and work with them to establish repayment plans to avoid further negative reports. Read More:How Long Does a Foreclosure Stay on Your Credit Report?

Donât Miss: How Many Bankruptcies Has Donald Trump

Returning To Good Credit After Bankruptcy

A personal bankruptcy filing will affect your credit report for a certain amount of time depending on how you file:

- Chapter 13 bankruptcy stays on your credit report for 7 years after final discharge

- Chapter 7 bankruptcy stays on your credit report for 10 years after final discharge

Having a bankruptcy on your record for 7-10 years does not mean it will take you this long to repair your credit score or get out of debt.

Right away, the “final discharge” releases you from personal liability in most debts. You need this bankruptcy discharge before you can take steps to build toward better credit, otherwise, you will continue to have large debts.

Once the process starts, you can decide what choices to make to rebuild your credit.

Recommended Reading: Declaring Bankruptcy In Oregon

What Happens To Your Credit When You File For Bankruptcy

How long your bankruptcy stays on your credit report depends on the type of bankruptcy you file. The two most common types of consumer bankruptcy are Chapter 7 and Chapter 13. In a Chapter 7 bankruptcy, you do not repay any of the debt owed. This type of bankruptcy listing remains on the credit report for 10 years from the date it is filed. Under Chapter 13 bankruptcy, you are responsible for paying back a portion of the debts that you owe through a debt repayment plan. A Chapter 13 bankruptcy is removed from your report seven years from the date it is filed.

Having a bankruptcy in your credit history will seriously affect your ability to obtain credit for as long as it remains on your report. If you do qualify for credit while the bankruptcy is part of your credit history, you will likely have to pay higher interest and fees than you would otherwise. It can also affect your ability to qualify for things like an apartment, utilities and even employment. Even insurance rates may be affected.

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

Read Also: Bankruptcy Preparer

You May Like: How Many Bankruptcies Has Trump Had

Best Credit Cards After Bankruptcy In 2021 And What To Know Before Applying

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

The best credit card after bankruptcy is the Discover it® Secured Credit Card, which comes with ample rewards and no credit score required to apply.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Can I Get A Car Loan After I File Bankruptcy

Yes! In fact, here are some statements by clients who were able to get a car loan shortly after filing bankruptcy:

I filed bankruptcy and was paying $594 per month on a used carit was horrible. I followed these techniques and six months later I bought a new car with a $277 a month payment at 4.5% interest. I was BLOWN AWAY! Sheri

I have benefited by following this advice. Seven months after my bankruptcy I purchased a Ford F150 with a 9.99% interest rate and the dealer said I could trade it in for a 3% loan in one year. Thank you! Gary

Recommended Reading: How To File Bankruptcy In Missouri

S To Rebuilding Credit After Bankruptcy

You might think youre a pariah in the eyes of lenders and credit card issuers, but thats not quite true. Youll have to prove yourself, of course, but it can be done.

Although your goal building a good credit score is the s ame as that of someone starting from scratch, your situation is different. Your problem isnt that creditors dont know anything about you, but rather that they know a lot. Here’s how to start rebuilding your credit after bankruptcy:

Your Credit Report After Bankruptcy

For the years following your bankruptcy, monitor your credit reports regularly. Watch for errors and then file disputes. Get help from a who can spot inaccuracies, dispute the errors and coach you toward your best credit score possible.

Lexington Law has helped clients work towards fair and accurate credit scores by leveraging their rights. Weve helped hundreds of thousands of clients remove unfair, inaccurate and unverified accounts from their credit reports.

Don’t Miss: How To File Bankruptcy Yourself In Va

Not Been Bankrupt Yet

If you have not yet filed for bankruptcy as a solution to your difficulties, reading this page was wise. We advise everyone with money problems to research personal bankruptcy and bankruptcy alternatives, so as to make the best possible decision. This site is intended to answer all your bankruptcy questions. If you still have a personal question, or wish to have a free, confidential consultation, please contact a Licensed Insolvency Trustee near you.

Talk to a trustee today in places anywhere from British Columbia to Ontario and more. Get a free consultation today.

Adding New Positive Activity To Your Credit Profile

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

Youve also correctly noted a couple of potential downsides to adding new credit hard inquiries and lower average account age.

Yet when focusing on the long run, your score is likely to benefit from the above-noted scoring pluses long after those inquiries stop counting in less than a year from now and as all of your existing credit accounts both good and bad continue to age.

Also Check: How Many Times Has Donald Trump Filed For Bankruptsy

Recommended Reading: Trump Bankruptcy History

New Credit Opportunities To Rebuild Credit After Bankruptcy

We are going to discuss new credit opportunity post filing for bankruptcy as well as other opportunities you have to improve your credit score after bankruptcy. You may want to consider timing from discharge when deciding whether to apply for new credit. Although minimal, hard credit enquiries can negatively affect your credit score.

Read Also: What Is Epiq Bankruptcy Solutions Llc

How Much Will Bankruptcy Affect Your Credit Score

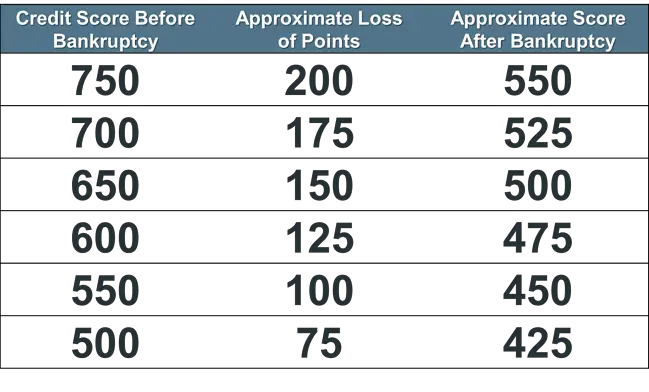

In 2010, FICO released a report that showed examples for the average credit score after bankruptcy. The decrease when you started with a high score is more significant.

| Starting Credit Score | |

|---|---|

| 150 | 530 |

In both cases, you end up with a bad credit score. But the decrease from fair to bad is less than from excellent to bad. Essentially, you have more to lose when you have good or excellent credit. If you already have bad credit then the point-damage may not be that bad. Remember, FICO scores only go down to 300, but its rare to see anything below 500.

Read Also: Leasing A Car During Chapter 13

Fresh Start Credit Rebuilding Program

It is possible to get credit after a bankruptcy or consumer proposal. Our Free Online Video Course on Rebuilding Credit outlines what lenders are looking for and the steps you can take to rebuild credit.

At Hoyes Michalos we want to help you take full advantage of the fresh start you can achieve by filing bankruptcy or a consumer proposal to eliminate your debt. To help, we have developed a comprehensive education and support program for our clients designed to provide you with the skills and resources you need to rebuild your finances and your credit after filing insolvency. The Hoyes Michalos Fresh Start Recovery Program enhances the mandatory credit counselling required when you file insolvency with additional tools, support and special online resources about budgeting, credit repair, dealing with creditor calls and much more. Our goal is to help you achieve a full financial recovery.

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

Recommended Reading: Renting An Apartment After Bankruptcy

Comparing The Best Credit Cards After Bankruptcy: Annual Fee

Of our three chosen cards, only the OpenSky® Secured Visa® Credit Card requires users to pay an annual fee of $35.

This is relatively low compared to non-secured credit cards, which can charge anywhere from $95 to over $500 for their annual fee. However, if you are annual-fee-averse, you may want to stick with the other cards on this list.

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

You May Like: Does A Bankruptcy Trustee Check Records

How To Build Back Your Credit After Bankruptcy

Rebuilding your credit after filing for bankruptcy can seem daunting, but there are some steps you can take to help your credit history begin to recover:

- Make sure all payments are on time going forward. Sometimes, the bankruptcy court will allow you to keep certain accounts open. If you still have open and active accounts that were not included in bankruptcy, be sure to make every payment on time.

- Open a new account. If you are starting from scratch with no remaining open accounts, it can be difficult to qualify for new credit after bankruptcy. Consider opening a secured credit card, getting a , or asking a friend or family member to add you as an on their credit card. Making small purchases and then paying the balance in full each month will help build a positive payment history, which in time can help offset the negative impact of the bankruptcy.

- Check your credit report frequently. Stay on top of your credit situation by reviewing your credit report often. You can also request your free credit score from Experian, which will include a list of the top risk factors impacting your scores.

- Sign up for Experian Boost. Adding your on-time cellphone, utility and streaming service payments with Experian Boost can help you increase your credit score so you can start to rebuild after bankruptcy.

How Long Does It Take To Repair Credit After Bankruptcy

Some have reported obtaining a credit score in the high 600s to low 700s within two years after filing for bankruptcy. The best way to repair your credit after filing for bankruptcy is to open a secured credit card and establish a good payment history. Within a year apply for another credit card and maybe take out an auto loan. Make all of your payments on time and you should have a fair credit score within 24 months of filing for bankruptcy.

Don’t Miss: Bankruptcy Petition Preparer Guidelines

Are All Bankruptcies The Same When It Comes To Credit

Myth: Bankruptcy affects the credit of all consumers who file equally, regardless of the amount of debt or the number of debts included.

The truth: Bankruptcies are far from created equal. As already stated above, some stay on your credit longer than others.

Creditors also tend to prefer to see Chapter 13 bankruptcies over Chapter 7 bankruptcies. Thats because Chapter 13 bankruptcy requires you to make some payment on your debt, so it demonstrates that you do try to pay your debts whenever possible. However, that doesnt mean Chapter 13 is the right choice for everyone and every situation.

How much debt you have and how much is included in the bankruptcy can also make an overall difference on how your credit is impacted. In short, your credit is going to suffer, but theres no single number that can be provided for how much it will drop.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: How To File For Bankruptcy In Massachusetts

Negotiating With The Trustee

Most Chapter 7 bankruptcy cases are what is called “no-asset” cases, which means everything the filer owns is protected through bankruptcy exemptions. Exemptions are specific to where cases are filed and vary by state law. Exempt property can’t be taken from the filer.

Nonexempt property is not protected through Chapter 7 bankruptcy and can be taken by the trustee and sold to pay back your unsecured debt. If a bankruptcy filer wants to keep otherwise nonexempt property, they can usually pay the trustee the value of the property. This is generally an option because the creditors will ultimately get the same amount whether the nonexempt asset is sold by the trustee or is bought by the filer.

How To Improve Your Chances

To get approved for a mortgage after bankruptcy, you need to demonstrate to lenders that you can manage your finances responsibly.

That will require establishing good credit habits and ensuring that youre not overutilizing credit, says Puricelli.

To rebuild your credit more quickly, follow these tips provided by Graham:

- Pay all your bills on time and in full

- Check your credit score and three free credit reports often and dispute anything inaccurate

- Dont take on unsecured debt, like personal loans or credit cards, which will most likely come with high interest rates

- Get a secure line of credit or loan that is backed with a deposit you pay beforehand

Having a friend or relative cosign on new credit lines can also help you qualify more easily and start building new credit.

But this strategy comes with a lot of risk, because the cosigner is agreeing to take over your new debts if you cant pay them. And if the loan goes bad, their credit will take a hit, too.

Recommended Reading: Sba Loan Bankruptcy Discharge