Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .

How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

Who Owns The Most American Debt

Taken together, Japan and China account for $2,353.3B or 34.55% of American debt owned by foreign countries. In other words, two countries alone control more than a third of the foreign market for American debt. But there are also a variety of other interesting nuggets about foreign holders of U.S. debt in our visualization.

Recommended Reading: Us National Debt 2021

Public Debt And Intragovernmental Holdings

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The Social Security Trust Fund owns a significant portion of U.S. national debt, but how does that work and what does it mean? Below, we’ll dive into who actually owns the U.S. national debt and how that impacts you.

Current Us National Debt

According to data published in February 2019, Americas national debt has hit a record high of $22 trillion. Thats a $2 trillion increase since President Trump was inaugurated in January 2017.

Public debt occurs when there is a deficit, which happens when government spending exceeds government revenues. When there is a deficit, the government doesnt have the freedom to let its payments slide until next month as we do. Instead, the federal government issues securities to be sold as a line of credit. Public debt is the cumulative total of budget deficits over the years.

Public debt was equivalent to about 77% of US GDP at the end of 2018, compared to 35% in Q2 of 2008, shortly before the Great Recession. The Congressional Budget Office predicts that without significant changes to current fiscal policies, the US deficit will drive public debt to 100% of GDP by 2028.

You May Like: What Are The Different Chapters Of Bankruptcy

What Countries Hold The Most Treasury Debt

Foreign holders of United States treasury debt According to the Federal Reserve and U.S. Department of the Treasury, foreign countries held a total of 7.03 trillion U.S. dollars in U.S. treasury securities as of March 2021. Of the total 7.03 trillion held by foreign countries, Japan and Mainland China held the greatest portions.

Is The Us National Debt Too High

As of April 8, 2021, the U.S. national debt is $28.1 trillion and rising. 2 Some worry that excessive government debt levels can impact economic stability with ramifications for the strength of the currency in trade, economic growth, and unemployment. Others claim the national debt is manageable and no cause for alarm.

Read Also: Can A Probate Estate File Bankruptcy

Who Owns $215 Trillion Of The Us National Debt

At this writing, the U.S. national debt has nearly reached $22 trillion, rising by nearly $500 billion since the U.S. governments 2018 fiscal year ended on September 30, 2018.

But to whom does the U.S. government owe all that money? Heres an answer to that question, as if it were asked before the U.S. governments 2019 fiscal year began.

From the end of its 2017 fiscal year to the end of its 2018 fiscal year, the U.S. governments total public debt outstanding increased by $1,271 billion, or $1.3 trillion, to reach a total of $21,516 billion, or $21.5 trillion. Put a little bit differently, the U.S. national debt grew at an average rate of nearly $3.5 billion per day on every day of the governments 2018 fiscal year.

Thats a very large number, but 2018 was only the sixth largest annual increase for the U.S. national debt in terms of nominal U.S. dollars. Larger increases were recorded during President Obamas tenure in office in 2012 , 2010 , 2011 , 2009 , and 2016 .

So its not an accident that the U.S. national debt has risen to $21.5 trillion, where these six years combined account for 37% of the official U.S. national debt. But to whom does the U.S. government owe all that money?

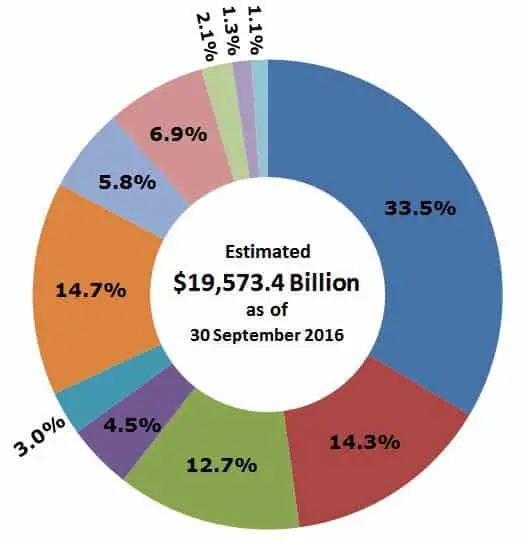

The following chart breaks down who the U.S. governments major creditors were at the end of its 2018 fiscal year, which is based on preliminary data that will be revised in upcoming months.

Heres the chart:

Building The American Future

Its obvious that the fiscal path were on is unsustainable and dangerous, threatening the future that we all want for our nation and our children. Despite clear warnings, policymakers have failed to show leadership, unwilling to make responsible, forward-looking decisions to do right by the next generation.

Fortunately, there is a better path, and many solutions exist. A sustainable fiscal outlook will give our economy the best chance to succeed, creating the conditions that encourage economic growth. A stable path enables an environment with greater access to capital, increased public and private investment, enhanced confidence, and a reliable safety net. Those factors, in turn, create a more vibrant economy with rising wages, greater productivity, and expanded opportunities for Americans.

The theologian Dietrich Bonhoeffer said: “The ultimate test of a moral society is the kind of world that it leaves to its children. This idea underpins the American Dream that is so central to our democracy and our society. Our leaders have a critical opportunity and responsibility to fulfill their moral obligation to future Americans by looking beyond the next election, and thinking instead about the next generation.

Don’t Miss: Bankruptcy Discharge Date Lookup

Current Foreign Ownership Of Us Debt

Japan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

What Percentage Of The National Debt Is Owned By The Government

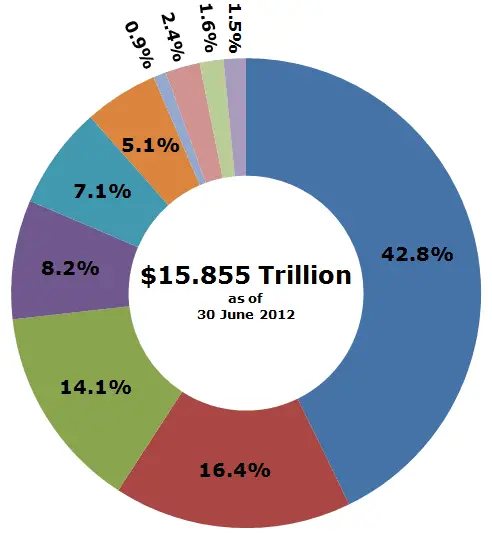

State and local governments own 5% The rest is held by pension funds, insurance companies, and Savings Bonds. The most recent complete breakdown from the U.S. Treasury is as of June 2018. The public debt was $15.6 trillion. Its in the Treasury Bulletin, Ownership of Federal Securities, Table OFS-2.

Read Also: Declare Bankruptcy What Happens

What Percentage Of Federal Debt Is Owned By Foreign Investors

The various trust funds operated by the United States government, like the Social Security and Medicare trust fund accounts, held another 22% of federal debt. Foreign investors owned the remaining 26% of federal debt. For a complete list of foreign investors, visit the Treasury International Capital System.

What Is The Debt Held By Government Accounts

Debt held by government accounts or intragovernmental debt are non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings,

Intragovernmental Holdings are mostly made up of the Government Account Series held by government trust funds, revolving funds, and special funds. Debt Held by the Public includes all federal debt held by individuals, corporations, state and local governments, foreign governments, and GAS deposit funds, such as the Thrift Savings Plan.

Governments, however, rarely do. Borrowing more money, raising spending, and cutting taxes are three surefire ways to dig deeper into the hole that is the US federal debt. And, these are three shovels that the US government continues to use. So, what are the appropriate ways to relieve the debt burden?

Read Also: Buy Wholesale Pallets Cheap

When Will Gross Debt Reach The Statutory Limit

Since 1917, the federal government has had a legal limit on the amount of debt it can accrue. The debt limit was most recently reinstated on August 1, 2021 at $28.43 trillion, the level of outstanding debt that day. On December 16, 2021, lawmakers increased the debt limit to $31.38 trillion. During the intervening period, the Treasury Department was able to use “extraordinary measures.”

How Much Of Our Debt Is Really Owned By China

The quick answer is that as of January 2018, the Chinese owned $1.17 trillion of U.S. debt or about 19% of the total $6.26 trillion in Treasury bills, notes, and bonds held by foreign countries. That sounds like a lot of moneybecause it isbut it is actually a little less than the $1.24 trillion China-owned in 2011.

Don’t Miss: Debt To Credit Ratio

The National Debt Dilemma

- The pandemic has taken the U.S. national debt to levels not seen since the 1940s.

- The United States is in a unique position because it holds the worlds reserve currency, allowing it to carry debt more cheaply than other countries.

- Some experts argue that the United States can safely continue to sustain high levels of debt, while others warn that it will eventually have to face the consequences.

The U.S. national debt is once again raising alarm bells. The massive spending in response to the COVID-19 pandemic has taken the budget deficit to levels not seen since World War II. This expansion follows years of ballooning debttotaling nearly $17 trillion in 2019that will now be even more difficult to reduce. Raising the debt ceiling, the legal limit on government borrowing, has become a perennial fight in Congress.

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Also Check: Will Bankruptcy Affect Renting An Apartment

How Do Current Debt Levels Compare Historically

Both gross and public debt are at all-time highs in nominal dollars, which is perhaps not surprising since the federal government has been running deficits for each of the past 20 fiscal years. As a percent of GDP, both are high by historical standards. Debt held by the public is currently around 98 percent of GDP, which is higher than any time in history other than in fiscal years 1945, 1946, and 2020, when unprecedented borrowing occurred to finance the World War II effort and to fight COVID-19. Even during those two periods, the record for debt was 106 percent of GDP in 1946 and 100 percent in 2020, both of which the federal government will surpass by 2031.

Gross debt currently amounts to 125 percent of GDP, which is the second-highest total in history, just short of the all-time record of 128 percent of GDP in 2020. By 2031, public debt will be at its highest level in history as a share of GDP, while gross debt will be slightly below todays level.

Why Measure Debt As A Share Of Gdp

The ratio of publicly held debt to GDP is a better measure of a country’s fiscal situation than just the nominal debt figure because it shows the burden of debt relative to the country’s total economic output and therefore its ability to finance or repay it. This measure also allows for an apples-to-apples comparison of one country’s fiscal situation over time or multiple countries’ debt burden in a meaningful way. A large nominal dollar debt is less of a problem if a country has a large economy and can easily repay it. For example, debt held by the public in 1946 was about $242 billion, or one percent of what it is today. But with a GDP of just $228 billion, debt held by the public was 106 percent of the economy, or roughly nine percentage points higher than its current level.

Also Check: Is It Better To File For Bankruptcy Or Debt Consolidation

Why The Federal Reserve Owns Treasuries

As the nations central bank, the Federal Reserve is in charge of the countrys credit. It doesnt have a financial reason to own Treasury notes. So why did it triple its holdings between 2007 and 2014?

The Fed needed to fight the 2008 financial crisis. In 2008, it ramped up open market operations by purchasing bank-owned mortgage-backed securities. In 2009, the Fed began adding U.S. Treasuries. By 2011, it owned $1.6 trillion, maxing out at $2.5 trillion in 2014. This quantitative easing stimulated the economy by keeping interest rates low and infusing liquidity into the capital markets, giving businesses continued access to low-cost borrowing for operations and expansion.

Did the Fed monetize the debt? In a way, yes. The Fed purchased Treasuries from its member banks, using credit that it created out of thin air. It had the same effect as printing money. By keeping interest rates low, the Fed helped the government avoid the high-interest-rate penalty it would incur for excessive debt.

The Fed ended quantitative easing in October 2014. As a result, interest rates on the benchmark 10-year Treasury note rose from a 200-year low of 1.43% in July 2012 to around 2.17% by the end of 2014.

What Can You Do About This Issue Take Action

There are currently no plans to reduce federal spending or increase revenues. This is an issue that will affect future generations and greatly reduce economic growth for the years to come. Net Impact has been raising awareness on this issue and advocating for responsible fiscal policies with our Up to Us program. You can make a difference by hosting an event in your campus and raising awareness of our fiscal future. With the 2020 election coming up, it is important that we are informed on how our votes can shape our future. Check out the 2020 Election page to learn more about fiscal issues, voter registration, and how to get involved with this year’s election.

Find out what’s your civic superpower and how you can elevate your community work.

Read Also: Can A Nonprofit File For Bankruptcy