Mortgages And Debts Secured On Your Home

Youll need to keep paying your mortgage and any other debts secured on your home for example, debts secured with a charging order. If you fall behind with the payments, bankruptcy wont stop your mortgage lender from taking steps to repossess your home.

If you have an income payment agreement or income payment order , tell the official receiver you need to keep paying a secured debt. Ask them if you can pay less under the IPA or IPO so you can keep paying the secured debt as well.

If your home is repossessed and sold, but doesnt raise enough money to pay off your outstanding mortgage or any other debt secured on it, the remaining debt known as mortgage shortfall will no longer be secured. This means youll be released from it at the end of your bankruptcy. Youll also be released from a mortgage shortfall if your home is sold at any time, even after your bankruptcy has ended.

Other Options For Clearing Your Tax Debt

Filing for bankruptcy to clear your tax debt might seem like an attractive option. But it does come with long-term financial implications.

Any future investors in your business will be able to see it on your record. And it could make getting a loan or mortgage extremely difficult.

So what are your other options? Well, there are a few of them. These include:

- Paying off your tax debt: Very few people can afford to do this in full. The IRS will sometimes agree to a long-term payment plan which you can use to pay back your debt. This is often means-tested so it depends on your current income being steady.

- Making an Offer in Compromise: This is a one-off payment that the IRS sometimes accepts in place of your debt. It doesnt match your total debt and relates to your income. It is a fair payment that reflects how much you can afford to pay.

- Appealing your tax debt: This is a good way to prevent your property being levied and can clear your tax debt entirely. There are several ways to appeal your tax debt and these depend on your circumstances. For example, you can claim Innocent Spouse Relief or make a claim of Financial Hardship.

- Waiting out the statute of limitations: This is a long game but it can be worth it. The IRS has 10 years in which to collect any tax debt from you and after that, your debt is forgiven. If they contact you towards the end of this ten-year window you might be able to delay paying until you dont have to.

Filing For Chapter 13 Bankruptcy

Chapter 13 bankruptcy doesnt involve selling off any assets. This makes it one of the most attractive options for anyone filing for bankruptcy.

If the IRS accepts your application for Chapter 13 bankruptcy then they agree to let you pay off your debt over time. This time period usually extends over three to five years. Once this time period is up, the IRS clears any remaining debt.

So you could end up paying off a portion of your existing debt in order to clear it entirely.

But applying for Chapter 13 comes with strict requirements. In order to qualify, you must receive a steady income leading up to your application, which is not set to change. This demonstrates that you will be able to stick to a payment plan for the foreseeable future.

Read Also: Free Foreclosure Homes Listings

What Happens If I Have Tax Debt That Cant Be Erased Yet

Plenty of taxpayers are in this boat, and they all have several legal options. An attorney can advise you on the best course of action, but ultimately, the decision is yours.

Pay in installments. Some people talk to the IRS about a payment plan. The IRS usually backs off once the taxpayer starts an installment agreement. After all, the IRS just wants the money. It doesn’t really want to garnish your wages. Keep in mind that installment agreements are only a good idea if you have the money. If thatâs not the case, you need another option.

Participate in the Offer in Compromise program. The IRS has many programs to help taxpayers pay their tax debt when they have little or no money. The main example is the Offer in Compromise program where taxpayers pay what they can, and the IRS forgives the rest. This program can be extremely complex, and few people qualify. Also, if the taxpayer has any assets whatsoever the IRS will force the taxpayer to sell them. Finally, while the taxpayer negotiates, the IRSâs harassing collections techniques continue.

Sales Tax Debt To California Department Of Tax And Fee Administration

The analysis for discharging sales tax debts owed to the California Department of Tax and Fee Administration , formerly known as the State Board of Equalization , is the same as for income taxes discussed above. But due to how sales taxes are assessed, it can be tricky. Sales taxes flow from a business. If the business was a corporation, then you have to wait until the taxes are actually assessed against the individual responsible for the taxes. Then there must be at least 240 days after that assessment date before a bankruptcy case is filed, assuming all other requirements for discharge have been met.

Often the assessment is the result of an audit. And these audits sometimes show willful efforts to evade paying tax. In these instances, that is a basis for the discharge of those tax debts to be denied.

There are other nuances involved with sales tax dischargeability. I have a lot of experience dealing with sales tax debts and know how to obtain the necessary information prior to filing a case so I can advise on the ability to discharge the sales tax debt.

Also Check: What Happens When You Declare Personal Bankruptcy

Buttax Liens Don’t Go Away

If the IRS has already placed a lien on your property, you’re out of luck. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debtthe lien will not go away. So even though the IRS won’t be able to garnish your wages to collect the discharged tax debt, you’ll need to pay off the lien when you sell the property.

You Must Have Filed Your Tax Return At Least Two Years Ago

The tax return for the debt you wish to discharge must have been filed at least two years before filing for bankruptcy. The time is measured from the date you actually filed the return, not when it was due.

Additionally, if the IRS filed the return for you called Substitute for Return you never officially filed. Therefore, you do not meet this test.

Read Also: How To File For Bankruptcy In Florida Without A Lawyer

Your Cra Debt Options

If you are having CRA debt issues, speaking with a licensed insolvency trustee to help review your options is the first step. They can see what the best solution is for you, which may include a consumer proposal or a bankruptcy. When successfully entering into either a bankruptcy or a consumer proposal, this stops any further actions against you by the CRA.

If you owe the CRA money, dealing with CRA tax debt should be your top priority. Not only can the agency use widespread collection actions, but it can also withhold GST and Child Tax credits or even remove money from your bank account leaving you out of luck when it comes to meeting other obligations like mortgage payments.

Dont delay if you find yourself in tax debt. There is a solution to all types of debt.

If you live in the GTA, book a free consultation with the caring professionals at David Sklar & Associates. We are here to help assist you in making the best decision for you.

Concluding The Tax Debt Debate

We have finally answered the epic question.

Does bankruptcy clear IRS debt?

The answer is, it can. But you need to know the facts in order to make an educated decision.

Take time to educate yourself or consult a professional to decide if bankruptcy is the right choice for you.

We can help you decide if bankruptcy is the right choice for you.

Contact us today for a free consultation!

Learn More About Your Taxes

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

You May Like: How Long Does Bankruptcy Affect Your Credit

Can I File Bankruptcy On Tax Debt

You may be able to file bankruptcy on some types of tax debt. For instance, you may be able to discharge income tax debt if certain conditions are met .

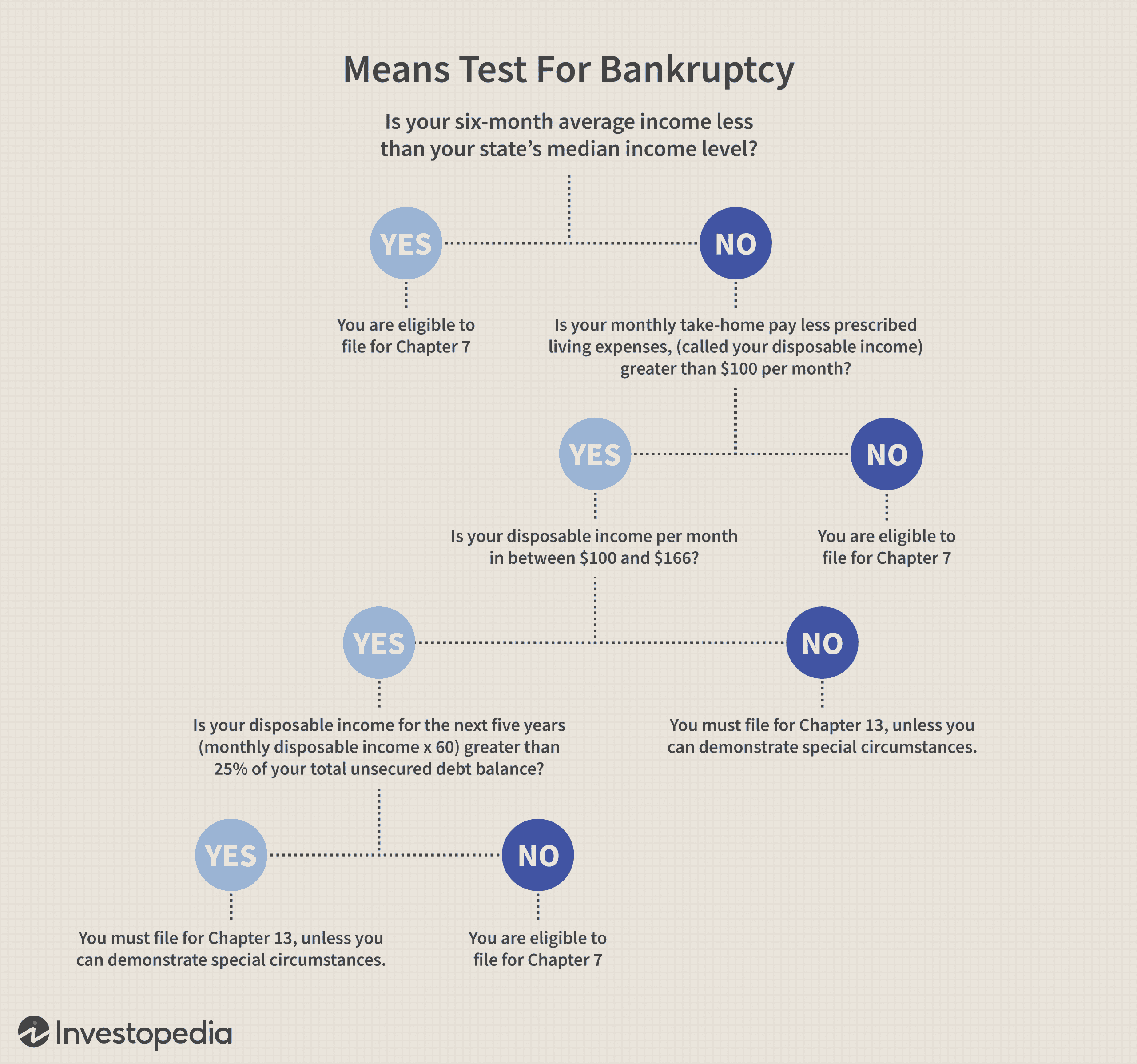

Note that you will need to pass the means test to qualify for a Chapter 7 bankruptcy in the first place. The means test compares your disposable income to the state median income for your household size. If your income is too high and you can’t pass the means test, you can file for Chapter 13 instead and develop a plan to repay your debts over the course of a few years.

Does Bankruptcy Clear Tax Debt Everything You Need To Know

Are you struggling with tax debt and facing bankruptcy? If so, you are probably wondering does bankruptcy clear tax debt? The good news is bankruptcy can sometimes clear tax debt. However, you must meet some very specific requirements. Heres what you need to know.

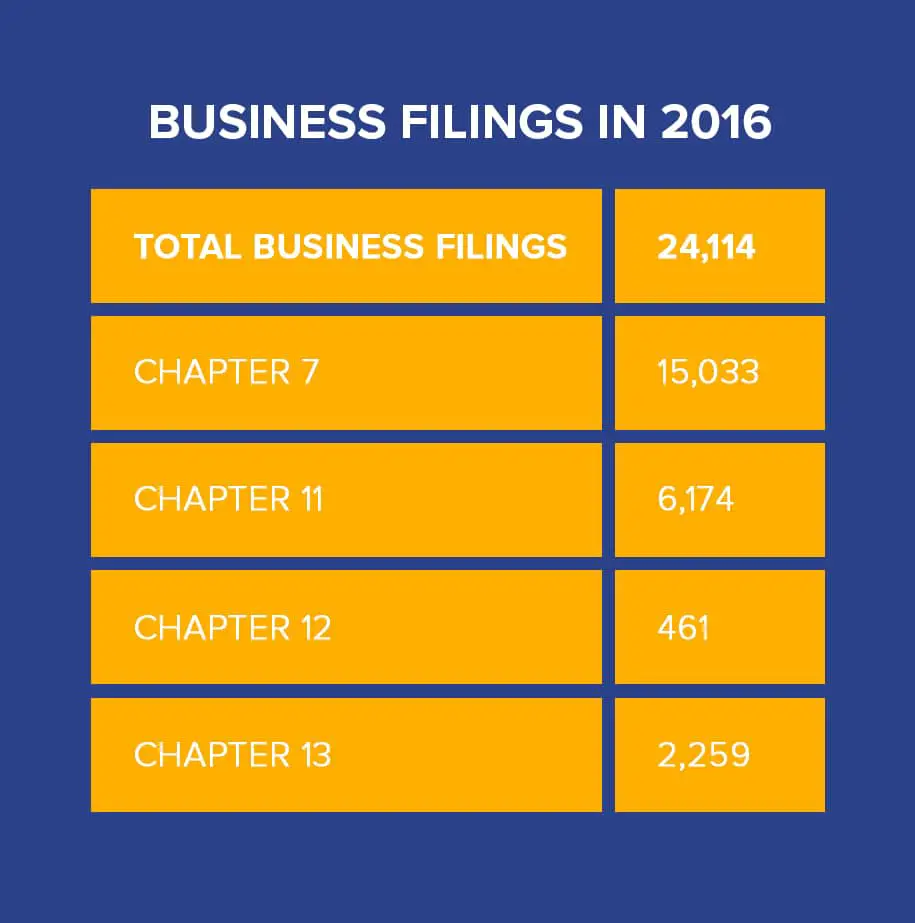

There are two main types of bankruptcy in the United States that you should be aware of: Chapter 7 and Chapter 13 bankruptcy. Both allow you to reduce or eliminate tax debt and other kinds of debt, but there are some major differences in how the two operate and who is eligible for each one.

Don’t Miss: What Information Do You Need To File For Bankruptcies

Kansas City Bankruptcy Lawyer Explains Irs Debt Options

Tax debt can be particularly stressful to those struggling to make ends meet. It is true that the Internal Revenue Service does not engage in illegal creditor harassment or threats such calls about tax debt are a scam! Letters are always the first indication from the IRS of collection issues that are being pursued. Still, this does not mean that the IRS will not try to collect money from you. The IRS is powerful and persistent, and interest on back taxes and penalties can grow quickly. However, depending on your circumstances, you may be able to use an IRS debt management program to reduce what you owe. Additionally, in some situations, filing bankruptcy can help you cope with or completely eliminate your tax debt.

If you are overwhelmed by tax debt, contact the attorneys at The Sader Law Firm today. Our attorneys have years of experience and Managing Member Neil Sader, is a board certified specialist in consumer bankruptcy law. We can explain your options for relief from overdue taxes. Together, we can explore options like bankruptcy, which can give you a clean financial slate for both taxes and other debt, in many cases.

Can Tax Debt Be Discharged In Bankruptcy

While some debts are almost never dischargeable, the rules for other types of debt like tax debt arent quite so clear cut.

Its pretty complicated stuff, says Robertson B. Cohen, a bankruptcy attorney at Cohen & Cohen, P.C. in Denver.

First and foremost, neither taxes you willfully attempted to evade nor penalties for tax fraud are dischargeable in bankruptcy. And, even without fraud, income taxes are dischargeable only under limited circumstances.

There are three elements that need to be satisfied for tax debt to be dischargeable, Cohen says.

- Taxes cant be discharged in bankruptcy until at least three years after they were due. For example, 2020 taxes are due in April of 2021, so cant be discharged until April of 2024.

- You must have filed a tax return for the tax you owe and you must have filed it at least two years before your bankruptcy in order to get it discharged. So if you didnt file 2015 taxes until 2019, youd have to wait until 2021 before the debt could be discharged. And if you never filed a return, it may be impossible to get the tax debt discharged.

- Taxes must have been assessed within 240 days before your bankruptcy filing. So, if you were audited and your taxes were reassessed after Tax Day, youd need to wait until 240 days after the audit.

To determine dischargeability, we order account transcripts from the IRS, Cohen said. Often we will wait to file so we can discharge the most tax debt possible.

Don’t Miss: How To Get A Copy Of Your Bankruptcy Discharge

Bankruptcy And Taxes: Qualifying For Discharge

Whether you can discharge tax debt will depend on the type of tax, how old the tax debt is, if you filed a return, and the type of bankruptcy. Federal income taxes in Chapter 7 are dischargeable if you meet all of the following conditions:

- The discharge is for income taxes: Payroll taxes and penalties for fraud are not eligible for discharge.

- You filed legitimate tax returns: You filed a tax return for the relevant tax years at least two years before filing for bankruptcy.

- The tax liability is at least three years old: The tax debt is from a tax return that was originally due at least three years before filing for bankruptcy.

- You are eligible under the 240-day rule: The IRS assessed the tax debt at least 240 days before you filed for bankruptcy. If the IRS suspended collection activity during negotiation, the applicable date may be extended.

- You did not commit willful tax evasion: Possible evasive actions include changing your Social Security number, your name, or the spelling of your name repeated failure to pay taxes filing a blank or incomplete tax return and withdrawing cash from a bank account and hiding it.

- You did not commit tax fraud: The return contains no information that was intended to defraud the IRS.

How Chapter 7 Bankruptcy Works

Bankruptcy proceedings start when you file a bankruptcy petition with the bankruptcy court in the area where you live. When you file your bankruptcy petition, you must also provide additional information, including the following:

- Your assets and liabilities.

- Your current income and expenses.

- An explanation of your current financial situation.

- Current contracts or leases.

- Recently filed tax returns.

Fees are also due when you file for bankruptcy. They are generally a few hundred dollars depending on where you live. The fee may seem expensive, but it is certainly worth it if it allows you to discharge tax debt that could total many thousands of dollars.

Don’t Miss: Jud Ct Gov Foreclosure

Tax Debt Not Eligible For Discharge

The following types of tax debt are not dischargeable in Chapter 7 bankruptcy:

- Tax penalties from tax debt that is ineligible to be discharged

- Tax debts from unfiled tax returns

- Trust fund taxes or withholding taxes withheld from an employee’s paycheck by the employer

A debtor unable to discharge tax debt under Chapter 7 may consider other arrangements, such as entering into an installment agreement with the IRS or making the IRS an offer in compromise which will result in the settlement of the tax debt for less than the amount owed.

You Can Wipe Out Or Discharge Tax Debt By Filing Chapter 7 Bankruptcy Only If All Of The Following Conditions Are Met:

- The debt is federal or state income tax debt. Other taxes, such as fraud penalties or payroll taxes, cannot be eliminated through bankruptcy. In other words, the debt needs to be a regular tax payment that you owed either the State of Wisconsin or the federal government.

- You did not willfully evade paying your taxes or file a fraudulent return. Bankruptcy will not help in these circumstances. Your actions need to have been lawful.

- Your tax debt is at least three years old. The original tax return must have been due at least three years prior in order to effectively file for bankruptcy. So if you were to file for bankruptcy in April 2020, for instance, this would apply to your 2017 taxes that were due April 15, 2018.

- You filed a tax return at least two years before filing for bankruptcy. To eliminate a tax debt, a return for that debt must have been filed. Generally, if your extensions expired and you filed late, you have not filed a true return and will not be able to eliminate the tax debt.

- The tax debt must have been assessed by the IRS 240 or more days before you file for bankruptcy, or must not have been assessed yet. This is called the 240 day rule. If the IRS suspended collection efforts due to a compromise or previous filing, this deadline may be extended.

Read Also: Can You Include Judgements In Bankruptcy

How A Chapter 13 Bankruptcy Can Help

If your state tax obligation wont go away, Chapter 13 bankruptcy will let you spread the payments over three to five years. Youll have the added benefit of potentially paying less on other debt, such as credit card balances, leaving you a larger percentage of your income to pay off the tax.

Understand, however, that tax debt can be complicated. Before you explore this route, youll want to get an assessment with a bankruptcy attorney. Getting legal help isnt as expensive as youd think, and most people believe hiring a bankruptcy lawyer is well worth the cost.

Recommended Reading: What Is Epiq Bankruptcy Solutions Llc

Filing For Chapter 7 Bankruptcy

Chapter 7 bankruptcy is the most straightforward kind of bankruptcy. After filing, you sell off your assets and use any money from them to pay off your creditors. Some assets, like cars or household furnishings, are exempt from sale.

This is also one of the most extreme types of bankruptcy. Almost all your assets can go up for sale, including your home and any other property you own.

After you have paid off as much as you can your remaining debts will be forgiven. This means that you no longer have to pay them off and creditors will no longer contact you for payments.

Also Check: New Foreclosure Law In California